A Mental Model to Evaluate Blockchain Technology

And a first principles examination of the evolution of information technology

Hello readers,

In today’s report, we’ll be laying the mental model through which we can view the highly disruptive force that is blockchain technology.

I’m keeping it high level in this report. I think it’s really important to see the big picture in crypto. There is so much noise in the space. Look left and you might see an economist, banker, journalist, policy maker, or some other incumbent spreading FUD (fear, uncertainty, and doubt) about crypto. Look right and you see someone in crypto making ridiculous price predictions with very little analysis. You might see a scammer or two. There is rampant bias on both sides of the debate. If you are pro-crypto you probably own some. And if you are anti-crypto you probably don’t. As adoption increases, in some ways, it becomes increasingly difficult for either side to step out of their inherent bias.

The only way to see things with clarity is to zoom out. Way out. To analyze blockchains and crypto from a technological, social, demographic, macroeconomic, and historical perspective. We can then begin to tighten the circle, cut out the noise, and assign probabilities for various outcomes per the analysis.

In this report, we’ll be analyzing blockchain primarily from a historical and technological perspective.

As a reminder, if you haven’t subscribed yet, hit the button below to receive these reports directly to your inbox as they are published.

Let’s go.

A revolutionary technology is a radical break from past practices which can transform one or many industries and products.

Each technical revolution has led to the massive replacement of one set of technologies by another, either by outright substitution or through the modernization of existing equipment, processes, and ways of operation. Each involved profound changes in people, organizations, and skills in a sort of habit-breaking hurricane. Each led to explosive periods in the financial markets.

New actors, usually young, burst into action shaking a firmly established and complacent world. Each time around, what can be considered a “new economy” takes root where the old economy had been faltering. 1

Per the framework laid out in Carlota Perez’s book, Technological Revolutions and Financial Capital, about every 50 years or so, we get a “big bang” and the introduction of a new, highly disruptive technology. The “big bang” is typically sparked in a fringe, dusty office setting, by a relatively unknown individual with a pale complexion and thick glasses. I’m kidding about the last part.

The point is, it happens quietly. The rest of the world finds out much later.

This occurred on January 3rd, 2009 with Bitcoin and the advent of Blockchain Technology.

High-Level Trends in Tech

One of the key trends that we’ve observed within information technology over the last 60 years or so goes something like this: open standards and protocols collapse and compress the costs of existing technologies. This disrupts the status quo incumbents and allows a new layer of value creation to enter the market. Open protocols win in the long run.

IBM had the market for computer hardware in the 1960s. The microprocessor (the last “big bang”) was introduced in 1971. This was an open standard that allowed anyone to build computer hardware. It disrupted IBM’s monopoly. Which opened the door for Microsoft to enter the market and create proprietary computer software - the Windows Operating System. Microsoft had the computer software market until the next open protocol was introduced by Linux in 1991. Linux is a family of open-source operating systems that disrupted Microsoft’s monopoly on computer software.

With open-source computer and hardware standards in place, we saw the creation of the internet and the data layer that we live in today. Companies such as Google, Facebook, Amazon, Netflix, etc. have created monopolies around charging advertisers for access to data or charging for a proprietary service based on proprietary data. There is nothing wrong with this - they have fantastic business models.

However, with the introduction of Blockchain Technology, we now have another open protocol that is poised to disrupt these proprietary data monopolies.

How did we get here and how does Blockchain change things?

It all comes back to the way the internet was built and the fact that it doesn’t natively hold “state,” independent of trusted operators.

Say what?

“State” is a technical term here. What happened is that the internet was built using simple protocols such as HTTP and SMTP. It’s not natively smart enough to keep track of what we do as we use it. From a user perspective, this essentially means that the internet cannot remember your favorites, your browsing history, saved settings, etc. Imagine if you had to enter your password every time you used a service? Or had to download all of your apps every time you used your phone? It would be a miserable experience.

