Hello readers,

Observing past innovation cycles, computing waves generally have two eras: the skeuomorphic era and the native era. In the skeuomorphic phase, design thinking is adapted mainly from older domains. For example, early web page use cases were primarily blogs, newspapers, mail-order shopping, etc. It was difficult to see the potential of the internet at the time because “do we really need to read the news on the computer?”

Truly transformative innovations such as SaaS companies, e-commerce, social media, etc. came of age when websites later became read *and* write via web2.

The same concept is playing out today with NFTs. Most NFT projects are simply taking the offline world of art and collectibles, and moving it on-chain. This leads some people to think NFTs are limited to these domains — in the same way that internet skeptics thought blogs and newspapers represented the web.

But if we look closely, it appears that NFTs are digital primitives (digital property). This means their use cases are broad in the same way that websites can be generalized to represent almost anything.

In this report, we’re providing a high-level update on the NFT space. Topics covered:

Top Blockchains for NFT Volumes & Users

Top Blockchains for Gaming Use Cases

NFT Marketplaces, Collections, and Use Cases

How an Investor Could Gain Exposure to NFT Growth

What to Look for as the Infrastructure around NFTs Matures

Disclaimer: Views expressed are the author's personal views and should not be taken as investment or legal advice.

Important Note: We receive lots of wonderful feedback from many of you and appreciate your support. To keep the service free and return value back to us, the most helpful thing you can do is simply like the post — which can be done directly from your inbox via the heart button in the upper left. Let’s make quality free content a win/win. This helps grow the community and responsibly introduce more people to DeFi and web3.

Please note that you can now schedule advisory calls directly on our Substack page or through the link here: Book a Call.

The DeFi Report is a data-driven exploration of the emerging web3 tech stack and an ongoing analysis of where value could accrue.

Let’s go.

