Solana Ecosystem Overview - Pt. 1

Is Solana dead or is the market dislocating?

Hello readers,

Happy New Year! I hope everyone had a wonderful holiday season.

Our first report of 2023 is a deep dive into the Solana ecosystem. After seeing a meteoric rise in market value in 2021, the “ETH Killer” was equally punished by investors in 2022. Solana’s token price — which peaked at $260 in November of 2021 — is currently down 96% and trading around $11. This begs the question: is Solana dead or is the market completely dislocated due to macro conditions and perceived contagion related to FTX?

Let’s dig in. We have a lot to cover, so we are breaking our Solana analysis into two parts.

Part 1:

Solana’s ties to FTX/Alameda

Developer Activity & Sentiment

Infrastructure, Ecosystem, and Key Projects

Part 2:

Founders, Core team, Investors

Tokenomics

KPIs vs Alt L1s

Risk Assessment

Disclaimer: Views expressed are the personal views of the author and should not be taken as investment advice. The author is not an investment advisor.

The DeFi Report is an exploration of the web3 tech stack and an ongoing analysis of where value could accrue. We provide easy-to-follow mental models, frameworks, and data-driven analysis for DeFi and web3 business models.

Let’s go.

Solana’s Ties to FTX/Alameda

Let’s address the elephant in the room first. FTX/Alameda Research were early backers of Solana and a handful of DeFi and NFT projects within the ecosystem. In particular, FTX/Alameda own or has a claim (now the bankruptcy trustee) to about 10% of Solana’s token supply. This breaks down as follows per Solana Labs:

4,000,000 SOL tokens issued 8/31/20 to Alameda. These tokens were fully unlocked prior to Alameda’s demise.

12,000,000 SOL tokens to Alameda on Sept. 11, 2020. These tokens were unlocking on a linear monthly schedule that began Sept. 2021 and was set to fully vest Sept. 2027.

34,524,833 SOL tokens to Alameda on January 7, 2021. These tokens were unlocking on a linear monthly schedule from January 2022 to January 2028.

7,500,000 SOL tokens to Alameda on February 17, 2021. The full balance was set to unlock on March 1, 2025.

61,853 SOL tokens to Alameda on May 17, 2021. The full balance was set to unlock on May 17, 2025.

If we assume the fully vested tokens are circulating in the market, this leaves a total of 46,311,790 tokens that are currently locked with the bankruptcy trustee, or 8.6% of Solana’s total token supply.

As you can imagine, the market is completely spooked by this — selling off the SOL token more than 73% since FTX/Alameda’s demise in early November. A lot of the uncertainty has now shifted to timelines regarding bankruptcy proceedings for creditors. I’m not a bankruptcy attorney, but some are estimating this could be the most complex bankruptcy case ever — with creditors waiting years and potentially decades. The Mt. Gox hack in 2014 is instructive as creditors are still waiting for that case to be resolved, though maybe not much longer.

As such, we think Alameda’s tokens are likely to be locked up for years — and therefore are not an immediate liquidation concern.

Total Value Locked

With all of this drama playing out, how is the Solana DeFi ecosystem holding up? FTX/Alameda was an investor in Solana DeFi projects such as Serum (DEX), Raydium (AMM built on Serum), Magic Eden (NFT platform), and SolFarm (yield aggregator). Here’s a quick look at the Total Value Locked within the Solana network:

Ouch. TVL is currently down 98% from its peak of over $10 billion late in 2021. For reference, Ethereum’s TVL is currently $23 billion (down 75% from its peak). Of particular note is that SOL — the native token of the Solana network — is leaving the ecosystem in droves as well. The amount of SOL committed within the blockchain is currently down 70%. By comparison, the amount of ETH within Ethereum is down just 30%.

SOL holders are rattled. This has them pulling their tokens out of Solana DeFi, selling them, sending them back to their wallets, or bridging to other blockchains such as Ethereum. More on Solana DeFi later in the report.

Developer Sentiment

Things aren’t looking so good on paper here. Adding fuel to the fire, two popular NFT projects — y00ts and DeGod — recently announced plans to bridge to Polygon and Ethereum respectively. As such, the Twitter trolls are buzzing that “devs are fleeing Solana.” Is this signal or noise?

