Hello readers,

Welcome back for another edition of The DeFi Report. As promised, we are brushing up on layer 2 scaling solutions within the Ethereum ecosystem this week. We think L2s are the story of the crypto winter so far. Time for a deep dive.

Topics covered:

Why do we need L2s?

The functionality of layer 2 scaling solutions

Economics and business models

Impact on Ethereum at the base layer of the tech stack

If you’re new to the program, drop your email below to receive free reports twice per month directly to your inbox. The DeFi Report is an exploration of the web3 tech stack and an ongoing analysis of where the most value could accrue.

Let’s go.

Why do we Need L2s?

Anyone that used Ethereum during 2021 knows that the chain can get highly congested. It’s a classic problem — too much demand and not enough supply. As such, gas fees (transaction fees) become quite expensive. At the peak of the bull market, it cost almost $200 dollars to send a transaction using the Ethereum blockchain. Yikes. This isn’t scalable. But it tells us a few things.

The first is that Ethereum block space is quite valuable. Some say Ethereum block space is the “New York City” of the ecosystem today. This is a good problem to have.

The second takeaway is that Ethereum is still very early in its product roadmap. It cannot support 1 billion users today. In order to support more users, applications, and use cases, Ethereum has to scale on layer 2.

It’s important to note that the demand for block space will likely always outpace supply. Why? Because this has been the case for every important computing resource in history. CPUs, GPUs, memory, storage, and both wired and wireless bandwidth all can provide helpful clues.

As Chris Dixon has noted, computing movements tend to have mutually reinforcing feedback loops between applications and infrastructure. For example, smartphones have improved dramatically over the last decade. Meanwhile, most of the value we get from our phones comes from the apps on them. As the apps improved, more users flocked to smartphones, which gave manufacturers more money to invest back into the base layer phone infrastructure — driving a reinforcing feedback loop between the development of the phone (infrastructure) and the things people use (apps).

We can observe this playing out today on Ethereum.

As Ethereum’s applications improve, more users flock to Ethereum. With more users flocking to the blockchain, we run into the issue of scalability. Which is now driving the demand to re-invest back into the infrastructure to support more users, better apps, and improved user experiences.

Ethereum is gearing up for its “broadband” moment. Layer 2s could be seen as broadband for blockchain applications. As the infrastructure improves, so will the apps. This should drive user demand, which will lead to even better apps and further investment into more scalable infrastructure.

Layer 2 Functionality

We could think of Layer 2 blockchains as “resellers of block space.” Essentially what they do is buy block space on Ethereum, make it more efficient (compress the data), and then re-sell it to users and applications seeking lower transaction fees and higher throughput.

Quick mental model: we could think of this similarly to how we use zip files when sharing information. Sometimes we want to send a really large file or many files at once. However, our computers often don’t have the storage required to send these files, so we create a “zip file.” This compresses the data and allows it to be more seamlessly shared.

Another way to think of this is how credit card transactions work in relation to our bank accounts. Credit cards are scaling solutions for bank transfers. Similar to L2s on blockchain, credit cards such as Visa batch transactions and later settle them on the base layer with the banks. This reduces fees and increases throughput/scalability.

Similarly, Layer 2 scaling solutions for Ethereum are batching transactions off of the main L1 chain, compressing the data, and then anchoring it back to Ethereum for security and proof of the transaction. This increases throughput and lowers costs — without sacrificing the functionality of Ethereum’s smart contracts and security.

As such, applications that were originally deployed on Ethereum’s base layer are moving up the tech stack to deploy on layer 2 solutions such as Optimism and Arbitrum. If you’re curious, you can check out various applications on Ethereum and the additional chains they have deployed to here.

There is currently a total of $24 billion of value locked within the Ethereum ecosystem. Of that, $4.38 billion is locked within applications leveraging layer 2 scaling solutions. Optimism currently has 79 projects. Arbitrum has 128.

Economics & Business Models

Optimism and Arbitrum are the leading layer 2 solutions for Ethereum today. In fact, they rank #6 and #7 in terms of transaction fees across all crypto projects over the last 6 months. Both have done $6.4 million in fees. This significantly outpaces alternative layer 1 blockchains such as Avalanche, Polkadot, Cosmos, Cardano, Near, etc. Solana ($8.4m) and Binance Smart Chain ($132m) are the only alternative L1s that are seeing more economic activity over the last 6 months.

Here are Optimism’s daily fees (green) and active daily users (purple) over the last 180 days:

Source: Token Terminal

And here are the % of transactions on layer 2 as a % of total ETH gas fees (proxy for total transactions):

Optimism earns fees by charging users (who are interacting with applications that utilize Optimism) for leveraging their scaling solution while still engaging with the functionality and security of Ethereum at the base layer. As with any business, Optimism makes money by creating value for others while taking a portion of the value created as revenue. In this case, Optimism’s tech is creating efficiency by compressing transactions at the execution layer of the tech stack, and saving users on transaction fees. In fact, the team claims they have saved users over $1 billion so far. Optimism charges slightly more to users than they end up paying for block space on Ethereum. The spread is their profit. Furthermore, Optimism’s “sequencer” is responsible for ordering, batching, and submitting transactions to the L1. Since the “sequencer” fulfills the role of determining the order of transactions, it can also earn revenue from extracting MEV. Today these fees are used to fund ecosystem development.

Optimism costs are incurred when batched transactions are recorded to Ethereum at the base layer. These costs are passed onto their users — who are happy to pay the cheaper gas fees when compared to Ethereum.

Tokenomics

Optimism released its token in June of 2021 (Arbitrum does not have one yet).

