Hello readers,

The DeFi Report is still pretty small. We’re growing slow and steady. Brick by brick. But I’ve also felt some undeniable momentum over the last 6 months or so.

And it’s because of you. You’re the reason we made it this far. Many of you have been with us from the start and we’re incredibly grateful that you find value in our work.

But it’s time to grow up. We work for you. And so we need your input as we move into the next chapter.

In this week’s report, we’re pulling back the curtain to share:

Our progress and the journey to date.

Where we are heading — and why I need your feedback.

Let’s go.

The Journey to Date

I started writing publicly in 2020 after several failed attempts at explaining my Bitcoin research to friends, family, and colleagues. There was no social media presence at the time. No business model. And not much of a plan.

I just knew that the public perception of Bitcoin (and crypto more broadly) was off. Like way off. And so there had to be an opportunity here.

That was it. I guess you could say that my stubborn passion to prove the naysayers wrong is what ultimately led to The DeFi Report.

For the first year and a half, I wrote nights and weekends while working at Inveniam as the Director of Ecosystem Strategy. The DeFi Report grew slowly but steadily.

Eventually, people started reaching out to me on LinkedIn looking for help. This led to some consulting contracts and before you know it, The DeFi Report became a real business.

I decided to leave Inveniam at the end of ‘22 to go full-time. Since then we’ve:

Continued to build our trusted brand anchored to research & data

Established key partnerships

Added a part-time research analyst. Shout out Matt Livesley.

Added two new revenue lines. Our services currently include content partnerships, content licensing, and advisory work.

Grown the social channels (lots of work to do here)

Launched The Rundown Podcast

Relentlessly studied onchain data

And argued with wayyy too many “no coiners” on LinkedIn :)

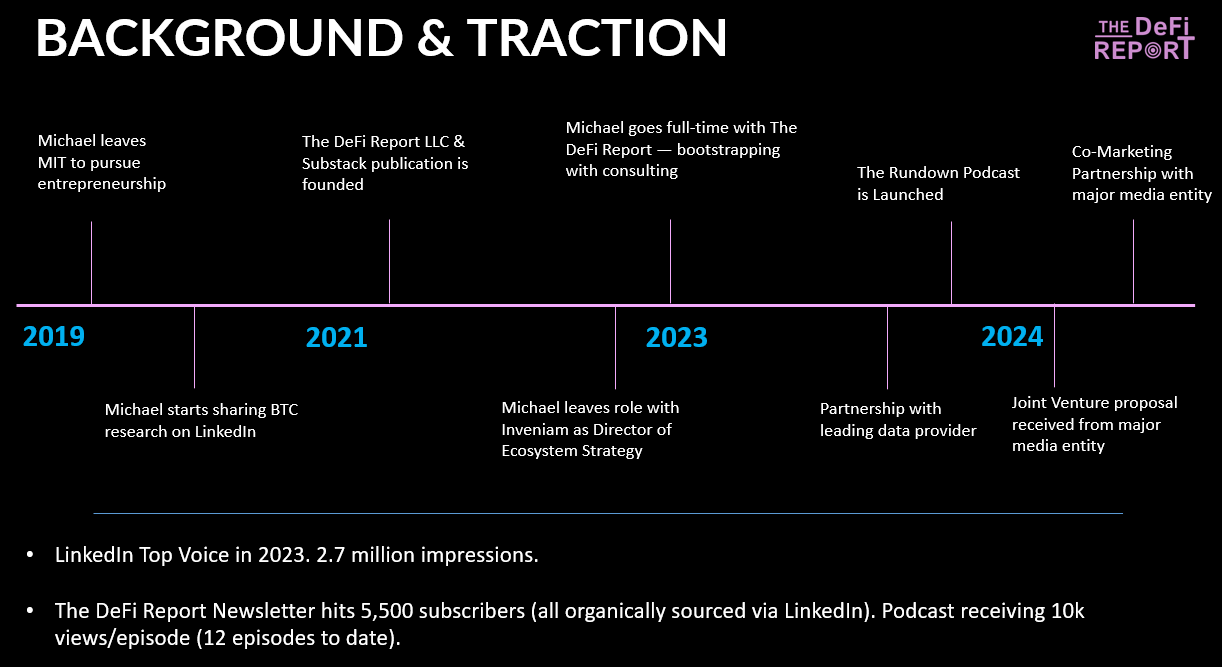

Here’s a (simplified) visual of the journey so far:

For those who would prefer to hear or watch an articulation of the journey, we discussed it on episode 6 of The Rundown. You can check that out here (starts at 14:44).

The DeFi Report is powered by Token Terminal — the leading data & analytics platform for institutions.

If you’d like to receive more data-driven analysis of the web3 tech stack as we uncover where the most value will accrue and why, sign up here.

The Next Phase

We bootstrapped our way from zero to one. Now it’s time to go from one to ten.

In this section, I’m going to share with you my plans for this year and ask a lot of questions. Because I desperately need your feedback as we grow. In addition to the poll questions, please feel free to tell me what you like and don’t like in the comments, or reach out directly via LinkedIn or by responding to this email. Actionable feedback that can help us improve is immensely valuable.

2024 Plans

Our priorities:

Grow our brand via social channels. We’re looking to onboard a rockstar who 1) understands our business and brand, 2) is obsessed with crypto & onchain data, 3) can write, 4) do research, and 5) grow our social channels. If you’re that person (or know the right person), please send me a DM on LinkedIn or respond to this post.

Grow our brand via The Rundown Podcast. Objective, trusted, data-driven content is a blue ocean market in crypto. We’ve produced 12 episodes so far, and are getting about 10k views via The DeFi Report + Proof of Work channels (the podcast content is syndicated). I’m pleased with the progress so far but we still have a very long way to go.

Continue to produce some of the best research in the industry. We obsess over this every single day. Of course, as the data gets better, we get better — and we couldn’t be in a better spot thanks to Token Terminal.

Build a new website (our web developer starts this week). The new website will consolidate all of our content, professionalize the operation, and enable a clean re-brand as far as our design aesthetic. The user experience on your end will not change.

Expand our partnerships with like-minded firms building the picks and shovels necessary to make crypto a universally accepted, global asset class. Respond to this email or reach out on LinkedIn if you’re interested in partnering with us.

Free Content

The current plan is to continue to produce two free written reports per month plus The Rundown Podcast weekly. We’d like to keep this content free for the long haul. But I’d want your input as to which types of content you prefer, and which ecosystems you’re most interested in currently.

If you don’t mind taking a few minutes, your answers to the below poll questions will help us deliver better content moving forward.

Please leave a comment (or reach out directly) if you’d like to add some context to any of your answers:

Premium Content

As the business grows, we are beginning to explore a few options regarding premium services for our highly engaged readers.

Here’s where I need more of your help.

Please leave me a comment (or reach out directly) if you’d like to add some context to your response.

Closing Statement

Thank you so much for all of your support these last few years. I honestly couldn’t be more grateful and motivated to continue to pay it forward with some of the best research and analysis in the industry.

If you’ve been following the journey and think you can help (or that I can help you) in some way, I’d love to hear from you. Please feel free to reach out via LinkedIn or by responding to this email.

And to be clear — nothing will change as far as the user experience on your end moving forward.

Onward and upward!

Take a Report.

And Stay Curious.

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.

Focused on RWA data for DeFi.

The beginning of your journey resonates me and definitely with a lot your readers. Keep doing what you’re doing.

Would love to help you out with researching and analysing coins (from a portfolio perspective). I have an intermediary level understanding about the US banking system too.