Solana tends to attract a blend of web2 & web3 talent. The ecosystem was the second fastest-growing blockchain in terms of developers last year. The developer community is everything. If the devs leave, it’s all over. Fortunately, a survey was recently conducted that went direct to the source. Here are the results:

This looks pretty good. 66% of the devs surveyed (107 responses) say they are still solely focused on building on Solana. Keep in mind that even if a project builds on another chain, it doesn’t necessarily mean they are completely leaving Solana. For example, many DeFi apps on Ethereum are building on other EVM chains to expand their network effects.

Looks like current developers are likely to recommend and recruit others to the blockchain. Another positive indicator from the community.

1 = extremely difficult. 5 = easy. The vast majority of Solana devs are somewhere in the middle here, which we’ll chalk up as another positive indicator.

Finally, 72% of developers surveyed indicated they had zero exposure to FTX. While the survey covers a fairly small sample set, it does provide some insights into how the dev community is thinking. A brittle community would fracture and break under trying conditions. We aren’t seeing that in the data here. This is a positive indicator in terms of Solana’s ability to right the ship. It helps that Vitalik Buterin himself provided a recent vote of confidence.

Developer Activity

Despite the shocking drop in price and TVL within the Solana ecosystem, the devs continue to build. Below we can see that the number of developer repos and unique programs is up 2.5x over the last year. Solana has about 78 daily active devs, which fluctuates a bit and is down over the last month or so. For reference, Ethereum had about 111 daily active devs in December 2018. It does look like Solana has lost some of its developers. We should note that developer activity over the last quarter is down slightly across all blockchains, including Ethereum. It’s also typical to see dev activity drop off around the holiday season.

Alchemy (blockchain infrastructure/node provider) recently released a web3 developer report. It echoed a similar sentiment:

When we stack up Solana Dev activity over just the last 7 days (post-FTX crisis), we see Solana sitting in the top 10, a position it has occupied throughout the last year. *Token Terminal counts “active developers” as unique GitHub users that have at least one code commit to the public GitHub repository over the specified period.

In addition to these data points regarding Solana developers, the network has one of the strongest Hacker House programs in crypto. 12,000 builders attended 24 Solana Hacker Houses around the world in 2022. These programs help to incentivize developer participation globally: from America — China — India — Eastern Europe — and Brazil. The 2023 schedule includes stops in Istanbul, Melbourne, Ho Chi Minh City, Austin, Taipai, NYC, Tel Aviv, Berlin, Bengaluru, and Mumbai. Past sponsors have included Microsoft, Google, Stripe, Visa, Jump, and Sumsung.

Finally, Solana hosted its annual Breakpoint Conference in Lisbon this past November. It was attended by over 3,600 people (almost double the prior year).

The idea that Solana devs are fleeing the network appears to be noise. We’ll continue to monitor this in the coming months.

Ecosystem Development

In this section, we’ll take a look at Solana’s infrastructure development and its most important use cases to date.

Programming Language

Solana devs primarily code in the Rust programming language. Unlike Solidity (Ethereum smart contract language), Rust was around prior to Solana and consistently ranks in the top 20 commonly used programming languages amongst developers (web2 and web3). Google, Facebook, and Microsoft are increasingly using Rust, and it was ranked the “most loved” programming language among a sample set of over 82,000 devs for the 6th year in a row. Additional blockchains that support Rust include Near, Aptos, and Sui (Aptos and Sui use the Move language which is based on Rust).

EVM Compatibility

In addition to utilizing a popular programming language, Solana is becoming EVM-compatible. Ethereum is currently the largest smart contract development platform and uses the Ethereum Virtual Machine (EVM) to run smart contracts on a globally distributed network of nodes. Because there are lots of devs building Ethereum applications and a network effect around the EVM, creating a Solana EVM to make Ethereum smart contracts compatible with Solana’s rust-based blockchain is advantageous. The Solana EVM will allow applications and transactions on the Ethereum blockchain network to also be processed by the Solana blockchain. This means that popular Ethereum-based applications could deploy on Solana in the coming years to enhance their network effects.

Validators

Despite concerns regarding centralization, Solana has 2,470 validators. The validators are distributed across more than 35 geographic locations and more than 138 unique data centers. Collectively, Solana’s Nakamoto Coefficient (measures decentralization), stands above the industry average at 32. We’ll note that 40% of the validators were hosted by a Hetzer, a German cloud provider that recently severed all ties with Solana (and crypto broadly). Fortunately, this did not cause any disruptions to the network, and the validator set is now more distributed as a result.

