Hello readers,

Crypto and AI are on track to “cross the chasm” of the S-Curve into mainstream adoption in the coming years. As the two technologies mature, we think they will converge in ways that feed off of each other — driving exponential growth and gains in productivity.

As AI goes mainstream, it will catalyze increasing demand for the following resources:1

Compute (GPUs)

Data

Today the market is primarily focused on #1. Nvidia’s current PE of 98 is instructive in this regard. However, we’ve observed that there is less focus on the increasing demand for cloud data storage driven by AI. Since AI’s are not humans, we think they will require a crypto solution — where disputes are settled with smart contracts instead of legal contracts.

In this week’s two-part report, we are sharing an investment memo on Filecoin — a decentralized data storage network and marketplace.

Part 2 will hit your inbox tomorrow.

Disclaimer: Views expressed are the author's personal views and should not be taken as investment or legal advice.

If you find our research & analysis helpful, please like the post — which can be done directly from your inbox via the heart button in the upper left. Let’s make quality free content a win/win. This helps grow the community and responsibly introduce more people to DeFi and Web3.

Let’s go.

What is Filecoin?

Two important distinctions:

IPFS: a peer-to-peer network for storing and sharing data.

The Filecoin Blockchain & Ecosystem: A decentralized marketplace for buying & selling cloud data storage — with the blockchain serving as the accounting and verification system upon which the marketplace functions.

Let’s break it down further.

Interplanetary File System (IPFS)

IPFS is an open-source protocol enabling the peer-to-peer sharing of data. It was created in 2014 by Juan Benet and we think it may have a profound impact on the future of the internet.

Unlike HTTP, the IPFS protocol is resource/content-driven rather than location-driven.

Here’s what that means: imagine you’re in a lecture together with 50 people and you all watch the same video. What happens in the background is the video must be fetched from the closest servers at Google (or Amazon, Microsoft, etc. — the physical location/data center where the video is stored). If 50 people look up the same video, the process is repeated 50 times. It’s inefficient. This is how HTTP works and it is increasingly causing congestion problems on the backbone of the internet.2

Enter IPFS. Instead of traveling to physical locations (data centers or “the cloud”) to find and retrieve data, IPFS addresses point directly to the data resources themselves via a content identifier — and make sure the data is delivered from the closest resource. It’s similar to the now-defunct Limewire service (peer-to-peer sharing of music).

Back to the lecture hall example: if 50 people need to watch the same video in the same location, they would fetch it from each other (via the content identifier) rather than each computer traveling hundreds or thousands of miles to fetch the same data from the nearest data center. This concept is akin to sharing pictures or videos with someone in close proximity via Apple’s airdrop feature (hat tip Matt Livesley). IPFS accomplishes this via content addressing — where every file is given a unique address — derived from a hash of the file’s content.3

The benefits of IPFS:4

Verifiability (trust): use of cryptographic hashes to verify the authenticity and integrity of files — making it difficult for malicious actors to tamper with or delete files.

Resilience: No single point of failure, and users do not need to trust each other.

Decentralization: IPFS is an open, distributed, and participatory network that reduces data silos from centralized servers, making IPFS more resilient than traditional systems. No single entity or person controls, manages or owns IPFS.

Performance: Faster access to data by enabling content to be replicated and retrieved from multiple locations, allowing users to access data from the nearest location using content addressing (hashes) instead of location-based addressing — reducing performance issues tied to latency.

Link Rot: Because data is addressed by the content itself — rather than by its location, content in IPFS is reachable regardless of where it is stored — and does not depend on specific servers being available.

Data Sovereignty: Protects data sovereignty by enabling users to store and access data directly on a decentralized network of nodes, rather than centralized, third-party servers.

Off-Chain Storage: IPFS enables verifiable off-chain storage by creating a link between blockchain state and content addresses published to IPFS via content identifiers (hashes).

No Vendor Lock-In: Content addressing (hashing) fundamentally decouples data from a single location or infrastructure provider. Unlike traditional cloud vendors, IPFS enables you to change data storage locations without changing things like APIs and data management.

In summary, we think IPFS could be the future of data storage and a fundamental shift to a peer-to-peer model that creates significant efficiencies and security in the way that content is stored and retrieved on the internet.

The DeFi Report is powered by Token Terminal — the leading on-chain data & analytics platform for institutional investors. Subscribe for free data-driven research covering the Web3 tech stack from first principles & on-chain data.

But what about the blockchain? Moving onto Filecoin…

Filecoin and the Business Model

We’ve written extensively about how blockchains can serve as coordination tools via well-designed economic incentive structures. They also function as fantastic accounting and verification (audit) systems.

It’s helpful to think of IPFS as just a distributed data network utilizing content addressing (peer-to-peer) rather than HTTP. It’s a new protocol serving as a breakthrough in computer science. But it doesn’t have a business model.

