Hello readers,

We’ve been hearing a lot about the metaverse. JP Morgan says it’s an annual $1 trillion opportunity. Goldman Sachs says it’s more like $8 trillion. The metaverse is full of hype. Big brands are talking about it. Some are even buying up digital land. Yes, you read that right. We’re talking about digital land. We’ve even got celebrities and rappers like Snoop Dogg going all-in on the metaverse.

But what exactly is the metaverse? How should we be thinking about it? How will it impact society? And what sort of economic opportunities will it present?

We’re breaking down the metaverse this week. Topics covered:

Evolution of the Web & Converging Technologies

Economic Opportunities and new Business Structures

Digital Land and Property Law

As a reminder, if you’re new to the program, drop your email below to receive future reports directly in your inbox as they are published.

Is this the future of business meetings?

Let’s go.

Evolution of the Web

Web 1: Approx. 1990-2000 - the read-only web. This was the earliest form of the web. We basically had a few people writing content and web pages for some consumers of that content. People could access facts, information, and content through web pages (think of an old-school, static blog). But there was no interaction with web pages. Users could not write to the web. For example, we couldn’t comment on a blog post. There was very little interaction amongst users outside of the early AOL chat rooms. The internet wasn’t really monetized yet besides early pioneers like AOL who owned the entry point/gateway to the web. The web 1 era started with a few million users and ended with about 500 million (about 9% of the global population)

Web 2 (2000-2010): the read and write web. With the rise of DSL and cable modems in the early 2000s, users no longer had to pay a fee to go through AOL’s walled garden to access the Web. Internet adoption exploded via social media websites in 2003 (Myspace), 2004 (Facebook), WhatsApp (2009), and Instagram (2010). A wave of SaaS platforms followed (think Salesforce). Users could interact. Chat rooms moved to a new format via social media. However, as users flooded the web, they became the product. This is how the internet was truly monetized. With large, *closed* networks. You don't own your Facebook account. Your Twitter account. Your LinkedIn profile. Or your Instagram Account. You can create content, and drive eyeballs to these platforms. But you cannot monetize your content directly. You cannot take your audience elsewhere.

Because you cannot own your data on Web 2, the value on the internet today largely accrues to walled gardens/closed networks that create a network effect. Google, Facebook, Amazon, Netflix, etc have created monopolies around charging advertisers for access to data or charging for a proprietary service based on proprietary data.

However, with the introduction of blockchain technology, we now have an open protocol that is poised to disrupt these proprietary data monopolies.

Web 3 (2010 - today): the read, write, and execute web. Execute? Yes. For the first time, we can transact bearer instruments with each other directly. It sounds odd, but a Bitcoin transaction is the same thing as me handing you a dollar bill. When I hand you a dollar, you have it and I don’t have it anymore. Bitcoin introduced this concept digitally in 2008. Instant, final, transparent, immutable, and secure peer-to-peer interaction. Execution.

Furthermore, Ethereum expanded on this concept in 2015 when it introduced smart contracts - this means we can execute services ourselves without the need for intermediaries. This is what web 3 is all about. With the birth and emergence of Web 3, we introduce an internet orchestrated by blockchains that allow for read, write, execution, digital property rights, decentralization, and open, permissionless networks enabling peer-to-peer interaction. We introduce an internet owned by its users and builders, orchestrated with tokens as the incentive and bootstrapping mechanism. Web 3 represents a paradigm shift and a new way to organize business and social interaction digitally. This all results from the evolution and convergence of tech over time: text, voice, video, VR, blockchain, AI, IoT, etc.

New Economic Structures

With web 3, we have finally discovered the native asset class of information networks. They are called tokens. We’ve been mismatching the Delaware C-Corp with networks all this time, creating endless strife, misaligned incentives, and economic inequality.

Let me explain.

Web 3 companies are funded via tokens. Cryptoassets. Retail investors and VCs get access to or purchase liquid tokens issued by the decentralized network or application. These tokens are also used to pay for services on the network/app and for block space (which settles in ETH on the Ethereum blockchain). They function as a digital commodity within the network or application. Furthermore, users own and govern these networks via the token.

Let’s look at the metaverse platform, Decentraland, as an example.

2,805,886,393 tokens were issued at the Initial Coin Offering.

40% of the total supply was issued to the general public.

20% goes to the Community and Partners

20% to the Team and Early Contributors

20% to the Foundation

The price at launch was 2 cents/coin and the coins issued to insiders (the team, VCs, advisors, etc) have vesting periods.

