Permissioned DeFi & Tokenized Equities

TradFi and DeFi are merging faster than the market appreciates

Today’s issue of The DeFi Report is brought to you by Homology Digital. Their institutional-grade platform offers an intuitive solution for asset managers looking to integrate crypto and digital assets within investment portfolios. Homology not only simplifies the process but also ensures that portfolio managers have access to the essential tools and resources needed to effectively manage risk and maximize returns.

To learn more, you can contact the team here.

[Please note that Michael Nadeau is a strategic advisor to Homology Digital]

The DeFi Report newsletter is a data-driven exploration of the Web3 tech stack from first principles & on-chain data.

Hello readers,

I’m pleased to share that Matt Livesley has joined The DeFi Report as a research contributor. Matt is also currently the co-lead of PwC’s Hong Kong Venture and Growth Hub — which helps crypto start-ups on their institutional journey with more affordable accounting, tax, legal, and fundraising advisory services. Matt is based in Hong Kong and will provide valuable insights from the growing Asian crypto market.

Despite the drawn-out crypto winter, we think TradFi and DeFi may be merging faster than the market fully appreciates. In particular, the trading of tokenized equities within regulated DeFi structures appears to be on our doorstep. We’re breaking it all down this week. Topics covered:

Thesis Update

Permissioned DeFi (through the lens of trading)

SOMA Finance

Tokenized Equities

Projecting the merger of TradFi and DeFi

Disclaimer: Views expressed are the author's personal views and should not be taken as investment or legal advice.

If you find our free research & analysis helpful, please like the post — which can be done directly from your inbox via the heart button in the upper left. Let’s make quality free content a win/win. This helps grow the community and responsibly introduce more people to DeFi and Web3.

Let’s go.

Thesis Update

Strong opinions, loosely held. Focus on data and first principles. Stay curious & humble. Be intellectually honest with yourself. And when the facts change, the thesis changes.

These are some of the core principles guiding our research and analysis. So when the facts change, it’s our job to let you know about it.

With that said, we’ve come to the conclusion that tokenized public assets (stocks, bonds) will trade at volume within DeFi before tokenized private assets (real estate, private equity, private debt, etc.)

It seemed reasonable to project that *private assets* would be tokenized first. After all, there are hundreds of trillions of illiquid capital tied up in private assets just begging to be unlocked.

*Public assets* do not suffer from a lack of liquidity. Therefore, our thesis was that public equities and bonds would tokenize later — after the benefits of smart contracts, global accounting ledgers (public blockchains), and composable digital bearer assets became obvious in the private market space.

So why the change in thinking? In our view, there are still many challenges that have yet to be solved with tokenized private assets:

Too much friction. The tokenization process needs to be seamless, integrated, and cheap. That’s not the case right now. For example, if a GP wants to tokenize a basket of commercial properties and raise capital, they need to jump through several hoops:

Consulting

Data room set up

Appraisals

Legal

Tokenization

Marketing

Trading venue

Cap table management (non-DeFi solutions)

In many cases, the services aren’t bundled. Multiple entities are involved — with each holding its hand out looking to collect a fee. It’s just not a seamless process yet — a turn-off for any private fund looking to provide liquidity to LPs.

Many GPs prefer capital to be locked up. If you’re running a fund, do you really want your LPs looking to exit during market dips? Is this in your best interest? Some GPs may want to offer liquidity as a selling point for the fund. However, established players are more likely to prefer the status quo. At least until competing funds start offering liquidity to LPs.

Some GPs don’t want transparency. It’s well-known that private asset valuations are often not marked down appropriately during market downturns. This is by design. It’s in the fund manager’s economic interest to maintain some level of opacity. As such, we think it’s more likely that new regulation would catalyze enhanced transparency in the private markets, rather than new technology.

Bootstrapping liquidity is really hard. The big selling point is liquidity. The unlock of trillions of illiquid capital. Collateralization. Trading. Packaged products and services. It all sounds wonderful. But there’s a bit of a chicken/egg problem here and we just haven’t seen it yet.

Private/permissioned blockchains. The vast majority of liquidity, users, and DeFi applications reside on *public* blockchains. Tokenization is cool because one could collateralize an ERC-20 (or maybe an ERC-3643) token representing an LP interest in a commercial high-rise in NYC within DeFi. This would allow the holder to access liquidity without selling his or her interest in the property. Of course, this is a powerful concept due to automation (smart contracts), transparency, composability, and shared standards available on *public* networks. Meanwhile, the majority of private asset tokenization is occurring on a disparate set of *private/permissioned* blockchains today — defeating the value proposition altogether.

