Hello readers,

We’re back for part two of our two-part series on the state of DeFi. Topics covered:

Lend/Borrow Markets

How the business models of MakerDAO, Curve, Aave, Compound, Frax, and Lido are merging

Dollar-backed Stablecoin Market

Disclaimer: Views expressed are the author's personal views and should not be taken as investment or legal advice.

If you find our free research & analysis helpful, please like the post — which can be done directly from your inbox via the heart button in the upper left. Let’s make quality free content a win/win. This helps grow the community and responsibly introduce more people to DeFi and web3.

Per the Federal Reserve and Coinbase, somewhere between 10%-20% of US adults own crypto assets. It’s only a matter of time before these markets are regulated globally and accepted as a new investable asset class. As this occurs, the stigma of “crypto” will wear off, and new valuation frameworks based on fundamentals and on-chain data will emerge as the new normal.

The DeFi Report has partnered with the leading data providers in the industry to lead the charge as we usher in a new asset class.

We starting with The Ethereum Investment Framework. It’s currently in the hands of investment banks, asset managers, advisors, researchers, regulators, and crypto-curious investors globally. Our framework has been reviewed and blessed by some of the leading analysts, researchers, engineers, and data providers in the industry.

It’s 50% off. Get your copy here: The Ethereum Investment Framework.

The DeFi Report newsletter is a data-driven exploration of the web3 tech stack from first principles & on-chain data.

Let’s go.

Lend/Borrow Protocols

The market currently views Aave & Compound as “peer-to-peer lend/borrow protocols.” Curve as a “DEX.” MakerDAO/Frax as a “collateralized debt position stablecoins.” And Lido as a “liquid staking protocol.”

We’re using different terminologies. But they are all doing the same thing from first principles. If we zoom out, each protocol is taking deposits and issuing liabilities. Naturally, their business models are converging as they integrate horizontally across product lines.

Asset in. Liabilities out. Managed autonomously via smart contracts — to keep the assets and liabilities (balance sheet) in check. It’s all decentralized banking in one form or another.

In each case, a user is depositing an asset into a protocol. The protocol then issues a liability token to the depositor — which typically represents “receipt” of the asset deposited + access to yield.

For example, DEX users deposit assets into liquidity pools. The protocol issues a liability token as a “receipt” + access to trading fees.

Same idea with peer-to-peer lend/borrow protocols — deposits in, receipt token out + access to borrower interest payments. MakerDAO does this via its Dai Savings Rate. Lido takes ETH deposits and issues stETH liabilities with access to Ethereum user/block reward fees. We see this even in bridges — which take deposits and issue “wrapped liabilities” on another chain.

Let’s break down each business model in more detail.

Curve

Curve is a DEX that primarily functions as a venue to swap dollar-pegged stablecoins. On the surface, this might seem like an edge use case. But some would say that Curve actually serves as critical infrastructure to the DeFi space. Traders swap stablecoins on Curve, and in doing so, the protocol helps maintain the dollar peg of assets such as DAI, USDC, Tether, etc. Curve found a way to do this with less slippage and at lower fees — that’s the key problem they initially solved and what separates Curve from Uniswap in our view.

Tokenomics

Curve is deeply embedded in the DeFi ecosystem via its CRV token emission incentives — playing a key role in the yield offered by Convex Finance and Yearn Finance (protocols that automate the ability for users to “yield farm”). Essentially, Curve incentivizes users and other protocols to hold and lock up its native token, CRV. In doing so, users and protocols can direct token emissions to liquidity pools of their choice via Curves “ve,” or vote escrow feature (incentivizing liquidity with higher yields).

The more CRV tokens you hold (and lock up) the more influence you have on which pools received boosted CRV token emissions. Which means you can pay yourself (or your users) more. I’ve simplified it here for brevity’s sake. Some folks describe Curve’s tokenomics as extremely innovative. Maybe it is. But we think the structure looks unsustainable in the long run. It’s notable that Uniswap hasn’t used its token to incentivize liquidity since late 2020. But Curve has to run through all these hoops, incentivizing users to lock up tokens, boosting emissions, etc. to incentivize liquidity. From our perspective, introducing extreme complexity to the token structure while inflating the token supply as a means to incentivize liquidity/users is an indication of a protocol that doesn’t have clear product-market fit. Curve’s on-chain financials shine a light on this:

Data: Token Terminal (million - last 365 days)

Curve’s emissions will drop over time. And to be fair, every protocol starts with high inflation (Bitcoin and Ethereum included). Eventually, user fees need to take over. We’ll have to wait and see if Curve can maintain liquidity as the token incentives drop off in the coming years.

