Hello readers,

I was out in Michigan last week for meetings and on the flight home, I listened to a really fascinating podcast from The Fintech Blueprint. The pod was an interview Lex Sokolin did with Paul Rowady, the Founder and Director of Research for Alphacution, a digitally-oriented research and strategic advisory platform focused on modeling and benchmarking the impacts of technology on global financial markets. I have no affiliation with them but since it’s under a paywall, I wanted to share the highlights with you here for free.

As a quick aside, if I do have an affiliation with a product or service mentioned here, I will disclose it to you. Blockchain and crypto are all about transparency and this newsletter shares that ethos.

Along those same lines, if I am writing about a particular asset or blockchain, please assume I have a position in it. My job here is to explain to you why I am so excited about this industry or a particular asset. And I want you to be able to follow my logic (which you are free to challenge - see me in the comments) so that we can all learn together and make the best decisions for our unique circumstances. My goal is to educate, inspire, and build community - not to give investment advice.

_____

If you’re new to the program and have not yet subscribed, you can do so below. By subscribing, you’ll receive these reports directly to your inbox as they are published.

_____

Let’s go.

I can’t stop thinking about the intersection of Robinhood, Payment for Order Flow, and Crypto. These three elements are colliding in real-time and disrupting liquidity structures in ways that are likely out of the purview of most of the market. In this report, I’ll explain what is happening under the hood (pun intended😊 ) and why it matters.

A few notes about Robinhood

Robinhood has about 20 million users today. They have $100b of assets in custody. $20b of which are cryptoassets. About a year ago they had just over 10 million users. This explosive growth came during Covid while many of their users were stuck at home during lockdowns. Their app makes it super easy for inexperienced retail investors to enter the financial markets. Below we can see what their user growth looks like compared to the competition. Please note the data below is old as Robinhood is currently up to 20 million users. This gives us an idea of how fast they are sprinting past their competition.

What’s unique about Robinhood is they are a mobile-first application. Their entire product design is geared toward Millennials and Gen Z. Their average user has about $3.5k in assets on the platform. This differs significantly from E-Trade, Schwab, TD Ameritrade, etc as seen below. 1

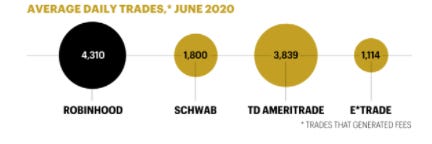

With that said, users on Robinhood are trading at a much higher velocity compared to the other platforms.

Quick Summary:

Robinhood is growing much faster than its rivals. And their growth is coming from an untapped demo: Millennials and Gen Z.

Trading velocity on Robinhood is significantly higher than their rivals. In particular, options trade on Robinhood at 100x the velocity of options on Schwab.

The average account balance on Robinhood is small, but their large user base and the velocity at which they trade make up for the small account balances

The growth in retail trading and the growth of Robinhood are intricately tied together. As Robinhood’s user base grew 2x over the last year, so did total retail trading. Retail activity doubled last year and now makes up 28% of all trading in US markets.

Market Structure and Robinhood’s Business Model

We’ve established that Robinhood has a lot of $ moving through their platform. Robinhood sells/routes these orders to large market makers. This is called Payment for Order Flow. It’s why trades are free for Robinhood’s users. This is the business model - and it’s highly profitable. Below is a breakdown of which market makers are buying Robinhood’s order flow:

These market makers and high-frequency traders are paying for this retail flow so that they can front-run it. That’s how they make money. It’s their competitive edge. Below is a workflow to visualize how this works:

What is really interesting, is the fact that Jump Trading (not even listed on the Q4-20 pie chart above) purchased $163m in crypto order flow from Robinhood in the second quarter of 2021.2 This is more order flow than Citadel Securities has ever purchased in a quarter. Furthermore, Jump Trading announced a new business division in September called Jump Crypto.

What exactly does this mean?

It means a ton of $ is moving away from traditional markets and into crypto. And regulators are way behind here.

When these trades are routed from RH to a firm like Jump Trading, the flow/liquidity stays off of the “lit” market. The traditional market. This means the other hedge funds, prop trading firms, ETF providers, etc do not see this flow. But they are accustomed to seeing it. It’s how they develop arbitrage opportunities. So they are sort of left sitting in the market trading against other institutional order flow and high-frequency traders.

This is a problem for them.

Alphacution has observed a trend here. Trading firms that do not have an arrangement with retail market makers are operating at a significant disadvantage. Their data shows that for proprietary trading firms core strategies to remain profitable, they must engage with buying private order flow. A bizarre development.

Keep in mind that on-chain crypto trading is super transparent. Anyone can see the data with these trades. That’s the beauty of blockchains. However, crypto trades on RH are not settled on-chain. This order flow is then moved to “dark” markets where firms like Jump Trading are front running and settling the trades on the back-end.

This is a huge advantage for them. And anyone looking for alpha that does not see this flow loses. I’m talking about the large players sitting in traditional finance. But they might not understand what’s going on right now. They just know their models aren’t working.

Takeaways

As Charlie Munger says, “show me the incentives and I’ll show you the outcome.”

Well, it appears that hedge funds, prop trading firms, and ETF providers are incentivized to get into the Payment for Order Flow game. And follow retail into crypto. Why? The firms that are doing it have a huge advantage right now. Robinhood cannot keep up with the growing demand to buy their crypto trades today. As such, they are currently looking at integrating Uniswap to better serve the market. 3 The firms that are purchasing crypto flow have a massive advantage right now. Is this going to push more institutional investors across the bridge to crypto? It appears the economic incentives are already in place.

Is the SEC going to have to step in and regulate Payment for Order Flow? It should be noted that Payment for Order Flow is already illegal in Europe and Canada today. PFOF may seem nefarious, but we can think of it as a marketing cost for these firms. It’s the cost of acquiring retail customers, who they then trade against for profit.

Finally, if you are buying and selling cryptoassets, I do not recommend using Robinhood. Because trades through the app are not settled on-chain, users cannot take custody of their assets. And your trade is being captured and front run by large market makers, which is sort of the antithesis of Robinhood’s entire ethos.

Robinhood —> Retail Traders —> Crypto —> Payment for Order Flow

Are we barreling toward a clash in traditional markets?

We’ll need to keep an eye on this trend.

_____

Thanks for reading.

As always, for more frequent updates you can follow me on LinkedIn.

And if you’re getting value from these reports, please share them with your family, friends, and social networks so that more people can learn about blockchains and crypto.

Question, comments, concerns? Leave them here 👇

Take a report.

And stay curious my friends.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.

All charts courtesy of The Fintech Blueprint by Lex Sokolin

Per Paul Rowady of Alphacution via The Fintech Blueprint podcast

https://ipfs.kleros.io/ipfs/QmR5e9kfxMjuDAUGgqam1Njpe9qo1CN35mVLkUCiU1PkKA