Studying MMT to become a better Investor

MMT, government finance, and the current economy

Hello readers,

Some brief housekeeping before we jump into this week’s report: we’ve moved off of Substack.

If you’d like to continue receiving our research, analysis, and thesis reports, please sign up here.

You can then unsubscribe to this feed.

Back to business.

I recently watched the documentary “Finding the Money?” It’s a film about Modern Monetary Theory, with Stephanie Kelton (the face of MMT and author of “The Deficit Myth”) playing the lead role.

While I disagree with some of the core tenets of MMT (which we’ll get to in this report), it got me thinking about why we aren’t taught about money in school.

I’m not talking about finance. Or the basics of banks and central banks.

I’m talking about money itself. How it makes its way into the economy and financial markets. The people that control this process. The impacts it has on pricing signals. And the role that taxes, debt, trade, and geopolitics play.

You know. The nitty gritty of how government finance works from first principles.

Is it just too complicated?

Or are we making it complicated? And if we’re making it complicated, why?

As I studied Kelton’s work, I realized that MMT is not so much a theory — but rather an explanation of how the current monetary system works.

Yet the perception of MMT is that it’s “quack economics.”

That’s what most academics, economists, and policymakers seem to want you to think.

And many will say the same about Bitcoin or sound money philosophy.

Just don’t talk about the money system.

That seems to be the message.

So, naturally, this week I want to talk about the money system and Modern Monetary Theory 🙂.

Topics covered:

I’ll share my views in each section as we make it through the report.

Disclaimer: Views expressed are the author’s personal views and should not be relied upon as investment, legal, tax, business, or any other advice.

Let’s go.

MMT Core Tenet #1: The Federal Government is the Issuer of the Currency

Nothing new here. MMT says that money primarily comes from the government (with bank lending playing a role as well). The government can direct where the money goes, influencing economic demand through fiscal policy.

The question is whether everyone is better off if a select group of people manage this process on behalf of the general public.

My View

There has to be a better way.

Here’s why:

Allowing a small group of people to decide how much money to create and where to send it breeds corruption. It’s really that simple. It may be a great idea in theory. Trust a small group of people to incentivize behavior amongst the masses via taxation and money printing. But the reality is that power corrupts.

The private sector does not have full transparency into how the money is used. For example, the Department of Defense has failed 6 audits in a row and cannot account for over $2.5 trillion of assets (during a period of relative peace!). Again, this breeds corruption. Here’s Jon Stewart calling it out:

Jon Stewart calls out The Department of Defense

The idea that governments (flawed individuals like the rest of us) could possibly know what is more valuable for you or I than the free market of millions or even billions is sort of absurd when you start to dig into it. As one simple example. Think of NYC for one minute. If you go to Manhattan, you can eat lunch or dinner at any type of restaurant you'd like within a 5-minute radius. Did the government coordinate this? Or is the free market (supply & demand) the guiding hand? Now think about what your dining experience might be like if a small group of people (who are not “in the game” as entrepreneurs) were to decide how many Italian restaurants there could be in Manhattan versus Indian restaurants versus Mexican restaurants.

MMT Core Tenet #2: Finding the money is not an issue. Finding the resources and managing inflation is the problem.

When a bill is proposed in Congress, you’ll often hear policymakers make statements like “where are we going to find the money for this?”

According to MMT, this is hogwash. It’s the wrong question to be asking.

The government doesn’t have to “find the money.” Rather, they simply create the money.

A better question to ask is “how are we going to find the resources?” As in, how are we going to find raw materials and labor? And how are we going to incentivize people to work for us without bidding up prices (creating inflation)?

For example, when we went to war in WWII, nobody was asking “how are we going to pay for this?” Rather, the concern of the government was “how are we going to resource this and control inflation?” The government had to create incentives for manufacturing businesses to shift from making products to making weapons. It had to push money into the economy via fiscal spending to do this. And it had to find a way to tame inflation at the same time.