Integration within the Tech Stack

Curve recently launched a stablecoin (crvUSD) and lending market. The business model here merges with that of MakerDAO’s collateralized debt position stablecoin/lending market/decentralized bank. Users can deposit crypto assets into pools, and mint (borrow) crvUSD — liabilities of the protocol. Borrowers then pay interest to the protocol DAO, with 50% of the fees/interest flowing to Curve token holders who lock their assets in the protocol (providing liquidity). The crvUSD pool currently has $111m in value locked — a drop in the bucket compared to $5.8b for MakerDAO.

Recent Exploit

A recent hack of several pools within Curve almost brought the protocol to its knees and created a systemic risk to the entire ecosystem. It turns out, Curve’s founder collateralized a $100m loan with his CRV tokens. With the token selling off, he was nearly liquidated from the position — which could have put further pressure on the entire ecosystem. This looked a lot like SBF collateralizing loans with the FTT token at FTX. The only difference is the transparency of DeFi — which allowed market participants to organize on short notice and conduct OTC deals — calming the markets and preventing forced liquidation.

In summary, we think Curve’s innovation around stablecoin swaps is useful and provides real utility to the space. They have a product market fit here, but it’s unclear if this is even a sustainable business model (will Tether/USDC/DAI continue to persist as structured?). Furthermore, if the model proves sustainable, a stronger protocol such as Uniswap could integrate stable swaps and potentially grab market share. Outside of stablecoin swaps and ponzi-like tokenomics, we’re unsure if a few tweaks/added features will prove sustainable in the long run. Remember, the leaders (in this case Uniswap) tend to keep leading when it comes to public blockchains & open-source protocols.

MakerDAO

MakerDAO is a DeFi OG, and the first protocol to give real utility to ETH via collateralized debt positions back in 2018. The business model is fairly straightforward. The protocol allows users to deposit crypto assets into pools, minting/borrowing DAI (a stablecoin) in the process. The DAO makes money by charging interest to borrowers and via liquidation fees. The goal is to undercut the cost of capital in traditional finance. In doing so, MakerDAO can grow its TVL — which increases the amount of DAI outstanding — increasing interest revenues in the process.

The DAO then uses its balance sheet to invest in real-world assets — predominantly short-term treasury bonds — driving additional revenue.

Speaking of real-world assets, MakerDAO is currently targeting a 75% allocation of DAI lending to real-world asset pools. Notably, the DAO has lent to Tesla, Societe Generale, and Huntington Valley Bank through these RWA pools. Governance is currently targeting a blended rate of 4%.

According to Makerburn, MakerDAO’s estimated annual fee income is currently $165m.

Data: Token Terminal (million - last 365 days)

*Note that MakerDAO reports its DAO operating costs/core unit costs to Token Terminal (which we do not have for Aave and Compound). This is the “supply side” figure above. The DAO retains 100% of the fees/interest revenue whereas Aave and Compound keep about 10% — with the remaining 90% going to the liquidity providers.

MKR Tokenomics

The DAO channels profits to its “surplus buffer.” This is the insurance fund that is used to cover any bad debts. Any funds received that exceed the surplus buffer are used to purchase and burn MKR tokens — acting as a “stock buyback,” reducing the circulating supply (similar to Ethereum’s token model). All MKR tokens are in circulation and there are no emissions or protocol inflation (token incentives in the data table above). As noted, we look for protocols that don’t have to inflate their token to incentivize users (indicating product/market fit) — MakerDAO fits the bill.

VC’s Selling

Maker’s primary backers, VC firms a16z and Paradigm recently sold some of their positions on the open market. a16z bought 6% of the supply in 2018 at a fully diluted value of $250m. It still holds 1.3% of the supply per blockchain forensics. Paradigm sold $3.5m (we think this is about 6% of their holdings). They bought 5.5% of the supply in 2019 at a FDV of $500m. Both firms still hold the MKR token. That said, it’s possible they sold for the following reasons:

MakerDAO recently released its “End Game” plans. We’ll cover this in a separate post since there is a lot to get to. But we think it’s possible that a16z and Paradigm disagree with the direction the DAO is moving and decided to exit their positions as a result.

a16z and Paradigm know something that we don’t pertaining to forthcoming regulation.

Each firm is simply taking some risk off as the MKR token surged over 100% within the last year.

