Does the Bitcoin Halving Create a "Supply Shock?"

A data-driven deep dive on Bitcoin's first three adoptions cycles. And a forecast for the next one.

Hello readers,

The Bitcoin halving is set to take place on April 8, 2024. Historically, the halving has sparked three shockingly similar adoption cycles. 9 months out, it’s time to start thinking about the next one.

In this week’s report, we’re breaking down the past three Bitcoin cycles and forecasting the next one.

Topics covered:

What’s the driving force behind Bitcoin Cycles?

Operating & Network KPIs from the first 3 Cycles

Price Action Through the First 3 Cycles

Forecasting the Next One

Disclaimer: Views expressed are the author's personal views and should not be taken as investment advice.

Important Note: We receive lots of wonderful feedback from many of you and appreciate your support. To keep the service free and return value to us, the most helpful thing you can do is simply like the post — which can be done directly from your inbox via the heart button in the upper left. Let’s make quality free content a win/win. This helps grow the community and responsibly introduce more people to DeFi and web3.

Please note that you can now schedule advisory calls directly on our Substack page or through the link here: Book a Call.

The DeFi Report is a data-driven exploration of the emerging web3 tech stack and an ongoing analysis of where value could accrue.

Let’s go.

The Driving Force Behind Bitcoin Cycles

The halving occurs every 210,000 blocks, which translates to approximately every 4 years. It marks the date that Bitcoin’s pre-programmed monetary policy changes such that the block reward (network inflation) paid to miners is reduced by 50%.

In April of next year, the block reward drops from 6.25 BTC/block to 3.125.

Since new issuance is halved, it’s reasonable to conclude that the reduction in new supply is the catalyst for each bull market.

The theory goes like this:

Post halving, miners sell less BTC into the market. This exhausts a large % of sell pressure. Price is set at the margin, so new buyers push the price up. The financial media starts talking about Bitcoin. People start googling it. Influencers and evangelists go viral. New buyers enter the market. On-chain activity picks up. VCs pour money into new businesses supporting the ecosystem. More businesses = more marketing = more users. Which fuels more buyers. More on-chain activity. And more media coverage.

Voila. New all-time highs.

It’s a nice story. Let’s see if the data checks out.

Net Position Change = net change in holdings of BTC by wallet addresses Glassnode has marked as belonging to a miner.

Halving #1: Annual new issuance was reduced by 1,314,000 per Bitcoin’s monetary policy. But miner holdings dropped by 4,458,603 bitcoins in the 12 months following the halving. This was more than 2x the decrease in BTC holdings in the 12 months prior to the halving. Miners were selling a lot of BTC as the price ran up in 2013. In total, over 8 million bitcoins were passed from miners hands during the first halving cycle. With the price/BTC at low levels, buyers simply overwhelmed the selling activity.

Halving #2: Once again, miner positions dropped more in the 12 months after the halving than in the prior 12 months. Once again, price action was driven by buyers simply overwhelming sellers in the market. In total, over 5.4 million bitcoins were passed from miners hands during the second cycle.

Halving #3: Again, miners sold more BTC post-halving than the twelve months prior. However, cycle #3 was the first accumulation cycle for miners. We’ve seen an additional 93k increase in net position over the last 6 weeks (beginning of the 4th cycle). Miners are extremely bullish right now.

The takeaway? It’s not true that supply shocks from reduced miner selling are kicking off the bull runs. Miners actually sell more BTC in the 12 months after the halving than at any other point in the cycles.

With that said, the halving narrative may still bring in net new buyers. Markets can be self-fulfilling. So, even though the data contradicts the narrative, if people believe it’s true, it can be true. Perception becomes reality. Markets are reflexive like this. And crypto markets are intensely reflexive.

But there’s more to the story…

Global Liquidity

You’ll hear less banter about Bitcoin’s correlation with global liquidity cycles. But this is where the data actually lines up with price action.

