Tokenomics 101

Frameworks, mental models, and best practices

Hello readers,

This week is all about breaking down and demystifying crypto tokens. Topics covered:

Mental models and frameworks for thinking about tokens

What would Uber look like with a web3 business model and a token?

What drives value to the token?

Best practices and what to look for

Regulatory challenges

If you’re new to The DeFi Report, drop your email below to receive free reports covering DeFi and web3 directly in your inbox:

Let’s go.

Token Mental Models and Frameworks

First things first: this report covers blockchain native crypto-assets only — those which do not represent equity or debt. If you own equity or debt of a traditional business, you have legal rights to dividend or interest payments. In the event of a liquidation, you also could have a legal claim on assets at the company. Finally, you get voting rights that the board must legally adhere to.

With blockchain native tokens, you do not have any of these legal rights. That said, if you are a seed stage investor in a crypto project (mostly VCs today), you are likely being allocated tokens. Why? The token is where the value is expected to accrue.

Why do we need tokens?

Simply put, tokens are used to bootstrap and incentivize the formation of multi-sided marketplaces. This is incredibly costly and difficult to achieve with traditional business models. The introduction of tokens allows for entirely new business and economic structures where the community and ecosystem of participants in a network (everyone that contributes to its success) get to own a piece of the network.

Comparing a Multi-Sided Web2 Network vs Web3

As a thought experiment, let’s imagine Uber as a web3 network and what that would look like. At its core, Uber is just a tech platform that brings together a two-sided network of drivers (supply) and riders (demand). To bootstrap this, VCs had to incentivize drivers to come into the network. They had to pay the drivers, even when there wasn’t demand. They also had to incentivize riders to join the network. To do so, fares needed to be priced below taxi fares. VCs footed the bill to make all of this happen. This was extremely expensive and risky.

If someone were to launch a web3 version of Uber, here’s how it might look: A small group of developers and engineers build an app that does what Uber does — match supply and demand for rides at any given time, in any given location. VCs fund the project and receive tokens as part of their equity package. The token allocation could look like the following:

Core Team - 20%

Investors & Advisors - 20%

Community (riders & drivers, ecosystem, partners, etc) - 60%

Let’s focus on the community element of this. This is where things get interesting. The web3 Uber could use this “community fund” to incentivize both sides of the marketplace to form. Drivers get tokens for opting into the network. So, not only do they get the same benefits that web2 Uber gave them (gig economy flexible hours, revenues from drivers), but they also get ownership of the value accrual as the network grows via the token. The early adopter riders would also get some tokens — and they should. They are helping to bootstrap the network. They get to participate in the value accrual of the network as well. But wait. We also need some talented devs and engineers to make sure the app runs flawlessly. They get some tokens as well. Everyone that needs to be involved with making the network and service run flawlessly gets to own part of the network — including the customers.

Great technology fundamentally collapses and compresses costs, creating efficiency and productivity. If the web3 version of Uber can deliver a high level of service at reduced costs, the value created gets captured across all participants in the network:

The core team and developers (they built it and keep it running)

The drivers (they brought the supply)

The riders (they brought the demand)

Ecosystem partners (think independent marketers as an example)

The early investors (they funded the early developers)

This model should attract many, many more drivers because they get to own the network. Furthermore, without an extractive entity in the middle, the drivers could take home closer to 90% of the rider revenues (vs 40-50% for Uber drivers today). More drivers = more supply = lower costs for riders. 10% could go to the core developers and engineers to keep the tech running flawlessly. Amounts left over could be paid out as dividends to the token holders, or kept in the project treasury for future expansions — which the token holders would vote on.

It seems to me that if executed properly, a network like this could grow really fast. Why? Everyone’s incentives are aligned. It’s really that simple. The token allows for a completely different bootstrapping and incentive structure for the formation of two-sided marketplaces — everyone wins as the network grows and not just the founding team and early investors.

What I just explained is playing out today within well-run DeFi applications such as Uniswap. We wrote about Uniswap last year.

Why Tokens Could (and should) Accrue Value

Keep in mind that the only way a token can have value is if the service related to the token delivers exceptional value to end users in the real world. In the Uber example, the web3 version would have to offer a similar user experience at a cheaper cost. The token can then capture some of the value created by the superior service/business model.

Let’s take a look at how this could be possible. We’ll use an example comparing a trade through a traditional broker such as TD Ameritrade vs a web3 decentralized exchange such as Uniswap (the largest DEX in the market today).

