Should we be taking Tron Seriously?

57 million unique wallets interacted with Tether on Tron last year.

Hello readers,

Stablecoins represent 5.8% of the entire crypto market cap today. But they account for nearly 70% of onchain settlement activity.1

Simply put, stablecoins are crypto’s killer app today. The largest stablecoin issuer is Tether. And Tether had over 57 million active unique wallets on Tron in the last year.

So it’s about time we do a deep dive on the Tron Network. Topics covered:

The founding story of Tron

The Tron Blockchain — what you need to know

Onchain Data (users, revenues, transactions, developers)

Top projects on Tron

Tether Usage on Tron

Financials

Token Economics

Community, Investors, Team

Comps

Conclusion

Let’s go.

Founding Story

Tron is an open-source, delegated proof of stake layer 1 blockchain launched during the peak of the ICO mania in September 2017. The smart contract network was founded by Justin Sun, a notable figure in the blockchain space who served as the Greater China Chief Representative at Ripple before ultimately turning his attention to Tron.

Shortly after launching the TRX token and the Tron Network, the Tron Foundation acquired BitTorent — a popular peer-to-peer file-sharing platform to further catalyze its mission to “decentralize the web.” The TRX token (TRON) is currently #10 in terms of market cap across the crypto industry. BTT (BitTorrent) is currently #72. More on BitTorrent later in the report.

The Blockchain — What You Need to Know

Tron uses a delegated proof of stake consensus mechanism — which is a variation of the traditional proof of stake model used by Ethereum. A high-level (simplified) overview of some of the core features:

Token Ownership & Utility: TRX token holders and Tron users can vote for delegates from a committee known as Super Representatives, or “SRs.” There are a total of 27 SRs — which are responsible for running nodes, validating transactions, and creating new blocks. 2

Economic Incentives: The SRs receive TRX tokens (consensus rewards only — 100% of transaction fees are burned) in return for validating transactions. They also return some of their rewards to the voters as a way to incentivize token holders to delegate to their validator.

Network Governance: SRs can also propose changes to the network, such as transaction fee adjustments or updates to the protocol. These proposals are then voted on by the other SRs.

Decentralization: Anyone can run a node on TRON and participate in consensus. However, the hardware requirements are higher than a more decentralized network such as Ethereum. For example, you’ll need the following specs: 32 Cores, 64G of RAM, 100M bandwidth, and 2.5T+ SSD. In addition, you’ll need to pay 9999 in TRX ($1,200 at current prices) and incentivize Tron account owners to vote for you as a Super Representative/SR.3 The top 27 SRs get to approve transactions and earn fees at any given time. Similar to BNB Chain, Tron appears quite centralized compared to networks such as Bitcoin, Ethereum, or Solana.

Standards & Interoperability: TRC-20 is the primary token standard on Tron — which functions similarly to the fungible ERC-20 token standard on Ethereum. The most famous TRC-20 token on the network is Tether or USDT — the largest stablecoin in crypto by market cap. More on Tether later in the report.

While TRON is not natively interoperable with Ethereum, it is EVM-compatible — which means that Ethereum developers can easily port over their apps to Tron using Solidity, the leading programming language on Ethereum. Having said that, there is very little evidence that Tron is attracting EVM developers who started in the Ethereum ecosystem. More on development activity later in the report.

BitTorrent: Shortly after launching mainnet in 2018, Tron acquired BitTorrent, a popular peer-to-peer file-sharing protocol that once boasted over 100 million users. Prior to the acquisition, BitTorrent was struggling to incentivize users to upload and “seed” data for other users to download. After the acquisition by Tron, BitTorrent released the BTT token — which is paid out to users/service providers who continue to upload and “seed” data for others on the peer-to-peer file-sharing network. When users pay service providers for data on BitTorrent, the transactions are recorded on the Tron blockchain. In some ways, this system seems similar to the way in which IPFS works in conjunction with Filecoin. With that said, the BitTorrent contract is currently #19 on Tron in terms of gas consumption ($322k over the last 365 days) and active users (107k over the last 365 days) — an indication that the project has not quite taken hold.

Transaction Fees, Bandwidth, & Energy: Transactions on Tron are paid with 1) TRX tokens, 2) “bandwidth,” and 3) “energy.”

Paying with the TRX token is how any other L1 blockchain works.

