Are L2s Complementary to ETH?

Ethereum's Scaling Solutions and Unit Economics

Hello readers,

The quiet story of the crypto winter has been the growth of Ethereum’s scaling solutions. Transaction fees are dropping. Apps are migrating to L2. TVL is growing. And user experiences are getting better.

Now, this is great for overall adoption. And it’s great for the L2s. But how does it impact ETH at the L1 level? Should ETH holders and validators view L2s as complementary to Ethereum? Does value move up the tech stack? And what does this mean for alternative L1s that were supposed to solve Etheruem’s scaling issues?

This week we have a data-driven update covering the economics of the Web3 tech stack as it pertains to L2s. Topics covered:

The L2 Business Model & Recent Growth of L2s

How L2s Impact ETH Unit Economics

A Mental Model/Framework for Investors

Do we still Need Alternative L1s?

Disclaimer: Views expressed are the author's personal views and should not be taken as investment advice.

The DeFi Report is an exploration of the emerging web3 tech stack and an ongoing analysis of where value could accrue.

We also provide “analyst as a service” resources for family offices, hedge funds, asset managers, VCs, start-ups, and more. Simply respond to this email if you’re interested in working with us.

Let’s go.

The L2 Business Model & Recent Growth

L2s seek to solve Ethereum’s inability to scale at the base layer. They monetize by compressing data and “reselling” Ethereum’s block space. The L1 is slow and expensive. Blockspace is limited. Of course, this is necessary to maintain proper security and decentralization (or so we’ve been told). As a result, we should think of Ethereum as the final clearing & settlement layer of the tech stack. The DTCC of Web3 if you will. The base layer records the final state of everything that happened on the execution and app layers above it — providing the single source of truth.

Execution services that enhance the user experience (lower cost, faster transactions) for app builders will be delivered on layer 2. These services are performed on another chain, separate from Ethereum. Call data is then recorded to the L1 as proof of what happened. Below is a simplified view of the tech stack.

Today most of the computational resources (gas) are consumed on Ethereum at the L1 level. This is where the apps started building initially. Remember, the Web3 stack does not have a centralized party coordinating development activity (and neither did the internet). Everything is open-source. Low barriers to entry. And entrepreneurs are rushing in to build. But not everyone is on the same timelines or working off the same agenda. This isn’t a well-coordinated agile sprint you’ll see at a well-run tech company. As a result, L1 infrastructure *and* apps were under construction prior to the launch of scaling solutions. With the L2s now gearing up for prime-time, we expect to see more apps migrating, and new projects launching directly on L2s going forward.

We can see this trend taking place in the data. Below is a quick look at the total computational resources (gas) usage on Ethereum, and how much the top L2s are now consuming.

Arbitrum and Optimism are now demanding more block space on Ethereum than Polygon. In total, the three L2s are responsible for about 4.5% of Ethereum’s block space today. This figure is up from about 3% at the end of 2022.