Wallets & Dev Tooling

Solana tokens are not yet supported by the popular MetaMask wallet (Ethereum only). The most popular hot wallet for Solana is Phantom (which has recently added Ethereum and Polygon assets). As always, we recommend storing only small amounts of crypto on exchanges or within hot wallets. Ledger is a hardware wallet that supports Solana for any cold storage needs.

As far as developer support, Solana is well organized when it comes to supporting its community. The network has ample financial resources (over $330m in funding) to incentivize developers, a well-organized and global hacker house schedule, well-attended hackathons, and uses the popular Rust programming language. Firms such as Alchemy offer a Solana tool suite and provide a number of resources to help devs get up and running.

Offering the proper tooling, resources, and support for developers is absolutely critical for a blockchain to build a sustainable development community. We see plenty of signs of this as we analyze Solana.

DeFi

Solana’s original vision was to position the blockchain to support global finance. Its scalability and throughput were designed to solve Ethereum’s weaknesses and make it the fastest blockchain on the market. As such, Solana has attracted a lot of builders who have come over from the TradFi space — market makers (Jump Trading), traders, lenders, etc. From what we hear from the developer community, Solana’s architecture is more prepared to handle the requirements of global finance than any other blockchain.

The first successful DeFi project was Serum, a decentralized exchange that employs a central limit order book — as opposed to the automated market maker model we see on Ethereum. It turns out that FTX had a significant influence on Serum and actually controlled private keys associated with the DEX. The Serum protocol is now defunct. It was later forked in the aftermath of the FTX collapse and now functions as the Openbook protocol — which has just $1.6m in value locked currently.

As if the FTX debacle with Serum wasn’t a big enough blow to Solana DeFi, Mango Markets — a perpetual futures market protocol on Solana — was recently “hacked” or manipulated by a trader, with over $100 million drained from the protocol. Not good.

Marinade Finance — a liquid staking protocol — currently sits in the #1 spot in terms of TVL with a paltry $65m of value committed to the application. In total, there are 85 DeFi projects still (barely) kicking on Solana today.

There isn’t much to add here. Solana DeFi had a tough year. The ecosystem may need to be rebuilt from the ground up. Furthermore, it’s possible that DeFi is not the best use case for Solana. After all, the chain was built specifically to solve Ethereum’s throughput challenges. As Layer 2 solutions look to solve those challenges, Solana’s value added to DeFi builders could become less impressive. Furthermore, as Solana adds EVM compatibility, it’s possible we could see the Ethereum “blue-chip” DeFi protocols (Aave, Uniswap, Compound, Maker, Synthetix, Balancer, etc) deploy on Solana and capture the market over there.

One bright spot for Solana DeFi is that Stripe recently integrated fiat-to-crypto payments with several Solana apps including Orca — a DEX on the platform.

NFTs

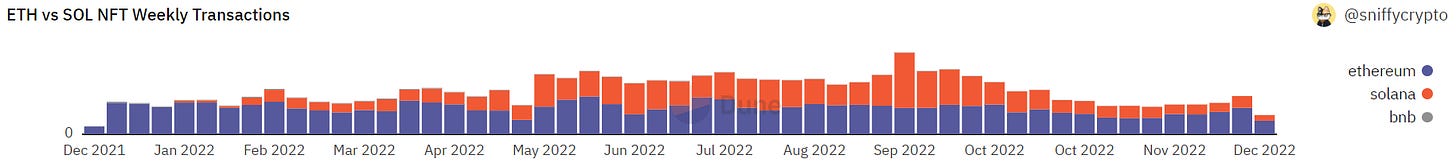

DeFi is currently in shambles on Solana, but its NFT markets appear alive and well. OpenSea integrated Solana in April of ‘22, and just one month later, Solana was doing more weekly NFT transactions than Ethereum. The top L1 recently recaptured the lead.