But “bandwith and energy” are new concepts. Let’s double-click on that.

Tron incentivizes users to “lock” their TRX tokens by providing “bandwidth and energy” resources in return. Users can then use this “bandwidth” to pay for regular transactions and “energy” to pay for more complex transactions involving smart contracts. Additionally, those with excess resources can delegate their “energy” to others, allowing for cheaper transaction fees. This has created secondary markets for energy on JustLend — a lend/borrow protocol on Tron. 4

Below is a visual of the transaction types since inception:

And here is a quick breakdown of the fees by transaction type since inception:

47.61% from Burning TRX tokens

44.41% from Energy (supplied by locking up tokens)

5.19% from Bandwith (supplied by locking up tokens)

2.79% from Energy (supplied from smart contracts)

In Summary, Tron is a smart contract network competing with Ethereum, Solana, Avalanche, etc. for developers, users, and mind share. In our view, the network is more centralized than its counterparts and primarily differentiates itself with its delegated proof of stake consensus model, and economic incentive structures.

We should note that this is the first time we’ve seen the concepts of “bandwidth and energy.”

From our view, the network is really just incentivizing users to “lock up” tokens here. We’ve observed similar tactics with liquidity mining, staking, etc with other protocols. With that said, providing liquidity or staking is a service to the network (and its users) — outside of simply “locking up the tokens.” In the case of Tron, there is no service provided as far as we can tell — unless we should view “not selling tokens” as the service. Imagine if you could lock up some ETH and receive free gas/gwei for doing so? This is how Tron has structured incentives around user transactions so far as we can tell.

In addition to incentivizing users to “lock up tokens in return for free transactions,” Tron burns 100% of the TRX used in transactions paid with the native token (validators are paid with network inflation). In combination, these mechanisms are reducing the circulating supply of Tron, which we note in the token economics section below.

Onchain Data

Let’s hop into the terminal to take a look at how things are going onchain.

Active Users & Fees:

