Web3 Domains

And a deep dive on Ethereum Name Service

Hello readers,

It’s time for a quick reprieve from bank runs, bailouts, and finger-pointing. This week we cover the business model of web3 domain services. We think web3 domains could be a massive business if crypto truly goes mainstream. Why? *Everyone* could ultimately own a web3 wallet — making human-readable digital wallet addresses potentially as prevalent as email addresses.

In this report, we cover Ethereum Name Service — the largest web3 domain provider in the market today. Topics:

Business Model of web3 Domain Naming Services

Network Effect & Financials

Tokenomics

Valuation/Addressable Market

Technology & Roadmap

Core Team/Backers

DAO Governance/Community/Social

Competition

Risks

Disclaimer: Views expressed are the author's personal views and should not be taken as investment advice. The author is not an investment advisor.

The DeFi Report is an exploration of the emerging web3 tech stack and an ongoing analysis of where value could accrue. We provide data-driven analyses of DeFi and web3 business models.

Let’s go.

The Business Model

We find it fascinating to uncover various parallels between the early days of the internet, and the early days of crypto. Ethereum Name Service is a fantastic representation of this. Before web domain names were introduced in 1986, internet users would identify websites with IP addresses — a random string of numbers. Each computer on a network would recognize and identify each other this way, enabling the sharing of data amongst computers.

Of course, this was not scalable. The internet could not go mainstream until IP addresses were mapped to human-readable domain names or URLs.

Today, the Internet Corporation for Assigned Names and Numbers (ICANN - a non-profit) manages the top-level development and architecture of the internet domain name space. ICANN authorizes domain name registrars, through which domain names may be registered or reassigned to end users/registrants. The high-level process is below.

If we were to map this process onto a web3 protocol such as ENS, we would see that in some cases, ENS acts as the base infrastructure (ICANN), the registry operator, *and* the registrar (GoDaddy, domains. com, etc.).

Today, crypto wallet addresses look similar to website IP addresses back in 1986. On the Ethereum network you get something like this: 0xd85f8858478a054d3ea67e8fb3d088b2ec86edce

Services such as Ethereum Name Service (ENS) make wallet addresses human-readable. So that they look more like this: michael.eth.

Crypto addresses can be more than just digital wallets. They can represent websites, identities, messaging services, and more. In terms of websites, ENS currently supports .com, .org, .io, .app, etc. Browers currently supporting ENS include Brave, Opera, Status (mobile), and MetaMask (mobile).

Today we have human-readable website addresses represented by extensions such as .com, .org, .net, .edu, .gov, etc. ENS introduces .eth to the world and seeks to be the #1 domain/address registry for the Ethereum Network — allowing crypto users to easily identify each other with human-readable blockchain addresses or wallets. ENS will not disrupt traditional domain names for websites. Rather, the protocol is built to integrate directly with traditional .com, .org, .edu domains — bundling content, blockchain native payments, and custody of digital goods (NFTs) into the same user interface.

The ENS protocol makes money by selling new address registrations and renewals. Users pay upfront for a set number of years for their crypto domain/address, with renewal fees driving further revenue.

The protocol produced $55m in 2022 and $4.8m so far in 2023.

Network Effect

ENS derives its network effect directly from Ethereum, the largest smart contract platform in the market today. As a layer 1 blockchain, Ethereum controls nearly 80% of the market in terms of developer talent, applications, value locked, revenues, developer tooling, and standardization (token standards, programming languages, EVM, etc.)

If you believe web3 will go mainstream, and Ethereum will be one of the major public blockchains, then a bet on ENS essentially acts as a leveraged bet on Ethereum (without the leverage).

