The Ethereum Investment Framework

Ethereum is on it's way to becoming a global monopoly. We need a framework.

Hello readers,

3 years of research and boots-on-the-ground experience working in web3 + 15 years total in business/technology/accounting/finance have led me to conclude that Ethereum has a clear path to becoming a global monopoly over the next decade.

In particular, I’ve spent the last 18 months relentlessly analyzing Ethereum against the other L1 networks. Exploring each ecosystem. Analyzing and forecasting the business models throughout the tech stack. Assessing the viability of private blockchains. Studying the history of technological innovations and the growth of the internet. Seeking out opposing views. Attending industry conferences. Speaking with analysts, researchers, operators, developers, and engineers.

Out of all of this work came The Ethereum Investment Framework. I’ve been working on it for several months now — and I’m pumped to share it with you in this week’s report.

Topics covered:

Why I created The Ethereum Investment Framework

What You Get

Who it’s For and the Problem I’m Solving

50% discount for readers of The DeFi Report

Why now?

Disclaimer: Views expressed are the author's personal views and should not be taken as investment or legal advice.

If you find our analysis helpful, please like the post — which can be done directly from your inbox via the heart button in the upper left. Let’s make quality free content a win/win. This helps grow the community and responsibly introduce more people to DeFi and web3.

The DeFi Report is a data-driven exploration of the web3 tech stack from first principles & on-chain data — and an ongoing analysis of where value could accrue.

Let’s go.

Why I Created The Ethereum Investment Framework

Crypto is complicated. To see it for what it is, one must have some understanding of economics, finance, technology, incentive structures, data, the internet, human behavior/psychology, politics, game theory, history, past innovation cycles, open-source tech, standards, and much more.

Not to mention, crypto markets and news cycles are full of noise. Endless noise. No matter where you turn, you’ll see wildly conflicting views on the space.

Having spent the last three years within the belly of the beast, I can say that navigating this industry is no walk in the park.

I didn’t leave a cushy job at MIT Investment Management Company because I thought it would be easy. I left because I see crypto as an opportunity to make a mark on the world. To do more satisfying and challenging work. To be part of something special. To learn. Grow. Challenge the status quo. And prove the naysayers wrong.

That’s my why. It’s what drives me.

When I started writing The DeFi Report, my goal was simple: cut through the noise in this space and save you time getting up to speed with trusted analysis. That’s the problem I’m solving.

I strongly believe that crypto will be around for many generations. I sometimes feel like an alien because this seems obvious to me. It’s certainly not obvious to everyone, but public blockchains are solving massive problems. Lots of people care deeply about them. And they are generating cash flows. It’s really all you need to know as a starting point.

I believe that crypto (referring to public blockchains & protocols) will spawn a new asset class first. And then it’s going to slowly change the way that just about every service on the internet works.

The birth of a new asset class will require new valuation frameworks. New business model analysis. New reporting and audit structures. New data providers. New KPIs, metrics, and benchmarks. New buy and sell side research structures.

Eventually, the market will consolidate around a shared consensus concerning how to analyze and value crypto networks and protocols.

I want to be at the forefront of this.

It’s why I’ve partnered with Token Terminal and Glassnode for the best data in the industry. It’s why I’m constantly studying and modeling on-chain data, conducting deep research throughout the tech stack, writing, and sharing my findings.

My research cuts deep. No rock goes unturned. I take pride in actively seeking out opposing views. I don’t care what your opinion is. I want to understand the logic of how you arrived at it.

I want to uncover the truth.

The output of this work has led me to conclude that Ethereum will grow into a global monopoly over the next decade. I have strong convictions about this. But I don’t want you to take my word for it. I simply want to present my research and analysis. And let you decide for yourself.

The problem is that I can’t pack everything you need to know into one or two reports.

I’ve been struggling with this for months now.

