Ethereum Valuation Framework

A new framework for a new asset

Hello readers,

This week we’re sharing our current thinking related to valuation frameworks for Layer 1 blockchains, with a focus on Ethereum. Topics covered:

Tokens as a Tool for Capital Formation

How ETH falls into the Super Asset Class Framework

On-Chain Financials & Discount Cash Flow Analysis

ETH as a Digital Commodity & Store of Value

Our Favorite KPIs to Monitor

Disclaimer: Views expressed are the author's personal views and should not be taken as investment advice. The author is not an investment advisor.

The DeFi Report is an exploration of the emerging web3 tech stack and an ongoing analysis of where value could accrue. We provide easy-to-follow mental models, frameworks, and data-driven analyses of DeFi and web3 business models.

Let’s go.

Why Tokens are Useful

We’ve covered token basics previously at length. If you’re interested, you can find more on tokenomics 101 here.

To set the stage for this report, I want to briefly reiterate why we think tokens are a powerful bootstrapping and capital formation tool. You can skip this section if this is already familiar to you.

Simply put, tokens are most useful when certain behaviors need to be incentivized in a permissionless fashion amongst the public at large. Tokens can help coordinate activity for a shared, broad, decentralized objective.

In the case of Ethereum, the shared objective is to create a world computer — or open data network, that can power new, internet-based business models utilizing smart contracts, peer-to-peer interaction, and user-controlled data.

To bootstrap this into existence in an open-source fashion — where no individual or entity controls access (or edit rights) to the data network — Ethereum issued a token and programmed the blockchain to reward early contributors. Drawing on the success of Bitcoin, this created the necessary incentive to help coordinate the behavior of individual contributors and service providers globally — developers, validators, node operators, miners, etc.

The Super Asset Class Framework

In traditional finance, we typically bucket financial assets into 3 super asset classes:

Capital Assets: Assets that produce cash flows directly. Bonds, real estate, and stocks fall into this bucket.

Consumable/Transformable Assets: Assets that can be consumed or transformed and have economic value, but do not produce cash flows directly. Examples include commodities such as corn, oil, or precious metals.

Store of Value or Money Assets: Assets that don’t provide an income stream and also cannot be consumed or transformed. Examples include currency, precious metals (the monetary premium), art, and collectibles.

How does a layer 1 crypto asset such as ETH fit into this framework?

ETH has features of all three super asset classes.

ETH as a Capital Asset: Ethereum produces cash flows — which are captured by validators/block producers through user transactions — yield which can only be captured by holding the native token and staking it to a smart contract. *Note that holding ETH itself does not entitle one to earn a yield — as a dividend-paying stock or bond would. One must stake their ETH — validating transactions and providing a service to the network — in order to receive the yield. Stakers currently earn a 5% *real* yield. Therefore, we could say that the p/e ratio for stakers is 20 considering the current stake rate and transaction fee volumes.

Consumable/Transformable Asset: Ethereum has features of a commodity as well. ETH is “consumed” as more people use the network. This feature is programmed through a burn mechanism that functions similarly to an automatic stock buyback as demand for block space increases. Just like you need gas to operate vehicles & machinery, you’ll need some ETH to use the Ethereum database or any application built on top of it. About 70-85% of what you pay will be “burned” and removed from circulation. This is why some people say ETH is like “digital oil.” It has features that make it function like a digital commodity.

Store of Value/Money Asset: The perceived value of a store of value/money asset is dependent on the exchange rate and the perception of market participants. For example, one might want to hold Gold over USD if they believe USD will have higher than normal levels of inflation in the coming years. Or one might hold USD over EUR if they perceive America to be a more stable economy. One might hold a collectible or luxury artwork based on the market’s perception of the value of these items. Generally speaking, store-of-value assets need to be unique and scarce. Because the utility of Ethereum (the network) could increase in the coming years while the supply of ETH (the asset) decreases, some market participants perceive ETH as a store of value.

On-Chain Financials

Ethereum sells block space. That’s the product. Its block space has demand because there is a network of developers, nodes, validators, data oracles, users, and businesses building on and around the blockchain. The functionality of the open database in conjunction with smart contracts allows peer-to-peer interaction and the formation of new, internet-based business models.

Want to get a loan on Aave or trade on Uniswap? You will need to pay for block space. Want to mint or purchase an NFT? You’ll need some block space for that. Want to send some USDC to a family member in Argentina? You’ll need some block space for that. Want to play a game built on Ethereum? You’ll need some block space. You get the point.

Every transaction — which is a recording of data (not just financial) — has to pay for block space. Users pay for block space with the native token, ETH. Ethereum is a tech platform. We could think of it similar to how we think about Amazon or Apple’s iPhone. In addition to selling hardware, Apple’s iPhone makes money when developers build apps and list them on the App Store. Amazon is a platform that captures a % of transactions. Therefore, if developers build interesting new businesses that people want to use on the Ethereum platform — ETH, the crypto asset powering the platform — should accrue economic value.