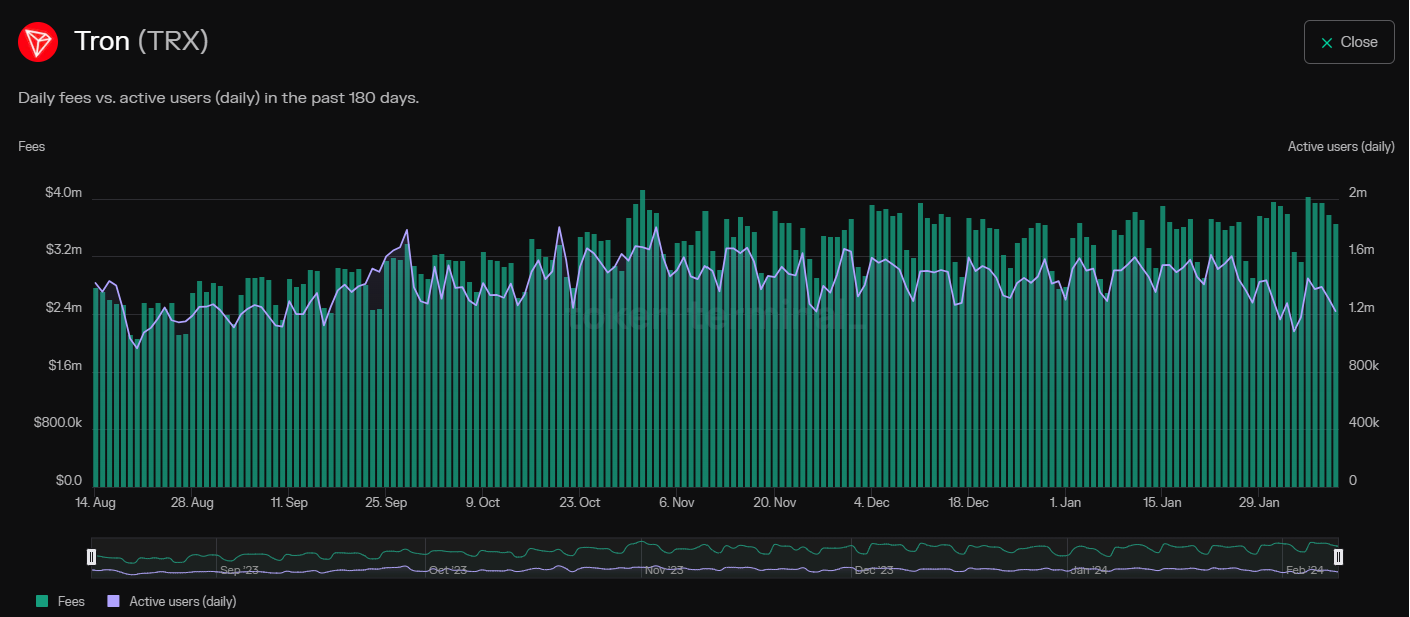

The network is averaging $3.2m in daily fees and about 1.4 million users/day over the last 180 days. From a fee perspective, this puts Tron in the #3 position for L1 blockchains — behind only Ethereum and Bitcoin. From a user perspective, Tron is #1.

We’ll note that consistent waves of onchain user and fee activity are a bit odd and something we have not observed in other networks. We did ask the team at Tron about this. It’s somewhat unclear why the data is presenting this way, but one explanation was that fees are doubled with a “dynamic energy” proposal put forth by some SRs as it relates to interaction with high-volume smart contracts such as Tether. This may be an attempt by the SRs (and Tron DAO) to disincentivize usage of Tether, and instead direct users to Tron’s stablecoin, USDD — which has seen relatively low volumes and TVL since launching in 2022. However, it still doesn’t explain the oddly consistent waves of users and fees showing up onchain.

Transactions per Day & Cost per Transaction:

The Tron Network is doing 4.8m transactions per day on average over the last 180 days — the second most of any blockchain network today. If you’re curious, BNB, Polygon, Arbitrum, and Ethereum L1 round out the top 5 (Solana is #1 — data coming soon).

Cost per transaction is averaging 67 cents over the same time period — which is significantly less than Ethereum L1 but higher than every L2 in the ecosystem. This could potentially put Tron in no man’s land for developers unless the network can scale via layer 2 or some other solution.

Regarding layer 2 development on Tron— the team has not indicated that this is on the roadmap just yet. However, Justin Sun recently tweeted that Tron is now planning to integrate with layer 2 solutions on Bitcoin — an interesting development we’ll be keeping our eyes on.

In terms of unit economics, the network does about $2/day in fee revenue for each active user. To put this into context, Ethereum has averaged $18/user over the last 6 months. Arbitrum is $1.27 and Solana averages $.76 per day per active user.

Core Developers and Code Commits

Shifting to developer activity, we can see that Tron has averaged about 11 active developers per day over the last 6 months and 1.8 code commits per day.

Furthermore, Tron has 2.5 million code commits since its inception. To put the figure into perspective, Ethereum has over 58 million since its inception (2 years before Tron’s launch). Solana, which launched its mainnet in March of 2020 has over 22 million code commits.

In summary, Tron appears to have lots of transactions, users, and fees. However, developer activity is materially lower than some of its more high-profile counterparts.

Let’s go a step further and take a look at which projects are driving Tron’s onchain activity.

The DeFi Report is powered by Token Terminal — the leading data & analytics platform for institutions.

If you’d like to receive more data-driven analysis of the web3 tech stack as we uncover where the most value will accrue and why, sign up here.

