A New Open Standard

The Foundational Framework Guiding our Analysis of the web3 Tech Stack

Hello readers,

I hope everyone is doing ok out there. This year has been really difficult for our industry. Sam Bankman-Fried is the latest bad actor. We’re not going to rehash the collapse of FTX here — others have done a good job of that already. But as our readership has grown, I want to take this opportunity to revisit the foundational frameworks guiding our research & analysis for DeFi and web3 — and crystallize the mission of The DeFi Report.

___

If you’re new to the program, drop your email below to receive free reports twice per month directly to your inbox. The DeFi Report is an exploration of the web3 tech stack and an ongoing analysis of where the most value could accrue. We provide easy-to-follow mental models, frameworks, and data-driven analyses of DeFi and web3 business models.

Let’s go.

Our Thesis

Per the framework laid out by Carlota Perez in Technological Revolutions and Financial Capital, every 50 years or so, we get a “big bang” and the introduction of a new, highly disruptive technology. The “big bang” is typically sparked in a fringe, dusty office setting, by a relatively unknown individual with a pale complexion and thick glasses. I’m kidding about the last part.

The point is, it happens quietly. The rest of the world finds out much later.

This occurred on January 3rd, 2009 with Bitcoin and the advent of blockchain technology — a breakthrough in computer science. To see this clearly, we need to zoom out.

Information technology historically has evolved in multi-decade cycles of expansion, consolidation, and decentralization. We’ve seen this play out in a repeatable pattern over the last 60-70 years.

Periods of expansion follow the introduction of a new *open platform* that reduces the production costs of technology. As production costs fall, the barrier to entry for new firms to compete with the established incumbents drops. This drives in hoards of new firms, further pushing down prices and margins while decentralizing existing market powers. New users are attracted to the drops in prices, which draws in entrepreneurial talent to serve new markets where costs and barriers to entry are low, competition is scarce, and the upside is rather high.

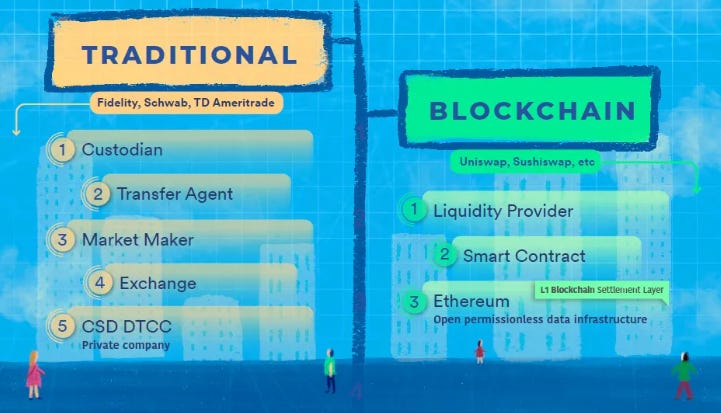

This is happening today — but it is difficult to see amidst the “crypto casino” running alongside the fundamental innovation. Below we show one simple example comparing how a trade works in traditional finance vs DeFi — removing intermediaries drives down costs and creates new business models.

Graphic Design: Laerta Premto

New business models are then created leveraging the new open standards. Consolidation eventually takes hold as these new platforms use their scale to integrate vertically and horizontally at the expense of their competition.

[Think Google, Facebook, Amazon, etc here.]

Eventually, barriers to entry become so great that the need for a new open standard arises, and the cycle repeats itself again.

We believe that we are currently in the midst of the birth of a new cycle, represented by public blockchains — the new open standard upon which the next wave of internet applications and services will be built “on top”.

When we scan the current state of the internet we can identify 4-5 firms that essentially control the economic activity of billions of users around the world. Amazon, Facebook, Google, Apple, Paypal, and a few others have consolidated and wield absolute power over how business is conducted on the internet. These firms were built on open standards — TCP/IP, HTTP, SMTP, etc. Yet they’ve consolidated around one thing: amassing large, uniquely valuable data sets and monetizing by charging users directly, placing ads, skimming transaction fees, etc. It has become nearly impossible to disrupt these firms utilizing the current infrastructure of the internet. Therefore, the free market created a new standard: public blockchain infrastructure. This innovation started on the fringes of society — where it always starts.