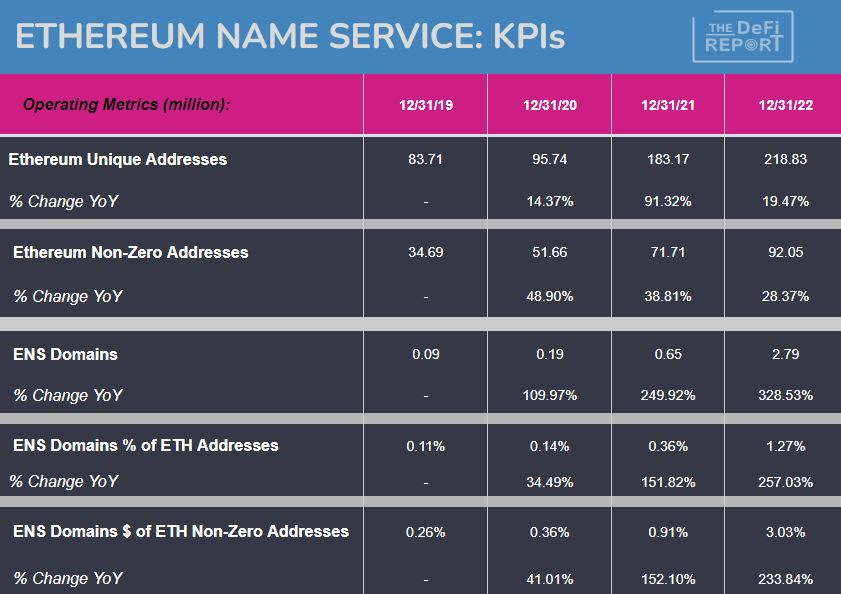

Here’s a quick view of ENS adoption so far as it relates to the number of Ethereum wallets:

There are currently over 95 million non-zero Ethereum wallet addresses globally. Meanwhile, only 2.8 million of those addresses are human-readable using .eth. About 3%. That’s a big gap. We think the vast majority of those wallet addresses will want to be human-readable at some point. Of course, our assumption hinges on mainstream adoption and use cases that make human-readable wallets a necessity. We like our chances given demonstrated growth rates.

In terms of renewals, on-chain data indicates an approximately 50% churn rate on average — showing pretty sticky users. And when we look at overall registration growth, .eth is growing 228%/year over the last 3 years.

On-Chain Financials

We can see that the protocol is growing in terms of new registrations and revenue. Meanwhile, ENS has had zero token incentives to date — a positive sign for product/market fit. On the expense side, the DAO burned $1.27 million on its core working groups in the second half of 2022 — demonstrating what appears to be an efficient operation.

Furthermore, ENS has one of the largest balance sheets in crypto — currently over $900 million locked in the DAO treasury. We’ll note that the treasury is held predominantly in the ENS token, so there is certainly some downside risk. With that said, the project development is capitalized primarily by user revenues and has a healthy balance sheet that can withstand a downturn in the market. Per the DAO wallet address on Etherscan, the treasury currently holds about $17 million in USDC, $24 million in ETH, and $132 million in ENS token. The remaining value represents unvested ENS tokens.

Tokenomics

ENS has a max supply of 100 million tokens. Currently, 25.7% of the supply is circulating in the market. The distribution is as follows:

25% to early .eth holders — based on the total time an address has held a domain. These tokens are fully unlocked and distributed.

25% to ENS early contributors (>100 individuals, groups, and >450 active Discord users). 24% are currently unlocked with the remaining allocation unlocking on a linear 4-year vesting schedule. 13,369 tokens/day or $159m/day at current market prices. The core contributor tokens will fully unlock at the end of 2025.

50% to the DAO community treasury. 10% (5 million tokens) of the allocation was available to the DAO at launch, with the remaining allocation unlocking over a 4-year vesting period. 24% are unlocked with the remaining allocation unlocking at a pace of 30,801 tokens/day, or $369m/day at current market prices. The community allocation will fully unlock at the end of 2025.

There are currently over 64,000 token holders. The largest wallet addresses outside of the DAO appear to be two Binance exchange accounts making up a total of 5.2% of the supply.

There are no outside investors or VCs involved with ENS as the project was spun out of the Ethereum Foundation and functions as a non-profit. This helps to reduce risks associated with large insider selling, but we should be aware that early contributors could have large allocations that are unlocking on a linear schedule. And while there are a lot of tokens unlocking on a daily basis, we should keep in mind that the DAO cannot spend these tokens without community approval. In fact, the community recently voted to sell some ETH to cover operating costs for the next few years.