So how did we solve this? Cookies were invented in 1994 to allow web-based applications written in JavaScript to preserve the “state” on each local device. As concerns around data privacy have risen, users today must “allow cookies” upon accessing most websites. You are authorizing the owner of the website/domain to capture your data when you do this. And of course, you allow it every time - you have to if you want to use the site and all its features. 2

And herein lies the problem. Cookies are controlled by service providers. Not the user. You don’t get to control your data. You don’t get to control your “state.”

Google, Facebook, Instagram, etc control your data. They control your “state.” And so over time, we moved into this world where it seems online advertising is the only business model that exists. Data is the golden goose. Advertising businesses like Google and FB are the only ones that can efficiently store and transmit the “state” of billions of users. Again, there is nothing inherently wrong with this - users of these platforms have benefited from free access to information and social networks.

The problem lies in how the benefits accrue disproportionally to these centralized companies. This is one of the reasons we have an economy today where a very small number of entrepreneurs control the VAST majority of wealth in the world.

Our data has value, but we don’t get to control it as individuals. And since we don’t control our data (value) we also cannot transfer it to others.

Facebook is a great example of this (one of many). Facebook does not exist if not for its users. The users make up the network. Our data is literally the product that they sell to advertisers. Yet, as users, we do not participate economically from the value created by our data.

Blockchains fundamentally change this.

Blockchains are simply data retention systems at their most primitive level. They record and keep track of the “state” of everything happening within a specific blockchain network. They do this in a permissionless manner - allowing all participants to access and coordinate around the same data. Every blockchain system relies on a global community to store and sync the information that makes up the system. There is no “golden goose” here. Everyone gets access to the same data.

To understand the shift in economic incentives created by open data, we can look to Uniswap as an example.

Uniswap is a decentralized exchange built on Ethereum. Exchanges in traditional finance have a middleman that take orders from the general public, matching buyers with sellers of assets. The exchange either charges a fee or sells your order flow to high-frequency traders who front-run your trades. This is how a centralized exchange functions.

Uniswap is decentralized. It’s run on computer code and smart contracts. No middleman. Here’s how this works: users on the network supply liquidity (cryptoassets) into paired trading pools. Traders leverage the liquidity in these trading pools and do their thing - trade. They pay fees to the liquidity providers as they make the trades.

So what just happened there? What we have is a circular, positive-sum game going on. Because there is no middleman siphoning fees or selling order flow, the network of users itself is the economic beneficiary. This is akin to you or I being paid to allow Facebook to use our data to sell to advertisers. Hmm.

When we start to unwind what’s going on here we can see an economic incentive structure that looks very different from what we see today. We can see a similar progression to past open standards - blockchains are clearly another open standard collapsing and compressing costs in the free market.

Here are a few recent stats about Uniswap if you’re curious:

The network of users has produced average fee revenue of $5.3 million/day over the last week. Again, this is revenue that goes to the users of the platform, not to any central party or company. 3

Over the last year, Uniswap has produced over $1 billion in revenue. Again - this goes to the users of the network. These are individuals all over the world, sharing in the growth of Uniswap. 4

Uniswap has produced these revenues at virtually zero cost. Because it is built on top of Ethereum, it has essentially outsourced its capital and operating costs to the base layer protocol.

Because Uniswap is just computer code, its marginal cost for adding users is virtually zero. This means Uniswap can scale at rapid speed (which it has) with virtually no cost.

This is not a call to tell you to go buy Uniswap (we will do a deep dive analysis in a later report). I am using it here as an example of how these blockchain networks provide a very different economic incentive structure from what we see today. Bitcoin, Ethereum, and many other sound crypto networks operate similarly.

Well-designed blockchains have created incentive structures where the users provide the service (supply) and are economic beneficiaries of that service. Lending/borrowing apps in decentralized finance operate similarly to Uniswap - the users are providing the loans which are executed using smart contracts. Demand for these services is coming from the general public simply because it’s a better product or service. Traders would not be using Uniswap if they could achieve their goals elsewhere. Lenders would not use services like Aave and Compound if they could get 6% interest from their bank. And nobody would use Bitcoin if there was another solution to send value all over the world with instant and final settlement 24/7, 365 days/year.