Top Projects on Tron

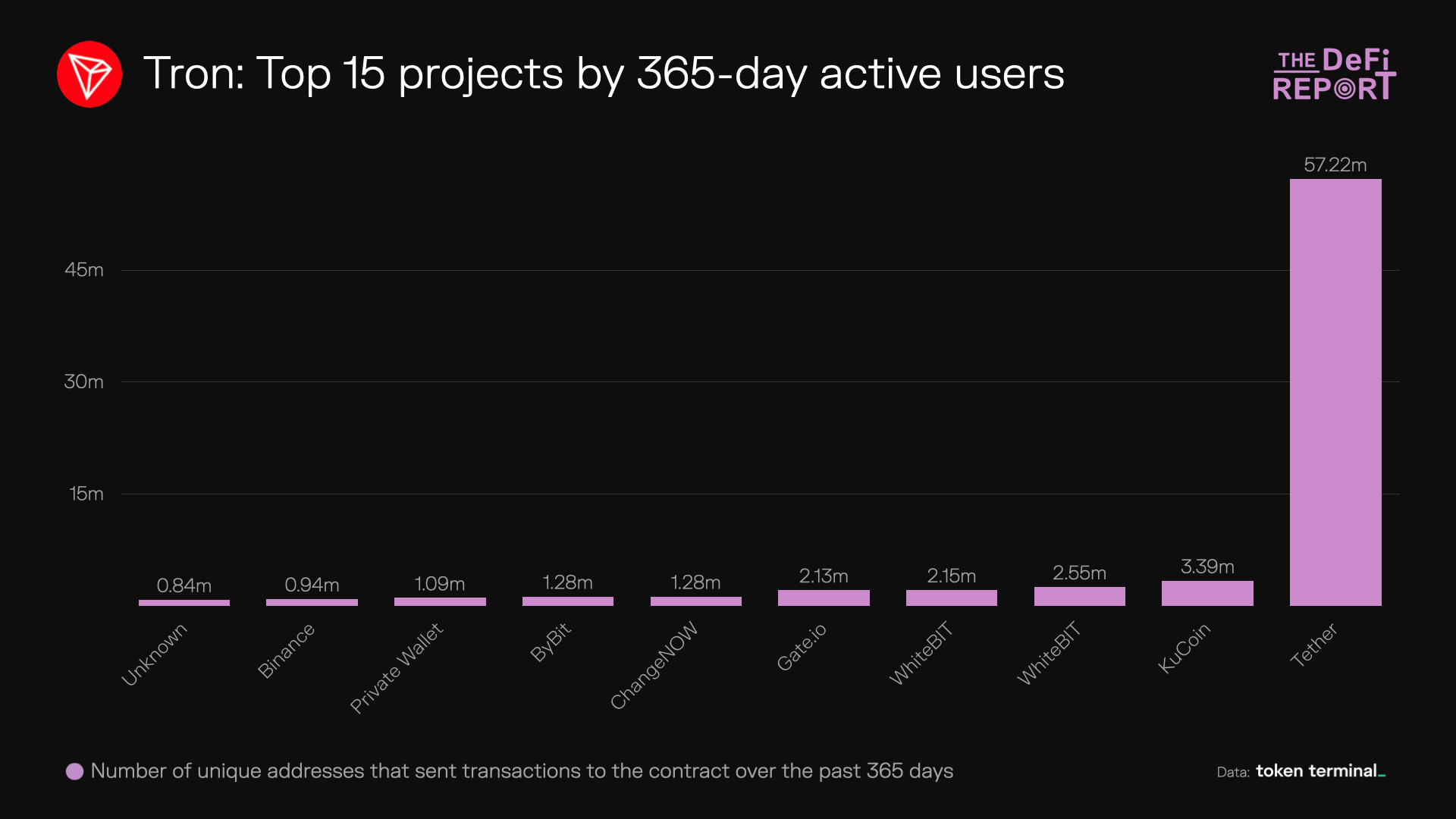

The chart speaks for itself. When it comes to onchain activity on Tron there is Tether...and then there is, well, not much else. 92% of gas consumption on Tron comes from Tether and there are over 57 million unique wallet addresses that have engaged with Tether on Tron over the last 365 days. This is an impressive product/market within a valid use case and growing market. That said, it also could present a concentration risk for the network. More on this later in the report.

Let’s dig a little bit deeper.

How is Tether being used on Tron?

For small, peer-to-peer transactions? Or is it simply the most common trading pair on centralized exchanges? A few notes as it relates to stablecoins broadly per Brevan Howard:

97% of addresses that hold stablecoins hold less than $1,000

Nearly 20 million addresses hold between $1-$100

34% of active addresses are transacting weekly volume between $1 and $100

The data is telling us that stablecoins are primarily used for small peer-to-peer payments. Interesting.

To be clear, all of the Tether data included in this report is onchain data — which does not include Tether’s use as a trading pair on exchanges (CEX trades do not show up onchain).

With that said, the other top projects on Tron in terms of active users are primarily centralized exchanges. Therefore, we wanted to understand the % of Tether transactions that involved a centralized exchange as a sender or receiver.

