Filecoin: Investment Memo Part 2

Quantifying the opportunity

Hello readers,

We’re back for the final act of our Filecoin memo. If you haven’t read Part 1, we recommend starting here.

Topics covered in Part 2:

The Filecoin Virtual Machine and DeFi on Filecoin

Addressable Market and Price Forecasts

Catalysts for Adoption

Team, Investors, Community

Competition

Risks

Conclusion

Disclaimer: Views expressed are the author's personal views and should not be taken as investment or legal advice.

If you find our research & analysis helpful, please like the post — which can be done directly from your inbox via the heart button in the upper left. Let’s make quality free content a win/win. This helps grow the community and responsibly introduce more people to DeFi and Web3.

Let’s go.

FVM & DeFi on Filecoin

It’s important to note that data storage is only the start for Filecoin. Computation and programmability are next. That’s where the Filecoin Virtual Machine comes into play.

The FVM essentially combines the power of smart contracts with verifiable storage. Similar to smart contracts on Ethereum, the FVM has the ability to self-execute certain behaviors or business logic based on predetermined conditions. This is super important because it means that web3 apps can automate processes while referencing large amounts of data to make optimal decisions. We think this could be pretty interesting for Data DAOs when combined with AI tools. Furthermore, the Protocol Labs team has shipped “FEVM” — which allows EVM (Ethereum Virtual Machine) devs to utilize familiar Ethereum tooling out-of-the-box.1

Here are a few examples of what is possible on the FVM:

Storage Insurance

Perpetual Storage

DeFi for Storage Businesses

NFTs

Time-locked data retrieval

Bulk Discounts

Similar to the EVM, it seems almost anything is possible on the FVM using programmable smart contracts. In terms of DeFi, Uniswap governance recently approved the deployment of v3 on the Filecoin Virtual Machine. Why is DeFi necessary on Filecoin? Well, they are building a marketplace for data. Just like any other business in the economy, storage providers need access to finance (loans) to grow their storage capacity and business operations.

In this case, the more FIL tokens a storage provider can get, the more excess storage capacity they can offer the marketplace (SPs need to acquire FIL to offer services, similar to how Ethereum validators need ETH to do the same on Ethereum). Therefore, a storage provider business could leverage a DeFi lend/borrow protocol to get the necessary FIL token needed to grow their storage offering, paying the loans back with revenues earned from operations.

Of course, there is a role for a DEX to play here as well. DEXs can enable the swapping in/out of the FIL token earned via operations — such as a stablecoin to pay the operating expenses of the business. They can also make it easier for the demand side to access the FIL token to pay for services.

Addressable Market & Price Forecasts

Cloud storage is about a $90b market today, with the market projected to expand out to $472b by 2030 per statista.2

If AIs go mainstream and are used to replace or supplement the manual efforts of knowledge workers today, business operations will become increasingly more productive. We think this productivity will be expressed in the efficiency that AI brings to the creation of content (knowledge) — leveraging large language models in the process.

Of course, it’s possible that the cloud storage market could grow faster and larger than most estimates. For what it’s worth, the Filecoin team has the market growing to $1 trillion by 2028.

Remember, all models are broken. With that said, TAM analysis is still helpful for high-level framing. We think it should be used as a basis to inform additional thinking rather than the end-all-be-all. Below are some high-level scenarios for Filecoin based on the size of the cloud storage market by 2030, the % moving on-chain, and Filecoin’s market share and value capture.

Again, this is just one high-level framing using a more rational analysis. Of course, anyone who followed this type of analysis ahead of the last bull market probably would have passed on Filecoin (and missed a 20-30x). Crypto markets aren’t exactly rational — and there are many reasons for that. We tend to think this dynamic will persist in the next cycle.

The right narrative + the market’s acknowledgment of Filecoin’s ecosystem growth over the last few years + an illiquid circulating float = potential for rapid new price discovery as we saw in the last cycle.

As always, the question for investors is whether you think FIL will outperform ETH and/or BTC.

The DeFi Report is powered by Token Terminal — the leading on-chain data & analytics platform for institutional investors. Subscribe for free data-driven research covering the Web3 tech stack from first principles & on-chain data.

Catalysts for Adoption

We see 3 primary factors:

Another bull market for crypto. If you haven’t read our analysis regarding the macro setup for the next cycle, you can do so here.

Growth of AI. AI’s need compute (GPUs). They also need data. If AI sees broad mainstream adoption in the coming years, we think there could potentially be exponential growth in cloud storage demand because of the efficiencies that AI will bring to business operations. In essence, if AI is twice as efficient as humans, we would expect to see twice the amount of data and content produced — which needs storage. Rather than use centralized services such as AWS, we think AIs will seek business interactions via smart contracts and immutable computer code — primarily because they have no way of settling legal disputes. Smart contracts seem to be the obvious answer here.

