Hello readers,

Assessing where value will accrue within the web3 tech stack is incredibly complex. We have public blockchains. We have private blockchains. We have Layer 1 blockchains. We have Layer 2 scaling networks. We also have bridges connecting disparate Layer 1 chains. Finally, we have the consumer applications on the top consumer-facing layer.

This week we’re sifting through the ecosystem in an effort to provide a framework for where value could accrue in web3. Topics Covered:

Defining the Fat Protocol Thesis and comparing its observations to web2

A framework for thinking about Layer 2 scalability and how Layer 2s interact with Ethereum at the base layer

Interoperability and bridges between Layer 1 chains

The consumer application layer and how value could move up the tech stack

Let’s go.

The Fat Protocol Thesis

A framework that I came across in my early days of studying the blockchain ecosystem is “The Fat Protocol Thesis.” This was first proposed in 2016 by Joel Monegro, a partner at Placeholder VC. At the time, Joel was observing investments his VC firm made in Coinbase’s Series A round and subsequent future rounds. What Joel observed was that Coinbase was essentially providing easy access to Bitcoin for their customers. An example of the consumer-facing application layer of the tech stack in web3.

Coinbase is an incredibly successful company to date. They went public last year and did almost 8 billion in revenue in 2021. They have $7 billion in cash on hand and nearly 100 million users. 11,000 institutions are using them, and they have 185,000 ecosystem partners across 100 countries.

But guess what? You would have been better off simply investing in Bitcoin (base layer) at each stage of Coinbase’s growth. Now, this is just one example. But it provides some clues and can help us form a framework regarding where value will accrue as we look forward.

The idea is that in web2, the vast majority of value accrued to the consumer application layer, instead of the protocol layer. We can think of the consumer application layer as Google, Netflix, Amazon, and Facebook. And we can think of the protocol layer as TCP/IP, HTTP, and SMTP. Nobody can own the internet protocols. But the entrepreneurs that built closed-off networks leveraging them created the most value in web2. We can visualize this below:

The “Fat Protocol Thesis” is an observation that in web3, the location within the tech stack where the most value accrues reverses:

The next wave of innovation will be built on top of Layer 1 blockchains. These are protocols that enable all of the cool things we like about web3: decentralization, open data, user control/ownership of data, peer-to-peer interaction, the ability to autonomously execute tasks via smart contracts, etc. The difference from web2? We can own the protocols this time. Examples of these Layer 1 protocols include Bitcoin, Ethereum, Binance Smart Chain, Solana, Avalanche, and Near (we could include Cosmos & Polkadot which are more Layer 0 which we’ll cover in a future report). Bitcoin is primarily a monetary and payments network. Therefore, in this analysis, we will carve Bitcoin out from the other L1s, which are smart contract platforms that enable all kinds of interesting innovations facilitating different use cases.

The critical question:

If we can own these Layer 1’s, and the next wave of consumer applications will be built on top of them, is this where the most value will accrue in web3?

Let’s explore.