In summary, MakerDAO has product market fit via its DAI stablecoin. The protocol is battle tested. It has some lindy. The tokenomics are strong. They control the market today. And the business model is profitable. The DAO still needs to prove that it can navigate the regulatory environment (they continue to slowly integrate with TradFi), and improve its governance woes. In doing so, MakerDAO could have a bright future as the “central bank” of the DeFi ecosystem.

Aave & Compound

Aave and Compound are the OG peer-to-peer lend/borrow markets in DeFi.

Business Model

Lenders deposit assets into smart contracts, with the protocol issuing liability “receipt” tokens to depositors. Borrowers can access loans (by putting up collateral), paying interest directly to lenders for supplying liquidity. The protocol DAO takes a small fee (about 10%) for providing smart contracts and market structures.

Aave pioneered the concept of flash loans — uncollateralized loans that allow a user to borrow assets with no upfront collateral as long as the borrowed assets are paid back within the same blockchain transaction (block) + a small fee to the protocol. This new financial primitive creates unique opportunities for arbitrage, liquidations, collateral swapping, and the creation of leveraged positions.

Integration within the Tech Stack

As a peer-to-peer lending platform, about 90% of the interest payments on the initial product accrue to the liquidity providers/lenders — rather than the protocol.

Naturally, we are seeing a number of DeFi protocols launch their own stablecoins, allowing the DAO to collect 100% of the interest payments in the process (as MakerDAO does). Aave launched it’s stablecoin, GHO, on July 17th and it currently has about $22m in value locked. A drop in the bucket compared to MakerDAO’s $5.8b. We think this is a futile attempt by Aave to diversify and capture more DAO revenue — primarily because copycats almost never work in DeFi (liquidity begets liquidity).

Aave launched Aave Arc in 2021 — designed for institutional compliance. Permissioned KYC/AML pools are designed to allow regulated institutions to know the counterparties to each trade. However, Aave Arc has seen very little adoption to date — currently with just $60k of liquidity.

Compound

Compound appears to have stopped innovating. Their founder recently left to start SuperState — a tokenized bond mutual fund — allowing crypto native investors to hold treasury bonds on-chain.

The protocol doesn’t offer flash loans, permissioned pools, or a stablecoin. They are also losing the battle against Aave:

Data: Token Terminal (million - last 365 days)

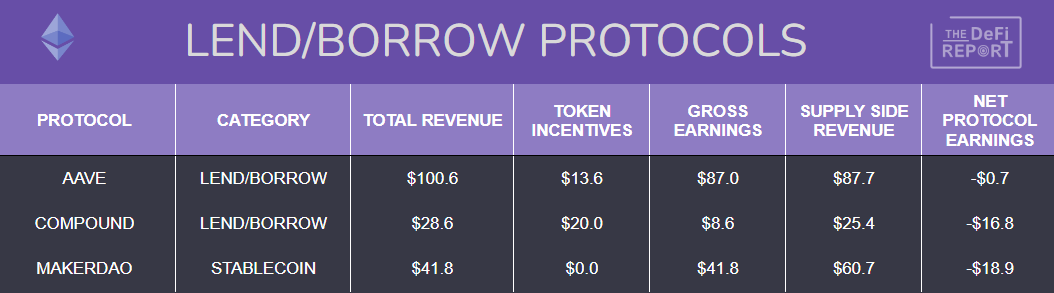

Takeaway: Lend/Borrow Platforms

The killer business model here is stablecoins. That’s why almost every DeFi application is launching one. MakerDAO was first. DAI has by far the most liquidity and lindy, and has essentially become the “Central Bank” of DeFi as a result. Furthermore, MakerDAO’s stablecoin is different from the others. Holders of DAI can stake it, earning a yield in the process. It’s also a capital formation tool. Users can farm DAI through sub-DAOs. This is utility we don’t see with any other stablecoin.

If MakerDAO can continue to undercut borrowing rates in traditional finance while integrating with real-world assets, it could become disruptive to the banking sector. Of course, in some cases, we are already seeing traditional banks (such as Huntington Valley Bank and Societe Generale) leverage MakerDAO for cheaper cost of capital — blurring the lines between DeFi and TradFi.

Marc Andreesen wrote that “software was eating the world” in 2011. MakerDAO kind of just looks like “software as a bank” — a new protocol enabling a lower cost of capital and full transparency by leveraging a global, shared accounting ledger. Navigating the evolving regulatory environment and overcoming governance challenges are the primary risks for MakerDAO today. We’re also keeping an eye on Frax —an emerging competitor with a diversified product mix across a collateralized debt position stablecoin ($100m TVL), liquid staking product ($420m TVL), and peer-to-peer lend product ($143m TVL).