It’s helpful to observe how this has played out in the past.

In the 1950s the transistor collapsed the production cost of electronics by replacing expensive vacuum tubes with smaller, cheaper, and more reliable switches. Barriers to entry dropped. Entrepreneurs rushed in. Computer hardware began to proliferate. The industry eventually consolidated around IBM and mainframe systems.

In the 1970s the microprocessor (new open hardware standard) collapsed the production cost of computer hardware by reducing expensive, bespoke CPU systems down to a single general-purpose processor that was easy to mass produce. Entrepreneurs rushed in. A new era in computer hardware unfolded that brought economies of scale and a wide range of devices and interfaces — the minicomputer, the PC, laptops, etc. As the hardware layer became more open and decentralized, margins and prices compressed. Barriers to entry for entrepreneurs were low. Eventually, the hardware layer became commoditized, and value creation moved up the tech stack — to the software layer.

In the 1990s cheaper computers attracted more users, which created the demand for software services. Microsoft created the first proprietary operating system for PCs and secured a formidable distribution advantage through lock-in contracts with manufacturers. Microsoft created a walled garden of standards around Windows. By the late 90s, we had gone from hundreds of PC software companies to basically one and Bill Gates was sitting before Congress defending accusations of anti-trust and monopolies.

Once again, the free market solved the heavy consolidation within computer software with an open standard…

The introduction of open standards for computer software (Linux and HTTP) eventually challenged Microsoft’s incumbent position. As we’ve alluded to in the past, Microsoft began attacking Linux in the 90s. There is a famous quote from Steve Balmer, the CEO at the time:

“Linux is a cancer that attaches itself in an intellectual property sense to everything it touches.”

Linux is just an open standard for creating computer software programs. It took some time, but Linux eventually ate into Microsoft’s market share. Today Microsoft is one of the largest contributors in the world to Linux. 3 billion Android phones run on Linux. Companies such as Oracle, Red Hat, Google, IBM, Facebook, Amazon, Dell, etc all use Linux software today.

With open hardware and software standards now in place, we saw exponential growth in the late 90s which included an epic boom and bust period, expressed through the tech bubble in the late 90s/early 2000s. With economic value creation moving away from software, data networks became the next monetization opportunity in the mid to late 2000s. This is where we sit today — with large networks such as Amazon, Facebook, Google, Apple, etc controlling the economics of the internet. Just like we saw Bill Gates sitting in front of Congress in the 90s, we now see faces such as Mark Zuckerberg sitting in the same seat.

Thankfully, a new open standard has been created to strike at these incumbent data monopolies. Here come public blockchains…

The Opportunity

The current infrastructure of the internet works well for the large web2 incumbents because they control both the consumer-facing interface and the information networks themselves. The business model relies on the data being closed and proprietary. Users do not control their “state” on these closed networks — the platforms have the control and use cookies to track our digital footprints — selling our information to advertisers as one example. Google is a closed information network. Facebook is a closed information network. Amazon is a closed information network. These networks are centralized.

Public blockchains are open, decentralized information networks. They differ from centralized networks in a number of ways:

The services they provide (ledgers, computation, programmability, automation, applications, data storage, etc) are provisioned by a network of independent computers that coordinate to run the network (providing security, record keeping, data/transaction validation, etc.) in exchange for the native token representing digital ownership of the network.

To consume their services, users need to hold and spend the native token, which is freely tradeable on liquid markets around the world. Price discovery is immediate with tokens because the market has a clear view inside the network — the data is open. As such, crypto networks are priced in real-time, with valuations rising with increasing usage.

Decentralized information networks are open to developers to build on and the rules cannot be later changed on these builders. For example, the apps built on these networks cannot be pulled from the app store. The API cannot be removed. And there is no 30-50% tax that must be paid to the network. Furthermore, open networks allow for faster scaling since the code is open source (each problem is collectively solved once) and composable — driving sustainable network effects.