Look, I hate to be the Debbie downer here. As an equity holder of a start-up in the space (in which I was a Director), I’m rooting for progress. But we have to call it as we see it.

Of course, we’d be remiss not to acknowledge the hard work and leadership of many firms in the space. Peter Gaffney of Security Token Advisors puts together an in-depth report each quarter on the sector, which I recommend checking out. But again, because much of the activity is happening behind closed doors, we have to trust what comes across the newswire and what CEOs are reporting.

This is in stark contrast with the transparency we see on public blockchains. Here we have private credit as an example:

Data: rwa.xyz

Permissioned DeFi

In my opinion, the solution to many of these challenges will emerge within DeFi, operating on a public blockchain. My sense is that most of the folks building on private blockchains view Uniswap as some “Wild West” toy the kids are playing with. They’re missing the forest for the trees in our opinion.

Uniswap is a breakthrough innovation because it enables the seamless bootstrapping of liquidity for illiquid assets. The AMM model also allows anyone to be a market maker (earning fees in the process), unlock idle capital, reduce risk (less slippage), and trade peer-to-peer, 24/7 in an automated fashion. Furthermore, because Uniswap operates on public blockchains, the market has full transparency into KPIs and Metrics of the assets trading on the protocol. For example, let’s say I want to swap USDC for Lido. I can easily check a few data sources to get a view of Lido’s financials. They’re all on-chain. This is not the case if I want to buy an interest in a commercial property of a fund I’ve never heard of.

Because Uniswap is a protocol, they don’t have a broker-dealer license. And they don’t need one in our opinion. Uniswap is infrastructure. Our thesis is that an existing broker-dealer could create an interface (requiring KYC/AML) that simply taps into Uniswap underneath for the formation of peer-to-peer trading pools — for any asset in which there was market demand. A KYC/AML ringfence at the interface level would ensure that only whitelisted wallets could trade peer-to-peer with each other.

I’m pleased to see the green shoots of this exact concept emerging today.

SOMA Finance

SOMA Finance is a permissioned DeFi platform built on Ethereum, BSC, and Polygon that recently launched. To be clear, we are not endorsing SOMA Finance in this report. We may in the future, but it’s way too early for us to get a sense of the platform’s long-term viability. With that said, we wanted to share what they’re building with you because we believe the platform provides a glimpse into the future.