Network Effects

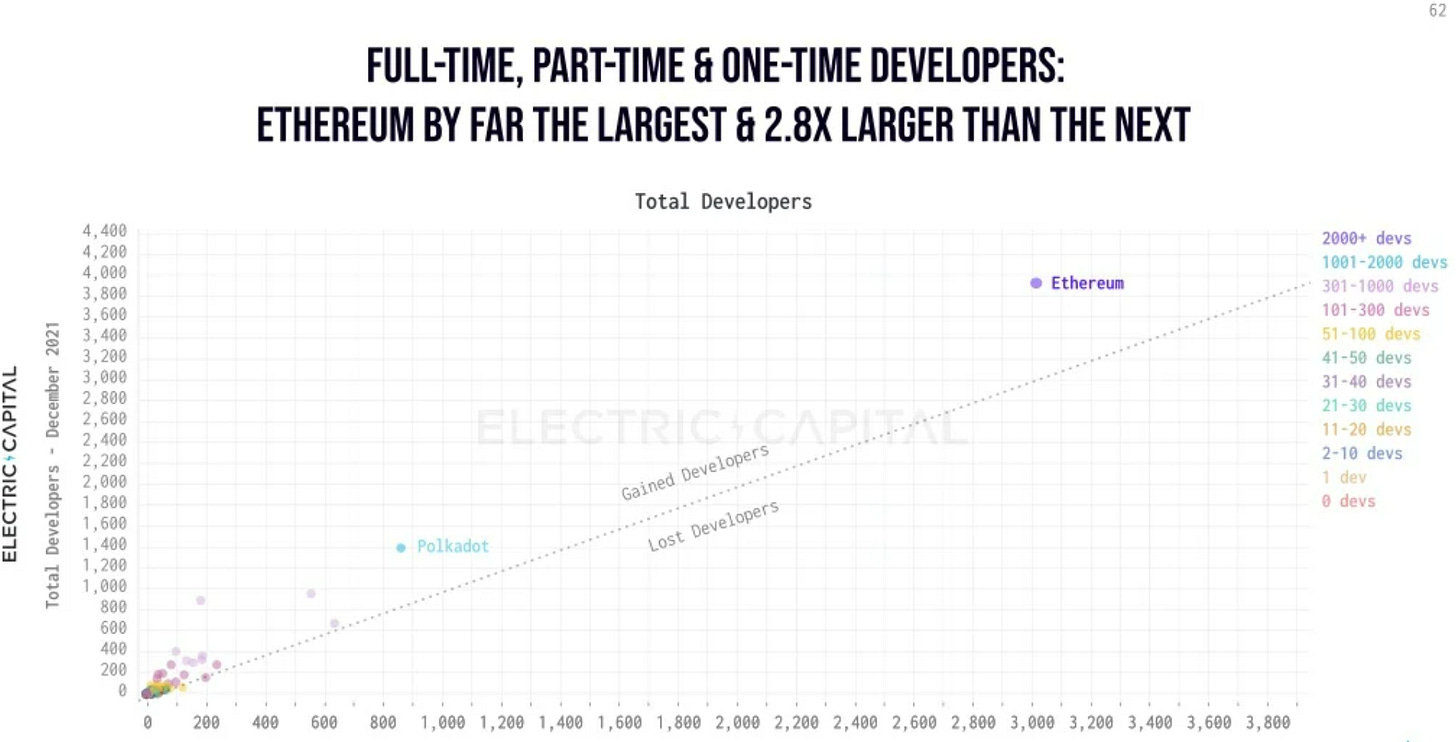

Network effects flat out matter. One way to assess network effects is to observe the # of developers, businesses, and applications leveraging public layer 1 blockchains. These activities drive transaction volume, which drives network values across public blockchains. Ethereum is the clear winner today. The vast majority of applications across DeFi, Gaming, NFTs, Metaverse, Stablecoins, etc are being built on Ethereum today. Below is a quick view of the location of web3 developers. Follow the developers to follow the $:

Source: Electric Capital

*Keep an eye on Polkadot as they currently have the second most developers in the ecosystem and have been quietly building.

It’s no surprise that Ethereum dominates the landscape in terms of applications, businesses, and transactions when we observe the chart above. As a result, this is where the most value is locked today:

Source: Defi Llama

Binance Smart Chain is number two with a mere $8.4b of locked value. Today, Ethereum has 8.5x the amount of value within its ecosystem.

Source: Defi Llama

For reference, the two largest “Ethereum Killers,” Solana and Avalanche, have about $3.5 billion of value locked today.

Finally, we can look at how Ethereum stacks up in terms of transaction fees paid on the network. Ethereum appears to be the New York City of block space here:

Source: a16z

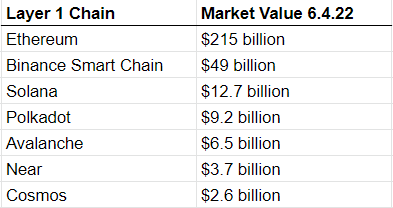

Not surprisingly, Ethereum also dominates in terms of market cap.

Ethereum has a healthy early lead. The critical question going forward is this: do network effects beget network effects? Developers and entrepreneurs will need to continue to flock to Ethereum. Users follow. This has been the case so far, but it is worth noting that the growth of developer activity on Solana, Avalanche, Near, Cosmos, and Polkadot actually exceeds the growth that Ethereum had in its early days.

This game is far from over. But if we assume that Ethereum will continue to grow its network effect, we must also consider the impact of layer 2 scaling networks that are proliferating of late.