There’s just too much to cover. Here’s everything you need to know:

The Flaws of the Internet and Ethereum’s Fundamental Value Proposition

The History of Open-Source Technology and Open Standards (and how crypto is simply the latest expression of these trends)

Ethereum’s Business Model

A detailed Analysis of Etheruem’s Network Effect from a Data-Driven Perspective

Why Ethereum may have already achieved Escape Velocity on its way to becoming a Global Monopoly

Ethereum’s On-Chain Financials from 2015 through Q2-23

Ethereum’s Tokenomics and Economic Incentive Structure

Valuation Frameworks

How an Investor should think about ETH as a Multi-Function Asset

Addressable Market Analysis and Adoption across Industries

Valuation Scenario Analysis (4 methods including price targets)

Valuation Metrics & KPIs

Ethereum’s Operating and Network KPIs through Adoption Cycles

ETH Price Correlations through Adoption Cycles

The Economics of Layer 2 Scaling Solutions

Margins of Applications & Protocols built “on top” of Ethereum and Unit Economics through the Tech Stack

On-Chain Gas Consumption by Use Case and Year

How firms such as Ernst & Young are Onboarding Enterprises to the Ethereum Network (and why they project 4 billion transactions/day from one use case alone)

How and why Ethereum will transform B2B interaction

Ethereum as Core Infrastructure for Global Finance

How Crypto and Traditional Finance will merge on the Ethereum Network

How Ethereum will spawn new Internet Native Business Models based on User-Controlled Data

Ethereum’s Governance & Core Team

Network Security and Decentralization

Ethereum’s Development Roadmap

Data-driven Comps to Ethereum’s Top 10 Competitors

Regulation & Policymaking

Catalysts and Drivers of Adoption

Private vs Public blockchains

Risks

It’s a lot. I haven’t seen anyone put all of this into one document or one course. And it will take you hundreds if not thousands of hours of work to put it all together on your own.

That’s how long it took me. 3 years.

This is why I created The Ethereum Investment Framework. Your time is valuable. I want to give your time back to you by packaging everything you need to know about Ethereum into one document.

I’ve set the document up so that you can easily navigate it section by section with easy-to-follow, clickable links. It even includes a Glossary of Terms, with click-through to key definitions as you navigate the document.

I’m proud to share that The Ethereum Investment Framework includes over $13,400 of data licenses (Token Terminal & Glassnode) covering every important KPI from inception (2015) through Q2-23. As always, the data lights the path.

It’s 77 pages. But it won’t feel like you’re reading a book. I want you to review it section by section. Leave it open on your desktop. Analyze the data. Stop and think. Take notes. Call your co-worker or friends to discuss. Put it down. Come back to it. And reach out to me with your comments and questions.

Members will receive quarterly updates, so you’ll get smarter and more well-versed on the ecosystem each quarter.

Who I Created it For

Crypto-Curious Investors: The Ethereum Investment Framework is a non-technical, approachable guide. It’s the only document you need to quickly get up to speed on crypto.

RIAs: Your clients are going to continue to ask you about crypto. Leverage our analysis to get up to speed quickly. Use my work as your secret weapon for informing clients and client strategy. Gain an edge over your competition.

Aspiring web3 Participants: Looking to get a job in web3? Get up to speed on the space with one document.

Hedge Funds: Use our data, analysis, and insights to study and forecast crypto markets through cycles.

Educators and Content Creators: Use our framework to teach others about Ethereum.

Family Offices: Mandated to invest or understand crypto? Leverage our analysis to get up to speed quickly. Save time and resources. You don’t need a crypto analyst and data scientist. You just need The Ethereum Investment Framework to get started.

Web3 Natives: Use our analysis to step out of the weeds and get a clear, high-level view of the space from on-chain data and first principles.

VCs: Leverage our analysis to uncover where the most value could accrue within the tech stack — and which ecosystems are most promising.

Financial Service Providers: Learn how you can offer new products and services by leveraging Ethereum and the protocols built “on top” of it.

Entrepreneurs: Become inspired by what you could build within the Ethereum ecosystem.

Developers and Engineers: Learn about Ethereum’s infrastructure, tooling, user base, tech stack, and network effects to inform where you should build.