[As a quick side note, we always like to see projects release their tokens after product/market fit has been achieved.]

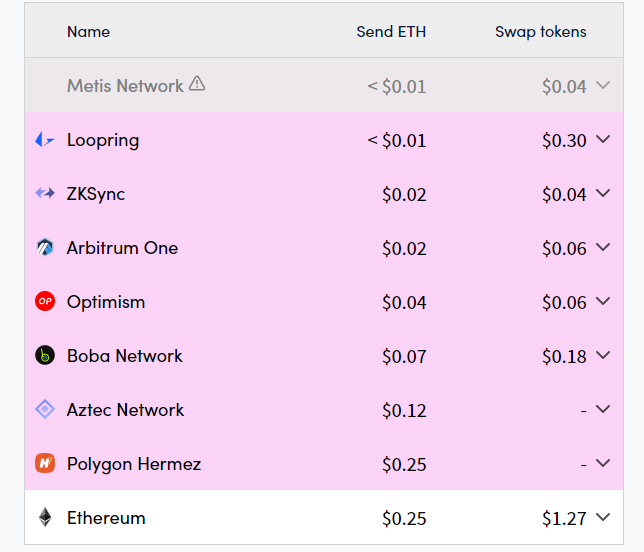

With that said, users of Optimism don’t pay fees in the OP token. Rather, they pay in ETH. Here’s what the fees per transaction look like currently:

Source: L2fees.info

Because fees are paid in ETH, there is no burn mechanism for the OP token. Rather, activity occurring on Optimism actually facilitates the burning of ETH at the base layer. Furthermore, since Optimism’s sequencer (where transactions are sent, validated, and ordered) is centralized today, there are no distributed validators or a standard protocol inflation rate as we would see with a layer 1 blockchain. Said another way, Optimism has outsourced its validators (security) to Ethereum at the base layer.

This means the OP token is simply a “governance” token today. Therefore, the value embedded in the token is derived from the ability of token holders to vote on key decisions in the future, including whether to route a portion of transaction fees back to token holders. This is a similar token model to DeFi applications such as Uniswap.

Optimism’s circulating token supply is currently just 5% of the total supply at launch (4,294,967,296) and will increase at a rate of 2% per year. Below is the unlocking schedule:

Source: Optimism Community Docs

Takeaways: with just 5% of the token supply circulating today, and no clear or set inflation rate, it’s tricky to project the proper value of the OP token. The circulating market cap is currently $214m with the fully diluted market cap coming in at a whopping $4.7 billion.

We think there is clear value here due to the product/market fit, usage, transaction volume/revenues, and early ecosystem development — particularly with DeFi apps such as Uniswap. However, the $4.7 billion valuation today seems quite high given the uncertainty as far as value accrual back to the token.

That said, Optimism Labs — the development firm behind the protocol — raised a $150m series B last March at a $1.5 billion valuation. Here’s how we think about this in terms of how it relates to the value of the protocol (and token): the investors in Optimism equity receive a pro-rata allocation of tokens when they sign subscription docs. Why? This is where the value is expected to accrue. Optimism labs and their investors get 36% of the tokens. So, if we take a $1.5 billion valuation for Optimism Labs, and divide that by 36%, we get to a valuation of the protocol (fully diluted value of the tokens) of $4.1 billion. How often can retail gain frictionless access to a Series B investment like this at a similar valuation that the silicon valley insiders invested at? Some food for thought.

Impact on Ethereum

We think scaling solutions are positive-sum for Ethereum. Layer 2s will enable Ethereum to usher in its “broadband” moment. We think this will eventually open up many use cases that likely have not even been dreamed about yet. Did anyone think that YouTube was possible when we were using AOL? Probably not. That was enabled by the throughput created by increased broadband.

As more apps deploy on L2s, this should bring in more users. Which creates more demand for block space. Which creates more transactions. Which leads to more ETH being burned. Which drives scarcity and value back to ETH the asset.

Per ultrasound.money, Optimism is currently the 12th largest contributor to ETH burned over the last 30 days (652 ETH). Arbitrum is just two spots behind.

The key takeaway here is that L2s leverage Ethereum for security and functionality. They pay Ethereum for these services. If these solutions had their own set of validators securing the network, they may not have the need to anchor their data back to Ethereum — and would therefore be seen as competitors rather than compliments.

Conclusion

While the mainstream media focuses on Sam Bankman Fried’s apology tour, the signal so far in the crypto winter is the growth of Ethereum’s scaling solutions. L2s are quietly becoming the “execution” layer of the tech stack, with Ethereum serving as the “settlement” layer. The application layer of Ethereum’s tech stack will ultimately be built on layer 2s (and possibly L3s). We think this is Ethereum’s “broadband moment” and expect to see a proliferation of new use cases and apps during the next cycle — all made possible by the new scaling layer. In the long run, we think L2s will be the primary driver of value accrual back to ETH the asset at the base settlement layer of the tech stack. Meanwhile, we are projecting significant value accrual to the leading L2s in the next cycle.

___

Thanks for reading.

If you got some value from this week’s report, please like the post, and share it with your friends, family, and co-workers so that more people can learn about DeFi and web3.

This small gesture means a lot and helps us grow the community.

If you have a comment, thought, or idea, drop it here:

Finally, if you are interested in working with The DeFi Report through any kind of partnership or bespoke consulting services feel free to reach out at mike@thedefireport.io or reply to the email if you are reading this from your inbox.

___

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.

Nice article. Thank you for the data and analysis. I'll be referencing it in an article I'm publishing soon.