Did We Bottom Yet??

A data driven market update.

Hello readers,

We’re back with a bonus report on the current state of the market. Topics covered:

Key factors driving crypto cycles

Human behavior & sentiment

Macro outlook & on-chain KPIs

Did we bottom yet??

Our research covers easy-to-follow frameworks of DeFi and web3 business models —and an ongoing analysis of where value could accrue within the web3 tech stack. Drop your email below if you’re interested in receiving two reports/month directly to your inbox.

Disclaimer: Views expressed are the personal views of the author and should not be taken as investment advice. Please do your own homework and never invest in anything you don’t fully understand.

With that out of the way, we hope this report can serve as a simple educational framework for crypto cycles and a sound assessment of where we stand today based on the data.

Let’s go.

Crypto Market Cycles: A High-Level Framework

Like most markets, crypto moves in distinct cycles. The cycles appear quite chaotic, driven by vicious bull and bear markets. However, underneath the hood, we are seeing consistent, long-term growth across important metrics such as the number of developers and the number of companies building, supporting, and integrating with the crypto ecosystem:

5 principal factors driving crypto cycles.

Macroeconomics: interest rates/liquidity. When the year-over-year rate of change in M2 bounces up, Bitcoin goes parabolic — with a healthy push from excessive leverage. When YoY M2 drops, BTC gets crushed (leverage unwinds). As we see below, BTC literally shoots off the chart when M2 is increasing. Right now? Global M2 year-over-year rate of change is at an 8-year low. Meanwhile, the price of BTC appears to be bottoming out — which we’ll get to later.

Software development activity. The data below was taken from Github code commits and compiled by Electric Capital. The open-source nature of crypto provides unprecedented transparency into the emerging industry. Note that the total is likely under-counted since only original code commits are represented and the data comes from one source: GitHub. For reference, there are approximately 30 million people worldwide that can write code. The fact that this emerging industry reached nearly $3 trillion in value with so few developers is reflective of the power and composability of open-source code —where each problem only needs to be solved once. The data below is through 2021. We’ll share an update on 2022 when it’s available early next year.

Bitcoin’s halving schedule: red lines mark the dates of the halvings — when the new issuance of BTC is cut in half. The next one is in the spring of 2024 — about 15 months away. Historically, the price of BTC bottomed about 15 months prior to the halving and peaked about 15 months post-halving. The entire process has taken about 2.5 years to play out. The last trough to peak was about 20x. The one in 2017 was about 90x for BTC.

Education/adoption/media coverage.

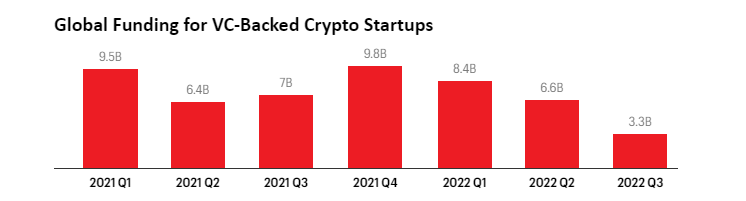

Venture Capital. $51 billion has been deployed over the last few years. This is seeding developer activity and the infrastructure build-out for the next bull cycle when liquidity returns to the markets.

Human Behavior & Sentiment

Look around. Is CNBC talking about the price of Bitcoin? Is Tom Brady slapping laser eyes on his Twitter profile? Is every other commercial on TV related to crypto? Are people on Crypto Twitter coming up with weird phrases in solidarity such as “WAGMI, GM, and HFSP?” Is every new idea the “next big thing?” Did you hear people talking about crypto in line at Starbucks?

These are all signs of the top.

Signs of the bottom? Crypto Twitter is fighting with each other. You have a queasy feeling in your stomach. Friends/family that know you’re into crypto or work in the industry are “checking in.” Firms are laying off staff. Frauds and Ponzis are being exposed. Articles in the NYT and WSJ are calling for Bitcoin to go to zero. The ECB is blogging about Bitcoin’s last stand. Assets are down 80-90%.

We know exactly where we’re at from a human behavior/sentiment perspective. Let’s take a look at the data…

Macro Picture

Everything seems to be one big trade today. Stocks, bonds, gold, tech/growth stocks, and crypto are all moving together. It seems the only thing that matters is liquidity. Said another way, the only thing that matters is what the Fed is doing. Therefore, we should first ask ourselves where we are in terms of the liquidity cycle. We think we’re about to see more liquidity in 2023, not less. The chart below tells us why:

The Institute for Supply Management (ISM) leading data is telling us the business cycle is about to turn as well. Inventories are increasing. Business is slowing. And liquidity is back to where it was pre-pandemic. Historically, when the ISM leading indicator hits 50 or so, the Fed typically steps in and buffers the market with liquidity (lowers interest rates). Below we can see that the ISM data is screaming, but liquidity has not caught up just yet. The takeaway? Bad news (the economy slowing) could lead to good news for crypto (and all financial assets).