Source: Cross Border Capital via US Federal Reserve, Peoples Bank of China, ECB, Bank of Japan, IMF (annotated by Michael Nadeau)

It appears that global liquidity bottomed at the end of ‘22, which also marked the bottoms for BTC and the S&P 500 (and several bank failures in Q1). We’ve seen a slight bounce in global liquidity to start the year. Bitcoin has responded with an 80% rally. The S&P 500 is up 15%.

The Liquidity Set-Up

In the US, inflation has come off. The Fed has paused rate hikes. Asset prices are up YTD and could run for a bit.

But there are also some clouds moving in — pointing to a potential shift in monetary policy.

Specifically, $7 trillion of Treasury debt is maturing over the next year.1 These debts need to be refinanced/re-issued to support fiscal spending. In the US, the deficit this year is projected to be $1.5 trillion per the May 2023 update by the Congressional Budget Office.2

Meanwhile, interest payments on the debt are now the second largest expense of the US Government and closing in on $1 trillion annually.

Source: Federal Reserve FRED Database

43 million Americans will be resuming student loan payments at an average rate of $503/month in October.3 Per surveys, 37% of borrowers indicate they’ll need to cut back on other spending. 34% indicated they cannot afford the payments at all. 4

Furthermore, banks are still anonymously requesting access to the Fed’s Bank Term Funding Program:

Source: Federal Reserve FRED Database

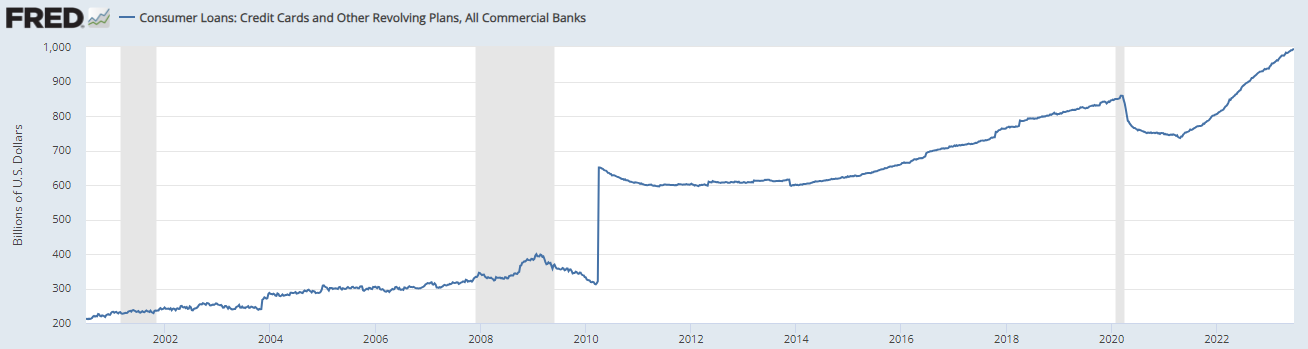

Consumer credit card loans are at an all-time high at over $1 trillion:

Source: Federal Reserve FRED Database

Bank lending standards are indicating a recession is on the horizon:

Source: Federal Reserve FRED Database

Finally, the Commercial Real Estate sector has over $1.5 trillion dollars of debt that need to be refinanced over the next few years.5 This comes as interest rates are at their highest levels since 2006. Of course, office space occupancy and valuations are down due to remote work. As if to add insult to injury, a group of analysts at Citigroup found that over 70% of commercial real estate office loans are held by regional banks.

These factors should put further downward pressure on inflation.

CPI inflation swaps are currently pricing 2% inflation as early as October of this year. The Fed projects inflation in one year to be 1.3%.6

Tieing it all together:

Bitcoin’s market price lives & dies with liquidity. From a US standpoint, it looks like liquidity conditions have bottomed. We’re hearing the same for China and Japan. Europe is in a similar spot. As inflation reverts back toward 2%, the global economy should slow along with it (the data is pointing to this outcome).