For the first time in history, we have subverted the power structure between computer hardware and computer software. Historically, the hardware can change the software or turn it off. That is not the case with public blockchains. The software commoditized the hardware — which is just used for computational resources & network consensus — the hardware has no say in the functionality of the software. Blockchains networks and markets run autonomously 24/7, 365 for this reason.

With the introduction of public blockchains, the entire tech stack is now open-sourced. The microprocessor created open-sourced hardware. Linux, HTTP, TCP/IP, etc created open-sourced software. And now public blockchains are open-sourcing the data.

When executed properly, crypto-economic incentive structures drive an army of core developers, users, service providers, entrepreneurs, and investors to evangelize the network by promoting it to friends/family, contributing code, running servers, or starting new businesses “on top” of the underlying protocol. Everyone shares an interest in the network, which can drive sticky network effects and massive scalability at nearly zero Capex cost.

With the invention of public blockchains, we now have a way for each participant in a network to hold and transfer their “state,” separate from a centralized intermediary. This is one of the original sins of the internet and a flaw of the simple protocols it was built on. As users, we do not control our “state”. As in, our data, or a record of what we did. The networks control our state. They do this with cookies. Cookies track everything that happens within these networks. The networks then sell that data/information to advertisers. If you’re curious to know what it feels like to control your “state” on the internet, buy $10 of bitcoin or your favorite crypto asset and do a peer-to-peer transaction or interact with a DeFi protocol. You control the asset. You control the data through your wallet — which is a unique and powerful thing.

Think of it this way: you control the asset (data) through your digital wallet (which is also data). The stuff that you do on public blockchains is tracked through your digital wallet. This becomes the cookies. But nobody owns the cookies this time, because the network is run by a decentralized set of servers. Now, if you have the ability to permission vendors, businesses, and other 3rd parties to see the contents of your wallet (your digital footprints) with a private key, we can create an internet that works for the user, instead of an internet that extracts value from the user.

When is the last time you bought something on the internet? Were you later chased around with ads for the thing you just bought? We could solve this if you were able to permission companies to see your data and bring you the things you want (information, products, etc) instead.

Public blockchains are computers that make commitments. For the first time, a computer system can be autonomous: self-governed by its own code — instead of by people. Autonomous computers can be relied on in ways that human-governed computers can’t. An example of this is finance. The most famous example is Bitcoin, which makes a commitment that there will never be more than 21 million bitcoins — a commitment that makes bitcoins scarce and capable of being valuable. What else can you do with computers that make commitments? Social networks are an area ripe for redesign. What if you could create a social network that made commitments to share the economic value of the user data, which you control? Or that made commitments around the rules of the network — protecting users and businesses from platform risk. It’s difficult to fathom how many new business models can be created around the concept that computers can now make commitments. [h/t to Chris Dixon]

Tokens are a breakthrough in open network design that allows for the efficient monetization of open-source development and the alignment of incentives across developers, users, investors, entrepreneurs, and service providers. We believe that tokens are a better measure of the real value of information networks because the value of an information network like Facebook only reflects its ability to monetize user data — and not the actual worth of the service it provides for its users. What if we could value Facebook based on the *value it creates for users instead?* We would therefore assign a monetary value to a network like Facebook based on the number of users, messages, groups, likes, marketplaces, etc. This would all just look like transactions on a blockchain — and the market would establish price discovery through the token in global liquid markets, 24/7.

The Web3 Tech Stack & Value Accrual

We believe that the majority of value accrual in web3 will invert when compared to web2. The vast majority of the value in web2 accrued to the application layer of the tech stack — where Google, Facebook, etc. sit. The reason for this is simple. The base layer protocols that the application layer leverages were not monetized — TCP/IP, HTTP, SMTP, Linux, etc. Nobody can own these things.