Top Blockchains for NFTs

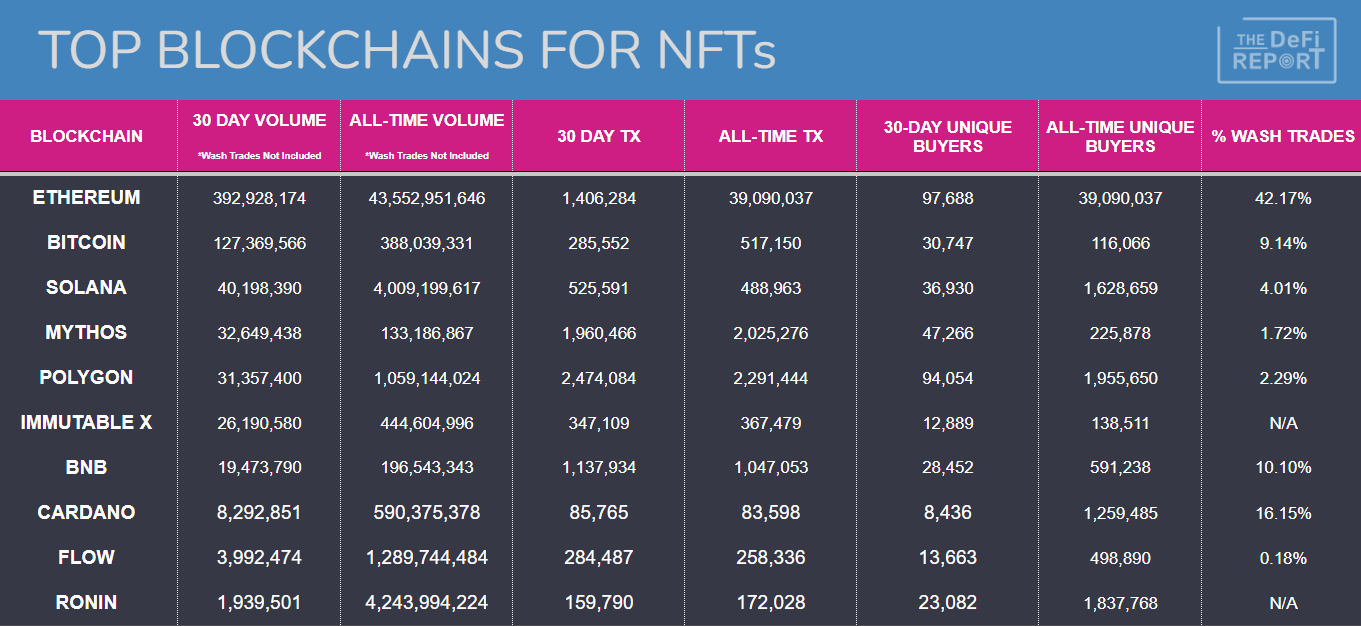

Kicking off with some high-level data pertaining to NFT hot spots:

ETHEREUM

Not surprisingly, Ethereum is dominant today across L1s and L2s in terms of NFT trading volume, total transactions, and unique buyers.

In terms of the last 30 days, 57% of NFT sales volume occurs on Ethereum. 16% of transactions occur on Ethereum, and 25% of NFT buyers are on the L1.

Takeaway: high dollar value NFT activity typically takes place on Ethereum. Lower value, higher transaction volume activity takes place on alternative L1s & L2s. We believe this is due to the superior security (decentralization) and settlement guarantees offered by Ethereum.