Digital Artwork by Laerta Premto

Great tech cuts out friction while creating efficiencies and lower costs. This is exactly what is happening with *well-run* crypto projects today.

Anyone that has used Uniswap knows that you don’t need the following to trade and custody assets:

Custodian - this can be your metamask wallet (as well as a few others). These are free, self-custody solutions. Your assets sit on the blockchain and you control them with your wallet and a private key - something that is not possible in traditional finance.

Transfer Agent - this becomes a smart contract, developed by Uniswap Labs.

Broker - unnecessary for anyone trading directly on the Uniswap app.

The value created by stripping out these intermediaries has to be captured somewhere. Up until last week, 100% of the revenues generated by Uniswap were paid directly to the liquidity providers (think of them as decentralized service providers to the network). If you hold the Uniswap token, you get to vote on how these revenues will be distributed in the future — the DAO is currently implementing a 10% revenue share to the protocol treasury for a few liquidity pools. VCs hold a lot of the tokens and will have a say in these future decisions. But keep in mind that 60% of the token supply is allocated to Uniswap’s community — everyone that is helping to make Uniswap the #1 decentralized exchange in DeFi.

Key Takeaway: VCs are helping to bootstrap many of these networks by funding the core developers. A portion of the tokens is then distributed to everyone needed to make the project a success. But at the end of the day, value has to accrue back to the token in some way. Today the value of these tokens is largely embedded in their governance rights over the protocol. For example, Uniswap is not paying dividends today, but if you get to vote on that in the future, the token should have some inherent value today. How much? This is unclear. But what is clear, is that Uniswap is creating value and doing what good tech is supposed to do. The critical question is whether they will be able to return the value created back to the token holder and those that make the protocol function properly.

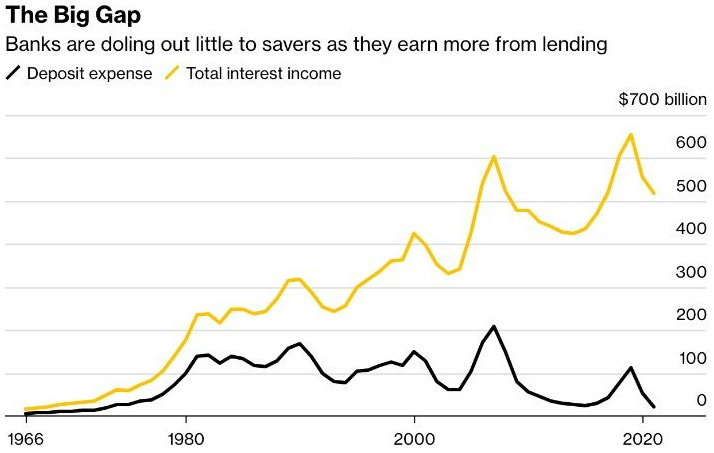

My guess is that by aligning incentives, these types of business models will pick up quite a bit of traction in the coming years Here is an example of what these new DeFi models are going up against:

Source: FDIC

And here is what the value share looks like for most web2 companies:

Versus web3 and the token model:

Source: a16z

Best Practices

Understanding the token model is critical when analyzing crypto projects. Here is what I typically look at:

Token Allocation/Distribution: how many tokens are reserved for the founding team, the investors/advisors, and the community/ecosystem? We’re typically looking for at least 50% going to the community. Why? The community allocation is used to incentivize the formation of multi-sided marketplaces — driving network effects and network value. Below is the breakdown for Optimism, a Layer 2 scaling solution for Ethereum:

Lock Up and Vesting Periods: look for 1-year lock-ups and 3-4 years vesting schedules for the founders/core contributors, investors, and advisors. This gives us confidence that the core team and investors are in it for the long haul and cannot dump their coins on the market as soon as the token is listed publicly.

Utility of the Token: What is the value prop of the project and what is the token used for? For example, Ethereum is a layer 1 blockchain that allows for a marketplace of decentralized business/apps and new economic models to be built utilizing its base layer technology. If you want to access DeFi, buy/sell or mint an NFT, anchor data, build an app, play a game, send a transaction, etc you need some ETH. ETH, the native token, is the asset that powers the Ethereum ecosystem. This is why some refer to its utility as "digital oil."