Thanks to our friends at Token Terminal, we looked at Tether activity on Tron from 1/1/24 - 2/13/24. Here’s what we found:

Total Tether Transactions = 73.9 million

Transactions where the sender/receiver were centralized exchanges = 29%

Transactions where the sender/receiver were not centralized exchanges = 71%

Average value transacted with non-centralized exchange as sender/receiver = $6,700 (note that large whales significantly impact “average” value transferred)

Average value transacted for CEX-related transactions = $14,372

We were impressed to see that the majority of the transactions do not involve centralized exchanges.

Let’s go a little bit deeper on Tether itself. How many users does Tether have on alternative blockchains?

BNB Chain shows up #2 here with over 26 million unique wallets over the last year. Ethereum comes in third with 6.3 million over the same time frame.

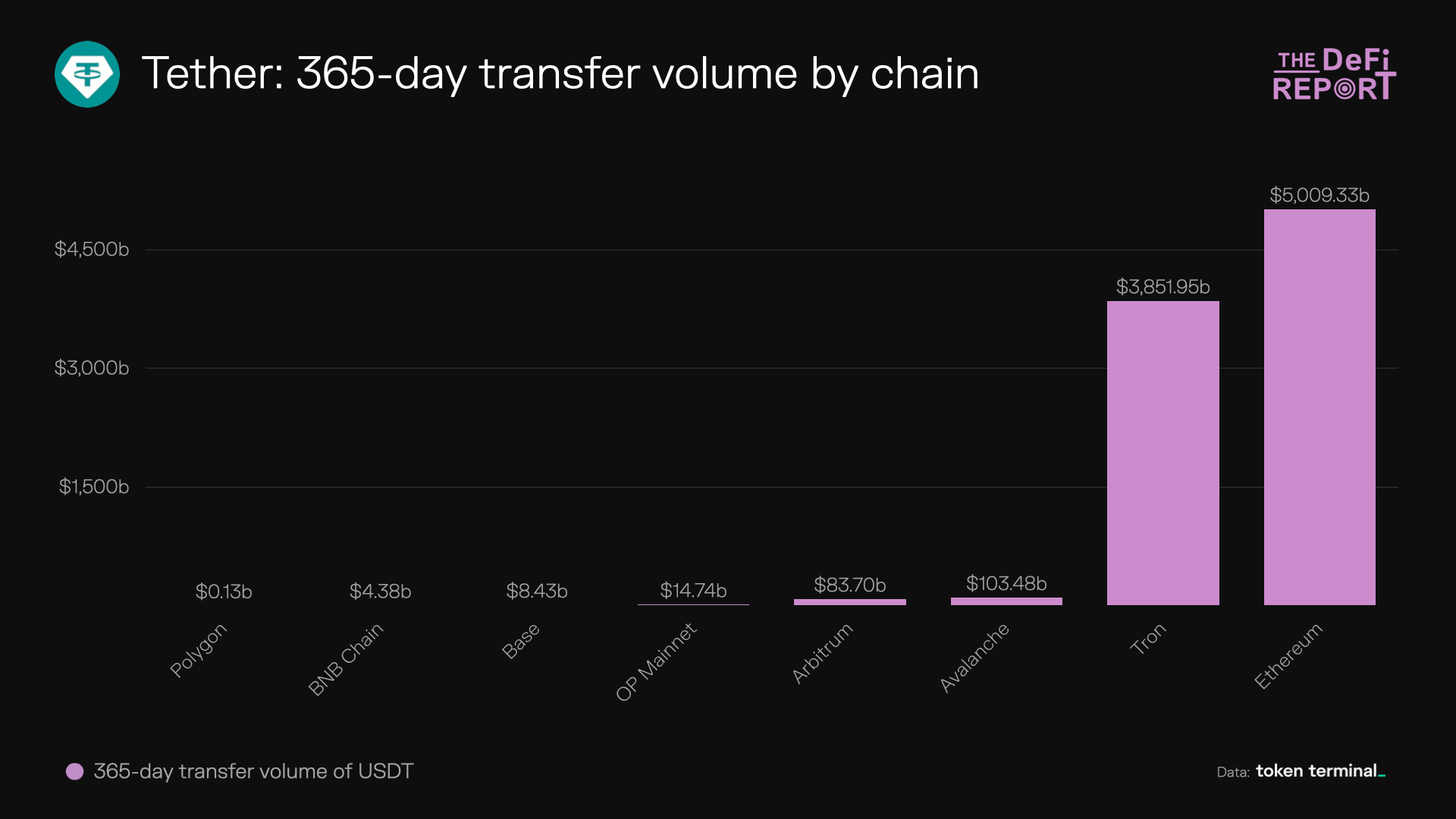

Shifting to transfer volumes. How much volume did Tether have on Tron vs other blockchains over the last 365 days?