Alignment of Incentives

Decentraland is an online platform where users can interact with each other. This is essentially the next iteration of Facebook and social media. It just happens to be much more interactive - users can attend concerts, play poker, gamble at a casino, shop at a mall, etc. They can also pay for digital goods and services. And they can buy digital land and build on it. Think of this as the discovery of a new frontier.

One such new frontier is powered by MANA, the native token of Decentraland.

If you are on the core team at Decentraland, you are incentivized to build a really cool platform that lots of people want to use. Why? You get tokens as part of your compensation. More users = higher price for Decentraland. This is the key distinction in economic incentives in Web 3. Users and builders are often equity holders. Imagine that? Imagine if Web 2 companies’ could create a community of users that were also equity holders? They wouldn’t need to do so much marketing - the community does it for you since they are utilizing the platform and hold the token. They are incentivized to bring in more users.

To access services on Decentraland, you have to own some MANA. And as users transact on the platform, a small % of each transaction is burned. This reduces the supply (acting as a stock buyback) of the token and influences the price as more users interact on the platform.

Furthermore, as Land is auctioned off on the platform, more MANA is burned. The MANA used to pay for the land goes back to the treasury/foundation and is managed by the DAO (token holders) via on-chain voting.

The key here is that incentives are aligned. The developers are incentivized to build a cool place where people want to play games, interact, and build things. The users themselves own the token. They are incentivized to bring in more users. And to build things. More users = more transactions = more MANA burned = lower MANA supply = higher price of the MANA token. If a network effect were to take hold, this looks like a pretty interesting flywheel in terms of value accrual back to the token.

The circulating supply of MANA is 1.84 billion tokens. The max supply, per the contract on Etherscan is 2.19 billion tokens. 84% of the max supply is in the market today.

Digital Land

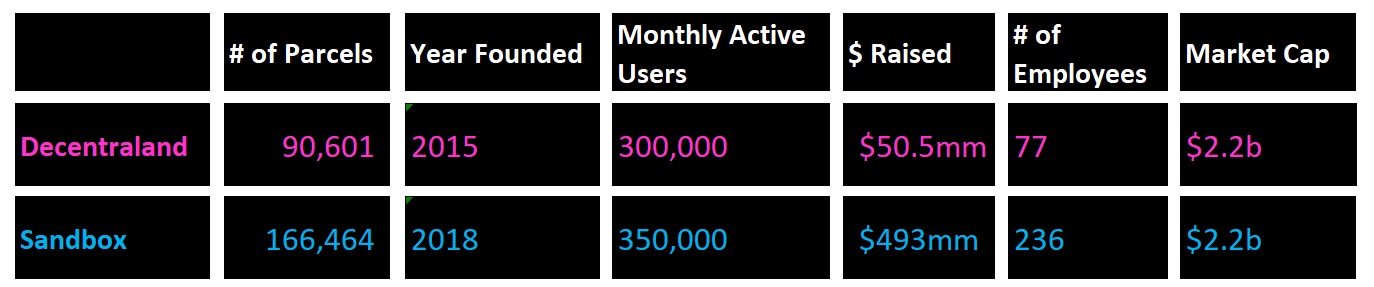

There are currently 90,601 units available on Decentraland. Decentralands largest metaverse platform competitor, Sandbox, has 166,464 parcels. Below are the total sales all-time on Sandbox - 155,000 (orange line). This totals up to $475 million (white line) in just over 2 years. For reference, Decentraland has done a total of 139,000 sales for $218 million all time.

*Sobering stat: These platforms have about 300,000 monthly active users. Roblox, a web2 gaming platform, has 45 million daily active users. Its market cap is $15b. Decentraland and Sandbox have market caps of $2.2b today (Decentraland touched $10b late last year).

Source: https://nonfungible.com/market-tracker/thesandbox

Digital land is an NFT. Just like with physical land, the idea here is that location is everything. To monetize the digital land, you want to be where the eyeballs will be. To be where the eyeballs will be, you need to build something cool on your land to attract them. Or you need to be located near something cool. We are seeing this in action, as plots of land located near Snoop Dogg on Sandbox recently fetched $450k.

Unsurprisingly, large brands are making the early moves on digital land. A few examples:

Sotheby’s bought land and built a replica of the London New Bond Street art galleries for users to display their NFTs

Samsung bought land and is building a digital version of 837, its New York City-based experience center

In June of 2021, Republic Realm, a New York-based real estate investment fund, bought a land plot on Decentraland for about $913k. The real estate group has turned it into a virtual shopping district named Metajuku, inspired and modeled after the real-life Harajuku based in Japan

Metaverse Group, another virtual real estate investment firm, purchased $2.34 million worth of land on Decentraland and built a platform for hosting virtual fashion shows

HSBC purchased plots of land on Sandbox with the intent to center it on sports, e-sports, and gaming

PwC bought land on Decentraland with plans for virtual offices and consulting services

Adidas bought land on Sandbox

JP Morgan bought land on Decentraland to build a lounge

The concept of digital land may seem absurd, but if these large brands are heavily investing in the space, it is probably prudent to do some critical thinking on the topic.