Staking or Incentives to Lock Up the Token: Is there a reason a user may want to lock up their tokens? This could include staking, which rewards users for locking up their tokens and providing services to the network (validating transactions). Look for valid reasons to stake — a service should be provided (such as validating transactions, providing liquidity, etc) rather than just locking up coins and being rewarded for doing so.

Feedback Loops that Drive Value back to the Token: once we establish the need and utility of the token (product/market fit), we need to understand how value accrues back to the token. To continue with the Ethereum example, as more people build apps on Ethereum, and more people use those apps, more transactions occur on the Ethereum blockchain. And with EIP (Ethereum Improvement Proposal) 1559, 70% of the transaction fees are burned. So, as the network grows, and more people use it, more ETH is removed from the market. This drives scarcity and should return value to the token holders as the network grows its user base.

Total supply, release schedule (inflation rate), and any mechanisms to pull tokens back to the project treasury as usage ramps up, or have them burned.

When analyzing the viability of a particular project, we would look at many more factors such as the core team, the problem being solved, the total addressable market, competition, product/market fit, etc. With that said, a project can check all of these boxes and still not work out because of poor tokenomics.

Regulation

We’d be remiss not to mention current regulatory uncertainty regarding crypto tokens. The big question right now is whether blockchain-native crypto-assets will fall under SEC guidance (securities) or CFTC guidance (commodities).

Bitcoin and Ethereum (about 65% of the entire crypto market cap) have been deemed digital commodities and fall under the CFTC today.

Clarity is very much needed for the rest of the space. It is very difficult to apply the Howey Test to crypto-assets because they legally do not represent equity, debt, or the rights to dividend payments or liquidation preferences. When securities laws were created in 1933 there was no way to foresee a period 90 years into the future when a decentralized, cryptographically based, automated financial instrument would be adopted en masse by millions of people in the US and around the world. As such, changes to the laws are likely coming. The current bi-partisan crypto bill in Congress seeks to make some adjustments to the Securities Act. Here’s what it says about crypto-assets:

Digital assets which are not fully decentralized, and which benefit from entrepreneurial and managerial efforts that determine the value of the assets, but do not represent securities because they are not debt or equity or do not create rights to profits, liquidation preferences or other financial interests in a business entity, will be required to furnish disclosures with the SEC twice per year. Assets in compliance with these disclosure requirements are presumed to be a commodity.

This is good news. Just about all blockchain native assets will fall under the CFTC if this is the case. This will bring clarity to entrepreneurs as well as crypto exchanges - both centralized and decentralized.

All other crypto-assets that represent existing securities (equity, debt, real-world assets, etc) would fall under the SEC and would be required to trade on regulated exchanges, such as FINRA & SEC-registered ATSs (Alternative Trading Systems).

Conclusion

To summarize:

Crypto-assets for native blockchain projects should be viewed as the bootstrapping and incentive mechanism for the formation of multi-sided networks

If successful in the long run, these networks will more evenly reward all participants that make them work

The value of a token is directly tied to the business model, the product/market fit, and the value created for end-users — by reducing costs, creating efficiencies, enabling new functionality, etc.

The protocol design regarding utility and how value accrues back to the token is critical when analyzing a crypto project

Token supply, allocations, lock-ups, vesting periods, etc should be considered when analyzing a crypto project

Regulatory uncertainty is a headwind for the industry and presents risks in terms of capital allocation today. This is in the process of being sorted out, and the crypto industry has shown strong lobbying power in Congress over the last few years

The bottom line is that VCs are plowing money into this industry. In 2021 we saw over $32 billion deployed into companies launching new businesses utilizing tokens. So far in 2022, we have already seen $18 billion deployed.

To make real money in investing, you have to see the future before everyone else does. While there are quite a few unknowns today, if we follow the business models and incentives, as well as the efficiencies created by this new tech, it gets much easier to project what could happen. Depending on your risk appetite, it may or may not be the right time to identify winning projects. Still, it is certainly the right time to be developing mental models and best practices for analyzing projects that could win once regulations are in place and consumers are ready.

I hope this report helped provide some clarity into how tokens can create new and exciting business models where the value captured is shared more evenly.

___

Thanks for reading and for your continued support. If you got some value from this week’s report, please do me a favor and share it with your friends, family, and social networks.

If you have a question, comment, or thought, please leave it here:

___

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such does not constitute investment advice.

This was an awesome read Michael! Really helped solidify token project concepts for me.

Fantastic framework for approaching tokenomics, very helpful.