Hello readers,

I hope everyone had a nice weekend and a strong start to the new year. This week we are breaking down the web3 business model vs the current paradigm we are in with web2. We’ll cover the following:

Does web3 really return control and ownership to individuals?

Who are the stakeholders of web3 and what do the capital tables look like?

How does the web3 model compare to web2?

Do VCs own web3?

As a reminder, if you haven’t subscribed yet and would like these free reports dropped in your inbox as they are published, leave your email below:

Let’s go.

Who Owns Web3?

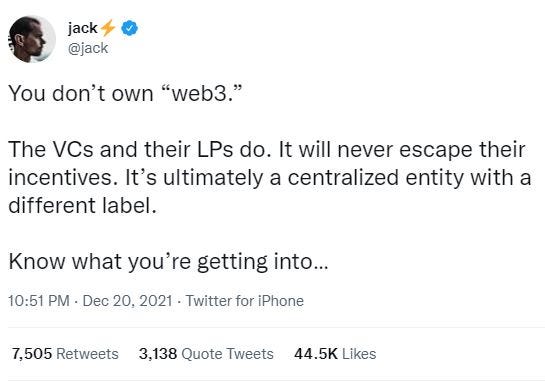

The debate started with the following tweet from web2 founder, Jack Dorsey, just before the holidays:

This sparked quite the debate on Twitter. Skeptics of web3 loved it. Web3 builders and users pushed back. VCs firms like a16z got into the mix. The founder of a16z, Mark Andreesen, eventually ended up blocking Jack Dorsey (the founder of Twitter), from seeing his tweets on the platform Jack created. A Twitter fight like you read about!

While this sparked a contentious debate, it is ultimately a really healthy one to have. This forces us all to step outside of the hype and get into the nuance of what web3 represents, who the stakeholders are, and what their incentives look like. These are the folks pushing web3 into the mainstream culture. So it makes sense to understand how these structures differ from web2 and who the winners and losers could ultimately be.

Web3 Business & Funding Models

Let’s take a look at Uniswap to break down the investor capital table and compare this to a web2 company. Uniswap is a decentralized exchange that leverages Ethereum as its base layer blockchain. Below is the initial allocation of the UNI token when they released it into the market in September 2020.

Source: Uniswap.org

We can see here that 60% of Uniswaps token allocation is going to the community (retail). The rest goes to the Uniswap Labs team (the folks who built the protocol and continue to work on it to make it better), the early investors (VCs & private investors), and the advisors to the core team (lawyers & consultants).

An important note: Uniswap had their exchange up and running for almost 2 years before they released the token. When they did so, they gifted 15% of the initial community tokens (via airdrop to user wallets) to folks that were early adopters of the protocol. Does anyone know of an existing legacy company that has taken an approach like this? I don’t know of any.

Furthermore, even if you did not receive a free airdrop of tokens, retail investors had access to the UNI token at essentially the Series A funding round (after the early private seed investors). If we compare this to a web2 company, retail would not get access until several funding rounds had been completed (all by VCs and private investors). When a web2 company goes public, that is when retail is getting access. So, several rounds of value have already been extracted by insiders in the web2 framework when compared to the model Uniswap (and many well-organized web3 networks) are putting forth.

Finally, we need to look at how these networks function. Who is contributing value, and how is that value dispersed? Does it go to the founders and private investors, or does the community participate? This is a major piece that I believe is being left out of the debate. Most of the debate I have seen is focused on who is seeding the projects and the tokenomic model. But very few are looking at the function of these networks and who participates in the revenues generated. Below we can take a look at revenues that Uniswap has generated over the last year:

Source: Token Terminal

We can see above that Uniswap has produced almost $1.6b of trading fee revenue over the last year. So who gets the revenue? The users or the founders and early investors? The users of Uniswap are earning 100% of these fees. Again, does anyone know of a web2 company that pays 100% of their gross revenues out as dividends? I can’t think of any. Imagine if Uber paid all of the rideshare revenues out to its drivers? These revenues are earned by the liquidity providers on Uniwap. This can be anyone, anywhere in the world, that is depositing liquidity onto the platform upon which traders use to trade assets. The trader fees are paid to these liquidity providers.

Below we can see the fees earned by the top 10 crypto protocols over the last week. Again, these are fees earned by the folks using these protocols, not by the central founding team as would be the case with a web2 company. Note that Bitcoin fees are low because miners are also receiving the block subsidy of new bitcoins.

Source: cryptofees.org

For further reference, below is a wider view of the tokenomic structure of some of the larger networks in the ecosystem. I used Uniswap as an example of a well-designed web3 structure. Not all protocols were created this way. And we should expect that - there are definitely bad actors in the space that are looking to prey on retail. However, this is not a web3 problem, it's a human behavior and greed problem. It’s ultimately up to the market to punish these networks by not investing in them.

Source: Messari

Comparing to Web2

In the web3 structure, there are 3 distinct groups of people that own tokens within the networks. They are the founding team/developers, the private investors (VCs and others), and the community (retail).