This is where Filecoin comes into play. Filecoin is a standalone blockchain network that sits on top of the IPFS distributed data network. It provides the accounting, verification, and economic incentive structure that coordinates a decentralized marketplace matching entities seeking data storage — with entities that have excess storage capacity.

Two key elements:

The FIL token serves as the coordination/economic incentive mechanism that brings together a two-sided market of supply and demand.

The Filecoin blockchain serves as the verification and accounting ledger — keeping track of who is providing storage (and if they are playing by the rules of the network) — and who is paying for the services offered by the supply side of the network.

In essence, entities (typically large data centers) with excess (hardware) storage capacity will opt into the Filecoin network. In doing so, they can offer capacity to entities seeking a low-cost product. To ensure that storage providers have skin in the game (and are acting in good faith), they must first acquire FIL tokens commensurate to the amount of storage they will provide. This is their consideration — or their stake — to be eligible to earn fees from those seeking storage capacity.

This concept is akin to Ethereum validators having to first acquire ETH to provide validation services on the network.

To verify storage on Filecoin’s decentralized network, storage providers must prove two things:

1) That the right set of data is physically stored in a given storage space — i.e. proof of replication.

2) That the same set of data has been stored continuously over a given period of time — i.e. proof of spacetime.

At a high-level, this concept is similar to Bitcoin miners using energy to show proof of work.

If a storage provider fails to prove either 1) or 2) they are penalized (slashed) of their FIL stake. This provides the economic incentive to do the right thing. Storage providers that do the right thing are rewarded with the FIL token — in the form of network issuance (block subsidies) and fees paid by entities utilizing the data storage network, which are also paid in the FIL token.

In addition to providing the economic incentives that ensure data providers are acting in good faith, the Filecoin blockchain keeps track of all of the economic activity occurring within the decentralized data marketplace. It’s the ledger and book of record for the distributed data economy powered by IPFS.

Supply Side

There are currently 3,400 active storage providers on the Filecoin network — down from a peak of 4,100 in Q3-22. In total, the network has a supply of 9.8 EiB — which is down roughly 43% from its peak of 17 EiB about 1 year ago.5 At the high water mark, Filecoin had approximately 10% of the capacity of Amazon Web Services.6 Anyone can provide storage to the network, but the vast majority of supply is coming from large data centers with excess capacity.

It’s noteworthy that Filecoin is developing very much as a decentralized marketplace for data. There are currently 115 projects building distributed data services within the ecosystem.7

In terms of network security, there are currently 1,845 nodes on the network running the Filecoin blockchain software. At a high level, the nodes are similar to Bitcoin miners or Ethereum validators — they provide the supply side of the network (storage), and also secure the network and validate transactions. Note that not all storage providers are also running Filecoin nodes — just as not all Ethereum validators are running their own network hardware.

Demand Side

There are currently 1,891 clients of the network ranging from UC Berkeley, The University of Utah, The City of New York, Internet Archive, Solana, OpenSea, GenRAIT (genomics data), Ewesion (China’s fastest growing host of graphic files), etc.

As of 10.30.23, 16.3% of the available supply was being utilized on the network8 — up from .5% one year ago.

The number one driver of demand for Filecoin right now is due to its extremely low costs.9 By most estimates, Filecoin is about 1% of the cost of AWS. Why? Free markets. Filecoin offers a global marketplace for data services. This drives down prices and ultimately benefits the consumer. With that said, if the network is successful, supply could eventually be consumed by demand, putting upward pressure on storage costs.

Financials

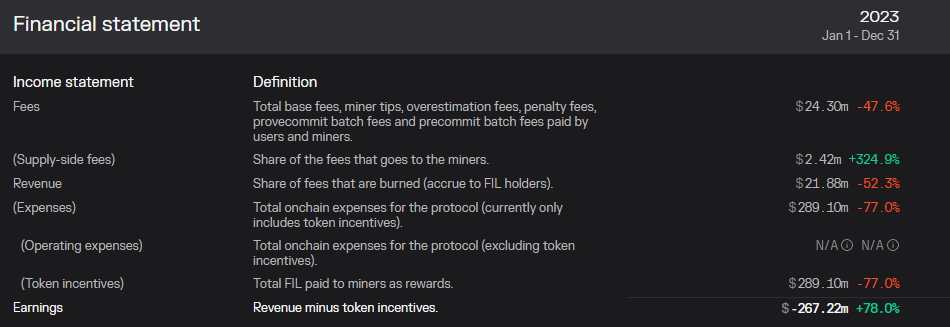

Below are Filecoin’s financials for the year as of 10.25.23 per Token Terminal.