Growth of crypto use cases. We’ve written extensively about how crypto introduces the concept of user-controlled data (digital property rights) to the Internet. NFTs are a large part of this. It’s important to note that the meta-data pertaining to NFTs is not stored on-chain. It’s stored in decentralized data solutions such as IPFS or Arweave. In fact, OpenSea stores most of the metadata pertaining to NFTs on its marketplace in IPFS. As use cases for NFTs grow in the coming years, the demand for storage of their metadata will grow as well.

Team, Investors, and Community

Protocol Labs

Protocol Labs was founded in 2014 by Juan Benet to support the development of IPFS. It emerged out of YCombinator and is tied in with the Silicon Valley tech scene. The team has a total of 312 employees per Linkedin with its headquarters based in San Francisco. It’s worth noting that the company had a reduction in force of 21% back in February of this year — with leadership citing the current economic situation and ongoing crypto winter.3

Generally speaking, we are impressed with the volume and quality of educational content coming out of Protocol Labs. We recommend checking out TL;DR4 resources, and the ecosystem YouTube channel if you want to do your own research. 5 We met with Jonathan Victor, the Ecosystem Lead at Protocol Labs, as part of our research. Jonathan was super professional and resourceful in making sure we had the right information to prepare the report. It’s clear to us that Protocol Labs is a well-run organization, is playing long-term games, and has really big ambitions.

Investors

Filecoin launched in August of 2017 via the largest ICO in history when the team raised $257 million.6 Notable investors include Sequoia Capital, a16z, Union Square Ventures, Placeholder Capital, and Blockchain Capital.

Filecoin Foundation

The Filecoin Foundation has a total of 74 employees. Their role is to facilitate the governance of the Filecoin network, fund critical development projects, support the growth of the ecosystem, and advocate for the decentralized web.

Social Presence:

Twitter: 662k followers for the Filecoin account7

Twitter: 130k followers for the Protocol Labs account8

Twitter: 50k followers for Juan Benet (the CEO)9

For reference, Arweave, the second-largest decentralized data network, has 85k Twitter followers.

Competition

Filecoin is by far the most developed decentralized storage solution in the market. But it’s not the only one. Arweave, Storj, and Sia are the three primary competitors today.

For the sake of brevity, we’ll focus our competitive analysis on Arweave — the second-largest decentralized data network.

Data: Starboard, https://viewblock.io/arweave, developer report, coinmarketcap, LinkedIn

For starters, Filecoin is about 20x the size of Arweave today in terms of data stored.10 It has almost 3x the number of projects building on it. It’s cheaper to use than Arweave. And it has a programmable smart contract layer.

With that said, Arweave is showing that it has product/market fit as well. Below we can see network transactions scaling nicely throughout the crypto winter:

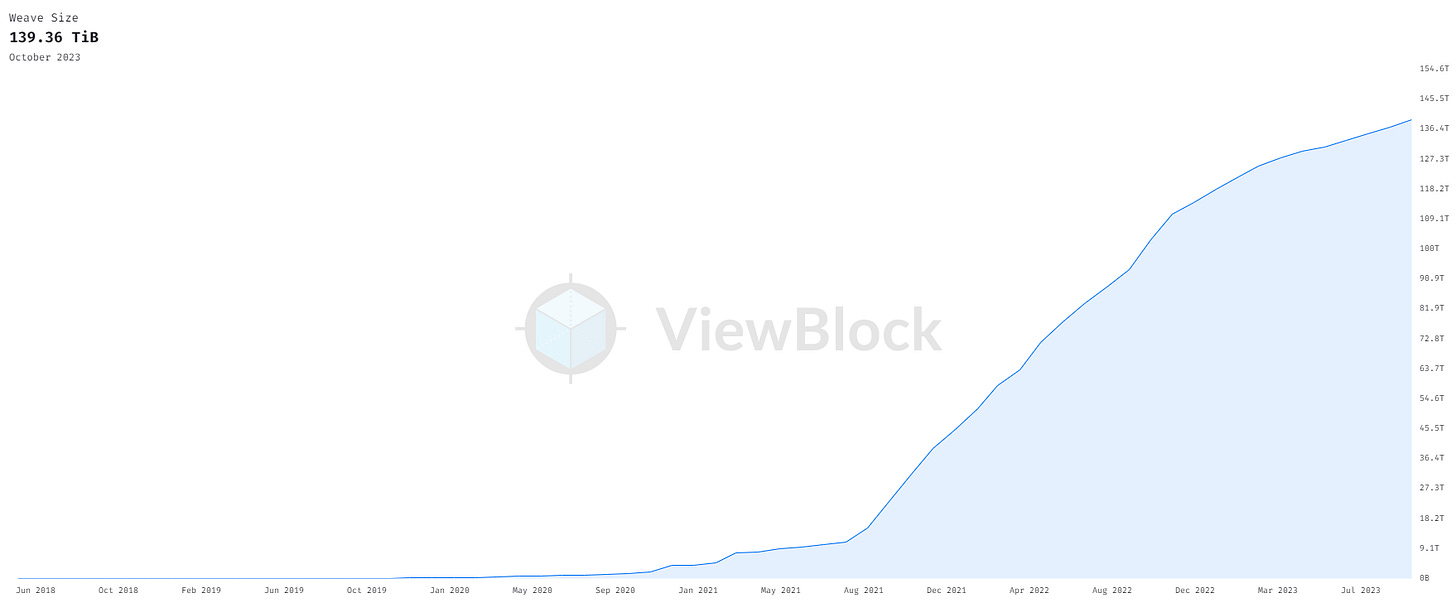

Furthermore, the network’s weave size is growing:

While the network is growing as an alternative to Filecoin, we think Arweave is playing a different game. The primary differences are below:

Filecoin is focused on short to medium file storage needs. Arweave is focused on making data storage permanent — with a one-time fee.