Let’s break down what this looks like using a simple on-chain financial statement framework:

Fee Revenue: refers to the total dollar value of block space sold during the period.

Cost of Revenue: refers to the dollar value of the fees that are paid to global service providers (validators). About 15% of the fees were paid out to validators over the last year — which equates to a yield of about 5.1% for validators currently.

Gross Profit: refers to the total fees generated less the amounts paid out to service providers/validators. This is also the total dollar amount of ETH burned — which we should think of as a share buyback, benefitting passive holders of ETH. More on this later.

Operating Expense: this is the dollar value of the block subsidy — or protocol inflation — that is paid out to the global servicer providers/validators. We can think of this line item as Ethereum’s security budget. It was reduced by 90% post-merge. *We’ll note that the blockchain doesn’t actually “pay” anything here. We should think of it more like a start-up issuing additional equity, diluting existing shareholders.

Net Income: the difference between gross profit and operating expense. This nets out the total network fee revenue less the % of fees and the block subsidy paid out to service providers/validators. When this number is positive, it signals that more ETH was burned (due to transaction volume) than was paid out to validators for securing the network.

Important note: the amount of ETH that can be “burned” or removed from circulation has no limit in theory — because it is directly correlated to the volume of transactions. More transactions (demand for block space) = more ETH burned and removed from the market. However, the amount of ETH that can be issued does have a limit. It’s determined by forward guidance by the Ethereum Foundation and is dependent on the volume of ETH locked in staking/validator smart contracts. Today, with 13.8% of circulating ETH locked in staking contracts, the network has an inflation rate of about 1,700 ETH/day.

The platform mints new ETH and pays it to its validators who verify transactions and secure the network — the operating expense/token incentives. As long as the demand for block space exceeds the security budget, the network could be viewed as profitable — because the circulating supply will drop (benefiting passive holders). Meanwhile, validators (active holders) will earn an attractive yield from transaction fees.

We can see that this was the case over the last quarter, despite crypto experiencing a deep bear market. When glancing at the P&L, you might be wondering why the blockchain was comparatively unprofitable over the previous 6 months and 12 months.

We can attribute the shift in profitability to the merge, which occurred on September 16. Below we can observe the net new issuance of ETH since the merge.

The Ethereum Foundation was overpaying its miners! This chart visualizes it. As noted, since the network went to proof of stake, Ethereum cut its security expense by roughly 90%.

Capital Asset Valuation

Since ETH is speculative and volatile — from both a market value and usage standpoint, we ran two simple discount cash flows.

#1: Total 2022 transaction fees with an average 25% annual growth rate, a 12% discount rate, 20-year term. This gets us to a market cap of $416 billion or $3,459/token fully diluted. Keep in mind these are bear market figures as fees were down 58% in 2022 compared to 2021. Here is a simple DCF calculation.

#2: Total 2021 transaction fees with an average 25% annual growth rate. If we keep everything else constant and extrapolate the annual revenues from 2021, we get to a $966 billion market cap or $8,022/token. This gives us an idea of valuation using bull market figures. Here is a simple DCF calculation.

Ethereum could potentially serve as a settlement layer for global finance with many additional use cases. As such, the addressable market is quite large. A $1 trillion market cap seems reasonable from this perspective.

Note that we’ve used a fairly conservative 25% annual average growth rate in fees. Ethereum’s actual compound annual growth rate for fee revenue is 146% over the last 5 years, which includes the noted drop of 58% in 2022.

These calculations are a starting point for valuation analysis. Please don’t take it as investment advice. The term, discount rate, and average growth rates can be adjusted as needed for various scenario analyses. Using total transaction fees as our starting point could also have flawed assumptions. Finally, a separate analysis between passive holders of ETH (non-stakers) and stakers/validators could be warranted.

Revenue/Earnings Multiple

Because Ethereum is a decentralized network, its expenses are taken on by its distributed set of service providers/validators. These expenses are essentially the consideration for staking, which is the dollar value of the ETH staked. As we’ve noted in the on-chain financials section, the network expenses could also be viewed as the protocol inflation/what the network pays out to incentivize participation from validators. Some analysts view the network expenses as decentralized and therefore should not be included in earnings multiple analysis or in discount cash flow analysis. In this case, the gross revenues would be considered earnings.

From that perspective, if we took a multiple of the revenues from the last few years and compared them to today’s market cap, this is what we get:

2021: 17x Revenue Multiple or Price/Sales Ratio

2022: 41x Revenue Multiple or Price/Sales Ratio

These figures could be viewed as attractive since a high-growth tech company could see a much higher multiple. Tesla, an extreme example, was over 200x during the bull market of 2021. Amazon is currently at an 86 p/e multiple and is currently 45% off its peak share price.