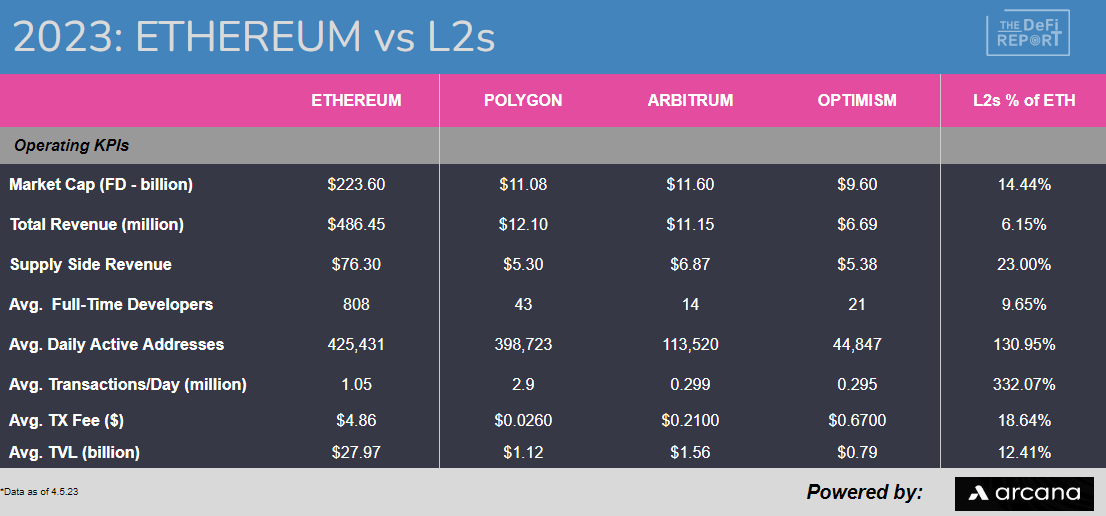

Let’s take a look at a few more data points across the L2s:

Note: the average transaction fee (across all types) on Ethereum L1 is $4.84 so far in 2023.

As mentioned, the L2s are providing services for the applications by delivering a better and cheaper experience for their users. In doing so, L2s buy block space on Ethereum, and then batch transactions while compressing data, ultimately recording proofs of the data to Ethereum.

But are all L2s created equal? Are they all complementary to Ethereum?

L2s & ETHs Unit Economics

Prior to L2s, when Ethereum got congested, transaction fees would skyrocket. Fees got as high as $200 at one point during 2021. Using Ethereum during an adoption cycle is sort of like trying to get an Uber after a late flight. Too much demand. And not a lot of supply. Rates skyrocket as a result.

L2s are here to solve the problem. But what happens when a user pays 21 cents on Arbitrum today? How much of that fee accrues to Arbitrum? How much accrues to ETH validators who approve and record the data for final settlement?

When you buy a sandwich at the local cafe, how much of the purchase price accrues to the bread maker? How much to the meat producer? How much to the distributor? How much to the toppings and condiments? What about the sandwich makes it special? What adds the most value? Is everything else a complement?

This is the thought process we should be going through with regard to L2s and the economics of the Ethereum tech stack.

The answer is that about 62% of the user fees that run through Arbitrum are paid to Ethereum validators so far in 2023. Since its inception in 2021, 64% of all fees have accrued to Ethereum validators.

Meanwhile, 80% of the user fees running through Optimism are accruing to ETH validators today. Since its inception in 2021, 74% of all fees have been paid to the L1. Here is a quick view courtesy of our friends at Token Terminal:

This is a win/win. App users get superior execution and lower fees — which should drive more use cases, more devs, and ultimately more users. Ethereum validators will benefit from this in the form of transaction fees, and passive holders will benefit from increased fee burns due to increased transaction volumes. Meanwhile, Optimism and Arbitrum benefit from Ethereum’s network effect, and can essentially outsource their consensus and security costs to the base layer.

What about Polygon?

Polygon is a side-chain of Ethereum. This makes it different from Optimism and Arbitrum. As a side-chain, Polygon has its own validator set. Therefore it has its own consensus and security and is not as “aligned” with Ethereum as rollups such as Optimism and Arbitrum are.

Polygon has paid 44% of its user fees to its supply side/validators so far in 2023. The remaining fees are burned. None of this value is accruing to Etheruem validators or ETH holders as the fees on Polygon are paid in the MATIC token. That said, Polygon periodically commits a checkpoint of the state of its sidechains to the Ethereum mainnet, which contains a summary of all of the transactions on the sidechain since the last checkpoint. The checkpoint is then stored on Ethereum as a Merkle Root, which is a unique hash that represents the state of the sidechain at that point in time. So Polygon is integrated with Ethereum, but the economic impact on the L1 is minimal compared to Arbitrum and Optimism because checkpoints require minimal data. We can see this by looking at the main sources of fee burns on Ethereum. Arbitrum and Optimism are near the top of the leaderboard, while Polygon is in the bottom third — despite the high volume of transactions processed.

In summary, not all L2s are created equal. Side chains such as Polygon operate more like their own L1 while leveraging Ethereum for final security and settlement assurance. Roll-ups such as Optimism and Arbitrum truly rely on Ethereum for consensus, security, and data availability.