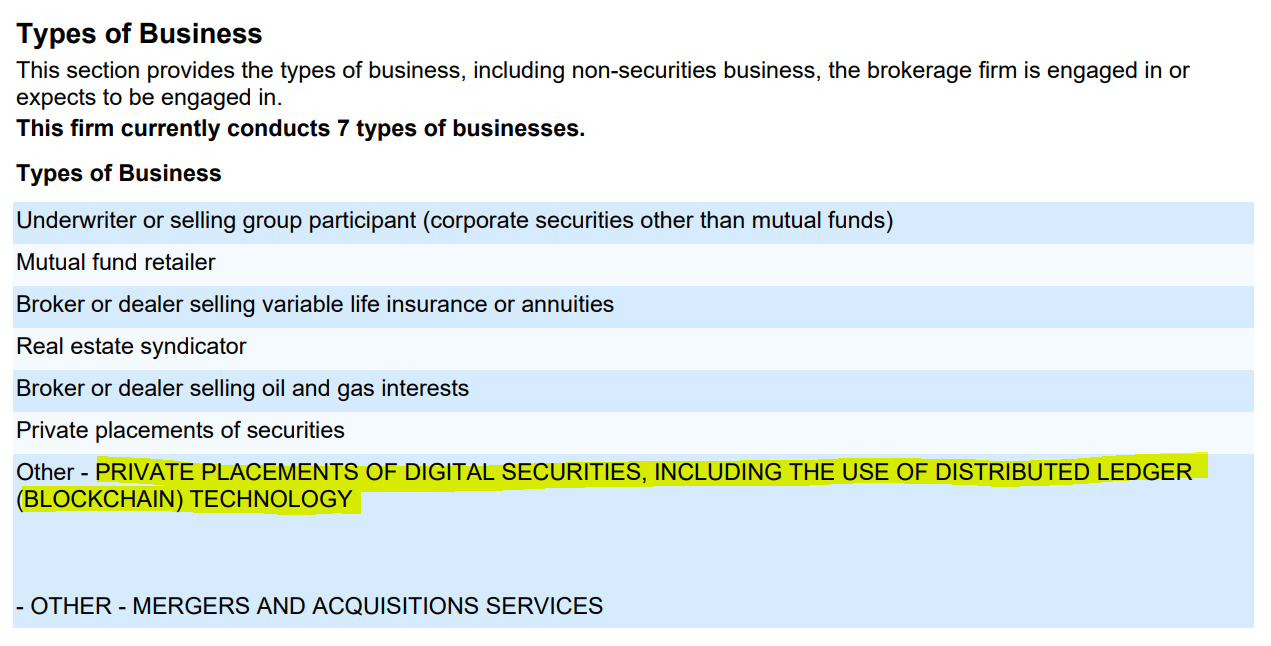

SOMA’s headquarters are based out of Hong Kong. However, they are registered with the SEC as a broker-dealer in all 50 states through Tritaurian Capital — the platform’s broker-dealer affiliate. Tritaurian’s license allows them to sell corporate securities, mutual funds, life insurance or annuities, real estate, oil & gas interests, and private placements. Furthermore, their licensing includes private placements of digital securities, including the use of blockchain technology.

Source: Tritaurian Capital FINRA Broker Check — firm 45500 for anyone that wants to look up the full licensing

We wrote previously about how every DeFi protocol was essentially going after the same product suite: lend/borrow, stablecoin, DEX, and staking.

SOMA Finance is no different.

But what really caught our eye is that the platform will offer the trading of tokenized public equities utilizing the AMM model (a fork of Uniswap). The interface looks similar to that of Uniswap:

SOMA Finance web interface

Here’s how it works:

Users must pass KYC/AML when onboarding SOMA’s web interface.

SOMA does not take custody of user assets (similar to Uniswap). Rather, users connect to trading pools leveraging self-custody wallets (metamask, ledger, etc.).

User wallets are ringfenced by the KYC/AML process. This means only wallets tied to user accounts that have passed KYC/AML can transact with each other. As a result, SOMA can partition users via smart contracts, based on eligibility of various security offerings on the platform.

The platform will initially offer access to tokenized representations of Meta, Tesla, Apple, Amazon, and Google.

Users will be able to swap BTC, ETH, or USDC for the listed tokenized public equities. They can also pay with fiat, “minting” new units of tokenized public stocks in the process (with SOMA purchasing and providing custody of the “physical shares” on the backend).

Minting is available during normal trading hours only. Peer-to-peer swapping is available 24/7, 365.

Users holding tokenized equities can provide liquidity into trading pools, earning a share of the trading fees in the process. That’s right. Anyone can be a market maker for the trading of public equities.

All tokens are on the ERC-20 standard.

All tokenized public equity “physical shares” are held with Tritaurian Capital’s custody provider. To be clear, these are not synthetics or derivatives. Rather, there is a “physical share” backing every token. *Note that we have not yet confirmed who the custodian is for the actual stock certificates backing the tokenized representations. Per the management team, assets are held 1:1 and users can redeem bi-directionally (stocks to tokens or tokens to stocks).

The manner in which the public equities are held in custody, issued as tokens, and redeemed looks quite similar to how a stablecoin like USDC functions on the backend.

While SOMA has the licenses to custody assets on behalf of users, they have chosen not to do so. They believe the future of finance is self-custody. With that said, if a user loses their private keys or access to their wallet, the platform can freeze and re-issue lost tokens to whitelisted wallets.

As a member of the SIPC, users are protected from mismanagement of the underlying securities by SOMA or Tritaurian Capital.

Hmm. This is pretty interesting.

The Benefits When Compared to TradFi:

In theory, a platform like SOMA Finance allows a crypto-native asset manager to construct a diversified portfolio of crypto-native assets, public equities, private assets, and treasury bonds — all on-chain with composable ERC-20 tokens. This makes asset management platforms such as Homology Digital (disclosure: I am an advisor to Homology) all the more important moving forward.

Self-custody. This means the assets stay with the user. As additional permissioned services pop up in DeFi, the user will be able to port assets into and out of services with a click of a button.

Global trading, 24/7. Instant, final, peer-to-peer settlement.

Lower costs because the ledger (public blockchain), transfer agent (smart contract), and security (decentralized) are outsourced to a global network of service providers.