A quick breakdown:

Total Network Fees = $24.3 million

Supply Side (share paid to miners/storage providers) = $2.4m (9.9%)

Revenue (share of fees burned, accruing to token holders) = $21.9m (90.1%)

Expenses (protocol incentives paid to miners) = $289.1m

Earnings (Revenue minus token incentives) = ($267.2m)

[We’ll break down our thoughts on the excessively high token incentives below.]

A quick view of cumulative total fees and revenue (fee burns) over the last year.

Token Economics

Circulating Supply: 514 million FIL10

Total Supply: 2 billion (25.6% circulating)

Here’s the breakdown in terms of token allocation and vesting schedules:11

Protocol Labs (developer of Filecoin): 15% allocation with about 50% vested. The remaining vests on a linear schedule, fully vesting in Oct. 2026.

Filecoin Foundation: 5% allocation with about 50% vested.

Investors (3 rounds): 10% allocation that is fully vested.

Simple Minting: 16.5% allocation with 26.2% fully vested. Note that simple minting follows a simple exponential decay model with a 6-year half-life.

Baseline Minting: 38.5% allocation with 15.1% fully vested. Note that baseline minting is indexed to network growth.12

Mining Reserve: 15% allocation fully vested.

In summary, the investors and foundation are fully vested and the Protocol Labs team is about 50% vested. The remaining token unlocks will come from block rewards — i.e. incentives issued to miners and storage providers.

The network block subsidies/inflation over the last year increased 49% and is projected to increase another 35% over the next year. This figure linearly scales down with each passing year until all tokens are issued. These inflation figures are certainly high and show that the network is very much relying on issuing its “equity” to incentivize the supply side. As the demand side builds out, the goal is for users to compensate miners/storage providers.

Keep in mind that network inflation is also being offset by token burns — with about 90% of the fees paid for storage services being burned today. In total, the network has burned over 38.8 million FIL — 7.6% of the current circulating supply.13

In terms of demand for the FIL token, the bid comes from two structural sources:

Storage providers need to buy FIL and put it up as consideration in order to provide storage (holdings are slashed if storage providers do not provide proofs of the data being stored on a daily basis). *Note that as of 9.30.22, locked tokens represented greater than 35% of the circulating supply.

Users need to buy FIL to pay for storage.

Structural sell pressure comes from miners and storage providers that need to pay operating costs.

Despite the high-inflation, we think the token structure is well-designed. Of course, we’d be remiss not to mention that Filecoin implemented EIP155914 — so that the token structure matches that of Ethereum. This sound economic structure should drive value to FIL token holders if demand for storage continues to grow.

Special thanks to Matt Livesley for his contribution to the immense research that went into this report.

Part 2 will hit your inbox tomorrow and cover the following:

The Filecoin Virtual Machine and DeFi on Filecoin

Team, Investors, Community

Competition

Catalysts for Adoption

Upside Potential & Addressable Market

Risks

Conclusion

Reminder: The Ethereum Investment Framework is now FREE. Download your copy here.

If you got some value from the report, please like the post (heart button in the upper left of your inbox), and share it with your friends, family, and co-workers so that more people can learn about DeFi and Web3.

This small gesture means a lot and helps us grow the community.

Finally, if you have a comment, thought, or idea, drop it here:

Take a report.

And Stay Curious.

*The % vested for the Filecoin Foundation token allocation was updated to 50% (initially 100%) on 10.30.23.

No part of this report may be copied, photocopied, duplicated in any form by any means, or redistributed without the prior written consent of The DeFi Report.

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.

https://www.youtube.com/watch?v=mdpN8iL4L8Q&t=618s

https://medium.com/innovation/how-ipfs-is-disrupting-the-web-e10857397822

https://docs.ipfs.tech/concepts/content-addressing/#what-is-a-cid

https://docs.ipfs.tech/concepts/ipfs-solves/#performance

https://messari.io/report/state-of-filecoin-q3-2023

https://cointelegraph.com/news/more-resilient-and-user-controlled-than-the-aws-colin-evran-s-vision-for-filecoin

https://ecosystem.filecoin.io/

https://dashboard.starboard.ventures/market-deals

https://cointelegraph.com/news/more-resilient-and-user-controlled-than-the-aws-colin-evran-s-vision-for-filecoin

https://dashboard.starboard.ventures/circulating-supply#fil-protocol-circulating-supply

https://token.unlocks.app/filecoin

https://spec.filecoin.io/systems/filecoin_token/minting_model/

https://dashboard.starboard.ventures/circulating-supply

https://filecoin.io/blog/posts/eip-1559-in-filecoin/

The Metaversal breakdown of IPFS, Arweave and Filecoin as NFT storage methods makes for nice complimentary reading here as NFTs do constitute a clear use case as FTX's doomed NFTs keep (and now lost) on a central server have shown us.

https://metaversal.banklesshq.com/p/nft-storage?r=rn6y&utm_campaign=post&utm_medium=web