As we analyze the economic impact on Ethereum validators and ETH holders, we see rollups such as Optimism and Arbitrum as complimentary to Ethereum. They can create net new demand for block space via superior user experiences for app developers. Meanwhile, the majority of the value processed by their solutions ultimately accrues to Ethereum validators in the form of transaction fees, and to passive ETH holders in the form of fee burns.

Polygon does not look nearly as complementary to us. In fact, it looks like Polygon holders and validators benefit much more from its close ties to Ethereum than ETH validators and holders do from Polygon.

Investment Perspective: Complements

Every product in a marketplace has substitutes and complements. A substitute is another product you might buy if the first product is too expensive. For example, chicken is a substitute for beef. A compliment is a product that you usually buy together with another product. Think gas and cars. Or hot dog buns and hot dogs. All else being equal, demand for a product increases when the prices of its complements decrease. For example, hotels in Miami will go up in price if flights to Miami decrease significantly.

Now. If L2s are complements, and they continuously drive down costs enabling superior user experiences, what does this mean for ETH?

We think ETH will continue to capture most of the value generated by L2s.

An analogy could be helpful to highlight our thinking: let’s compare Ethereum, Google, and the Internet. We think owning Ethereum is potentially like owning a slice of the internet, or the important protocols that run the internet. Now, Google sits on top of the internet protocols. Google is great. It solved the search problem on the internet. In doing so, Google enhanced the utility of the internet. This brought in more users. Now, let’s hypothetically imagine that every time someone uses Google search, 6 cents goes to Google, and 14 cents goes to the internet protocols. Which would you pick as an investor? And what if Google was just one of thousands of apps running on the internet (on Ethereum)?

From the same perspective, Arbitrum and Optimism are solving important problems. We think they will drive more users to Ethereum. But we cannot ignore the fact that approximately 70% of the value flowing through them accrues to ETH validators and holders today. It appears that the market is valuing security, decentralization, and settlement assurances over the execution services offered by L2s.

Now. Does this mean investors should avoid L2s? There is certainly some nuance here. We think Ethereum could reach a trillion-dollar market value in the next bull run. If L2s continue to capture 30% of the user transaction fee, and *all* transactions (or the vast majority) flow through L2s in the future, one could argue that they could garner 30% of Ethereum’s valuation — or $300 billion in the next adoption cycle.

Under this line of thinking, there is still a significant upside for the L2s. Remember, only about 4.5% of the gas used on Ethereum is running through L2s today. With that said, the top three L2s combine to produce 6% of Ethereum’s transaction fees and about 14% of Ethereum’s market cap on a fully diluted basis.

Investment Approach

Our current thinking is that a handful of L2s are likely to capture the majority of value on the second rung of the tech stack. This is what we have observed thus far, and would be in line with power-law dynamics we are observing across the web3 tech stack at large. We’ll be watching Coinbase’s release of its L2, Base, later this quarter as well.

Another way to think about this would be to compare owning ETH to owning an index fund. Just as the S&P 500 rotates in new corporations, L2s & Apps will rotate in and out of the Ethereum ecosystem. ETH validators and ETH holders will benefit from this. Just as holders of SPY benefit from strong new businesses being added to the index fund.

We think investing in L2s and Apps is more like picking stocks vs picking an ETF or an index. Of course, in this case, the (ETH) Index still represents a call option on the future of Web3.

Do We Still Need Alternative L1s?

That’s the elephant in the room. If L2s are solving Etheruem’s scaling constraint, what is the value proposition of alternatives such as Solana, Avalanche, and Cosmos?

First, let’s take a quick look at some numbers to compare Solana’s performance.

Solana is still 10x + more efficient than Polygon, the most scalable L2 (side chain) on Ethereum today. Solana also dominates in terms of developers and has strong user statistics with over 381k/day in 2023. With that said, TVL reveals the benefit that the L2s get from their “alignment” with Ethereum. The L2s didn’t have to bootstrap their own TVL as Solana does. It was already sitting on Ethereum, looking for a scaling solution. I guess this is why SOL validators get to keep 50% of the transaction fees (with 50% burned) vs approximately 30% in aggregate for Arbitrum and Optimism.