Valuation & Addressable Market

Current Token Price: $12.63

Current Market Cap: $256 million

Fully Diluted Market Cap: $1.26 billion

365-Day Revenue: $50.98 million

365-Day P/S Ratio: 24.71 (fully diluted)

There are currently 95 million non-zero Ethereum addresses — a figure growing at an average rate of 39%/year over the last 3 years. About 3% (2.79 million, 228% avg. 3-year growth rate) of these addresses today have a .eth domain extension.

Base Case

A base case could assume a 30% growth rate in non-zero Ethereum addresses over the next 3 years. This would take us to over 200 million non-zero addresses globally in 2025. If we assume a conservative 30% increase in ENS domains (228% avg. 3-year growth rate) over the same time period, this would get the network to over 13.5 million ENS domains, or 6.6% of all non-zero ETH addresses. At $15/year/address (avg. $19.71 last year), it adds up to $200 million in recurring revenue for the protocol.

Bear Case

A bear case could assume a 15% growth rate in non-zero Ethereum wallets, a 15% growth rate in ENS addresses, and $10/registration/year. This equates to about $64 million in ARR.

Bull Case

If non-zero Ethereum address growth *and* ENS addresses were to accelerate in the coming 3 years at a rate of 45% per year, at $15/ENS address the network could get to nearly $400 million in ARR. In this case, we would have over 280 million non-zero accounts by 2025 and over 9% of those addresses would have .eth extensions. 280 million Ethereum addresses would represent just 5% of global internet users.

If Ethereum were to reach 500 million non-zero addresses (8.9% of internet users today), and 15% adopted a .eth address at an average cost of $10, this would equate to $750 million in revenue.

Relative Valuation: ENS’ web2 counterpart is Verisign — a mature company now trading at a P/E ratio of 31.7 and a $20 billion market cap. We think ENS has the potential to be an even larger business than Verisign because we believe the vast majority of web3 users will have a web3 domain if Ethereum goes mainstream — rather than a relatively small % of internet users who own web domains today.

Tech & Road Map

ENS’s tech is fairly straightforward. The registry consists of a single smart contract that maintains a list of all domains and subdomains while storing 3 critical pieces of information about each:

The owner of the domain (the blockchain native address)

The resolver for the domain (translates the name into the address)

The caching time-to-live for all records under the domain

The owner of a domain may be either an external account (a user) or a smart contract. A registrar is simply a smart contract that owns a domain and issues subdomains that follow some set of rules defined by the contract. A sub-domain for thedefireport.eth could look something like this: pay.thedefireport.eth.

The team is currently focused on integrations, PR, and marketing per a recent town hall. Coinbase is currently working with ENS to offer Coinbase managed web3 usernames to its 110 million verified accounts. In this case, “cb.id” is a registrar on top of ENS, and the sub-domains are user addresses — for example, mike.cb.id would sit as a subdomain under Coinbase’s cb.id domain name. This then allows Coinbase users to leverage human-readable coinbase accounts for transfers rather than the random string of numbers and letters tied to their Coinbase accounts today.

Audits. We can’t forget audits. The ENS smart contracts have been audited by Consensys and ChainSecurity.

Core Team/Backers

ENS is a project that was originally seeded with a grant from the Ethereum Foundation. It officially functions as a non-profit incorporated in Singapore and has three directors: Nick Johnson, Brantly Millegan, and Kevin Gaspar. Vitalik Buterin, the founder of Ethereum, is a supporter of the ENS team, and highlighted the project in a recent blog post titled “What in the Ethereum ecosystem excites me.”

To facilitate upgrades and maintenance, the ENS root is controlled by a four of seven multisig, with members of the core team and related projects as keyholders. In the long run, the protocol plans to replace the root multi-sig with a form of distributed decision-making as systems become available. The multi-sig signers are below.

Nick Johnson - ENS

Dan Finlay - MetaMask

Aron Fischer - Colony

Martin Swende - Ethereum Foundation

Sergey Nazarov - Chainlink

Taylor Monahan - MyCrypto

Jason Carver - Ethereum Foundation

DAO Governance/Community/Social

ENS is a non-profit organization running the infrastructure for web3 naming through ENS Labs. The idea is that internet naming is basic internet infrastructure. It shouldn’t be owned by a single centralized entity — just like base layer internet protocols like SMTP (email) are not owned by anyone. The ENS constitution provides a set of binding rules for what governance actions are legitimate for the DAO to take.

