Bitcoin Onchain Data Update

Bitcoin is nearing all-time highs. Are we still early in the cycle?

Hello readers,

As I write this, Bitcoin is up 45% over the last month. We’ve seen over $6.7 billion of net flows into new ETF products since launch (!). And we’re about 9% off all-time highs.

But it feels oddly quiet.

My sense is that retail has not shown up just yet. Why? Because I’ve yet to have a random conversation about crypto with someone in my everyday life so far this cycle. I’m talking Uber/taxi drivers. Bartenders. Barbers. College kids. Real Estate agents. Neighbors. Friends/family.

It’s been mostly crickets.

This tells me we’re still in the early stages of the cycle — when crypto natives make up the majority of market participants who realize we have entered a bull market.

But there is no need to rely on instincts and intuition when we have onchain data. And I’ll be honest. Sometimes it feels like we have inside information. But then I remind myself that public blockchains are….well….public. It just so happens that we are early when it comes to crypto and onchain data. The market doesn’t quite know what to look for just yet.

It certainly won’t always be this way. So let’s enjoy it while it lasts.

In this week’s special report, we are going onchain for a quick temperature check on Bitcoin — so that you can quickly get a sense for where we are at in this cycle using purely onchain signaling.

Topics covered:

Market Signal Metrics

Long-Term Holder Behavior

Miner Behavior

Exchange Balances & Leverage

Signs that Retail has Arrived

Conclusion

Disclaimer: Views expressed are the author's personal views and should not be taken as investment advice.

If you find our research & analysis helpful, please like the post — which can be done directly from your inbox via the heart button in the upper left. Let’s make quality free content a win/win. This helps grow the community and responsibly introduce more people to DeFi and Web3.

Let’s go.

Market Value to Realized Value

Up first is Market Value to Realized Value — as the name implies, the MVRV ratio measures the realized value (a proxy for the cost basis of all coins in circulation) against the current market value. It’s one of our favorite top and bottom signals.

Data: Glassnode

What do we see today? We just passed 2. This is consistent with the early stage of a bull cycle as we can see from the past few cycles. In ‘21, we topped out at 7.6. When the orange line gets close to the red horizontal bar we’ll know that the market is officially out over its skis. We are not there yet.

Quick note: the only way to make real money investing in crypto (for retail) is to buy quality crypto when everyone is running for the exits. In the chart above, these are the periods when the orange line hits the green zone. We had 6 months to accumulate in the last bear market. Those that did so are already up 2-4x on their Bitcoin. If you’re curious, here’s what we wrote in December of ‘22 as the markets bottomed.

Bitcoin Dominance

Data: Glassnode

Historically, Bitcoin leads the rest of the crypto market off the cycle lows and into the next bull market. BTC dominance increases early in cycles and decreases later as the wealth effect sets in and long-term holders rotate into altcoins for more upside.

What do we see today? BTC dominance rising. BTC is once again leading the market out of the bear and currently has 51% of the total crypto market cap. Once again, this signals the early stage of the cycle. For reference, in the last cycle we we got as high as 70% dominance before “alt season” kicked off. We’re not expecting to see those levels again, but we do expect Bitcoin dominance to strengthen as we near all-time highs.

The DeFi Report is powered by Token Terminal — the leading onchain & analytics platform for institutional investors. Subscribe for free data-driven research covering the Web3 tech stack from first principles and onchain data.

Long-Term Holder Supply

Data: Glassnode

The Long-Term Holder Supply is currently at 14,658,031 Bitcoins or 74.6% of the circulating supply. To be clear, Glassnode defines long-term holders as bitcoin in onchain wallet addresses that have not moved in over 155 days. This is Bitcoin’s “smart money.” As in, the folks with long-term conviction to buy at cycle lows. We can see in the chart that this cohort tends to trim their holdings as each cycle heats up. We can see that above as the orange line is starting to slope down.

Let’s double-click on that.

Long-Term Holder Net Position Change

From a net position change, we’ve seen the first wave of selling from long-term holders since the market bottomed in Dec. ‘22. Again, this is consistent with the early innings of a bull cycle.

Let’s shift and look at what the miners are up to.