Ethereum outpaced Tron in terms of total Tether transfer volumes — even with significantly fewer Tether users. This is due to the average Tether transfer value on Ethereum coming in at over $18k over the last year vs $4.1k for Tron.

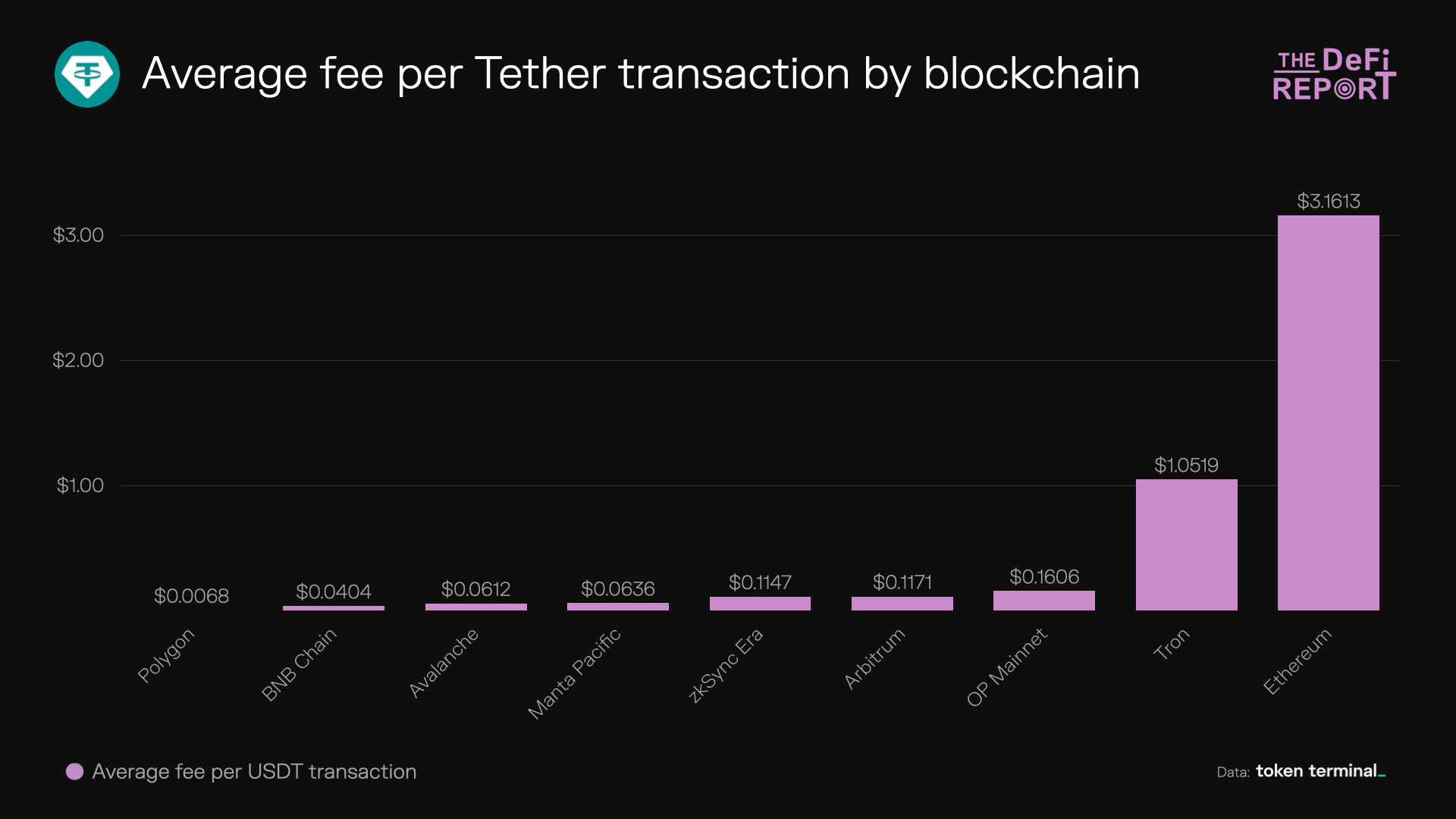

Finally, let’s take a look at the average gas per Tether transaction on Tron vs the other chains:

Interestingly, Ethereum and TRON, two of the top three blockchains in terms of Tether users, also have the highest fees to transfer Tether. Go figure.

