TradFi Meets DeFi - A Market Analysis

High inflation means interest rates are rising. What does this mean for risk assets and crypto?

Hello everyone,

We’re back in the saddle after a week off last week. In the short term, we’ll be moving to a twice/month schedule. The DeFi Report is currently a one-man show and it’s always a balancing act between my time here and working for a high-growth start-up on the front lines of this innovation and growing ecosystem. My goal is to continue to give you a boots-on-the-ground perspective of this budding industry and ecosystem. We’re in talks that will bring more resources to The DeFi Report, but for now, we’ll focus on the twice/month schedule. More to come on this front!

This week I want to take a high-level look at the traditional markets and tie that into what we are seeing in crypto. Topics covered:

Inflation

Interest Rates & the Economy

On-Chain Crypto Data and Market Metrics

If you are new to the program and would like to subscribe to have these free reports land in your inbox as they are published, drop your email below:

Let’s go.

Interest Rates

The market has decided that inflation is not transitory. As a result, interest rates have been on the rise:

Source: Ycharts

And when we look at the short end of the yield curve, we see an even larger move:

Source: Ycharts

Finally, below we can get a view of the full yield curve to see that it is flattening out. While the 30-year bond has not moved much, the short end is rising:

Source: Treasury.gov

Meanwhile, the recent week ending January 8th was the worst week in terms of bond prices in 49 years for the 30-year treasury note (49 years is as far back as the data goes). It lost 9.35% in one week! And it only took a move from 2.01% to 2.11% for this to occur.

The reason I am sharing this is that the bond market leads ALL markets. When we see big moves in credit markets, it is only a matter of time before it hits equities and other assets like real estate. Fast forward to today and what do we see? Huge sell-offs in high-growth tech and crypto.

It remains to be seen if the pain will stop here. If rates continue to rise, or the market expects them to continue to rise, we could see the sell offs bleed into the entire equity market and potentially real estate. This will depend on what the Fed does. This tweet thread by Jim Bianco does a great job of breaking down the bond market and what we can expect moving forward.

Inflation

Inflation is driving these moves in the market. At 7% CPI (if you measure with a manipulated figure), holders of US treasuries are dealing with a negative real return of over 5% on the long end of the curve. Monetary repression is at play - anyone holding US treasuries thinking they are risk-free assets might be confused. An asset that loses 5% in purchasing power is fundamentally not risk-free. Will the holder of bonds be paid back? Yes. But they will be paid back with less purchasing power.

Imagine this: I borrow $10 from you and guarantee to pay you back with 2% interest. But in the meantime, I print so much money that I just pay you back with dollars that buy you 7% fewer goods and services. This is not risk-free - you lost 5%. The idea that treasury bonds are risk-free because the Gov’t can just print money or increase taxes is a farce when we factor in the difference between real returns and nominal returns. But can’t the Gov’t just raise taxes to pay back the debt? Imagine if I borrowed $10 from you and couldn’t pay you back so I raised your taxes? I just took more of your money to pay you back. Is that risk-free?

So, naturally, interest rates have to move up. The Fed can only keep this ruse going for so long before people (like massive pension funds holding bonds) start to look around wondering what the hell is going on.

And when interest rates move up, the bond market will suck in money from all other asset classes. The first area it will draw from is risk assets as we see today. Why? Because the risk/reward analysis changes for assets that are perceived to be riskier by the market (like pre-profitable tech and crypto) as interest rates move up. And so the long end of the risk curve is the first to feel the pain. We also see investors simply switching out to dollars. The result? Demand for dollars is increasing. We can see this below. Watch out if the dollar on the DXY gets over 100. This could cause issues in emerging markets that earn revenue in their weaker local currencies but have dollar-denominated debts.

Source: Trading View

The Fed is Choosing Winners and Losers

It’s important to note that the Fed is stuck between a rock a hard place. They have 2 options, neither of which are ideal:

1. Keep interest rates low, and let inflation run hot. Negative real yields on bonds will continue to increase. Stocks, bonds, real estate, crypto, etc prices would continue to rise. This will create a glaring and accelerating separation between main street (the real economy) and wall street (the financial economy). The risk here is that inequality will continue to increase. The bottom 40% of the country has less than $1,000 in savings per a recent Fed report. These folks will suffer greatly. They do not own assets to offset higher prices. When they go to the grocery store and the gas pump, their earnings are buying them fewer goods and services. This is a straight-up tax on the poor. We should expect to see populism and growing social and political angst if this path is chosen.

2. Increase interest rates to stifle inflation. This is the path they are signaling to the market. This will dry up the excess liquidity in the market and cause a sell-off of financial assets. How bad will the pain be? We are starting to find out.