In the web2 structure, only the founding team and the private investors end up owning equity in a company during the early stages of growth. Therefore, web3 has a distinct structural advantage in its ability and desire to get economic incentives into the hands of its community (retail).

Some web2 companies have attempted the web3 model. Airbnb and Uber both tried to give their hosts and drivers equity. However, the explicit rules regarding private companies and accredited investors made this unworkable. This is an issue for regulators to solve: why do the current rules prevent retail from accessing the economic upside that today only accredited investors have access to? The emergence of web3 should force changes to these regulations.

Who owns Web2?

If we are looking under the hood of web3, we should do the same for web2. Chris Dixon, from a16z, tweeted out the ownership % of some of the larger web2 tech companies. Below is a snapshot of a few of them:

Why is Jack Dorsey complaining about web3, when the company he founded (previously Square) is owned by some of the largest investment firms on Wall Street?

Below we have Facebook (now Meta):

This gives us an idea of what we are comparing to here. Keep in mind that retail did not get any access to these companies at the early stages that web3 is now enabling.

Do VCs Really Own Web3?

First, we need to define “VC” and understand what is behind a Venture Capital firm. These firms have investors themselves. They are taking their investor’s capital and deploying it into these web3 networks. The average VC firm participates in 20% of the economic upside of the investments. So, who invests in VCs?

Sequoia Capital is one of the largest and oldest VC firms in the country. Below is a direct quote from their website:

“Sequoia invests primarily on behalf of nonprofits and schools, with organizations such as the Ford Foundation and Boston Children’s Hospital forming most of our limited partner base. Working for them gives us a greater sense of responsibility and purpose.”

This tells us that 80% of the VC capital backing web3 is actually coming from large ivy league endowments, non-profits, pension funds, and foundations. Interestingly, these are the same folks that own web2 companies.

Conclusion

Incentives drive everything. Economic and social incentives tend to be the strongest drivers of human behavior. So, if we can align the economic and social incentives of a company or network between early founders, investors, and the community of users, we’ve created a paradigm shift. In my opinion, web3 is doing this. This structure does not exist in web2. Skeptics will continue to point at web3 and how these projects are seeded as some sort of “gotcha” for the networks not being decentralized or user-owned and controlled. In my opinion, this is completely missing the point. Crypto tokens are the bootstrapping mechanism upon which developers become incentivized to build decentralized information networks and protocols that can be community-owned and governed. These developers need to be seeded before they start building. And current regulation prohibits web3 companies from seeding their efforts strictly from retail.

Is this perfect? Of course not. But I’m not sure how anyone could compare web2 to web3 and say that web3 is not providing access and upside to a wider group of people. And that’s really all that matters - we are making things better and moving in the right direction. There will continue to be bumps in the road and lessons learned.

Finally, we should understand where Jack Dorsey is coming from when he disparages web3. Jack and his companies only support and work on Bitcoin. I wrote about the hierarchy of decentralization recently. You can check out that post to get a better understanding of Jack’s perspective. Because Bitcoin did not have any VC money and had a perfectly fair launch process, the most ardent Bitcoiners view this as the only relevant web3 model. Bitcoin IS the most decentralized crypto network. And it has to be - Bitcoin is the only crypto network that seeks to become a base layer monetary asset and settlement network.

However, this does not mean that every other web3 network is meritless, centralized, or controlled by VCs.

___

Thanks for reading and for your continued support. If you have a question, comment, or thought, leave it here:

And if you’re getting value from these reports, please share them with your friends, family, and social networks so that more people can learn about crypto and this exciting new innovation.

Finally, if you would like to send me a tip, you can do so through the addresses below. If you do send a tip, please be sure to let me know so that I can send you a thank you note.

Bitcoin: bc1qghetd4g3lk7qnsn962amd9j92mkl4388zxz0jz

Ethereum: 0x084fcd3D9318bAa383B9a9D244bC0c32129EE20E

___

Take a report.

And stay curious my friends.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.

Hello there, thanks for the post, I think you hit the point in your final words, BTC maxis can´t resist to attack web3 development because of the purity of bitcoin. I believe that both worlds must coexist, actually all the web3 deployment is only increasing the BTC legend... but it is true that the dominance of bitcoin is going down in the increase of more web3 dapps. Let´s see how this evolve.

Hi Micheal,

Also really loved (all of) your post. Just had a two questions though, wondering what your take on it would be :)

1) In the earlier days, indeed, when an ICO was done, retail was relatively early so you can consider it similar to Series A. Then my question, if the founding team needed more funding (e.g. to hire/reward more devs), would they then mint new tokens & sell them to the public/VC, thereby diluting current tokenholders? How does/did this work in practice?

2) Nowadays, you see that ICO's happen at a later stage of the project. VC's are now investing more and more, and projects doing funding Series B, C, D etc before doing an ICO. This would be much more similar to the current stock market I think. This has of course upsides (better product, more funding to optimize the project) and downsides: retail pays a relatively high price, at lot of value has already been extracted by VCs, and much of the voting power is concentrated at these funds. How would you look at this?

Anyways, just curious how this would work. Many thanks for all your insights, helped a lot to gain more clarity!

Kr,

Jeroen