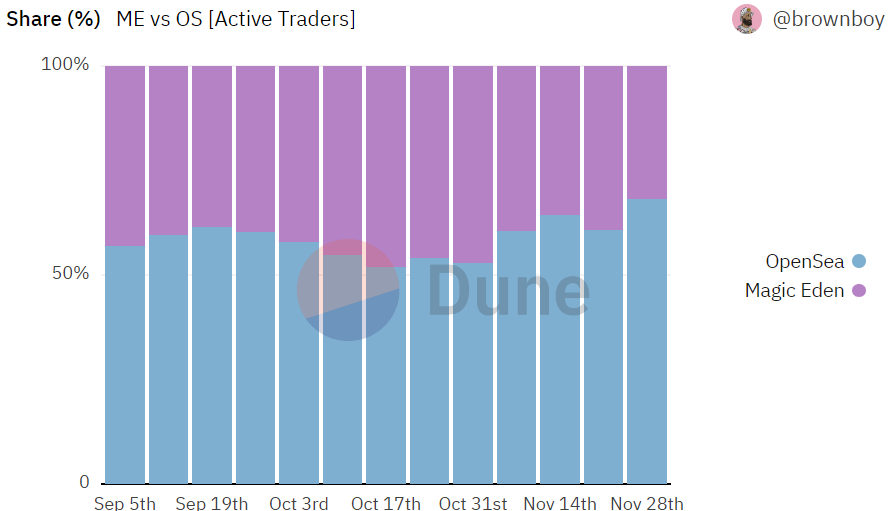

Magic Eden is the largest NFT platform on Solana. Here’s Magic Eden vs OpenSea in terms of active users (284k in November):

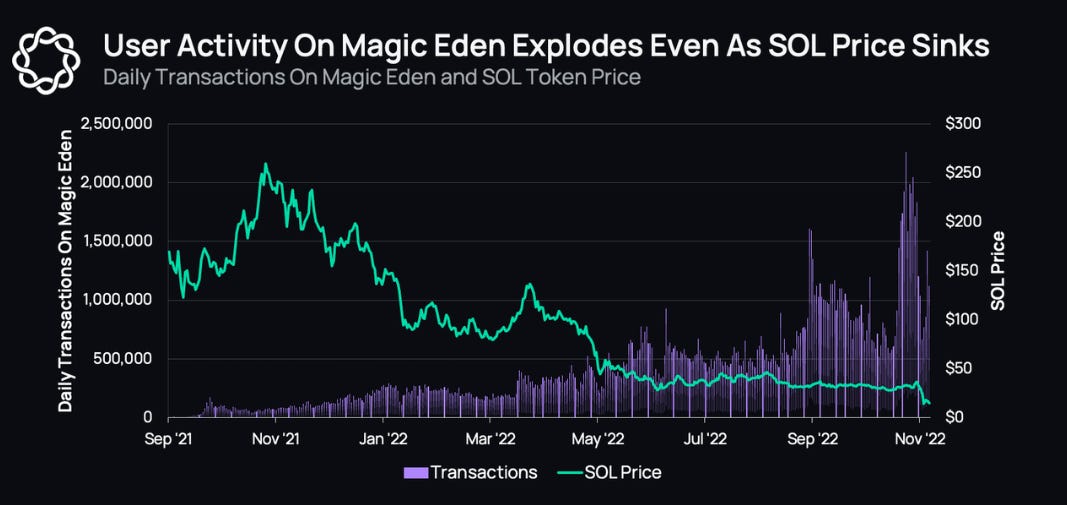

User activity on Magic Eden has been healthy despite the SOL token sell-off:

Solana’s NFT ecosystem has held the #2 position behind Ethereum in terms of secondary sales and continues to narrow the gap. Much of the network’s success in the NFT space can be attributed to innovation around the Metaplex Digital Asset Standard — the foundational token standard for all NFTs on Solana (similar to ERC-20, ERC-721 or ERC-1155 for Ethereum).

Despite the health of this sector, we have to ask ourselves if NFTs are a large enough addressable market to sustain the network. We think NFTs will be the wrapper for many digital goods and assets in the future (certainly not just digital art). With that said, Solana will need additional use cases.

How about physical infrastructure projects?

Physical Infrastructure Projects

Decentralized Physical Infrastructure Networks (DePIN) are used to bootstrap decentralized networks of physical hardware. Things like data storage (Filecoin, Arweave), wireless access for IoT (Helium), and cloud computing services (Cudos, Ankr, Akash) are extremely difficult to bootstrap. Tokens have proven effective at catalyzing the supply side of these networks as they incentivize the investment in decentralized hardware at scale.