In web3, the base layer protocols are the *public* layer 1 blockchains — which can be owned via their native tokens. These networks could capture more value (and have thus far) than the applications because of the positive flywheel that occurs with strong network effects. New applications built “on top” of the layer 1 blockchains drive further demand for block space. This brings in more validators or miners who are paid to secure the network. More security brings in more developers and entrepreneurs. Which brings in more users. Which creates further demand for block space. Which drives value to the base layer blockchain.

Coinbase is an extremely successful example of a company at the application layer in web3. Despite Coinbase’s success, they have yet to come close to surpassing Bitcoin’s market value — a layer 1 blockchain.

We believe there will be 4-5 layer 1 networks that dominate the space when all is said and done. We think the proper analogy is to look at cloud computing services, computing architectures, mobile providers, etc. In each case, we ended up with a handful of dominant players that served slightly different use cases. In web3, there will be different applications that require different functionality from the layer 1 chain they build on. For example, gaming may have different requirements when compared to DeFi, which has different requirements for communities and social networks.

We think that Bitcoin and Ethereum have achieved escape velocity and will be dominant players. Why? Network effects. Network effects in blockchain are extremely sticky due to the composability of the open-source code. For example, on Ethereum, a DeFi wallet such as MetaMask can function as a brokerage account in your pocket by tapping into the network of open-source decentralized exchanges built on the protocol. This connectivity and interoperability dramatically drive costs down while creating new business models.

There is an ongoing battle for the remaining 2-3 dominant base layer blockchains. Binance Smart Chain, Solana, Avalanche, Algorand, Cosmos, Polkadot, Near, Aptos and Cardano are all contenders. Keep in mind that there could still be a long tail of less important blockchains — which is the case for past base layer internet infrastructures.

Layer 2 scaling solutions and side chains are growing as well. Stay tuned as we’ll cover this layer of the tech stack in our next report.

The next layer of the tech stack is the middleware protocols and applications. This is where DeFi sits. Similar to the base layer, we think there will be a handful of dominant DeFi protocols. Uniswap, Aave, MakerDAO, and Chainlink (data oracle) are a few of the blue chips today that leverage Ethereum. We believe that ultimately these protocols will provide back-end services to banks, exchanges, insurance companies, etc.

Value accrual at this layer of the tech stack is currently much more difficult to project for a few reasons: 1) an interface with a sticky network effect and broad distribution could fork a protocol and start using it for back-end services. This could potentially make the original protocol (and the token) obsolete. For example, JP Morgan recently conducted a pilot using Uniswap and Aave. What’s to stop JP Morgan from forking these protocols and using them on the back end of their customer interfaces? [We’ll explore this further in future reports] 2) these applications are profitable but are having some issues driving value to their tokens — primarily due to regulatory concerns today.

The application layer, or consumer-facing layer of the tech stack is the final area to analyze. This is where firms such as Coinbase and OpenSea sit. As time goes on, we expect to see more value move up the tech stack, while still driving further value back to the winning base layer blockchains.

The Mission of The DeFi Report

Our mission is simple. We want to be the most trusted resource for data-driven analysis of the web3 tech stack.

The DeFi Report is an ongoing exploration of where value will accrue, and why.

We don’t trade crypto or look for get-rich-quick schemes. If that’s your jam, The DeFi Report is not for you.

However, if you are looking to form a thesis and express it over a long time horizon, we think you’ll find great value here.

Our core principles: Seek the truth. Leverage data. Stay curious. Learn from mistakes. Earn the trust of our readers.

One report at a time.

We’re happy to have you along for the ride.

___

If you got some value from this week’s report, please like the post, and share it with your friends, family, and co-workers so that more people can learn about DeFi and web3.

This small gesture means a lot and helps us grow the community.

If you are interested in working with The DeFi Report through any kind of partnership or bespoke consulting services feel free to reach out at mike@thedefireport.io or reply to the email if you are reading this from your inbox.

___

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.

Well written. Also h/t to Chris Dixon is to think of tokens as primitives of web3 (similar to websites for web1/2) but programmable. At peak interoperability, what was a relatively passive website in web2 (changing acc. to cookies, now more or less dead) transforms in web3 to a tailored experience based on token connecting to it.