Sandbox vs Decentraland

Source: Pitchbook, Coinmarketcap, Nonfungible

*Sandbox is currently looking to raise $400m in a private round at a $3.6b valuation

Is Digital Land Scarce?

It is scarce to the extent that its scarcity is enforced at the protocol/application level. Sandbox and Decentraland have no incentive to create more land. This would dilute their users and the very people that built the platform. I don’t see this happening.

Of course, we could see many more metaverse platforms emerge. This could be dilutive to platforms like Decentraland and Sandbox. Similar to how more cryptoassets, in general, are dilutive to Bitcoin and Ethereum. However, it’s very interesting to me that Bitcoin and Ethereum maintain themselves as the top 2 cryptoassets. It’s all about network effects. Anyone can spin up a new metaverse platform. Just like anyone can fork Bitcoin or Ethereum. But will they get the users? That is an entirely different story. Network effects flat out matter. The platforms that achieve sticky network effects will likely win in the long run. This has yet to be determined, but Sandbox and Decentraland have an early lead.

Does Digital Land follow Property Law?

Current ownership of metaverse assets is not governed by property law, but rather by contract law. As law professor Joao Marinotti points out, when you buy an item in the metaverse, your purchase is recorded in a transaction on a blockchain, which is a digital ledger under nobody’s control in which transaction records cannot be deleted or altered. Your purchase assigns you control of an NFT, which is simply a unique string of bits. You store the NFT in a digital wallet that only you can open, with your private key. Each NFT is linked to a particular virtual item.

Because you need a private key to access the NFT, it is easy to think that the NFT cannot be taken from you. However, when you join a metaverse platform you have to agree to the terms of service first. The blockchains these platforms leverage are decentralized. But the service offered through the platform is not. Therefore, there are no laws protecting your property rights to digital land. The NFT exists on the blockchain - which is immutable, secure, and allows you to control your data. But the land, goods, and services on metaverse platforms exist on private servers running proprietary code. Therefore the visual and functional aspects of the NFTs on these platforms are not on the blockchain itself.

It’s worth noting this. This doesn’t mean that the platform will be incentivized to alter or make the visual aspects of your NFTs inaccessible. In fact, they are incentivized to do the opposite.

Does this mean some web3 apps are centralized? I would say no. The blockchain they leverage is still decentralized. And the apps themselves are still decentralized. The economic structures are different. An application like Decentraland could be its own economy - where users buy land. Build on the land. Offer services and experiences on the land they developed. Users get to own these assets. Trade them. And they get to own the platform itself, through the MANA token. Elements can still be centralized, and this is a good thing because it makes the platform easier to use. For example, Coinbase is centralized. But Bitcoin transactions are not. Coinbase just makes it easier to access the Bitcoin network.

Conclusion

The most interesting thing to me about the metaverse is the business models and the new economic incentive structures introduced through tokens - these structures fundamentally spread the value accrual of a network across a much wider set of users. With that said, the metaverse will produce $5-$10 trillion annually (as predicted by Morgan Stanley, and Goldman Sachs) only if it attracts massive amounts of users. To do this the experience needs to be on point. It needs to attract users in the same way that Fortnite, World of Warcraft, and Roblox do. As the user experience improves, new users, will be attracted by the superior “ownership economy” these platforms are putting forth. Do you think users would prefer to own and build on digital land? Do you think they want to own their avatars, skills, skins, etc? Do they want to be able to create and monetize things in an immersive, digital world? And will big brands be incentivized to build cool experiences in the metaverse to promote their brands and engage with their customers?

I think the answer to all of these questions is a resounding yes. It will just take some time for this to be built out.

___

Thanks for reading and your continued support. If you got some value from this week’s report, please share it with your friends, family, and social networks.

If you have a question, comment, or thought, please leave it here:

Finally, if you would like to send me a tip, you can do so through the addresses below. If you do send a tip, please be sure to let me know so that I can send you a thank you note.

Bitcoin: bc1qghetd4g3lk7qnsn962amd9j92mkl4388zxz0jz

Ethereum: 0x084fcd3D9318bAa383B9a9D244bC0c32129EE20E

___

Take a report.

And stay curious my friends.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.

Great informative summary of where we’re headed in the Exponential Age.