The DeFi Report Responds to the Bank of International Settlements

And a note about Inflation & the Economy

Hello readers,

The Bank of International Settlements published a report recently titled “DeFi Risks and the Decentralisation Illusion.”

Shout out to the CEO of Inveniam, Patrick O’Meara, for initially raising awareness around the article. Since the BIS report made some bold one-sided claims about DeFi, I thought it would be good to address a few of the key points raised in this week’s report.

I’m also going to touch on inflation/the economy and the narrative coming from the Fed and other Gov’t officials. It seems necessary to address this since it helps us see the messaging and narrative coming from these agencies for what it is.

Topics covered in this report:

Inflation/the economy & narratives

The “illusion” of decentralization

Excessive leverage and concentration of power in DeFi

If you haven’t subscribed to The DeFi Report and would like to receive these reports directly to your inbox as they are published, drop your email below:

Let’s go.

As a quick reminder, this man above has been telling us that inflation is “transitory” for over a year now. Look, I don’t blame him. He has to say this. He has to control the narrative. And that’s why we have to take what he says with a grain of salt.

It’s interesting because I looked back at the messaging out of the Fed in the highly inflationary decade of the 1970s. They were using a special term to describe inflation back then as well. You guessed it. “Transitory.” It was “transitory” back then until it peaked at 20%.

But there was a big difference in the 1970s:

Source: Federal Reserve

The United States debt situation was actually quite healthy in the 70s. This is critical in dealing with inflation.

The Fed had an out in the 70s. They could raise interest rates, stifle demand for loans, cut off the flow of easy money in the economy, and bring inflation down to more normalized levels.

This is exactly what they did. Interest rates went as high as 20%. The result? Two recessions in the 70s, and two more in the early 80s (the gray lines in the chart indicate recessions). This is how you deal with inflation. You raise interest rates. The economy suffers. You take the pain pill and allow creative destruction to cleanse the economy of its excesses.

Things are different this time.

Why?

Debt to GDP is at its highest level since WWII. If the Fed were to significantly raise interest rates they would stem the flow of easy money in the economy and kick off a recession. The issue here is that we have a house of cards of debt that could deleverage and unwind itself. The economy is crippled with debt. Debt weights on production. So, we are essentially printing money today to service the existing debt. Congress just raised the debt ceiling by $2.5 trillion so that we can keep printing and paying our bills. You don’t have to be an accountant to know that you cannot solve a growing and unsustainable debt problem by creating more debt.

Reversing the Ponzi scheme would essentially expose the house of cards to a massive deleveraging event that could rival the great depression.

So what does the Fed do? They continue to expand the money supply and adjust the inputs of the CPI calculation. They shore up their messaging and say it’s “transitory.” This obscures the real impact of inflation on taxpayers. We essentially gaslight people into thinking they are doing something wrong as their purchasing power is eroded away from them. This will continue until the rubber eventually meets the road. What that looks like is anyone’s guess.

Inflation is ultimately a tax on the poor. We can observe this by following the flow of funds - first into stocks, real estate, and other financial assets (benefits the wealthy). Then we see rent prices rise (again, benefits asset owners). Finally, we see food, commodities, and consumer staples rise (hurts everyone). The Dollar Store raising their prices by 25% is representative of this. Does anyone believe that the customers of the Dollar Store received 25% raises to offset these increases? Or that their loss in purchasing power is offset by their asset holdings? [hint: they don’t own financial assets]

If you’re interested in how the CPI inflation number is manipulated you can read this.