As far as “crypto presence,” ENS is quite strong. The twitter account has over 240,000 followers. The discord channel has over 43,000 members, and the LinkedIn account has over 17,000 followers.

We’ve observed that many Twitter users now display their .eth address as part of their public-facing profile — a way to show “social proof” that users are “crypto native.” This could serve as a powerful form of organic marketing for the protocol.

Competition

Unstoppable Domains is ENS largest competitor today. Unfortunately, they leverage a web2 business model. Therefore, we do not have transparency into their financials or growth besides what they report internally.

Unstoppable Domain registrations are good for life, so there are no recurring revenues. The benefit to users is that they never have to think about renewing or dealing with their domain expiring and someone else snatching it from them. By contrast, ENS domains are registered annually or for several years at a time. Both solutions are ERC-721 tokens (NFTs). Unstoppable domains offers a variety of extensions across various chains: .zil, .888, .dao, .blockchain, .x, .nft, .wallet, .crypto, .bitcoin. Meanwhile, ENS offers one extension on the Ethereum Network: .eth.

Both products offer the ability to integrate with other networks/wallets, and both offer subdomains. For example, a user can set up thedefireport.eth, and then pay.thedefireport.eth.

From what we can see, ENS is currently a more popular domain provider within the Ethereum Network. As mentioned, .eth domains are being used on Twitter as a social signal that you are “deep into crypto.” We think this is quite powerful, and could put ENS in the drivers seat to capture the majority of the crypto domain market within the Ethereum Network (80% market share). We expect Unstoppable Domains to compete across a more horizontal market within each layer 1 ecosystem.

A final thought on competition: we think that ENS’ stance that “web3 domains are public infrastructure” could prove to be a powerful business strategy amongst crypto natives. We’ve seen the power of open-source projects when compared to closed source. ENS vs Unstoppable Domains has a bit of a (monetized) Wikipedia vs Encarta feel to it. As Joy’s law states: “no matter how many smart people work at your company, there are more smart people that work outside your organization.” Open-source tends to win long term. Competing centralized solutions backed by venture capital could have a hard time overcoming narratives + the power of open-source if their solutions do not offer clear differentiation.

Risks

ENS is built on the Ethereum blockchain and is therefore tied to its adoption and growth. Ethereum’s 80% dominance for smart contracts is defensible in the short to medium term. However, competitors could cut into market share over time. Each blockchain network will likely have its own domain extension. For example, ENS’ counterpart in the Solana ecosystem is Bonfida — which introduces the .sol extension for web3 domains.

There is also smart contract risk and treasury risk — as assets in the DAO are predominantly held in the native token.

Verticals such as DNS naming services typically tend to gravitate to winner takes most market dominance. Instructive is the .com extension which still controls over 50% of all internet domains. There are two dominant players in web3 today: ENS & Unstoppable Domains. The business models are quite different, and so it remains to be seen if users will gravitate more toward the “domain for life” model of Unstoppable Domains or the recurring revenue model of the .eth extension.

ENS is still a very young project. A lot of decisions today come down to a multi-sig controlled by 7 individuals acting as the “ENS Board.” For the project to succeed long term, we need to see 1) a growing developer base, 2) integrations with ecosystem infrastructure, 3) ongoing maintenance of the smart contracts, 4) effective marketing, and 5) responsible management of the DAO treasury. We’ve seen execution in these areas and will continue to monitor the project.

Thanks for reading.

If you got some value from the report, please like the post, and share it with your friends, family, and co-workers so that more people can learn about DeFi and web3.

This small gesture means a lot and helps us grow the community.

If you have a comment, thought, or idea, drop it here:

Finally, we provide “analyst as a service” consulting for family offices, investment banks, HNWs, hedge funds, start-ups, and more. Our Starter Pack will get you up to speed with a profesional crypto framework without needing to hire an analyst or a data scientist. To learn more, reach out at mike@thedefireport.io

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.

Considering mainnet is very expensive for retail, and the masses are retail users, does ENS work on layer 2? do you see this as a risk?