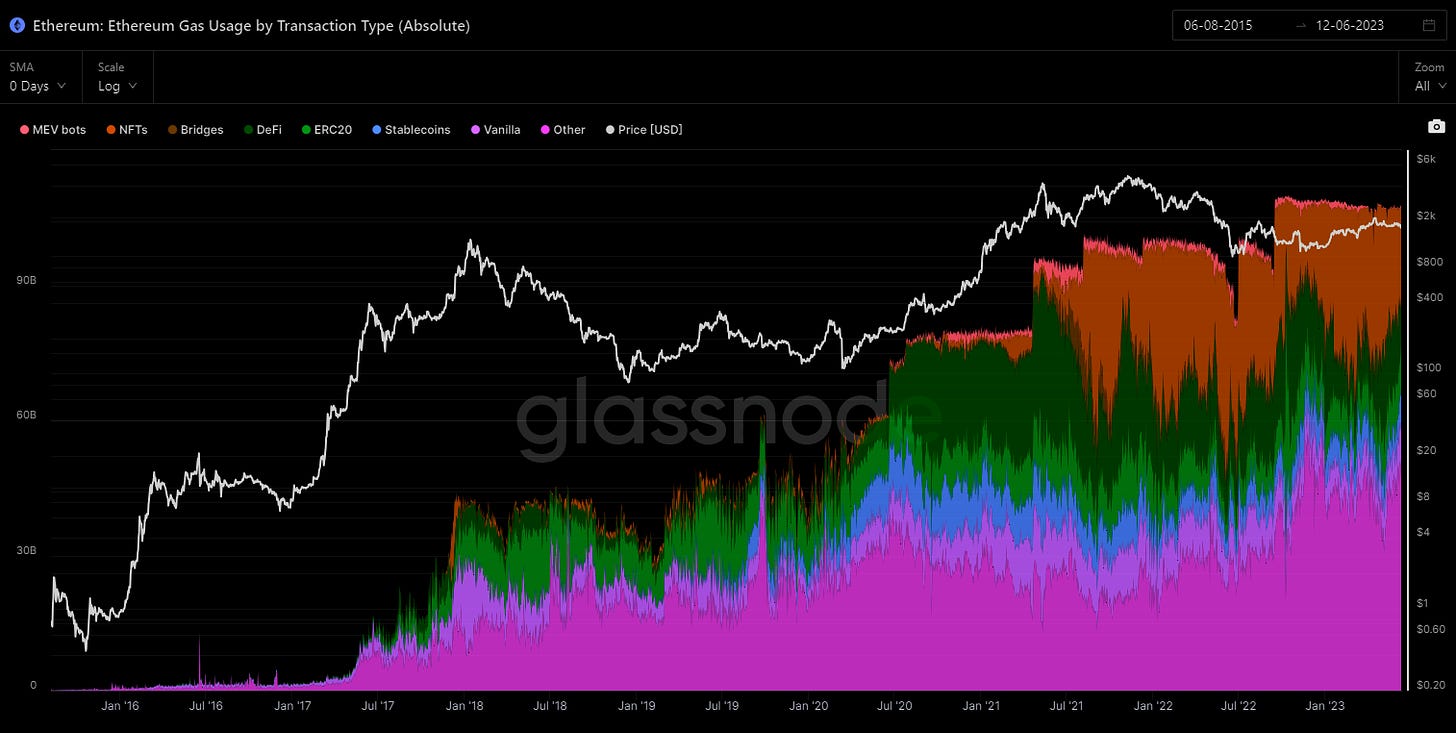

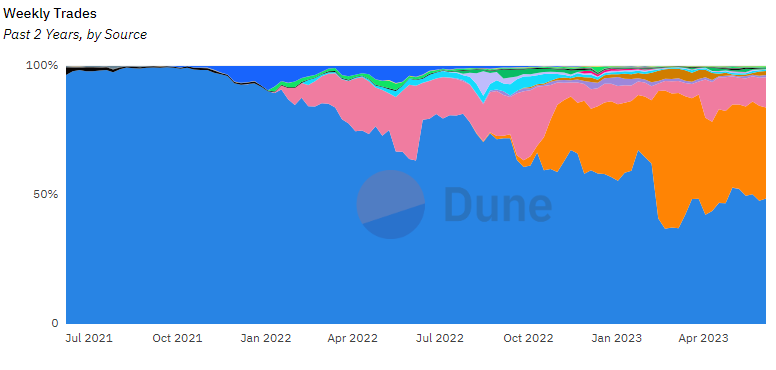

NFTs are currently driving the most demand for block space on the network when compared to DeFi, payments, bridges, etc. Below we can see the breakouts over time:

NFTs (orange) started to capture market share on Ethereum in the second half of ‘21 and have continued to do so ever since — currently driving about 33% of the demand for block space.

DeFi is currently about 10% (after peaking at 25%). ERC-20 contract interactions represent 7.5%. Stablecoins are 6%. ETH transfers are about 5%. Bridging is about 1%, and all other on-chain activity represents about 40% of the demand for block space on Ethereum today.

Back to NFTs.

The network has done over $43 billion in sales volume all-time, with the vast majority coming over the last 2 years.

For reference, when Ebay went public, they were doing about $340 million in annualized volume ($580m adjusted for inflation). Ebay did $74 billion in gross volume last year. Facebook Marketplaces does about $26b in gross sales annually.

Considering total sales volumes in the first few years of existence, NFTs might be the most popular consumer good since the iPhone. 🤯

Ethereum NFT Marketplaces

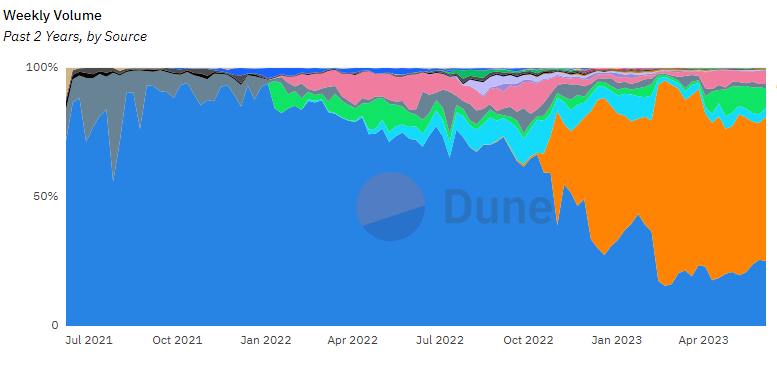

In terms of marketplaces/platforms for trading, it’s currently a two-horse race between OpenSea (blue) and Blur (orange).

Weekly Volume

Having launched in October of last year, Blur (orange) has captured the market in short order. LooksRare (green) is a distant third with less than 10% market share.

Weekly Trades

We can see here that OpenSea (blue) is still hanging onto the lead in terms of # of trades. Gem (pink) is a distant third with about 12% of the market.