Ethereum Layer 2 Scaling Solutions

At the base layer, Ethereum simply does not scale very well. Transactions are slow and costly. Many view this as a bug. I actually view it as a feature - it is a sign of how popular the chain is. I will avoid getting deep into the technical aspect of this, but it primarily has to do with how decentralized Ethereum is. For blockchains to be truly decentralized, there needs to be a wide network of nodes running the software all over the world. The only way to accomplish this is to make the requirements of running a node simple. For example, it costs less than $200 to spin up a Bitcoin node and run the software from home. For this reason, Bitcoin is the most accessible public blockchain network. Ethereum is #2. Solana and Avalanche can scale at the base layer, but there is a trade-off: these networks are very centralized compared to Ethereum. The requirements to run a node (cost, data storage, complexity, etc) make it such that there is a barrier to entry on Solana and Avalanche. For reference, Ethereum has over 4 million nodes around the world running the software per Etherscan (this includes full nodes, archive nodes, and light nodes). Solana has about 1,500. Avalanche has about 1,000.

Because Ethereum is committed to decentralization, unlike Solana and Avalanche, they have to scale on layer 2. Networks like Polygon, Arbitrum, Optimism and Starkware allow for this. These networks work on top of Ethererum, and are essentially batching transactions off of Layer 1, and then recording proofs of the transactions on Ethereum at the base layer. This increases transaction throughput and reduces the cost of transactions. The functionality is very similar to Visa/Mastercard batching transactions that later settle between banks at the base layer. With transactions executing at less than 5% of the cost on Ethereum, many of the DeFi applications on Ethereum L1 are migrating onto Layer 2.

Critical question: If transaction execution is moving up to layer 2, what does this mean for the value of ETH, the native asset of the Ethereum network?

What we see today is that Layer 2s are still settling their transactions on Ethereum. They are essentially outsourcing their security to Ethereum at the base layer. And they are driving transaction volumes that otherwise would likely not take place on the base layer. I view this as additive to Ethereum, further enhancing Ethererum’s network effect. Another way to think about this is to ask whether or not Visa and Mastercard are hurting or helping the banks? I think we can clearly say that Visa and Mastercard are helping the banks. The banks are providing the security and transaction settlement finality at the base layer. And Visa/Mastercard are allowing ease of execution at the consumer layer. They work together and complement each other.

The relationship between Ethereum Layer 2 scaling solutions and Ethereum at the base layer looks very similar to me.

Another way to think about this would be to view Ethereum as a nation-state (like the US) at the base layer. The US provides security to all of the states. The US GDP is comprised of all the states’ GDP. So, if California produces a ton of GDP, this is additive to the US GDP. Ethereum’s GDP is comprised of all of the activity on the Ethereum network. So, if L2s take off, this is ultimately good for Ethereum since those networks are utilizing Ethereum for final settlement and security (they pay for block space).

We are seeing signs of this in the data as well. Below are the top 10 sources of Ethereum burned - these are the areas within the ecosystem where a lot of transactions are occurring (70% of transaction fees are burned per EIP1559).

Polygon is the largest L2 on Ethereum today. If we scroll down the list, we’ll find that Polygon is responsible for burning 11,500 ETH to date. As L2s scale, I expect to see them move up the leaderboard and be the largest source of ETH burned in the future. This means L2s are driving value to the base layer because the transactions ultimately settle on the L1 in batches.

It is worth noting, that we may see a ton of value/investment start accruing to these L2 networks. Some of them are just coming out with tokens now. Optimism just released theirs. My guess is Arbitrum is next. I expect investors to flock here as data starts to come out showing increased usage, apps deployed, and transaction volumes. The key thing to understand is that these L2s are still paying Ethereum for security. Optimism’s token will not be used to pay for transaction fees.

ETH 2.0

A quick note here regarding ETH 2.0. There is some misinformation out there regarding the merge to proof of stake. The merge *will not* scale transaction throughput and make L2s useless. Sharding is coming later, but this will still not scale Ethereum to where it needs to be at the base layer. The merge will do many things, but it will not solve transaction throughput. The Ethereum Foundation has made it clear that they are committed to scaling on additional layers. The L2s are seen as friendly to Ethereum and vice-versa.