One such project that has gained some traction is Helium — the blockchain-based network for IoT devices that uses nodes as hotspots to connect wireless devices to the network. “The Peoples Network” has been able to scale out its hotspots to almost 1 million globally and recently partnered with T-Mobile. The idea here is that we will have a “smart planet” in the future that will need to connect to billions of IoT sensors that require internet connections. Helium is building out the supply side to serve those use cases. With that said, demand for the services has not caught up to the build-out of the supply side of the network just yet.

Helium is backed by reputable VC firms such as Google Ventures, a16z, Tiger Global, Multicoin Capital, and Union Square Ventures. The team recently ditched its own blockchain and will instead migrate over to Solana.

Additional Solana projects in this space include 1) Pollen Mobile — a Helium competitor in the 5G space, 2) Hivemapper — a drive-to-earn network incentivizing users to provide the network with street view mapping data with 11,000 KM mapped in its first month, and 3) Teleport — a web3 Uber service.

Gaming

Gaming is another area we are tracking within the Solana network. Stepn, a “move to earn” game that rewards users for exercise saw 700,000 monthly active users earlier this year and garnered a partnership with Asics. That momentum has since fallen off a cliff with the game seeing just 45,000 users in December. Meanwhile, we continue to hear that GameFi is poised to usher in a new cohort of users across the crypto space. Solana Ventures’ $150 million fund to bootstrap GameFi is well underway and an area to keep an eye on in 2023.

Solana Phone & Mobile Payments

Crypto developers are looking for a distribution mechanism outside of the App Store and Google Play (which take 30% of top-line revenues). As such, Solana is launching a phone and an open-source mobile stack — which might be the most interesting thing about Solana right now.

If crypto is going to make it to the mainstream, it has to deliver a world-class mobile experience. Not an easy task. Fortunately, it looks like Solana selected the right guy for the job. His name is Jason Keats and he previously lead the architecture of the Apple iPad.

We think the Solana phone is interesting from a few different perspectives:

If it catches on, it could allow crypto developers access to a distribution mechanism for their crypto-native apps while avoiding the 30% fees in the App Store and Google Play.

It will be the first phone with integrated secure cold storage.

The Solana Mobile Stack is open-sourced and can be integrated into any Android phone by the manufacturer. This means anyone can compete against Solana Saga Phone, which could drive rapid innovation in this area.

Solana Pay for Android — apps on the phone will be able to easily integrate mobile crypto payments.

If you’re interested in a deep dive on the Solana phone and mobile stack, check out this write-up by the Superteam Substack.

Wrapping up Part 1

Our takeaways:

Alameda had a claim to a large % of the SOL token float. These tokens (most of which are not vested) are now locked up in bankruptcy proceedings. Therefore, we don’t think there is a threat of these holdings being sold into the market anytime soon.

DeFi has been completely decimated on Solana and may need a full reset with new apps to re-catalyze usage. It is currently unclear if DeFi is a good long-term fit for the blockchain. We should note that while the numbers look bad, Solana (launched in March 2020) has a similar TVL today when compared to Ethereum in December 2018 - when it was in its first bear market after launching a few years prior. Ethereum’s market cap was $9.8 billion back then. Solana is $4.1 billion today.

NFT volumes and marketplaces are thriving on Solana. GameFi is another area to keep an eye on in 2023 as many projects were seeded with Venture Capital last year.

Helium migrating to Solana in the wake of the FTX debacle provides a needed vote of confidence in the chain from a promising crypto project with strong backing.

The Solana phone could differentiate the ecosystem in the coming years and is potentially a zero-to-one moment for crypto adoption on mobile.

Most importantly: while some devs have left, we see a vibrant, well-funded developer community persisting through the turbulence. This has the potential to solidify Solana’s core foundation and re-invigorate the community to build useful applications over the coming years — potentially setting Solana up for a strong rebound when liquidity returns to these markets.

That’s all for now.

Part two drops tomorrow. We’ll cover Solana’s founding team, investors, tokenomics, KPIs vs other L1s, and risks.

If you got some value from the report, please like the post, and share it with your friends, family, and co-workers so that more people can learn about DeFi and web3.

This small gesture means a lot and helps us grow the community.

If you have a comment, thought, or idea, drop it here:

Finally, if you are an investor, VC, hedge fund, family office, or start-up interested in working with The DeFi Report through any kind of partnership or bespoke advisory services feel free to reach out at mike@thedefireport.io or reply to the email if you are reading this from your inbox.

___

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.