Automated markets where anyone can be a market maker. Leverage idle capital, earning fees in the process. Less slippage. More efficiency.

Composability. ERC-20 tokens and public blockchains allow wallets and assets to be interoperable across public blockchain networks and protocols. This means a user could collateralize their assets to provide liquidity and earn additional yield. Or access liquidity (loans) or other services without selling assets.

ERC-20 tokens are divisible up to 18 decimals. This means equities can be fractionalized in ways not possible in TradFi.

Smart contracts can be leveraged to automate the distribution of dividends to wallets holding tokenized equities.

A platform like SOMA enables anyone in the world (except for sanctioned countries) who passes KYC/AML to get exposure to public equities as a buyer or market maker without having a bank account or a brokerage account. 🤯

Note: to our knowledge, SOMA Finance is licensed in the US only (through Tritaurian Capital). Per their recorded AMA, one of the founders indicated that anyone in the world can access the platform if you can buy US assets in your jurisdiction (except sanctioned countries & Canada at the moment). We are not securites lawyers, but we did talk with one about this. We think some regions actually require local licensing to onboard users from their jurisdiction — an open item we were unable to close with the SOMA team. If you’re an attorney or have any insight here, let us know in the comments.

Private Placement Launchpad

In addition to offering access to tokenized equities, SOMA can be a launchpad and capital raising platform for the issuance of private tokenized assets — in what we think could be a more streamlined service offering when compared to existing approaches.

Issuers could leverage the platform for a host of security offerings including Reg. CF, Reg. A, Reg. A+, Reg. D, etc.

Challenges

Bootstrapping liquidity will be no easy task.

One possible way to do so would be to incentivize the users of another broker/dealer (Robinhood?) to transfer their equity holdings over to SOMA. Our understanding is that SOMA leadership could create a simple process for users to do so — by making it easy for RH users to attain and submit the proper paperwork.

SOMA is issuing a token, which represents an equity interest in the platform (issued compliantly through Reg. CF). We think they could use their token to incentivize Robinhood users to port their assets over — something to keep an eye on because this would allow Robinhood users to become equity owners in SOMA, simply by porting their assets over to the platform.

Uniswap

Uniswap controls the DEX market right now. They have one of the strongest brands in crypto. Alignment with the Ethereum Foundation and the DeFi ecosystem. The backing of powerful VC firms. Plenty of capital to play with. And a team that continues to innovate.

Anyone entering the market with an AMM model will need to find a way to pull liquidity away from Uniswap — something we just haven’t seen at scale to date.

It’s worth mentioning again that Uniswap isn’t a broker-dealer. It’s a protocol. Therefore, they don’t need licenses in our opinion. Why? We think it’s possible that an existing broker-dealer will simply create an interface to permissioned Uniswap pools.

In this case, the firms controlling the distribution (interface) and the infrastructure (the protocol) come out winning. SOMA controls neither at the moment.

Conclusion & Looking Ahead

It’s unclear if SOMA Finance will ultimately have the winning formula. If it’s not SOMA, we think the winning solution may look similar to what the team is building.

The big takeaway here is that the merger of TradFi and DeFi may be closer than the market is pricing in. To our knowledge, SOMA is the first permissioned & compliant DeFi platform offering access to and the trading of tokenized equities. As we were drafting this report, news came out that Kraken (the second-largest US crypto exchange) is planning to offer tokenized equities beginning next year.

Given the speed at which stablecoins are proliferating, it’s reasonable to project a similar adoption path for tokenized equities.

We think this will happen at a faster clip than private tokenized assets due to the frictionless onboarding, clear benefits, and familiarity of users with the assets themselves.

As the benefits of tokenized equities become more obvious and understood, we should expect customers of traditional brokers to demand access to tokenized assets.

Will they build their own end-to-end solutions? Create an interface to Uniswap? Or “tap into” a solution such as SOMA?

Time will tell. And the clock is ticking.

Thanks for reading.

Special thanks to Matt Livesley for his contributions.

If you got some value from the report, please like the post (heart button in the upper left of your inbox), and share it with your friends, family, and co-workers so that more people can learn about DeFi and Web3.

This small gesture means a lot and helps us grow the community.

Finally, if you have a comment, thought, or idea, drop it here:

Please note that this report is not an endorsement of the SOMA Finance platform or token — which is untested and has yet to launch its core products.

Take a report.

And Stay Curious.

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.