The Fed will then have the green light to shift monetary policy.

This will open up the floodgates for another wall of QE. As far as timelines? We think it will play out over the next few years.

This shift in liquidity is setting up to coincide with the Bitcoin halving cycle and the narrative that comes with it.

Keep in mind that we are likely to see some volatility at some point. A lot of analysts are projecting Q4 of this year or Q1 of next year. These periods could offer interesting entry points as we gear up for the next halving.

Innovation Cycles: Operating & Network KPIs

So, Bitcoin cycles rely on liquidity. Understood.

But liquidity isn’t everything.

If we sprinkle in some network growth we might have something.

Liquidity + growth in network fundamentals + the right narrative = new price discovery.

The reflexivity of new price discovery = new VC $. Which then leads to more building. Which brings in more users. And further price discovery.

It’s the flywheel for how speculation drives real capital formation and economic development.

It’s chaotic. But it’s happening.

Breaking down Bitcoin’s Network Fundamentals:

The Bitcoin Network is looking strong across just about every metric we track. You want to see the numbers moving up and to the right. We’ll call out a few below:

Non-Zero Wallets: we’ve seen steady growth in non-zero wallets throughout each cycle to date. Our projection here simply extrapolates growth over the last year (47m currently).

*Keep in mind that this figure does not represent all Bitcoin holders. Tens of millions of exchange customers are not represented as the data is limited to on-chain wallets.

Developers: Steady growth since inception. With the introduction of the Ordinals protocol, we’ve seen a recent uptick in dev activity. Our projection here is the actual current number of active devs per Electric Capital. 7

Hash Rate: An indication of network security and the sentiment of miners. Hash rate is up 3x over the last two years. Miners are bullish.

Long-Term Holder Behavior: One of the most important KPIs we track. Long-term holders and % of supply not moved within a year are at all-time highs right now. Our projection is the current figure per Glassnode. Through cycles, we observe that investors & users typically enter during bull markets. They then learn more about Bitcoin and tend to become long-term holders. We can observe this in the growth of wallets with over 1 BTC, which recently surpassed 1 million. As the long-term holder base builds over time, it creates the set-up for the next bull market when buyers eventually overwhelm sellers in the market.

Lightning Network: The lightning network is Bitcoin’s layer 2 scaling solution. It enables payments at a fraction of the cost offered on the L1. While still quite nascent, we can see that the capacity within the network has grown substantially over the last few years. The number we used in our projection is an extrapolation of prior growth in conjunction with network development.

Additional Catalysts

Coinbase sparked the bull run in 2013.

Ethereum provided the ignition switch in 2017.

Microstrategy, Paul Todor Jones, Tesla, Block, Mass Mutual, etc. lit the match in the last cycle.

What’s it going to be in 2024/2025?

A Blackrock ETF approval would be a good start.

Blackrock has an impeccable reputation. A 575-1 track record with ETF approvals. And they control about 30% of ETFs today.

In some ways, Blackrocks name on this EFT is more meaningful than the spot ETF itself.

The Blackrock name matters to RIAs. It matters to Asset Managers. It matters for just about every investor on the planet.

Investing in Bitcoin on behalf of clients could expose money managers to career risk in the past. It’s possible that a Blackrock ETF would flip this in the opposite direction.

Some food for thought: what happens if it becomes riskier to not have a 1% allocation to Bitcoin through a trusted vehicle like a Blackrock spot ETF?

Price Action Through Cycles and Forecasting the Next

5 Key Points:

Timing the Market: The best time to buy BTC is when everyone thinks it’s dead. Every. Single. Time. We had two opportunities in 2022. We alerted readers in December that our signals were flashing bottom. The second best time to buy BTC? Historically it’s been during any dips leading up to the halving. Of course, timing the market is really hard. Dollar cost averaging works well for an asset in the early innings of global adoption like BTC. Even those who have bought the top of cycles in the past have done well in the long run. Bitcoin is currently 55% off its all-time high, yet its 10, 7, 5, and 3-year compound annual growth rates are 84%, 73%, 36%, and 49%. The key is to have long-term conviction. Know exactly what you’re buying. And ignore the noise.

