Welcome to The DeFi Report

Welcome to the first edition of The DeFi Report!

I couldn’t be more excited to write about decentralized finance and share my research with you.

We’re jumping right in. Here’s the first item I want to address: you are not too late to crypto. Everyone assumes they missed it. But I want to be clear - you’re not late. In fact, if you’re reading this, you’re early.

In this report, we’ll cover how early we still are and how big these markets could get.

Let’s go.

Bitcoin has been around for 12 years and is just now beginning to show signs of escape velocity. However, we know it’s still early because Bitcoin is still not easy for the general public to engage with. It’s clunky. And many institutional investors (banks) still cannot hold it on their balance sheet. Can you think of any other asset that retail got first dibs on? I can’t. Ethereum launched in July 2015 - it’s only 6 years old and gas fees are still expensive. Still building. Still scaling. Initial Coin Offerings (ICO’s) came onto the scene in late 2017. DeFi (borrowing/lending protocols) and cross-chain networks like Polkadot launched in 2020. Social/community tokens took off in 2020. NFT’s took off in 2021. The metaverse (Decentraland) is growing exponentially today. Tomorrow it will be something else. The opportunities are endless. And they’re just beginning.

The clunkiness of the user experience in crypto today reminds me of the early days of the internet. Remember when you would get kicked off of AOL when someone called the house? That’s where we’re at with crypto today.

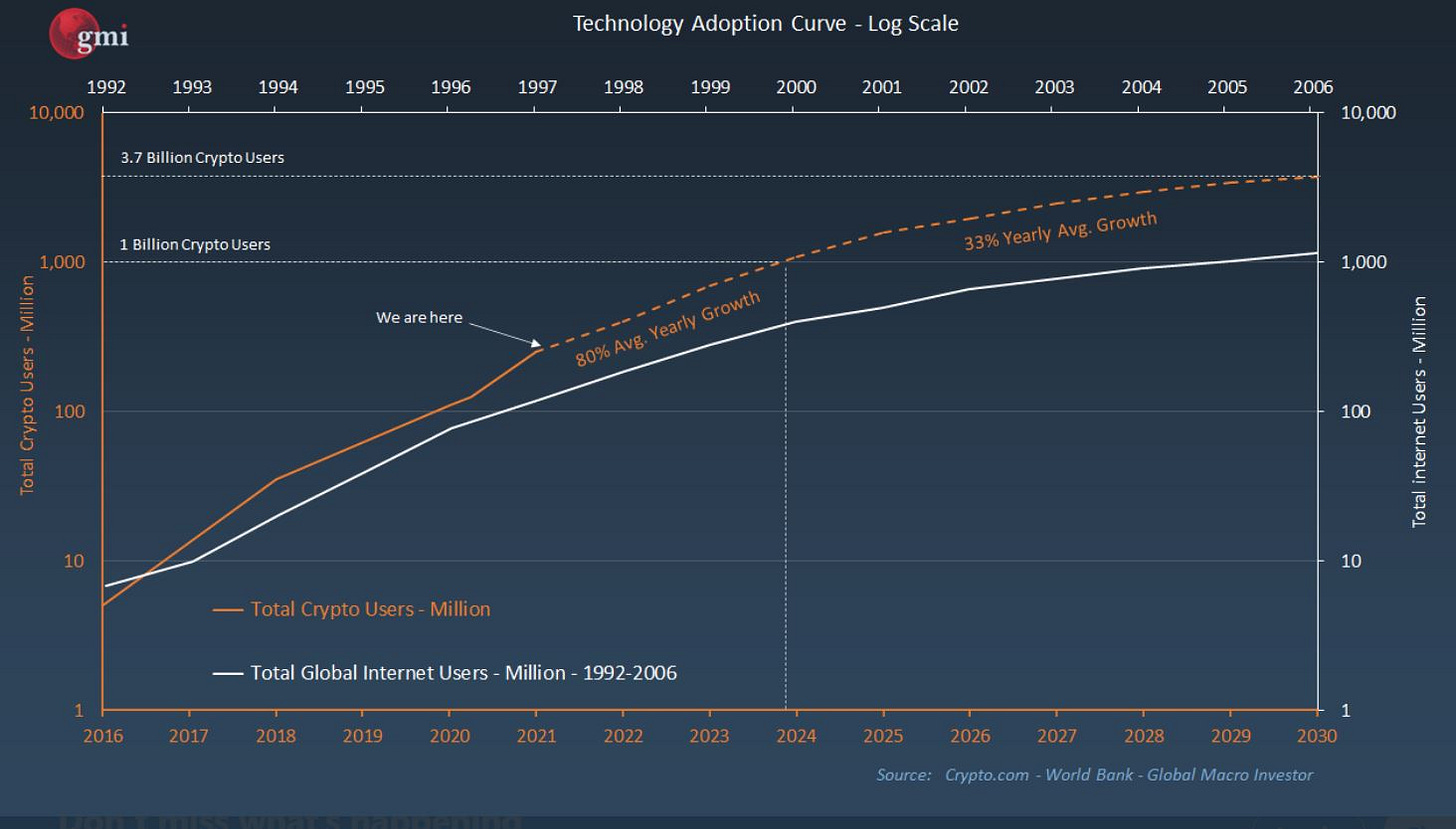

The crypto market has an average growth rate of 113%/year. For reference, the internet peaked at 63%/year. In terms of adoption, crypto today looks like the internet in 1997. If we continue at the pace we are on (with growth slowing after its peak), we should surpass 1 billion users around 2024. It’s possible we’ll see 3-4 billion users by the end of this decade. That’s how massive this opportunity is.