Daily Flows

Figures above are post-merge from 9.16.22 - 1.15.23. We want to highlight the massive shift in flows since the merge. Prior to the merge, when the Ethereum Foundation was wildly overpaying its miners, the network was issuing about 13,500 new ETH per day. Using ETHs market price today, that’s $20,925,000 of new supply/day. Furthermore, miners had operating costs (hardware + electricity) and therefore sold about 80% of their rewards.

Post-merge, we have about 1,700 new ETH issued per day. Almost a 90% reduction! This number fluctuates slightly based on the total ETH staked. Keep in mind that validators do not have operating expenses. So, that 80% of automatic new supply sell pressure is gone.

Finally, there are 4.7 million ETH locked in DeFi applications currently. Adding this amount to the 16 million ETH locked in staking contracts, we have approximately 18% of the circulating supply locked in smart contracts earning a yield. We could think of this as “illiquid circulating supply.”

Key Takeaway: The market had to absorb approximately $16,000,000 in guaranteed daily selling pressure prior to the merge. That selling pressure is essentially gone today. In fact, on days when more ETH is burned than is issued, structural *outflows* would be needed to keep the price from *rising.* We are in a bear market, but a quick glance at Etherscan reveals that issuance has been net deflationary 11 out of 14 days so far in 2023.

We can observe the shift in flows with recent market activity. Ethereum sold off sharply back in June of 2022 (pre-merge), hitting a bottom at around $900. We had another capitulation in November related to FTX (post-merge) — at that time Bitcoin led the broader market to new lows. However, Ethereum held its ground. It didn’t make a new low. In fact, it bottomed about 27% higher than its June low. We think this is due to the structural change in flows resulting from the merge on 9.16.22.

Commodity Valuation

ETH has commodity-like features because you need ETH to use the blockchain. Just like you need oil or gas to power your car or heat your home. The difference with ETH is it has a cap (or forward guidance from the Ethereum Foundation) on how much can be created. It does not have a cap on how much can be destroyed (or burned). The key for the Ethereum Foundation is to find an equilibrium where ETH consumption outpaces ETH creation but does so without driving transaction costs too high. After all, if the price of oil rises too fast, people stop taking road trips. Or they seek alternative options for travel. In the case of Ethereum, users would likely move to other blockchains. We think that the cost/transaction will drop over time (due to layer 2 solutions), but the volume will pick up with more adoption and use cases. Since transactions on L2 ultimately settle in batches on Ethereum L1, this should result in low fees but a deflationary token supply — which would be the best of both worlds.

The commodity value of ETH is difficult to forecast. It’s based on speculation regarding supply/demand. We have an idea of what the supply will be based on the transparent policy or forward guidance from the Ethereum Foundation related to ETH stake rate and new issuance. The demand depends on what the developers are cooking up. Users will come when it’s easier to use stablecoins for payments. When games are fun and allow users to own the in-game assets via NFTs. When the largest brands in the world are issuing NFTs and adding experiences for consumer loyalty. When social media allows users to control their content. When wallets and DeFi applications are easy to use, KYC/AML pools are introduced, and standards have been created for smart contract audits. You get the point. We think this will happen because of the benefits of open networks, superior user-centric business models, and user-controlled data.

Store of Value/Money Asset

ETH is a medium of exchange within the Ethereum ecosystem. It’s the grease that powers the blockchain. That said, when an asset is used as a medium of exchange, such as fiat currency, it typically does not serve as a great store of value. However, based on ETH’s token supply/demand structure outlined in this report, we think it is possible that the market could assign a monetary premium to ETH.

ETHs monetary premium as a store of value could ultimately come down to the network effect it achieves, new use cases, and the demand for block space within competing layer 1 ecosystems. Let’s keep in mind that the price of ETH can only go so high before the blockchain becomes uneconomical from a user perspective.

Key Data Points

There are many data points to track as we monitor the long-term viability of Ethereum vs other blockchains. We think the below metrics provide the most signal at this stage:

Number of Developers & Developer Growth

The compound annual growth rate for Ethereum developers is 32% over the last 6 years. We are monitoring the drop-off of late but think it’s largely seasonal. Interestingly, the code commits have been flat for several years and are down from the early years. We think this is due to the power of composable, open-source code — where each problem is solved once, allowing others to build on top — sort of like legos plugging into each other.