Direction for NFT Marketplaces

Marketplaces today are hosting all kinds of NFTs. For example, if you go onto OpenSea you’ll see categories across gaming, collectibles, ENS domains, music NFTs, digital art, etc.

We think there will be many categories of NFTs as the space matures. And we think it’s unlikely that aggregators will host a wide range of NFT types. For example, we think there will be markets for real estate NFTs in the future. It’s unlikely these will list next to digital art on OpenSea.

*Notably missing from the conversation concerning NFT marketplaces: Coinbase & Uniswap. Coinbase launched its NFT markets to compete with the likes of OpenSea in April of ‘22 but has been unable to cut into the early lead. In fact, that last sentence is an understatement. Coinbase is doing about 5 NFT sales per day right now.

Uniswap acquired Genie about a year ago and has had about as much traction in the space as Coinbase.

Ethereum Collections

The primary use case for NFTs on Ethereum today is digital art/collectibles/profile pictures. This is evident when we examine the top collections by all-time trading volume:

Bored Ape Yacht Club — $2.8b

CryptoPunks — $2.5b

Mutant Ape Yacht Club — $2.1b

Otherdeed for Otherside — $1.4b

Azuki — $1.2b

Art Blocks Curated — $1.2b

CloneX — $.94b

Moonbirds — $.75b

Doodles — $.69b

Bored Ape Kennel Club — $.54b

Notable mentions:

Sandbox Digital Land: $.39b

Adidas Originals: $.15b

Decentraland: $.058b

Wash Trades & Illicit Activity

We’d be remiss not to mention that a whopping 42% of all NFT trades on Ethereum have been labeled as “wash trades.” Wash trades are a tactic to manipulate the market price of an asset. These traders are easily identified on-chain because they show the same wallet address buying & selling the NFT, or two addresses swapping the same NFT more than 3 times. *Note that the volume & trade data above does not include wash trades.

In terms of marketplaces, LooksRare and X2Y2 have the most wash trading by far. Currently, 94% of the trading volume on LooksRare is labeled as wash trading. X2Y2 is 84%. We think poor token incentive design has rewarded the wrong behaviors amongst users, leading to high volumes of wash trades. Blur, the #2 marketplace today has a staggering 24% of its all-time volume being labeled as wash trades. OpenSea is just 2.38% all-time.

Illicit Activity & Money Laundering

Money laundering is often facilitated through physical art. As such, it is reasonable to assume the same is happening with digital art. However, per on-chain monitoring from Chainalysis, there appear to be fairly low levels of illicit value flowing through NFT marketplaces today. At the peak of the bull market in ‘21, Chainalysis identified just $1.5m of illicit activity.

BITCOIN

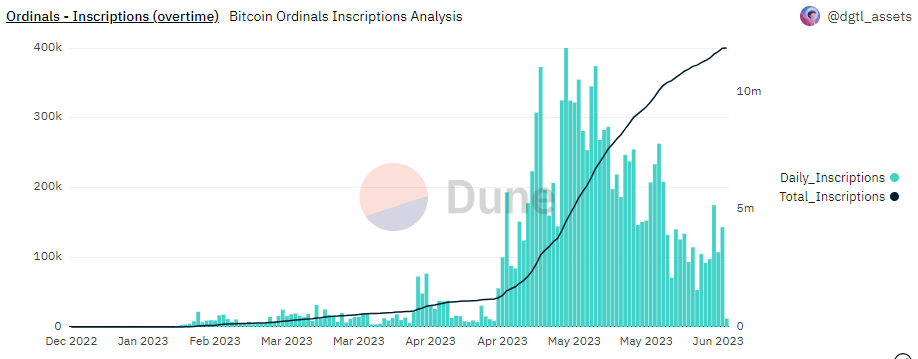

With the introduction of Ordinals, Bitcoin has skyrocketed into the #2 position in terms of volumes over the last 30 days (18.6% of the market).