Visualizing the New Tech Stack

So what does this new paradigm look like in terms of the tech stack? And how should we be thinking about where the most value will accrue?

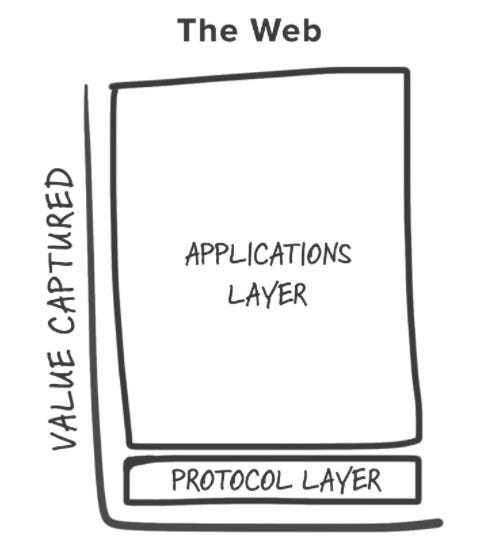

The generation of internet protocols that we live in today (TCP/IP, HTTP, SMTP, etc), produced immeasurable value, with most of it being captured on the top of the tech stack - at the application layer.

The protocol layers saw very little value creation. Why? Nobody owns internet protocols. We can visualize it below - Google, Netflix, Amazon, FB, etc sit in the fat application layer where all the value accrued. TCP/IP, HTTP, etc are in the thin protocol layer where very little value accrued, even though massive internet companies are leveraging services from these base-layer protocols.

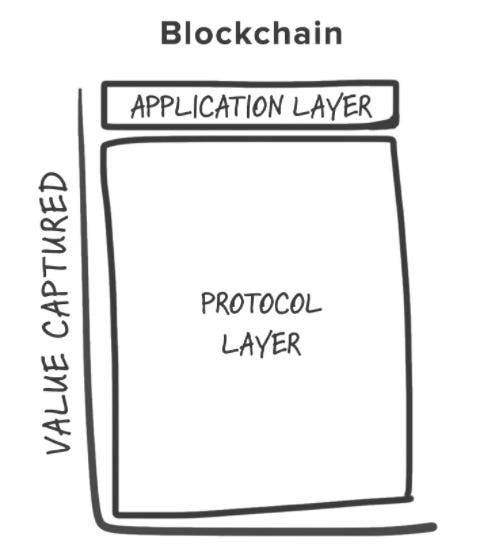

With blockchain, the relationship between protocols and application layers reverses. 5 Bitcoin and Ethereum are the layer 1 blockchain behemoths today that sit in the protocol layer.

If you’ve ever heard someone say that buying Bitcoin is like “buying real estate in NYC in 1900” or “buying a slice of the internet” this is what they are referring to. You are literally buying into the base layer protocol itself. This could be viewed as if you’re buying into the TCP/IP as the internet was being built.

The key thing to understand here is that these base layer blockchains are open, permissionless networks. Their data, and the functionality (smart contracts) they permit, are open and accessible for any company to leverage as a means to provide end-user services and applications.

Today we have Google leveraging TCP/IP, HTTP, SMTP, etc. Knowing the value that was built on top of those protocols, if you had the opportunity to buy them in 1994, would you? And would Google still have the same value it has today in this new value structure??

It is my opinion that the majority of value in this new paradigm will accrue to these base layer blockchains. I’m talking about Bitcoin, Ethereum, and possibly a few others.

Why?

When these base layer blockchains came onto the scene, they drew in interest from early speculators, engineers, developers, and entrepreneurs.

Speculation from these visionaries and risk-takers was rewarded with Bitcoin’s early success. Financial gains were redeployed into businesses built on top of and around Bitcoin. Some of these succeeded in making it easier for new market participants to engage with Bitcoin. This brought in more interest. More adoption.

Which brings in more investors. More VC funding. More companies get built on top of and around Bitcoin. Again, these businesses are making it easier for the general public to engage with Bitcoin. In the gold rush, you could mine gold or make picks & shovels. We see the same dynamic playing out today in crypto.