Projections: Our base case forecasts a continuation of the decreasing returns from the first 3 cycles and a $158k price target.

High-Level Framing: We’ve forecasted a market cap peak of $3.15 trillion in the next cycle (up from $1.2 trillion last cycle). This would put BTC at about 25% of Gold’s market cap. Long-term readers know that we ultimately believe that Bitcoin will reach and surpass the Gold market (currently $12.6 trillion).

Big picture, we think the total crypto market cap could surge into the $8-$10 trillion range in the next cycle (up from $3 trillion last cycle). This could present interesting opportunities in Ethereum, alt L1s, important infrastructure, etc. More on this in the coming months.

Post Cycle Lows: We anticipate that Bitcoins volatility will continue to persist for years to come. With that said, we expect the volatility to dampen over time. The size of the market, more sophisticated investors entering the space, maturing market structure & products (a spot EFT??), new regulations, and less “wild west” leverage (and fraud) point to this outcome. *Note that BTC trades like a commodity — extending well past its cost of production in bull markets before collapsing to (and sometimes below) the cost of production in bear markets.

A Note About Last Cycle: We think it was muted due to China’s ban on mining. If you remember, the price of BTC had just hit all-time highs. Tesla had just bought Bitcoin for its balance sheet. As did Block (Square). And Mass Mutual. Michael Saylor was buying billions through Microstrategy and on a media tour. We think Bitcoin would have broke $100k if not for the Chinese ban on mining — which created forced selling and a capitulation event (50% correction) due to the concentration of miners within mainland China (where cheap hydropower is abundant). Many of these miners are now in Texas.

Mid Cycle KPIs

Zooming out to give you an idea of where we sit today, relative to past cycles.

Market Value to Realized Value:

Source: Glassnode

Measures market price vs average price of each BTC circulating. We came out of the green zone in early ‘23 which historically has been a great entry point. That said, we are still at relatively low levels.

Realized Price:

Source: Glassnode

Realized Price is a proxy for the avg. price each BTC in circulation was purchased at. It currently sits at $20,323.34.

200-Week Moving Average Heatmap:

Source: Look into Bitcoin

For the first time in Bitcoin history, we dipped below the 200 Week Moving Average in 2022, and spent about 9 months there.

We’ve since recovered, with the 200 WMA currently sitting at $26,665.

Conclusion

Bitcoin’s adoption cycles are primarily driven by global liquidity, network growth, and the *narrative* of the halving supply shock.

All three elements appear to be lining up nicely.

The cherry on top would be an approved spot EFT with Blackrock’s name on it in the coming months.

Stay tuned as we’ll continue to share data and forecasts across the entire ecosystem.

The DeFi Report is brought to you by Glassnode, the leading crypto platform for on-chain analytics and insights. As a reader of The DeFi Report, enjoy a 10% discount on any license tier by clicking here.

If you got some value from the report, please like the post, and share it with your friends, family, and co-workers so that more people can learn about DeFi and web3.

This small gesture means a lot and helps us grow the community.

If you have a comment, thought, or idea, drop it here:

Take a report.

And stay curious.

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.

https://data.nasdaq.com/data/USTREASURY/MATDIS-maturity-distribution-and-average-length-of-marketable-interestbearing-public-debt

https://www.cbo.gov/publication/59159#

https://educationdata.org/average-student-loan-payment#:

https://www.businessinsider.com/what-will-happen-when-student-loan-payments-resume-sizeable-shock-2023-6

https://www.politico.com/news/2023/06/05/mortage-interest-rates-property-values-00094969

https://fred.stlouisfed.org/series/EXPINF1YR

https://www.developerreport.com/