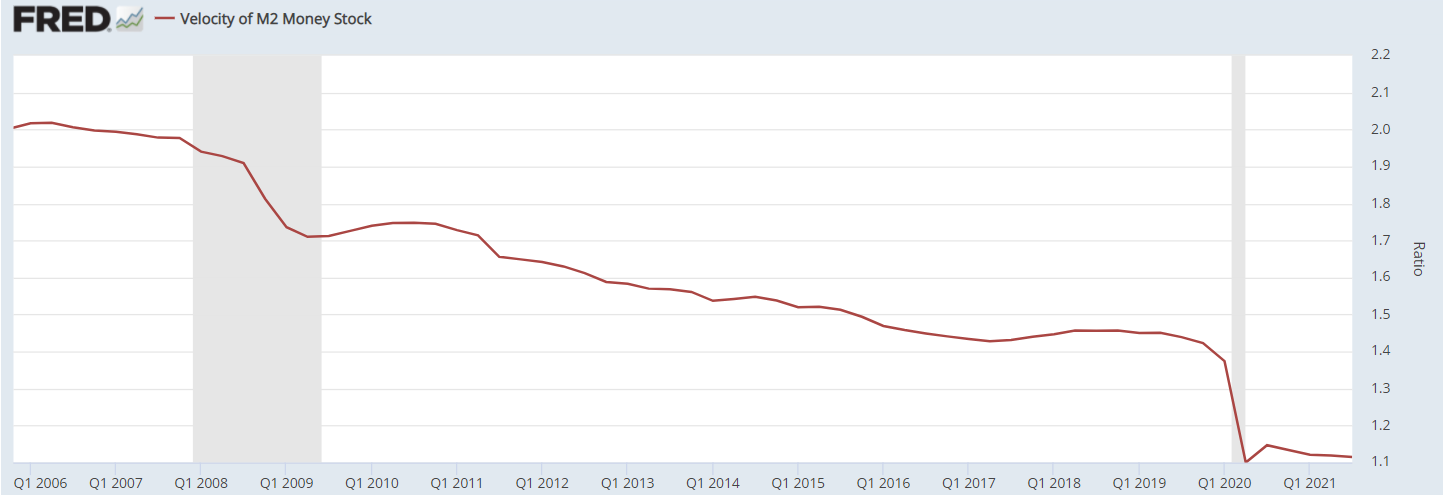

To be clear, I have no idea if inflation will continue to persist or even accelerate. I’m concerned about all of the excess money printing via loose monetary and fiscal policy. And we’ve got supply chain issues and worker shortages. But I am also concerned about shifting demographics, accelerating deflationary tech advances, and the impacts of Covid on the economy. When we look at the velocity of the M2 money stock since the Great Recession, it becomes abundantly clear that something is dramatically off in our economy. In particular, M2 velocity is now at a level equal to the Spring of 2020 lockdown period. Money is not moving. So, while M2 money stock is WAY up, it is not being passed around in the economy. This is deflationary, not inflationary. This is telling us that the treatment (money creation) is simply not resulting in real economic activity. The patient is not getting better. The law of diminishing returns comes to mind.

Source: Federal Reserve

The reason I bring this up is so that we can see the narratives for what they are. A big fancy title, a nice suit, and the ability to eloquently use the term “transitory” on camera unfortunately will not reduce the debt in our economy and solve all of our problems.

Just like the Bank of International Settlements calling DeFi and decentralization an “illusion” does not make it true.

BIS: “Decentralization is an Illusion”

Did the BIS just learn that there are in fact human beings that are creating these decentralized finance protocols?

The key point they tried to make is that smart contracts cannot handle every single real-world scenario, and therefore decentralization is “illusory.” Hmm. It’s an interesting take. Here is a direct quote: “In DeFi, the equivalent concept is “algorithm incompleteness,” whereby it is impossible to write code spelling out what actions to take in all contingencies.” I think what they are trying to say is that if a smart contract is hacked, there is no recourse? This is true today. DeFi is a super nascent industry. We have seen smart contract hacks. These are the growing pains and risks that early adopters of these protocols take in order to get yields 10-30x higher than the typical manipulated interest rate you get from your bank. There’s no smoking gun here.

I wrote about decentralization a few weeks back. The point of decentralization is to create user-owned and governed information networks. And this is exactly how they function - a paradigm shift from the centralized information networks (Google, FB, Banks, etc etc) we see today. Let’s look at Uniswap for example. Uniswap is a decentralized exchange protocol that leverages the Ethereum blockchain. But just so the BIS is aware, there are actual humans that built the protocol. There are even venture funds that invested early on to help them scale the network. People like to point at this as if it’s some “gotcha” moment. But they are completely missing the point. The point of these networks is to create positive-sum games. The network of users also owns the network and participate in governance. For example, Uniswap averaged $5.6m in fee revenue over the last week. These fees were earned by users of the network. Not the people that built the network. The BIS might be asking how that’s possible? Because it is decentralized. That’s how. There is no central party matching buyers and sellers of assets on Uniswap. Smart contracts are doing the work. Therefore the users (liquidity providers) are earning the fees (paid by traders) and not a central party like Robinhood (which doesn’t charge fees but sells customer orders to market makers and high-frequency traders). Furthermore, if you own the UNI token, you get to participate in the governance of the network. This is also how Aave, Compound, Balancer, Curve, etc operate. Users make the network function, own the network, and also get to vote on protocol updates and key business decisions.