Stablecoin Market & Paypal

Stablecoins are the killer use case on public blockchains to date. In this section, we are pivoting to dollar/treasury-backed stablecoins as opposed to the crypto-backed version offered by MakerDAO (and now Curve, Aave, Frax, and others).

Business Model

Dollar-backed stablecoins allow crypto users to cash out to “dollars” without bridging back to “TradFi.” This saves users on fees, and creates a better user experience for crypto natives.

Stablecoin issuers such as Tether and USDC have fantastic business models. They simply take in dollar deposits, mint “crypto dollars” on-chain (issuing liabilities), and invest the deposits into short-term treasuries. This is an incredibly simple and profitable business in a rising interest rate environment.

Stablecoin issuers are basically fully backed banks — that don’t have to pay out interest to depositors.

The business model is almost too good to be true in the current rate environment. Tether reported (unaudited) $1.45b in profit in Q1 and over $1b in profit in Q2. For reference, Blackrock (the largest asset manager on the planet), is projected to make about $5.5b this year.

Given the popularity of crypto, the need for stablecoins isn’t going anywhere anytime soon. Furthermore, stablecoins are just a better payment product. Full stop. Here’s what you get with stablecoins:

A superior form of payment via global, peer-to-peer digital wallets

Reduced costs for merchants, e-commerce, and remittance payments globally

New demand for US treasuries, enhancing the network effect of the dollar. In fact, annualized on-chain stablecoin transactions are already over $9 trillion annually. For reference, this is more than Mastercard, Amex, and Discover combined. Visa is the only card network outpacing stablecoin volumes today at $12 trillion annually.

Financial inclusion, lower costs for remittances, and the ability to save in dollars globally

A new line of revenue for banks and fintechs

Unprecedented transparency for regulators and compliance officers

Naturally, Paypal wants a piece of the action.

But where do we go from here?

The incentives appear to be lining up across banks, fintechs, the US treasury, consumers, merchants, and regulators.

A few questions we’re contemplating:

Will every bank and fintech issue a stablecoin?

Which blockchains will they be issued on? We think Ethereum is the obvious choice. Similar to a company deciding where to host its website data. Are you going to pick AWS or an AWS upstart? You’re probably going to pick AWS.

Will they all be interoperable and accepted within global commerce? First movers could have a big advantage.

Congress and the regulators need to get on top of this quickly. Fortunately, we are starting to see some progress via the Clarity for Payment Stablecoins Act — which recently made it out of committee.

And let’s not forget that other jurisdictions are racing to issue stablecoins. Circle (USDC issuer) has launched a Euro-backed stablecoin on Ethereum and Avalanche. They are now working with Singapore. Hong Kong, Bermuda, and the UAE are launching stablecoin projects.

Crypto cannot go mainstream until everyone has a wallet on their phone. Stablecoins could be the catalyst in the coming years.

Finally, what happens when money market accounts are issued on-chain? We think this will eat into USDC and Tether’s business model — which does not share yield with depositors today. Franklin Templeton (green below) is already taking an early lead in this category:

Data: rwa.xyz

Remember, crypto assets are multi-function. This points to standards coming into play — in ways that were not necessary with traditional products. Standards point to network effects. Network effects point to early mover advantages. Keep in mind that there is nothing special about Tether or USDC. They were just first.

The leaders tend to keep leading when it comes to public blockchains, protocols, and on-chain products.

Of course, new laws and regulations will play a critical role in all of this.

There are many open questions. The answers aren’t perfectly clear, but we’ll continue to read the tea leaves by following the incentives, market structures, and network effects.

We’ll let you know where the puck is going as the path continues to unveil itself.

Thanks for reading.

If you got some value from the report, please like the post, and share it with your friends, family, and co-workers.

This small gesture means a lot and helps us grow the community.

If you have a comment, thought, or idea, drop it here:

Take a report.

And stay curious.

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.

There is a considerable amount of growing innovation around stables. Frax for instance considers themselves to be a stablecoin protocol as they consider FRX, frxETH and FPI to all be stablecoins. But each serves a different market. USD pegged stables are pretty narrow in their worldview (in that sense Num Finance might steal a march on many with their Latin American stables).

That's even before we get to things like ETH backed stables (e.g., LUSD) or other more exotic ideas. Frax's FPI falls into this category as would any potential BTC backed stable from someone like Stacks or Threshold Network.

Would love to see you dive into the non US treasuries backed stablecoins.

Great piece Michael, keep up the good work!