In short order, Bitcoin has over $388m in trading volume, and 116k unique buyers (8% of the market over the last 30 days). Remember, Bitcoin NFTs (inscriptions) are super nascent. It isn’t easy to access marketplaces, mint NFTs, trade them, etc. Therefore, it’s impressive to see this much activity in such as short time frame.

As the most decentralized and secure L1 in the ecosystem, we recently covered potential use cases for Bitcoin NFTs. You can check that report out here if interested.

SOLANA

Solana seems to have found product/market fit with NFTs. The network ranks #3 in terms of 30-day volume and #2 in all-time volume. About 10% of unique NFT buyers originated on Solana over the last 30 days. Similar to Ethereum, the primary use cases have been art/collectibles/profile pictures. Solana is also the only other network where we’ve seen widespread use of the native asset as currency within NFT markets. Users pay for NFTs on Ethereum with ETH. They pay for NFTs on Solana in SOL.

Marketplaces

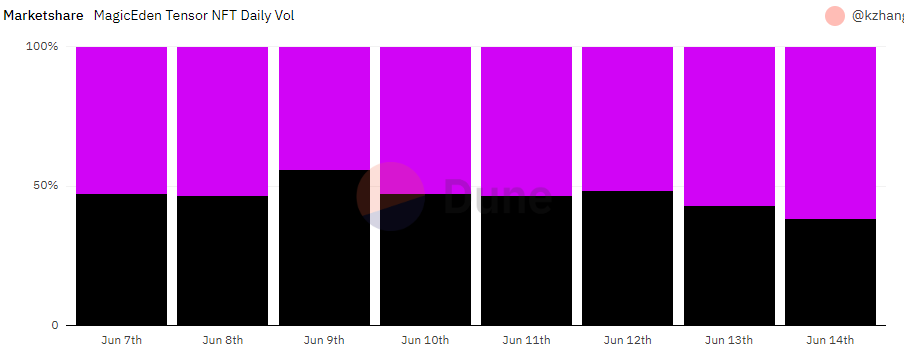

As with marketplaces on Ethereum, it’s currently a two-horse race on Solana. Magic Eden is the incumbent in this case, and Tensor is the upstart.

As we can see, market share in terms of volume is currently split about 50/50. *Note that volumes are currently less than 1/10th of that of popular marketplaces on Ethereum such as OpenSea and Blur.

POLYGON

Over the last 30 days, Polygon is #2 in terms of unique buyers, and #1 in terms of the number of NFT transactions. That said, Polygon ranks #5 in terms of dollar volume.

The data highlights what we have observed (and heard anecdotally) regarding user preferences concerning high-value NFTs: Ethereum is preferred due to the settlement assurances and security of the L1. Lower-value NFTs such as consumer brand loyalty programs, gaming use cases, etc are more likely to proliferate through an L2/side-chain such as Polygon. Per DappRadar’s Q1 gaming report, Polygon is currently the #2 blockchain for gaming use cases.

Gaming

Gaming is a massive growth area for NFTs. We think it’s only a matter of time before most games incorporate a blockchain element. 3 primary reasons for this:

Blockchains will allow gamers to own their unique abilities and gaming accomplishments. This could allow for monetization of gaming skills, and also the ability for gamers to display their abilities with verifiable proof via the blockchain.

Blockchains will allow gamers to own and control in-game assets. This will create secondary markets for sought-after gaming assets.

User-controlled data within games could ultimately lead to new gaming business models, rewarding gamers for their time and abilities.

Major gaming brands such as Animoca are currently developing multiple blockchain games for these reasons. The blockchains where gaming use cases involving NFTs are starting to take hold are below per CryptoSlam data:

Mythos: a newer, permissioned EVM blockchain focused on gaming use cases. Over the last 30 days, it’s moved into the #4 slot in terms of total volume, #3 in terms of transactions, and #3 in terms of unique buyers.

Immutable X: a layer 2 blockchain for Ethereum, also focused on gaming use cases. Gods Unchained is a game that is gaining popularity on Immutable and has driven almost over $182m in sales with over 82k unique buyers since inception.