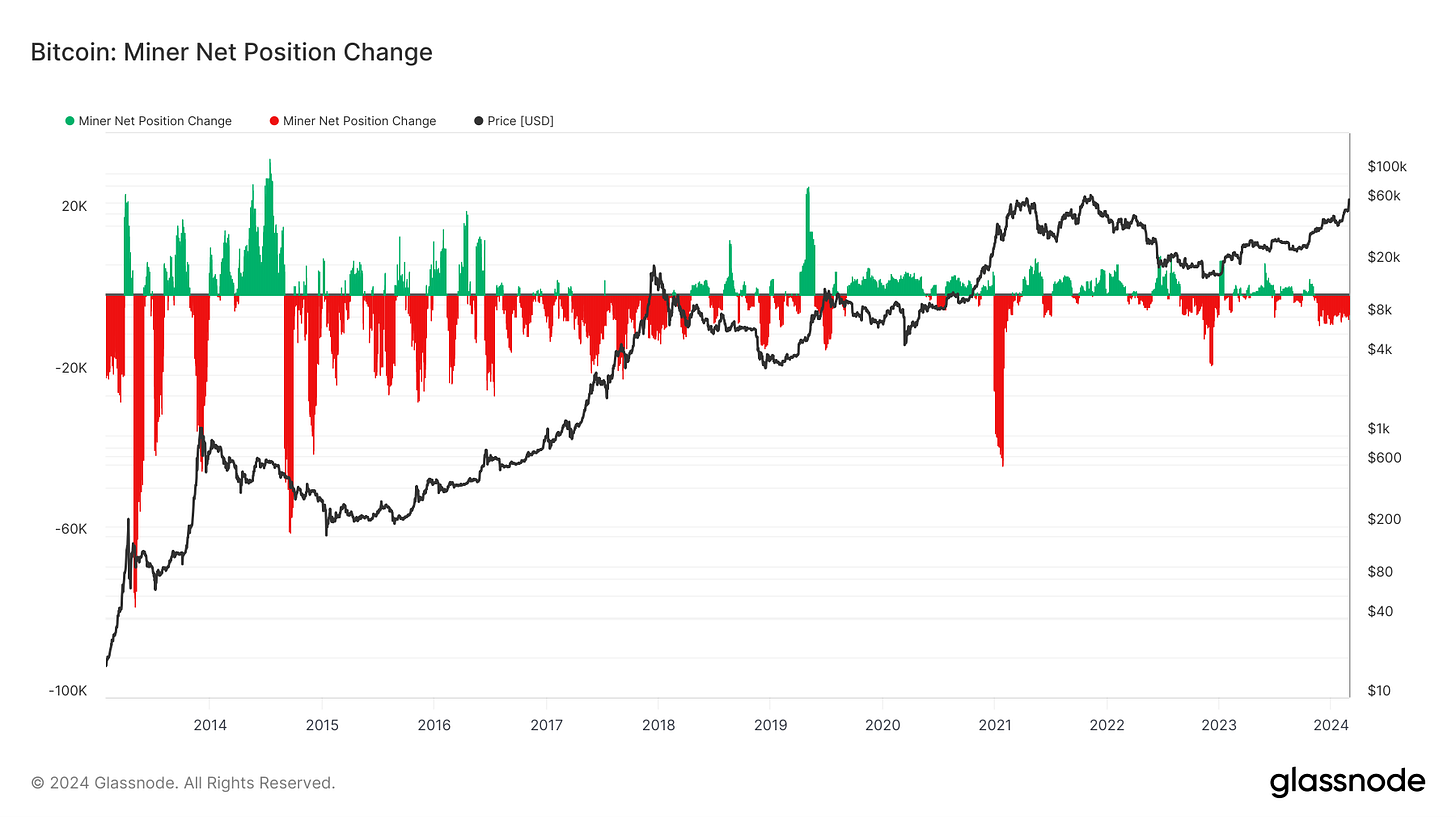

Miner Net Position Change

What are the miners up to? They’ve been selling into the recent rally. In fact, since early November of last year, miners have been selling 4,802 bitcoins/day on average. This is quite a bit of selling when we consider that only 900 bitcoins are mined/day. Why all the selling? We think miners are shoring up their corporate treasuries ahead of the halving — which is prudent considering their revenue is about to be cut in half.

What’s most impressive is that the price of Bitcoin has been rallying into this persistent sell pressure.

That’s what happens when you have a new financial product with flows like this…

Spot ETF Net Flows

Data: Glassnode

In total, the Bitcoin ETFs have already seen over $6.7 billion of inflows (!) and currently have 753,145 bitcoins or 3.8% of the circulating supply (!).

Pivoting to balance on exchanges and leverage.

Balance on Exchanges

Data: Glassnode

It would appear that Bitcoin is becoming more “illiquid” as the number available on exchanges is currently just 11.7% of the circulating supply — the lowest level since late 2017.

Leverage via Perpetual Contracts Funding Rates

Data: Glassnode

Starting to heat up but certainly nowhere near where what we’ve seen in the past at cycle peaks.

Open Interest

Data: Glassnode

Open interest is starting to near levels last seen at cycle tops — something to keep an eye on in the short term.

Stock to Flow

We’ll leave you with one of the classics — the stock-to-flow chart as a reminder that in 2 months Bitcoin will become the hardest (most scarce) asset on the planet — with a stock-to-flow of over 120.

Data: Glassnode

As we can see in the chart, Bitcoin cycles have been remarkably consistent since inception — visualized here in a log chart with the colors representing the days until the next halving date.

Conclusion

Bitcoin is in a bull market. But we are in the early innings. Retail isn’t here just yet. And this time we have institutions buying up BTC before they FOMO in.

How will we know when retail has arrived? Look for these signs:

The media won’t stop talking about Bitcoin & crypto

The Coinbase App goes to #1 in the app store (or close to it). It’s currently #186.

Google searches for Bitcoin and crypto increase exponentially.

Slimy YouTubers who shill shit coins will see massive growth in subscribers.

Celebrities and Politicians will be endorsing Bitcoin & crypto.

Your random friend who knows nothing about crypto is bragging about how much money he is making.

Your cousin tells you he bought the “Japanese version of Bitcoin.”

The Uber driver, bartender, and barber won’t stop talking about Cardano.

Web2 founders who learned about crypto a few months ago are raising capital for new crypto projects.

We’re not there yet.

And remember, Bitcoin leads. Alt season comes later. And we should expect pullbacks. There were 6 corrections of over 30% in the last bull cycle.

Good luck out there and please do your own research.

If you got some value from the report, please like the post (heart button in the upper left of your inbox), and share it with your friends, family, and co-workers so that more people can learn about DeFi and Web3.

Finally, if you have a comment, thought, or idea, drop it here:

Take a Report.

And Stay Curious.

© The DeFi Report 2024. No part of this report may be copied, photocopied, duplicated in any form by any means, or redistributed without the prior written consent of The DeFi Report.

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not a registered investment advisor and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.

As a Canadian CPA, gotta say I love the format of your analysis and the weekly podcast with Shiv! Easy to follow and love that the analysis is based on a data based / rational approach as opposed to being based on purely on narratives / to the moon claims. Looking forward to following more of your work!

Good report. Thank you always