In my opinion, this is becoming a political issue. Biden’s approval rating is at an all-time low today and is currently lower than Trump at this stage of his tenure. While Covid is raging, in my opinion, the approval rating is a very clear indicator that inflation is causing major problems for the bottom half of our country. We are seeing this in the polling.

So we have a choice: try to tame inflation and potentially destroy the financial markets, or let inflation run and destroy the purchasing power of the bottom 50% of the country. Does anyone want Jay Powell’s job?

Important Note

The reason the Fed is in this predicament is very simple. Our financial system is a Ponzi scheme - it’s just not obvious because there is a money printer underpinning it.

The bottom line is that there is never enough money in the financial system to pay back the debt.

This can be explained very simply: every dollar that comes into existence is a dollar of debt. But that dollar of debt must be paid back with interest. So, where does the interest come from? It must come from the dollars that are already in circulation. We didn’t create extra money for the interest payment. So, naturally, there is never enough money in the system to pay back the debt. This is why we go through approximately 75-year long-term debt cycles. It has played out throughout history like this. And when you get to the end of the cycle, the amount of new money that must be created has to grow exponentially to ensure the existing mountain of debt can be serviced. It’s no surprise that the Fed’s balance sheet looks like it does below. It’s also no surprise that it is increasing exponentially at the end of the cycle. This helps to explain why we had to print over 30% of all money ever created to get through Covid - to service existing debt and keep the system intact. If you’re curious, we are in year 78 of the long-term debt cycle. We got a new monetary system via the Bretton Woods agreement in 1944 when the last cycle ended. Of course, the Bretton Woods agreement was broken when Richard Nixon removed the gold peg to dollars and defaulted on the rest of the world to pay for the Vietnam War. We have been in a fiat standard now for 50 years, where the dollar has no backing.

Source: Federal Reserve

Transitioning to Crypto: On-Chain Data

Let’s take a look under the hood to see how the volatility is impacting on-chain metrics. I’m using Bitcoin here as it still leads the entire crypto market.

Market Value to Realized Value

Below we can observe Bitcoin’s MVRV Z-Score. It measures the price of Bitcoin relative to its Realized Value (the avg. price each coin was purchased at). As we can see, the best time to buy Bitcoin has been when this metric gets into the green area. We are very close today. When we get into the green, it is typically a sign that the sell-off is bottoming out.