This is what the sequence of events looks like: base layer blockchain speculation --> capital gains --> capital gains reinvested --> entrepreneurs/developers build on top --> more utility and more adoption --> VCs invest in more entrepreneurs --> more products/services built --> more utility and adoption. This is all leading to larger and large market caps for Bitcoin and Ethereum. The base layer becomes more and more valuable as its utility and network effect increases with more and more applications built on top.

As we can see, speculation is leading to actual business activity, which is leading to more speculation, which is leading to more actual business activity.

When we start to parse this out and see it for what it is, it becomes laughable how many “smart people” we still have calling Bitcoin and other viable cryptoassets Ponzi schemes. Large swaths of well-educated folks still do not see what is happening here. This is how we know we are still early. And therein lies the opportunity.

Network effects flat out matter. These protocols have them in the form of developers/engineers, users, investors, businesses built on top, etc etc. The top, consumption/app layer is easy to disrupt - you just build a better mousetrap. If the consumer likes it, you win. But you cannot just easily recreate another base layer blockchain with a mountain of applications built on top of it, provisioning services to the top application/consumer-facing layers. You simply cannot replicate these network effects.

Again, as more applications are built on top of these Layer 1 blockchains, their utility value grows. This brings in more speculation. On and on we go.

Here’s an example: El Salvador recently adopted Bitcoin as legal tender, not because of Bitcoin’s base layer blockchain. They adopted Bitcoin because of the Lightning Network built on top of Bitcoin. Lightning allows for micropayments and instant and final global settlement at zero cost. This allows the residents of El Salvador (70% of which do not have bank accounts) to send remittance payments back home, saving 15% in fees they would normally pay to Western Union, which is set to lose $400 million/year as a result.6 Remember when I said open protocols collapse and compress the costs of existing tech?

Lightning only works because it is built on top of Bitcoin.

And so when this happened, we started hearing rumors that other countries were looking into Bitcoin. Countries like Panama and Ukraine have already introduced bills to move forward. Other Latin American countries are taking notice and developing Bitcoin strategies.

Twitter is currently building out functionality to allow users/content creators to leverage Lightning Network to receive tips from the community. They have also started the process of building a decentralized social network called Bluesky.

You cannot own Lightning, the layer on top of Bitcoin that allows this functionality and use by the general public. But you can own the base layer, which is Bitcoin.

As we analyze these developments, we can start to see economic game theory playing out right before our eyes.

Ethereum has many use cases. It has countless businesses being built on top of it. Uniswap is built on top of Ethereum. The fact that Uniswap can produce $1b in revenue further enhances Ethereum’s value in the market.

Again, as more and more successful products and services are built on top, the value of the base layer blockchain compounds further. The base layer is the dog. The apps built on top are the tail. The dog wags the tail, not the other way around.

Lots of people talk about speculation like it’s some dirty word. Speculation is at the absolute base of all innovation. It’s why these networks exist. It’s why all innovation and technology we use today exist. It’s created vast amounts of productivity and wealth in the world.

When we step back and look at how speculation has led to a mountain of legitimate businesses built around and on top of these blockchains, we can re-frame how we think about what’s going on here. Do you think people were calling the gold rush a speculative craze in 1848? Of course they were.

How did that work out?

Thanks for reading and for your support. Up next we’ll do a deep dive comparison between Bitcoin and Ethereum. Thereafter we’ll start exploring some of the projects that are being built on top of these blockchains.

As always, for more frequent updates you can follow me on LinkedIn.

And if you are getting valuable insights from these reports, please share them with your network so that more people can learn about blockchain and crypto.

Take a report.

And stay curious my friends.

-----

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.

Technological Revolutions and Financial Capital - Carlota Perez

https://blog.coinbase.com/understanding-web-3-a-user-controlled-internet-a39c21cf83f3

https://cryptofees.info/

https://www.tokenterminal.com/

https://www.usv.com/writing/2016/08/fat-protocols/

https://www.cnbc.com/2021/09/09/el-salvador-bitcoin-move-could-cost-western-union-400-million-a-year.html