I guess the BIS has a problem with this since they are accustomed to governing from top-down with little transparency for the general public they serve.

BIS: “Excessive Leverage and Concentration of Power in DeFi”

I almost spit out my coffee when I read this. What a preposterous and clearly disingenuous take from the Bank of International Settlements. DeFi literally exists because of “excessive leverage and concentration of power” in traditional markets. That is precisely the problem being solved. They actually penned those words without mentioning that excessive leverage and concentration of power are the exact reasons that we have banks that are “too big to fail.” They somehow glossed over the fact that taxpayers bailed out the banks in 2008. What caused that problem? Did concentration of power and excessive leverage have anything to do with it? C’mon guys. You’re better than this.

As I read through this, a famous quote by Upton Sinclair comes to mind. It’s the only way I can rationalize how someone from the BIS could pen those words. Here it is:

“It is difficult to get a man to understand something when his salary depends on his not understanding it.”

The best part about this is that they acknowledged that lending in DeFi is overcollateralized. To get a loan in DeFi today, you quite literally have to put up more collateral than you receive for your loan. Why? Because this ensures the stability of the system. The smart contracts execute (liquidate) when the collateral drops below the required threshold. It is for this reason that the DeFi industry comfortably absorbed the 50% drop in Bitcoin price last May. Imagine that? The system itself handled the losses and we didn’t have to socialize them to taxpayers that had nothing to do with it.

So, the BIS acknowledged that DeFi loans are over collateralized while also pointing out “excessive leverage” in their report.

Conclusion

DeFi is a work in progress. It's not perfect. It’s being worked on. There are definitely growing pains. But the reason DeFi continues to explode in terms of users and value locked is that people love using it. If you’re a bank, a fintech business, or a government it would be wise to not overlook this.

Generally speaking, there can be quite a bit of noise around DeFi and broadly around Web 3.0 innovation. The noise typically comes from incumbents - those whose power structures will be disintermediated by this innovation. History tells us this is par for the course for any disruptive innovation. So, it’s important to understand that these folks will likely never see DeFi or Web 3.0 for what it is. For them to do so, they would have to be willing to see the problems DeFi seeks to solve - which are often problems that were unintentionally created and perpetuated by the aging institutions they represent.

We’ll leave it there this week.

___

Thanks for reading and for your continued support. If you have a question, comment, or thought, leave it here:

And if you’re getting value from these reports, please share them with your friends, family, and social networks so that more people can learn about DeFi and this exciting new innovation.

Finally, if you would like to send me a tip, you can do so through the addresses below. If you do send a tip, please be sure to let me know so that I can send you a thank you note.

Bitcoin: bc1qghetd4g3lk7qnsn962amd9j92mkl4388zxz0jz

Ethereum: 0x084fcd3D9318bAa383B9a9D244bC0c32129EE20E

_____

Take a report.

And stay curious my friends.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.

Well written - true.

However, a bit incorrect in the macro economic analysis. Inflation is a tax on the poor. No. If the low income wages go up by more than the CPI, the poor are definitely happy with inflation. As long as earnings of an individual rise faster than CPI, that individual is just fine. Wealth is only second order (wages are re-set usually annually, other sources of income more frequently).

Inflation is much more a tax on the (fix rate) lenders to the benefit of the (fixed rate) borrower.

The largest fixed rate borrower is, indeed, the US treasury; but all the fixed mortgage rate borrowers (e.g. farmers) will also be happy. And the largest lenders are pension fund, insurance companies, sovereign funds and such. Fixed rate mortgage lenders are going to loose as well.

Regarding the cause of inflation, I would personally say this is mainly due to the virus. Thus, bottleneck in the supply chain, great resignation, child care issue, energy prices... And none of these are going away anytime soon, so I fully agree that this is not transitory.

By the way, I don't mind the libertarian view.

As always, we’ll written and presented. I agree with your assessments- particularly in regards to inflation. I’ve thought, ‘what the heck is “transitory “? What does it truly mean? I think it manufactured self-serving FED-speak gibberish!