It’s amazing to me that it’s possible to create a product that can be helpful to such a broad spectrum of people. Crypto is unique in this way, and it’s humbling to be part of it.

Why now?

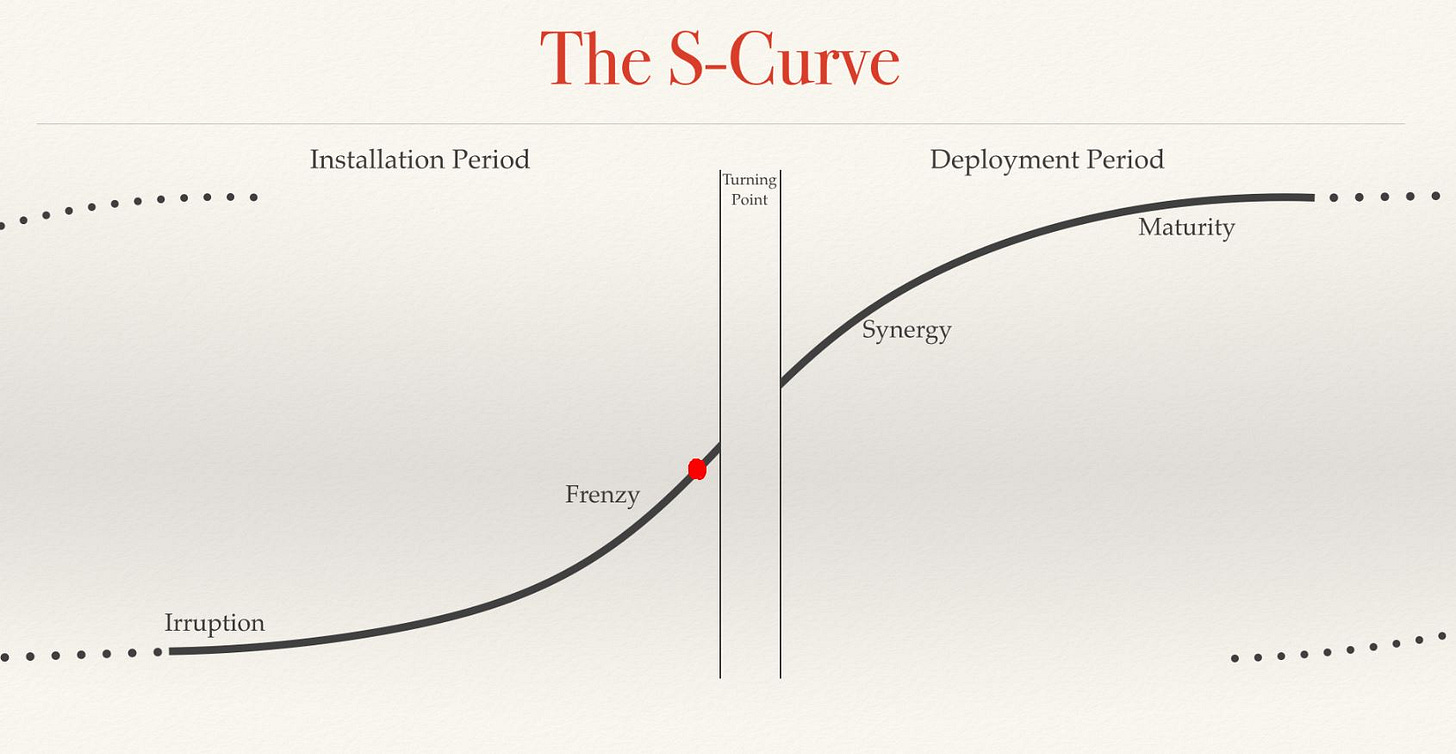

Per the framework laid out in Carlota Perez’ Technological Revolutions and Financial Capital, revolutionary technologies go through 4 distinct phases as they are Installed and Deployed.

I believe we are on the cusp (red dot) of entering the critical “Turning Point” period between installation and deployment for crypto. Turning Points occur during the hangover from the “Frenzy” period — which we left at the end of 2021. These periods are highlighted by regulation and policymaking — marking the end of the Installation period, and the beginning of the Deployment period. This is where the hockey stick growth can occur.