It’s possible that interest rates have peaked as well. Here’s the 10-year, sitting at 3.59% which got as high as 4.25% about a month ago.

We see a similar trend with the dollar on the DXY, which peaked at about 114 earlier this quarter.

Meanwhile, the bond market is pricing in rate cuts next year:

Finally, the spread between the 2-year Treasury rate and the Fed Funds rate has collapsed to 34 basis points. The Fed is expected to hike rates another 50 bps this Wednesday. If this happens, the Fed Funds rate will invert the 2-year treasury — which has reliably marked the end of Fed hiking cycles for many decades.

Crypto Data

BTC is still the king so we’ll use Bitcoin KPIs to get a feel for where we’re at broadly across crypto today. We’ll follow on with some additional data across some alternative L1s and Ethereum DeFi projects.

Up first is Bitcoin’s MVRV Z-Score. This metric is measuring the Market Value in relation to the Realized Value (the average value each bitcoin was last moved on-chain — a proxy for Bitcoins cost basis), with a standard deviation test that pulls out extremes in the data.

As we can see, we’ve been in the green now since June, and we recently hit a cycle low. In the past, the price of BTC has bottomed at the same time that the MVRV Z-Score bottomed.

Next is the 200 Week Moving Average.

In past cycles, the price of BTC brushed up against the 200 WMA. This typically signaled a cycle bottom. We’ve broken resistance here with the market value significantly below the 200 WMA — which sits at $24k.

Next is Realized Price.

Realized Price is calculated by taking the average price that each bitcoin was last moved on-chain. It’s a proxy for the average cost of each bitcoin in circulation. Historically, when the Market Value dips below the Realized price (currently $20,037), this has indicated a period of profound value. We’re here today.

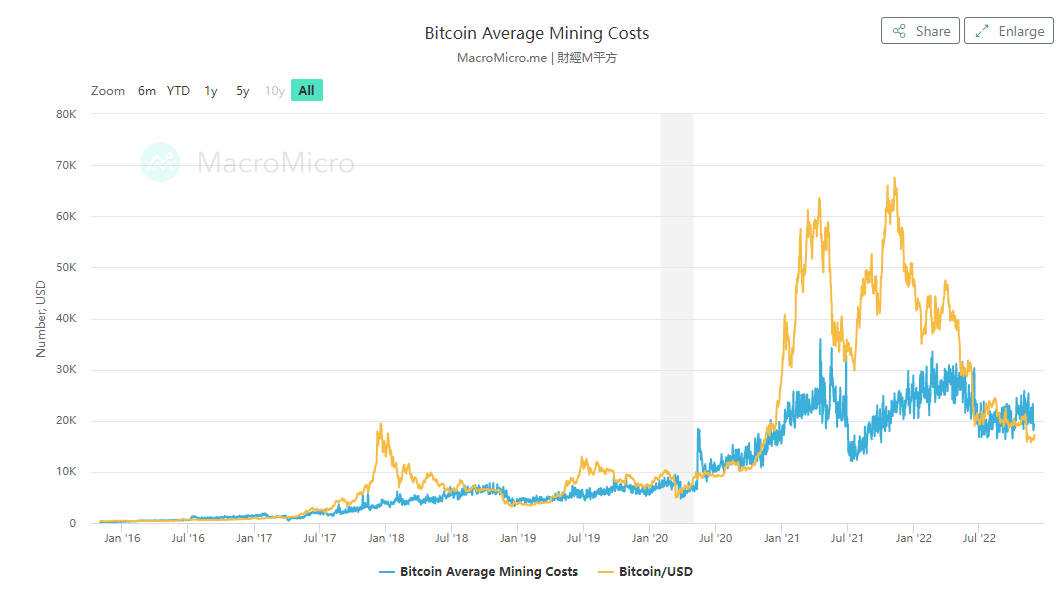

Up next is Average Production Cost vs Market Value.

As we can see, Bitcoin behaves similarly to traditional commodities — with the price rising sharply above the average production cost during bull runs before crashing again and intersecting with the average production cost during the bear market — where we sit today.