Source: Glassnode

Realized Profit

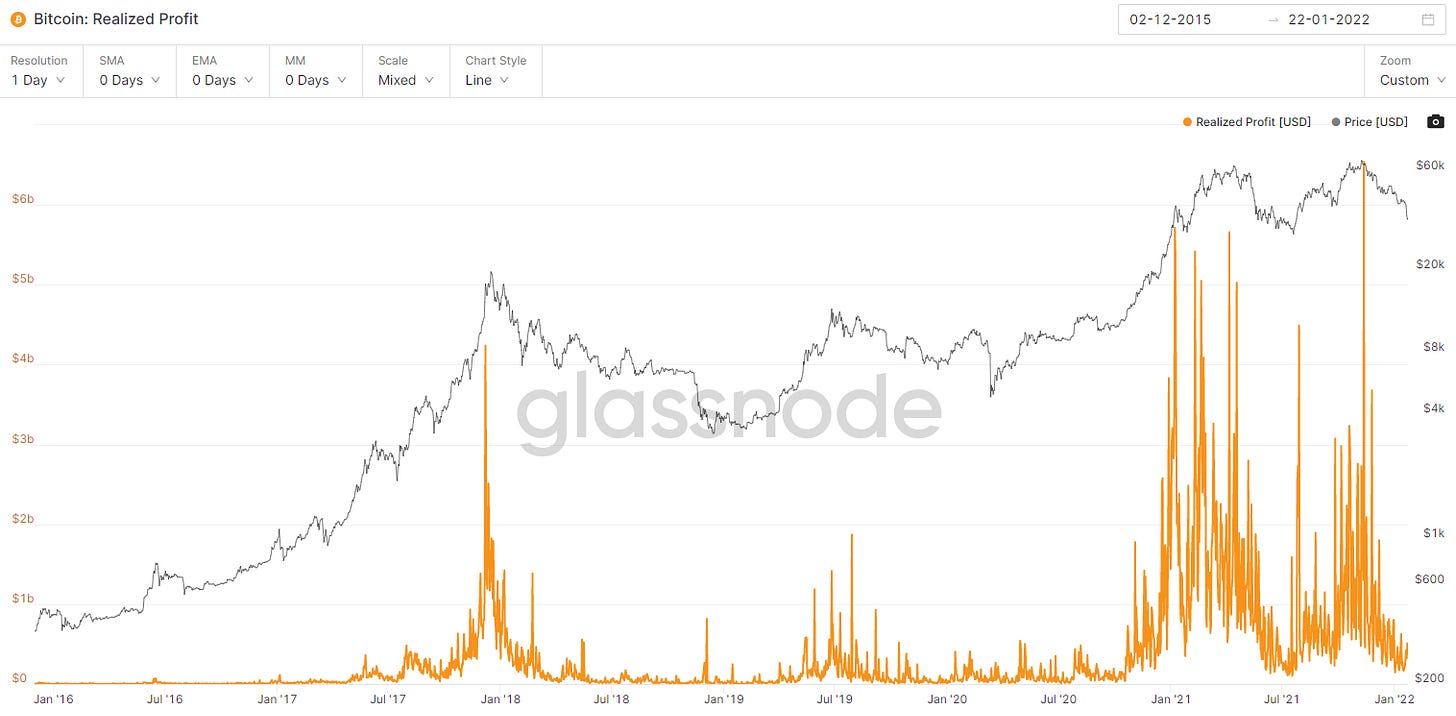

Realized Profit measures the total profit (USD value) of all coins moved whose price at their last movement was lower than the price at the current movement. As we can see, the best time to buy Bitcoin is when Realized Profit is very low. This metric is also flashing a buy signal.

Source: Glassnode

Puell Multiple

The Puell Multiple measures the daily issuance value of Bitcoins (in USD) by the 365 day moving average of daily issuance value. When we get into the green band, it has typically been a good time to buy Bitcoin.

Source: Glassnode

Coin Movement On/Off Exchanges

We use coin movements to get a sense of what long-term holders are doing. These are the folks that buy their bitcoin and move it into cold storage off of the exchange. When coins are flooding into exchanges, it is typically a sign that investors are sending them in to convert to fiat. We are not seeing high volumes of coins moving onto exchanges today. In fact, this metric just flipped back to net coins moving off of exchanges - a sign that long-term holders are already back in the market buying Bitcoin.

Source: Glassnode

Derivatives & Trader Sentiment

Below we can see that BTC funding rates are deeply negative. This means traders shorting the price of Bitcoin are paying those on the long side of the trade to keep their position open. When sentiment is extremely bearish as it is today, we tend to get a set up for a short squeeze if the price starts to move in the other direction. Something to keep an eye on as these shorts will be liquidated fast when the price reverts.

Source: Coinglass

Futures Open Interest

Futures Open Interest has not yet flushed. We can see below that there are still significantly more futures contracts open than what we saw after the last significant price correction in May of 2021. We’ll need to keep an eye on this - this is the one indicator that makes me think we could see prices drop a bit more. The options open interest chart looks similar to this one as well.

Source: Coinglass

Conclusion

When we look at the on-chain data we see indicators that are signaling that it’s a pretty good time to buy crypto. With that said, the macroeconomic picture is playing an accelerating role in the flow of capital into crypto markets. If we continue to see interest rates rise, we could see further pain for risk assets.

On the other end of this, when the market stabilizes, and if for some reason rates end up dropping, we should expect risk assets to bounce back fast.

Finding the bottom of bear markets is not easy. The on-chain data helps, but we also need to factor in the macro picture in traditional markets.

Furthermore, historically, the bottom of bear markets does not move much past Bitcoin’s Realized Value (the avg. value of all coins purchased in circulation). Today, this number sits around $25k. However, that figure includes a large % of coins that were purchased or mined in the early days and are lost. If we think about the buying activity over the last few years and back out the lost coins, we could estimate Realized Value to be closer to the market price we see today.

We could also look at the cost to mine 1 bitcoin with an Antminer S19j Pro 100 th/s asic mining machine (latest tech). Based on current CAPEX prices and cheap energy at 5.5 cents/kWh, we get to about $20k.

I hope this helps us all get a better sense of the market as we move further into what could be an interesting year in financial markets.

___

Thanks for reading and for your continued support. If you have a question, comment, or thought, leave it here:

And if you’re getting value from these reports, please share them with your friends, family, and social networks so that more people can learn about crypto and this exciting new innovation.

Finally, if you would like to send me a tip, you can do so through the addresses below. If you do send a tip, please be sure to let me know so that I can send you a thank you note.

Bitcoin: bc1qghetd4g3lk7qnsn962amd9j92mkl4388zxz0jz

Ethereum: 0x084fcd3D9318bAa383B9a9D244bC0c32129EE20E

___

Take a report.

And stay curious my friends.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.

As always, thank you for your informative analysis.

PS- I’ve thought that the term, ‘transitory inflation’ was just gobbledygook FED-speak!