Filecoin is focused on private, enterprise data. Arweave is focused on public data.

We expect both ecosystems to grow and evolve in the coming years, and we think there is plenty of space for both of them to thrive. Please note that a full report on Arweave is required for proper competitor analysis. We plan to cover the network in depth in a future report.

Risks

We’ve identified 8 primary risks for Filecoin:

UX. In order to consume services on Filecoin, one must first purchase the FIL token on a centralized or decentralized exchange. This requires deep crypto knowledge today as the user experience is still very “crypto native.” We expect this to improve dramatically over time — but it could hamper enterprise adoption in the short run.

It could take longer for AI to go mainstream. This could delay the demand for decentralized storage solutions.

Regulation. Crypto has still not been blessed by regulators. This hinders enterprise adoption of solutions such as Filecoin.

Filecoin is an extremely technical and ambitious project. This introduces execution risk. It’s also possible that it takes much longer to build out the ecosystem.

Token economics. Filecoin has a complex economic structure. It’s possible that instead of value accruing to the token in the long run, it accrues to the applications building SaaS-type businesses “on top.”

IPFS. Filecoin’s success is inherently tied to the growing usage of the IPFS protocol.

Competition. It’s possible that existing centralized solutions adapt to the evolving market structures and find a way to capture new demand.

Unforeseen geopolitical risk. It’s possible that the AI race becomes geopolitically complicated. Supply chains related to chips and GPUs could be caught in the crosshairs — hindering the growth of AI, and demand for decentralized storage solutions.

Conclusion

We think decentralized data storage is investable for the following reasons:

There is potentially a profound catalyst via the intersection of crypto + AI.

Demand for cloud storage is likely to grow significantly in the coming years.

Peer-to-peer data solutions are cheaper and more secure than existing solutions.

AIs will require decentralized solutions governed by smart contracts rather than legal contracts.

The market seems to have forgotten about the solutions out there — which are showing signs of clear product/market fit during the crypto winter.

We think Protocol Labs is a mission-driven organization and one of the most well-run projects in crypto. The team has a clear vision via its 3-step master plan:11

Build the world’s largest decentralized storage network.

Onboard and safeguard humanity’s data.

Bring retrieval and compute capabilities to the data and build scalable applications.

The recent launch of the FVM is a notable development for the ecosystem — with no other network remotely close to its capabilities. We also think it’s noteworthy that Protocol Labs has taken many of the best elements of Ethereum and implemented them on Filecoin. Smart contracts for programmability. DeFi to service business needs. EIP1559. These are all learnings from Ethereum — revealing a team that is deeply aware of what works and doesn’t work in other ecosystems.

For more coverage on Filecoin, we recommend Arthur Hayes’s presentation at Token2049 or his essay on the topic.

Special thanks again to Matt Livesely for his contribution to the immense research that went into our 2-part coverage of the Filecoin ecosystem.

Reminder: The Ethereum Investment Framework is now FREE. Download your copy here.

If you got some value from the report, please like the post (heart button in the upper left of your inbox), and share it with your friends, family, and co-workers so that more people can learn about DeFi and Web3.

This small gesture means a lot and helps us grow the community.

Finally, if you have a comment, thought, or idea, drop it here:

Take a Report.

And Stay Curious.

No part of this report may be copied, photocopied, duplicated in any form by any means, or redistributed without the prior written consent of The DeFi Report.

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.

https://filecoin.io/blog/posts/the-filecoin-virtual-machine-explained/

https://www.statista.com/statistics/1322710/global-cloud-storage-market-size

https://www.coindesk.com/business/2023/02/03/filecoin-parent-company-protocol-labs-cuts-21-of-staff/

https://filecointldr.io/

https://www.youtube.com/@FilecoinProject/videos

https://www.coindesk.com/markets/2017/09/07/257-million-filecoin-breaks-all-time-record-for-ico-funding/

https://twitter.com/Filecoin

https://twitter.com/protocollabs

https://twitter.com/juanbenet

https://viewblock.io/arweave

https://filecoin.io/blog/posts/the-filecoin-masterplan/

The Metaversal breakdown of IPFS, Arweave and Filecoin as NFT storage methods makes for nice complimentary reading here as NFTs do constitute a clear use case as FTX's doomed NFTs keep (and now lost) on a central server have shown us.

https://metaversal.banklesshq.com/p/nft-storage?r=rn6y&utm_campaign=post&utm_medium=web