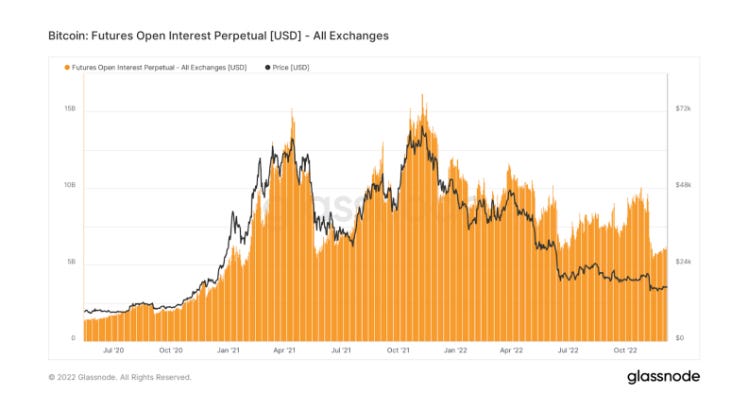

Leverage

As we can see below, as interest rates have risen steadily over the last year, leverage across all exchanges has been squeezed out of the system. Open interest is currently at levels we haven’t seen since early 2021.

In summary, Bitcoin data is flashing bottom signals across the board. Finally, here is a positive signal regarding Long-Term holders — the “hodlers” are still hodling. Today, 72% of the circulating supply has not moved within the last 155 days or more.

Let’s take a quick look at some data across the rest of the ecosystem.

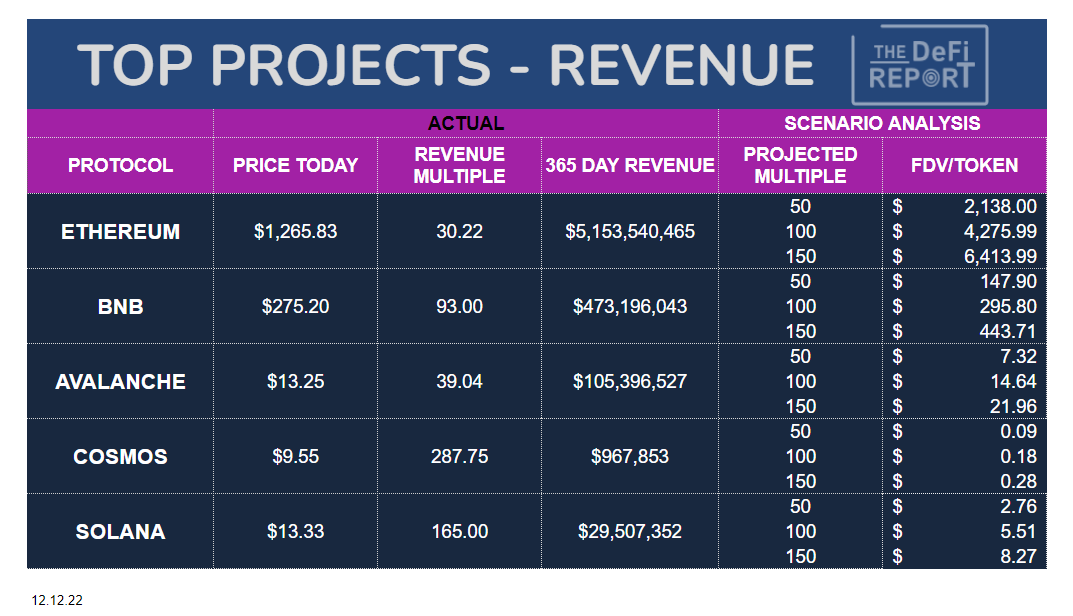

Top Tier L1s - Revenue Multiple

In this analysis, we are strictly looking at revenue multiples to get a sense of how each blockchain compares to its competitors. Valuing crypto networks is tricky because the revenues are paid out to a distributed set of service providers and the network itself has no direct expenses. We could analogize this concept to a public park, privately funded by a distributed group of people — who earn revenue from people who want to access the park. It’s interesting to see that ETH, the fastest horse in the race, also appears to be the most undervalued. A few additional notes:

Avalanche: despite the *relatively* low revenue multiple today of 39, when we look at the scenario analysis, we see unimpressive results. The data almost looks off — how could a projected 50 multiple result in a lower token price when compared to today at a multiple of 39?? This is due to the future dilution of the token. Since many projects are early stage, the best way to compare these blockchains on a relative basis is to factor in dilution. Avalanche has a max supply of 720 million coins, with just 310 million in circulation today. Meanwhile, Ethereum’s supply has likely already peaked —so there is very little future dilution to come — if any at all.

Solana: Despite the token being down 95%, the numbers still don’t look great given the future dilution (68% of the supply is in the market today) and the relatively low revenues compared to its $5 billion market cap today. That said, there are several well-respected analysts in the space that think Solana may be bottoming out and due for another epic run in the next cycle. This is drawing parallels to ETH in Dec. 2018 (at $80). We’ll be covering Solana in depth in our next report.