Total Value Locked

Tron currently has $8.83 billion of value locked onchain per DeFiLlama — with 94% of that coming from just two projects. JustLend — a lend/borrow DeFi project currently has $6.85b of TVL. If you’re curious, here is a link to the “energy” markets on Tron via JustLend. JustStables — a collateralized debt position/money market project — comes in #2 with $1.45b of value locked.

In total, there are 43 projects currently building on Tron per Token Terminal. As a point of reference, Ethereum has over 548 projects currently listed within The Terminal.

The Business Model

100% of Tron’s transaction fees are burned today — accruing value to TRX holders.

In the above chart, we can see that Tron’s revenue = burned tokens (removed from circulation) which matches its network fees over the last year.

Tron’s validators & delegates are compensated with consensus rewards/network inflation — rather than transaction fees. We can see below that the supply-side compensation was lower than the burn rate over the last year — indicating onchain profitability and a deflating token supply.

Financials

Notably, Tron did almost $1 billion in user fee revenue last year — which was up 237% from 2022. The data above shows a similar progression as Ethereum — in which high consensus rewards/network inflation was needed in the early days to incentivize the supply side of the network. As a result, the network was unprofitable until 2022 — the first year that user fees exceeded token incentives.

With onchain activity picking up early in 2024, Tron has surpassed $1 billion in user fees over the last 365 days and is currently number two across all layer 1 networks:

TRX Token Economics

Circulating Supply: 88,033,491,0125

Total Supply: No Cap

Burn/Buyback? 100% of the transaction fees are burned. Supply side/validators are paid with network inflation — which is offset by burned tokens.

Inflation Rate: -4.16% in 2023. -9.71% in 2022. 6

% of TRX Staked: 50.6%7

Number of TRX Token Holders: 117.6 million. 8

Initial Allocation: 100 billion TRX. 40% was made available to the public via the ICO in 2017. The remaining 60% was distributed to private investors and the founding team.

Team, Investors, Community

As noted, Tron was founded in 2017 by Justin Sun — a prominent figure in the crypto space for over a decade now. He’s also known for various controversies and aggressive marketing tactics — including paying $4.5 million for a charity lunch with Warren Buffett and being sued by the SEC for allegedly violating securities laws. Despite his antics, Sun is also recognized for his contributions to the blockchain space and has been listed in Forbes “30 under 30” in Asia. 9

The Tron DAO currently has over 350 associated members per LinkedIn.

Investors

Tron raised $70 million via its ICO in 2017. We’ve had difficulty finding reliable sources for Tron’s cap table but some sources have indicated that over 25% of the token supply was allocated to private investors — which are unknown to the general public as far as we can tell.10

GitHub Developer Activity

In total, Tron has 68 GitHub repositories. When we examine repositories, we are primarily looking for red flags, such as:

An indication that top developers are leaving the protocol

A lack of updates to the repositories

We just want to see active repositories. As in — developers are working hard to update and enhance the project's code and functionality.

When we reviewed Tron’s repositories we saw relatively low developer activity — which aligns with the low developer and code commits we noted in the progress section of this report. For example, of the 68 repositories, only 5 were updated last week. As a point of reference, Ethereum has 24 repositories that were updated in the last 24 hours.

For further comps, here is a view of Solana’s main repository on GitHub:

Next is Bitcoin:

And here is Tron:

Community

Tron DAO Twitter: 1.4m followers

Justin Sun Twitter: 3.5 million followers

Discord: 48k members

Reddit: 27k members

LinkedIn: 32k followers

Comps

Tron is unique in that its primary use case is stablecoin transfers. There are very few smart contracts or apps that see a high volume of user interaction besides Tether. As such, it’s difficult to compare Tron against any other network.

With that said, Tron is currently the #10 project across all of crypto in terms of market cap. It’s #1 in terms of active unique wallets and #2 in terms of transactions and 365-day revenues. Therefore, the only valid comps in our view are the top three smart contract networks.