There are plenty of signals in the market pointing to the inevitable “Turning Point.”

Blackrock recently applied for a Bitcoin ETF. Ripple just won its court case against the SEC — which I believe is a forcing function for Congress to act as soon as possible. Why? The status quo based on the court ruling is that crypto assets are not securities, but institutional investors are protected while retail is not.

Furthermore, The next Bitcoin halving is about 8 months away. Global liquidity appears to have bottomed for the cycle. Ethereum is scaling. It’s executing on its roadmap. Ernst & Young is onboarding enterprises. Regulation passed in Europe. The UK wants to be a crypto hub. Hong Kong is pressuring banks to work with crypto companies. Japanese and Singaporean regulators have joined forces on a crypto pilot project.

Naturally, we’re seeing more action and urgency from Congress.

8 years in, Ethereum’s network effects have achieved escape velocity in my opinion. We cover this in detail in The Ethereum Investment Framework. Network technologies are often natural monopolies. And the giant typically emerges within 10 years of the introduction of new technology.

In summary, many factors are starting to line up. There’s still a way to go, but my spidey senses are telling me the next adoption cycle could be much larger than the last one.

50% Discount for Readers of The DeFi Report

To me, business is about creating win/wins. I strongly believe that The Ethereum Investment Framework will provide a return on investment for those who decide to purchase it. I’m confident in my research. I’m proud of this product. I want to save you time. I want to deliver value. And I want to win together.

I can only hope that I’ve earned your trust by consistently putting out quality, free reports for two years now.

*As a courtesy, I’m offering readers of The DeFi Report first dibs with a 50% discount to the first 100 buyers.*

There are three versions of the product:

The Ethereum Investment Framework: 2-year Membership Pro.

$1,499.$749.50. Included:The Q2-23 report

Quarterly updates through Q2-25 ($27/quarter or $0.30/day)

2 hours of “ask me anything” calls. You’ll receive an email with a Calendly link for scheduling upon purchase.

The Ethereum Investment Framework: 2-year Membership.

$499.$249.50. Included:The Q2-23 report

Quarterly updates through Q2-25 ($27/quarter or $0.30/day)

The Ethereum Investment Framework.

$199.$99.50.Included:

The Q2-23 report only

For those who purchase the 2-year membership, quarterly updates will be delivered to your inbox by the 15th day after each quarter close. They will include updated data for the prior quarter, network and ecosystem developments (L2s, apps, alt L1s), sector updates, and any important information we think you should have. I will be improving the framework each quarter, taking suggestions from members in the process.

I believe the product is properly priced given the immense time, research, data, and expertise that went into it — and will continue to go into each quarterly update. With that said, I want everyone to have access to it. If it’s a financial hardship, please reach out to me directly.

Why wait?

Buy now before the 50% discount expires. Here’s the discount link to purchase and download The Ethereum Investment Framework: Buy Now

As always, thank you for reading and for supporting my work.

If you got some value from the report, please like the post, and share it with your friends, family, and co-workers.

This small gesture means a lot and helps us grow the community.

If you have a comment, thought, or idea, drop it here:

P.S. Long-time readers might be wondering about my thoughts on other networks. Nothing has changed regarding my thesis for Bitcoin and Solana (the only other networks I’m constructive on and have covered extensively).

I’m focusing on Ethereum here because I think it has the largest addressable market in the space. I think Bitcoin has already won a monopoly position in the race to be “internet money.” I do not consider Bitcoin a competitor to Ethereum or Solana.

Ethereum and Solana are competing to some degree, but offer uniquely different architectures. This makes Solana interesting when compared to the rest of the alternative L1s, and it’s the reason (among many others) that we initiated a position in the network in January of 2023.

Take a report.

And stay curious.

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.

Hi Mike, we're interested in doing some co-marketing with you if you're up for it. Can't seem to find a way to get in touch, hence messaging here.