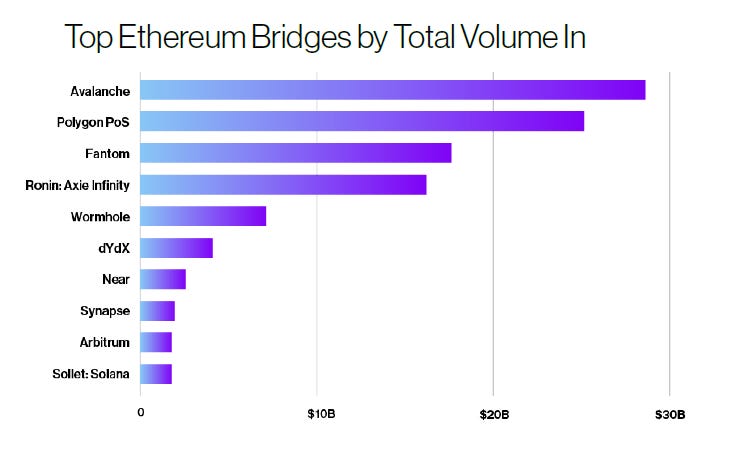

Bridges & Interoperability

We’ve established that Ethereum has an early lead in terms of network effects. We’ve also established that L2s are likely to further enhance that network effect. With that said, there is also a case to be made for bridges and interoperability. It is possible that multiple Layer 1 blockchains will ultimately end up connected. Today we have several bridges connecting Ethereum to other chains.

Let’s say you are using DeFi on Ethereum and you want to move your assets over to a DeFi application on Solana. The underlying infrastructure is not the same. The token standard is not the same. So, we now see bridges, such as the Wormhole bridge, providing this service to users. To date, bridges have been very risky to use. For example, the Wormhole bridge (Ethereum to Solana) was hacked for $325 million in February. This doesn’t mean that bridging infrastructure will not improve, but it does highlight concerns that Vitalik Buterin, the founder of Ethereum, has raised. Bridges could represent a single point of failure within the ecosystem. This is something that needs to be avoided at all costs - the point of decentralization is to avoid an outcome like this.

I will continue to keep an eye on the growth and technical solutions being brought forward by bridges. It is still very early in their life cycle and it remains to be determined if they will proliferate and ultimately connect all of the L1s.

Accumulate, a public blockchain featuring an interoperability solution is currently in testnet and will be going live later this summer. If you’re curious, you can learn more here.

Disclosure: Accumulate is run by DeFi Devs, a subsidiary of my employer, Inveniam.

If a solution like Accumulate connects all of the Layer 1s and their applications, a single user interface at the candy-coated application level could be able to leverage any blockchain ecosystem underneath. This will likely commoditize the L1s and the Fat Protocol Thesis would be debunked.

Conclusion

You may have noticed that this analysis did not mention private blockchains. I didn’t go there because I view private blockchains as a complete misnomer. To me, the point of a blockchain is that they are open-source and permissionless to build on and use. Private blockchains are like building a car and then powering it with a horse and buggy. It makes no sense to me. This will probably be obvious in the years to come - I expect the private chains to go away or maybe serve small niche use cases. All of the network effects and developer talent are on the public chains.

It’s worth noting that we should expect some of the value to move up the tech stack as time goes on. Blockchain solutions are still largely unused by businesses and consumers. There will undoubtedly be some really interesting solutions that will transform industries in the years to come. My company, Inveniam is working on one such solution for private market assets. These businesses will also attract lots of users and capital.

I hope this report provides a decent framework for you to think through the ecosystem today and how we can project how things could play out in the coming years. I look forward to keeping you abreast of the ecosystem as the markets evolve.

___

Thanks for reading and your continued support. If you got some value from this week’s report, please share it with your friends, family, and social networks.

If you have a question, comment, or thought, please leave it here:

Finally, if you would like to send me a tip, you can do so through the addresses below. If you do send a tip, please be sure to let me know so that I can send you a thank you note.

Bitcoin: bc1qghetd4g3lk7qnsn962amd9j92mkl4388zxz0jz

Ethereum: thedefireport.eth

___

Take a report.

And stay curious my friends.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such does not constitute investment advice.

Michael, thanks for the deep insights. I'm curious on a couple levels:

One, it seems that regulatory framework clarification may open the door to a wider institutional adoption according to the likes of Michael Saylor and Kevin O'Leary?

Second, it appears we are seeing a shakeout (i.e. Luna) similar to the dot.com to dot.bomb bust in the tech-stock craze of the late 90's? What are your thoughts on this? What coins/platforms will make it and which won't? I know this requires some prognostication.

Thanks