Cosmos: Crypto natives love Cosmos. It has a strong developer community and an interesting technical design. However, the lack of robust revenues in conjunction with significant future dilution represents potential red flags for the project. The projected fully diluted value per token based on current revenues looks dismal as a result.

Ethereum DeFi Blue-Chips

Compared to the alternative L1s, Ethereum DeFi looks relatively undervalued. These protocols have established product/market fit and have been battle-tested many times now. What remains unclear is the regulatory landscape as well as value accrual back to token holders. It’s still very early. Crypto is risky. This should go without saying. That said, the potential risk-adjusted returns in DeFi may be greater than in any sector of the industry today.

*Note that Maple Finance has been getting pummeled of late. Maple is a platform that enables institutions to access undercollateralized loans. Maple does not underwrite the loans themselves — they simply provide the platform for others (delegates) to do the underwriting for lenders. They are the tech platform enabling decentralized lend/borrow for businesses on-chain. The platform takes .66% of the loan originations and did a whopping $1.8 billion in their first 18 months — primarily during the bull run. A recent default by Orthogonal Trading (related to FTX) impacted 30% of the outstanding loans on the protocol. As such, the market has been selling the token off hard. That said, we don’t think this is existential to Maple because the platform itself is not a creditor. Furthermore, each delegate operates within segregated lending pools (currently 4 pools are operating) — so one bad loan cannot take down the entire platform. In total, including the recent default (and a few others back in June), the platform has a 97% repayment rate. We like the platform, team, and their backers. As such, if you’re willing to lose all your money, at a $17 million valuation today, this looks like an interesting opportunity.

[If you’d like to see a separate deep dive on Maple Finance, like this post and leave a comment expressing interest.]

Have we Bottomed?

That’s the million-dollar question. Nobody can say for sure. If you have a crystal ball, please share your thoughts in the comments.

Based on the data, we think there is a decent chance (greater than 50%) the market has bottomed — for BTC this was at $15.7k. The caveat is that Genesis, crypto’s largest lender, has still not plugged the hole in its balance sheet left by FTX. Furthermore, crypto Twitter seems intent on executing a self-fulfilling prophesy to take down Binance — so, there could still be a few land mines out there. If you’re interested, this interview was a good overview of the current situation with Genesis.

It’s worth noting that while BTC made a new recent low, ETH bottomed in June and has not revisited those lows (around $900). This chart showing the impact of the merge on block rewards explains why. Token incentives = block rewards paid to validators. There is simply less ETH entering the market, and therefore less sell pressure — this bodes really well for when liquidity returns to the market.

We aren’t out of the woods yet. We’re expecting a bumpy road in the near term.

Keep in mind that even if we have bottomed, we’re not projecting the start of the next bull period to commence until clear signaling from the Fed that liquidity conditions will change.

What are we doing at The DeFi Report? Dollar-cost averaging BTC & ETH. We’re also taking a hard look at alternative layer 1’s, L2’s, and DeFi protocols that may have achieved escape velocity/product-market fit and are severely undervalued. If you want to know more, feel free to reach out directly to schedule a call.

Looking Ahead

Market sentiment is BAD right now. However, we continue to see significant progress across the ecosystem: Bitcoin is more integrated with the global financial system today than it ever has been. Ethereum successfully completed The Merge this year. Scaling solutions are seeing significant growth and adoption. Firms such as Blockrock, Fidelity, Google, BNY Mellon, Charles Schwab, Citadel, Stripe, etc. are all leaning into crypto more than ever. And the change in liquidity conditions appears to be around the corner.

There are plenty of well-run networks and projects with product/market fit that are producing real cash flows today. We’ll continue to focus our analysis on these areas of the ecosystem as we work our way through the bear market. A lot of people who came into crypto during the bull run of 2021 are now leaving. This is something that has happened over and over throughout crypto cycles and is the biggest mistake we see.

Crypto bear markets are rough. But the strong survive.

The future still looks really bright.

___

Thanks for reading.

If you got some value from this week’s report, please like the post, and share it with your friends, family, and co-workers so that more people can learn about DeFi and web3.

This small gesture means a lot and helps us grow the community.

If you have a comment, thought, or idea, drop it here:

Finally, if you are an investor, VC, hedge fund, family office, or operator interested in working with The DeFi Report through any kind of partnership or bespoke advisory services feel free to reach out at mike@thedefireport.io or reply to the email if you are reading this from your inbox.

___

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.

Great market summary! have you looked into Constellation Network?