As we can see, Tron holds its own across all key metrics outside of developer activity — which makes sense given that 92% of user activity is related to one use case — Tether transfers.

Conclusion

From a geographic perspective, it seems that developers and users in the West (Europe, US) are driving network effects around Bitcoin, Ethereum, Solana, etc. And in the East we see similar dynamics around chains such as BNB and Tron — which tend to be more centralized in nature. Of course, 4.5 billion people live in Asia. With a big early lead, a network like Tron may become one of the top L1 networks — primarily serving the Asian markets.

If we put on our “investor hat” we would acknowledge that Tron has a clear product/market fit with Tether stablecoin transfers. This has catapulted the network into rarified air in terms of users, revenues, and transactions.

With that said, the initial vision for the network has not come to fruition just yet. Most of the early marketing materials we observe indicate that Tron was initially on a mission to “decentralize the internet,” and create “a web3 entertainment/creator platform.” The acquisition of BitTorrent in 2018 fits this narrative but we haven’t seen any strong evidence that the vision has taken hold just yet.

Meanwhile, Tron has introduced some interesting concepts as it relates to token economics, incentives, and transaction fees — but it is unclear if these structures will hold up in the long run. For example, the network provides “bandwidth and energy” for “freezing TRX.” It’s possible that in some instances when this free resource is being used to “pay” for transactions, it is being recorded as fee revenue. Double counting if you will.

Finally, with the recent announcement from Justin Sun on Twitter, it appears that Tron will be focused on supporting Bitcoin Layer 2. Notably, Sun shared that efforts are underway to bridge many Tron tokens and assets over to Bitcoin. We may be missing something, but the strategy here is a bit odd in our opinion — typically you’ll see blockchains create bridges so that assets can move to their chain, not the other way around. If Tron assets are bridged to Bitcoin, it’s possible that this could lead to lower transaction volumes and TVL on Tron in the future.

Like many blockchain networks today, Tron needs an identity (outside of Tether). The current concentration of onchain activity related to Tether presents a material risk in our opinion.

With that said, we’ll continue to monitor the chain and its growing role as a stablecoin settlement layer.

If you got some value from the report, please like the post (heart button in the upper left of your inbox), and share it with your friends, family, and co-workers so that more people can learn about DeFi and Web3.

Finally, if you have a comment, thought, or idea, drop it here:

Take a report.

And Stay Curious.

© The DeFi Report 2021 - 2024. No part of this report may be copied, photocopied, duplicated in any form by any means, or redistributed without the prior written consent of The DeFi Report.

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.

RESOURCES:

https://developers.tron.network/v4.4.0/docs/vm-vs-evm

https://developers.tron.network/docs/nodes-and-clients

https://github.com/orgs/tronprotocol/repositories?type=all

https://tronscan.org/#/data/charts/trx

https://trondao.org/initiatives/about/history/

https://app.justlend.org/energy

https://medium.com/tokenlon/tron-bridge-seamlessly-connect-trc20-and-erc20-usdt-ecae492bf896

https://www.stakingrewards.com/asset/tron

https://www.binance.com/en/research/projects/tron

https://www.theverge.com/c/22947663/justin-sun-tron-cryptocurrency-poloniex

https://www.theverge.com/21459906/bittorrent-tron-acquisition-justin-sun-us-china

https://blog.orai.io/oraichain-x-tron-ai-for-tron-network-and-hackatron-collaboration-b067a9e3579

https://www.charliedefi.com/chains/tron

https://en.wikipedia.org/wiki/BitTorrent

https://www.sec.gov/news/press-release/2023-59

https://twitter.com/justinsuntron/status/1758034850798346517?s=20

https://tronprotocol.github.io/documentation-en/mechanism-algorithm/sr

https://developers.tron.network/docs/nodes-and-clients

https://app.justlend.org/energy

https://coinmarketcap.com/currencies/tron/

https://tronscan.org/#/

https://www.stakingrewards.com/asset/tron

https://tronscan.org/#/token/0/transfers

https://www.forbes.com/profile/justin-sun/?sh=243194ec603f

https://www.binance.com/en/research/projects/tron

Good analysis!👍

This is a great report about the TRON Network.

SO good! 10/10