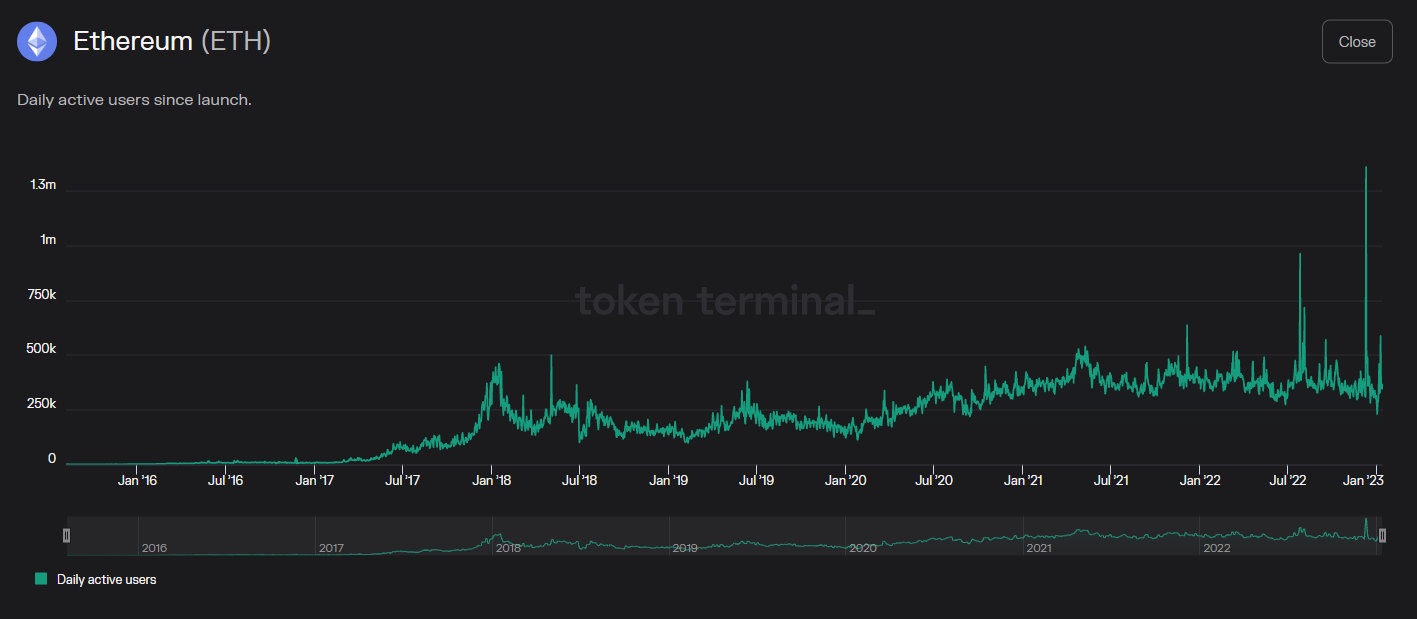

Number of Active Users & User Growth

Daily active users are currently in the 400k range and have seen fairly steady growth. The compound annual growth rate in users since 2016 is 92.9%, and 38% since 2017. Users were down about 3% in 2022 when compared to 2021.

Network Transactions & Transaction Growth

Transaction volume held up well last year despite the drop in prices. For the year the network was down 12%. With that said, the compound annual growth rate is 76% over the last 6 years and 32% over the last 5. With layer 2 scaling, we are starting to see transaction growth at the base layer start to level off.

Revenue

Ethereum’s revenue figures are still holding strong. The network has averaged about $2.6m in daily sales over the last 30 days. The compound annual growth rate over the last 6 years is 454%. If we start with the more active year of 2017, the CAGR is 146% over a 5-year period — even with a 58% drop in 2022 when compared to 2021.

Total Value Locked is a metric we keep an eye on as well. However, TVL is tied to crypto asset prices and is quite volatile. It also can be gamed as we saw with Solana last year. Within TVL, we primarily focus on the amount of the blockchain’s native asset locked up. This is about 18% for ETH (DeFi + staking) with total TVL currently at $27 billion — orders of magnitude higher than any other blockchain.

The bottom line is it’s still incredibly early as it relates to blockchain adoption. As such, our north star needs to be rooted in tracking developer activity and the resulting network activity spawned out of new projects, new use cases, and layer 2 scaling solutions. As a network effect forms, we can then forecast and monitor the relative strength and unit economics by tracking our KPIs.

Ethereum has the strongest network effect amongst the layer 1 smart contract platforms today.

Thanks for reading.

If you got some value from the report, please like the post, and share it with your friends, family, and co-workers so that more people can learn about DeFi and web3.

This small gesture means a lot and helps us grow the community.

If you have a comment, thought, or idea, drop it here:

Finally, if you are an investor, VC, hedge fund, family office, or start-up interested in working with The DeFi Report through any kind of partnership or bespoke advisory services feel free to reach out at mike@thedefireport.io or reply to the email if you are reading this from your inbox.

___

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.