Ronin: another Ethereum side-chain focused on gaming use cases. The once-popular Axie Infinity play-to-earn game resides on Ronin. Given Axie’s challenges, it’s not surprising to see Ronin drop in the 30-day stats all the way to #12, with just .28% of total volumes.

NFTs & Value Accrual

There were 853,000 unique NFT buyers last month and nearly $1 billion of sales volume.

While the infrastructure around NFTs is still incredibly nascent, it’s clear that product market fit has been achieved. The sales volumes speak for themselves now that we are a year and a half into the latest crypto winter.

NFTs demonstrate what we’ve learned from past innovation cycles: when you reduce the cost and technical barriers to entry while transforming and creating net new business models, the size of the new markets can far exceed growth forecasts.

This is already happening with NFTs.

But how might an investor gain exposure to the growth of the asset class?

Buy an NFT from a popular or up-and-coming collection

Buy the native token from a popular NFT IP company (Yuga Labs/ApeCoin)

Invest in a Marketplace (OpenSea/Blur/Magic Eden/Tensor)

Invest in a popular game that utilizes NFTs (Iluvium, Gods Unchained, STEPN)

Invest in social or fan tokens (Chilliz)

Invest in a particular business model to transform an existing market (such as real estate)

Invest in an L2/side-chain focused on gaming infrastructure (Mythos, Immutable X, Polygon)

Invest in the L1 such as Ethereum or Solana

In our opinion, it’s really difficult to project the value of various NFT collections. It’s also really difficult to forecast how Yugu Labs will monetize its IP to support the current $800m market cap for ApeCoin.

Marketplaces are another option. But we tend to think the market will become quite bifurcated in the coming years as NFT use cases proliferate. We’re expecting to see marketplaces fall into the protocol layer of the tech stack. As this happens, each collection/use case will have its own marketplace. There could be thousands of marketplaces for NFT trading as a result.

We think on-chain games are an interesting category. Given the early popularity of Gods Unchained ($182m in total volume and 82k unique NFT buyers), the current valuation of $28m looks more reasonable when compared to other sectors of the market.

Of course, there is also the option to invest in gaming infrastructure such as Immutable X (where Gods Unchained is built), though a project like IMX is currently trading at a much higher valuation of $548m.

The least risky option is to simply invest in ETH, SOL, or MATIC — which will capture some of the value as the settlement & infrastructure layer for all NFT activity occurring on the network.

Moving out of the “Skeumorphic Phase”

The vast majority of use cases for NFTs likely haven’t even come to market yet.

Ultimately, we think NFTs can be generalized while representing almost anything from both the physical and digital worlds.

Right now the primary use cases are collectibles, profile pictures, digital art, and gaming.

But there is a staggering amount of digitally native content that can be placed on blockchains in the form of NFTs.

The critical concept with NFTs is that we now have the technology to make intellectual property liquid, for all forms of digital content.

To fully appreciate this, consider that we seldom own anything on the internet today. We license ebooks from Amazon. We rent music from Spotify and Apple. We make payments to borrow web domains from a registrar.

Even when we create our own digital content, the rights to it are often owned by the content platform, distributor, or label.

If we cannot own digital content, we cannot value digital content. If we cannot value digital content, we cannot trade digital content. We cannot have secondary markets.

NFTs and the concept of user-controlled data will transform digital content dramatically in the coming years.

As this occurs, net new markets will appear for intellectual property and digital content that was previously unthinkable. New business models will emerge. An explosion of on-chain value and the financialization (trading/lending/collateralizing) of digital goods and content will become normalized.

Eventually, even physical assets (e.g. real estate) will move on-chain, unlocking trillions of dollars of illiquid value.

Stay humble. Stay patient.

And thanks for reading.

The DeFi Report is brought to you by Glassnode, the leading crypto platform for on-chain analytics and insights. As a reader of The DeFi Report, enjoy a 10% discount on any license tier by clicking here.

If you got some value from the report, please like the post, and share it with your friends, family, and co-workers so that more people can learn about DeFi and web3.

This small gesture means a lot and helps us grow the community.

If you have a comment, thought, or idea, drop it here:

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.