But what about the *monolithic* approach to scaling that Solana takes vs the *modular* approach on Ethereum via L2s?

Solana bundles settlement *and* execution services into the same solution. This is unique when compared to Ethereum, as well as the alternative L1s — such as Cosmos and Avalanche.

The modular approach taken by Ethereum, Cosmos, and Avalanche produces many additional complexities related to interoperability, security, centralization, data availability, etc that Solana does not have to deal with (note that there are some trade-offs here that are technical and outside the scope of this report).

We think Solana is clearly different from Ethereum and the rest of the competition due to its unique monolithic architecture. In fact, Etheruem’s approach to scaling via L2s is starting to look quite similar to Avalanche and Cosmo’s approach. Therefore, it’s unclear why developers would opt for an Avalanche sub-net or a Cosmos app chain when they can deploy on an Ethereum roll-up with instant access to Ethereum’s liquidity and network effects.

Putting it all together, we view Solana as a substitute, rather than a complement to Ethereum. In our opinion, this makes Solana the most interesting alt. L1 opportunity in the web3 tech stack — and is the reason we initiated a position in the network during the market dislocation earlier this year. We covered the project in early January. If you’re interested: here is Part 1. And here is Part 2. We’d also recommend using the network, its wallets, apps, staking services, etc. We think Solana offers the best user experience in crypto right now.

In summary, as L2s gain traction, we think this will call into question the value proposition for the alternatives that haven’t sufficiently differentiated themselves from Ethereum. It could also create a premium for the competitors that are truly unique, such as Solana.

Conclusion

Ethereum L2s are growing and becoming more efficient. It’s still very early, but we are seeing signs that roll-ups are quite complementary to ETH as validators and holders accrue 70% of the fees running through them. This is not exactly the case for side chains such as Polygon that run (and pay) their own validators.

L2 (roll-up) margins on Optimism and Arbitrum need to be monitored. We expect margins to collapse as more competitors enter the space, but will continue to follow the data. A race to zero could ultimately commoditize the execution layer of the tech stack.

Since L2s are complementary to Ethereum, we believe that as costs drop on L2s, demand for Etheruem-based applications will increase, driving further value to validators and ETH holders. *Note that the volume of transactions (adoption) flowing through L2s will ultimately need to increase faster than the drop in fees.

As solutions such as Arbitrum and Optimism mature, it appears that the Ethereum ecosystem approach to scaling is converging with that of Cosmos, Polkadot, and Avalanche. For example, Optimism’s “Superchain” approach looks similar to the Cosmos Hub or Avalanche’s C-Chain approach.

Investors have an array of options when allocating to the Ethereum ecosystem (ETH, L2s, Oracles, Bridges, Apps/Protocols). With that said, it appears that ETH is well-positioned to produce superior risk-adjusted returns due to the complementary nature of L2 roll-ups. Furthermore, investors should consider that a side chain such as Polygon is less “aligned” with Ethereum and functions more as an alternative L1 while leveraging Ethereum’s network effect and the EVM standard. Polygon has a stronger value accrual potential when compared to rollups in our opinion. In some ways, Polygon should be compared more to Solana than to Optimism and Arbitrum.

We think that the growth and scalability of Ethereum L2s will call into question the value proposition of alternative L1s that take a similar approach to scalability — such as Cosmos, Avalanche, and Polkadot. We view Solana as distinctly different due to its monolithic approach to scaling (settlement & execution bundled).

Thanks for reading.

This issue of The DeFi Report is brought to you by Glassnode, the leading crypto platform for on-chain analytics and insights. As a reader of The DeFi Report, enjoy a 10% discount on any license tier by clicking here.

If you got some value from the report, please like the post, and share it with your friends, family, and co-workers so that more people can learn about DeFi and Web3.

This small gesture means a lot and helps us grow the community.

Finally, if you have a comment, thought, or idea, drop it here:

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.

Have seen you, across reports, refer to protocol "revenue."

Curious what exactly you mean by this?

You posts have been really informative, thanks.

Great report!