Today the total market cap of crypto is about $2.2 trillion.

The global bond market is over $200 trillion, with $18 trillion of that carrying a negative real interest rate 🤯. The real estate market is over $200 trillion. Global equities are over $100 trillion. Fine art is $17 trillion. Gold is $12 trillion.

We should expect crypto to eat into the value of these global asset classes in the coming years.

And that’s why you’re here.

To separate the noise from the signal. I want to make sure you don’t fall into the trap of your skeptical friend or family member. To help you stay curious. To identify the big, high-level moves. And then find the opportunities within those moves.

————-

Below are some additional trends within the macroeconomic, social/demographic, and technology environments that give us great conviction when assessing the probability of accelerating crypto adoption in the coming years:

Blockchain Technology - we haven’t even come close to seeing the power of blockchains just yet. Blockchains offer superior payment settlement rails since they are open 24/7, 365 days/year. Instant and final payment settlement means velocity in crypto networks is astronomical compared to fractional reserve bank money settlement. Blockchains remove friction and unnecessary middlemen/intermediaries. This compresses costs and accelerates efficiencies within the user experience for consumers. Public blockchains are also more secure since there is no central server for bad actors to attack. Furthermore, blockchains introduce triple entry accounting - debits and credits are recorded for all transactions (much like today), but the network of decentralized computers also records each transaction. This functions as an automatic audit - data is indexed, time-stamped, and validated on all computers on the network.

History of Open Source Protocols - Open source computer protocols collapse the cost of existing technologies which allows for a new layer of value creation to enter the market. We saw this in the ’60s with IBM. IBM had the market for computer hardware until the microprocessor was invented. This was an open protocol that collapsed the cost of computer hardware and allowed competition to enter the market. Microsoft came onto the scene, created computer software, and owned that market until open-source software was introduced with Linux in the early ’90s. The open computer hardware and software era lead to the internet and the data layer we find ourselves in today. Google, FB, Amazon, Netflix, etc. are companies that have created monopolies around charging for access to data or charging for a proprietary service based on proprietary data. Blockchains are an open protocol on top of this layer that is poised to disrupt these data monopolies.

Smart Phone adoption - This is a really important metric to keep an eye on. About 83% of the world's population has a smartphone today (up from 49% in 2016). As emerging markets continue to scale up the use of smartphones, we should expect to see increased adoption of crypto. Remember, all you need is a cell phone and an internet connection to participate. The expansion of internet infrastructure as well as 4G and 5G networks are also playing a part. As a point of reference, we can think about the impact that smartphones had on the growth of FB, Instagram, Snapchat, etc. We should anticipate the same with crypto.

Macroeconomics - Debt to GDP levels are at all-time highs around the world as we enter the final stages of the long-term debt supercycle we are in today. For reference, the last time we were at these levels was right after WWII. We got a new monetary system at that time via the Bretton Woods Agreement. Interest rates on sovereign debt are exceedingly negative around the world. Today, $18 trillion of sovereign debt is producing a negative real yield. When interest rates are pinned at the zero bound (as they are today), monetary policy has almost zero stimulative effect on an economy. This is why we’ve seen an unprecedented fiscal response from Congress in dealing with Covid. We should expect more, not less of this. The end result does not look great - governments have 4 options when we reach the end of the long-term debt cycle: 1) austerity, 2) print money, 3) raise taxes, 4) revolution/war. 3 out of the 4 are not politically palatable. Therefore, we should expect more printing, currency debasement, and the social problems that can arise from that.

Shift in Demographics - Millenials (now the largest generation) and Gen Z favor innovation and change. They grew up in a world of cell phones. A world of gaming. The digital world. Crypto is intuitive to them. Meanwhile, Baby Boomers are aging out of the economy at a blistering pace. The last of the baby boomers are set to retire around 2031. This means that the future tech and economic growth will be coming from millennials and the younger generations. Do you think they want change or the status quo? Furthermore, millennials do not trust our institutions today. Many are still scarred from the aftermath of the Great Recession in 2008. A 2018 study by the World Economic Forum (30,000 sample size) indicated that 77% of millennials believe “the whole financial system is designed to favor the rich and powerful” and that “it’s only a matter of time before the bad behavior of the financial industry leads us to another global financial crisis.”

Follow the Money - venture capital continues to pour into the space. Just like the gold rush, where you could mine gold or you could build picks and shovels. Today we can mine Bitcoin and others can build products and services that will allow the general public a friendly user experience when engaging with crypto in the near future. Andreesen Horowitz's recent $2.2b venture crypto fund, as well as the lobbying power crypto recently displayed in Congress, are clear signals rather than noise.

A Paradigm Shift - Decentralized crypto networks are positive-sum games. This creates an economic incentive structure that is a complete paradigm shift from what we have today. In decentralized networks, users provide services for the network and are economically incented to do so. Here are a few examples: Bitcoin miners secure the network and validate transactions. They are incentivized to provide these services because they receive a bitcoin subsidy and fees for doing so. Uniswap is a decentralized exchange. Users supply liquidity and are paid to do so in the form of fees from traders. This is akin to being paid by the Facebook network for sharing your data. While most technologies today tend to automate workers on the periphery doing menial tasks, blockchains automate away the center. Instead of putting the taxi driver out of a job, blockchain puts Uber out of a job and lets the taxi drivers work with their customers directly.

We’ve covered the high-level, big picture here. Next, we’ll review crypto cycles and use blockchain data to get an idea of where we are at currently in this cycle.

Thanks for reading and for your support. Feel free to respond to this email or leave a comment if you have questions or would like me to explore a particular aspect of DeFi.

Take a report and stay curious.

_______

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.