How do you tame inflation? You create incentives for people to save, rather than spend. How do you do that? You run creative marketing campaigns designed to drive Patriotism around “freedom bonds and war bonds.” People buy the bonds with their savings (instead of spending the savings), and you create Patriotism at the same time.

That’s what the government did. And it worked.

But it didn’t need the citizens to buy the bonds to pay for the war as people believed (they printed money for that). Rather, the bonds were used to prevent people from spending — managing inflation in the process.

My View

MMT acknowledges that taming inflation and finding resources is a critical issue. It’s also the critical flaw in my view. Again, it’s my opinion that the government does not have a special talent to determine where money is most needed in the economy (it’s more about politics). When we allow a small group of people to determine where to deploy resources based on politics, we create artificial, distorted pricing signals in the economy. The invisible hand of the free market and organic supply/demand is better suited for this in my opinion.

The DeFi Report is powered by Token Terminal — the leading onchain data & analytics platform for institutional investors. If you’re interested, you can sign up for a free account at the link here: FREE ACCOUNT

MMT Core Tenet #3: Governments spend first. They don’t need our tax money to spend.

MMT says that when we pay our taxes, the money is “destroyed,” or “burned” (via ledger entries). Just as when we pay back the principal on a bank loan.

The government does not tax its citizens to finance critical infrastructure and services.

Rather, the government taxes its citizens as a way to force people to use the currency, manage inflation, and incentivize behavior in the economy.

For example, if you own a home, you get a tax break. If you are married, you get a tax break. If you own assets, you get a tax break.

Taxes are not used to pay for critical services. We print money for that.

My View

When you learn about how money works, it can sometimes feel disorienting. Like you’ve been lied to. I felt this way when I realized that the government cannot collect taxes until after they spend. They create the money. Therefore, there is no money to pay for services until they create it via fiscal spending.

“Just don’t talk about the money system.”

If everyone knew that our tax dollars were not used to pay for critical services, what would that mean for society?

What would this mean for the relationship between the public and private sector? The prevailing belief is that “the public sector/government works on behalf of the people.” Is this actually the case if our tax dollars are not used to pay for critical services?

To be clear, I’m not sure if there is any way to verify that our taxes are “burned or destroyed” (via ledger entries) when they are paid. It is common knowledge that we pay taxes as our contribution to society. But Kelton makes two key points here:

There is no money to tax if it isn’t first created by the gov’t.

Reserve accounting & government finance reveal that gov’t spending increases bank reserves, while tax payments and bond sales decrease them (used to manage inflation).

If you’d like to look into this further, you can check out the paper “Can Taxes & Bonds Finance Government Spending?” by Stephanie Kelton

Core Tenet #4: Government Deficits = Private Sector Surplus

This is one of the more interesting concepts that Stephanie Kelton comes back to time and again.

Government deficits = private sector surplus (good for the economy).

Government surplus = private sector deficit (bad for the economy).

According to MMT, the size of the deficit does not matter, as long as it is managed in relation to inflationary pressures. Deficits should not be seen as borrowing that must be repaid.

My View

I think this is a helpful framing, but it certainly does not mean that runaway deficits are sustainable.

The US Treasury is running a $1.7 trillion budget deficit this year. Everyone is wondering how the economy is so resilient given the Fed hiked rates at unprecedented levels from March ‘22 - July ‘23.

Well. Fiscal spending is plugging the gap left by monetary policy/bank lending. In my opinion, this is why unemployment is low. It’s why financial markets are healthy. And why risk assets & crypto are getting a bid.

It’s also why inflation is high.

CNN polling indicates that Trump has a 22% lead over Biden when it comes to the economy. This is despite a robust recovery from Covid, low unemployment, and a stock market that was up 19% last year and 8% this year.

It’s a surprising data point that points to Americans getting pinched by inflation — largely due to fiscal deficit spending. Of course, none of this will change under Trump.

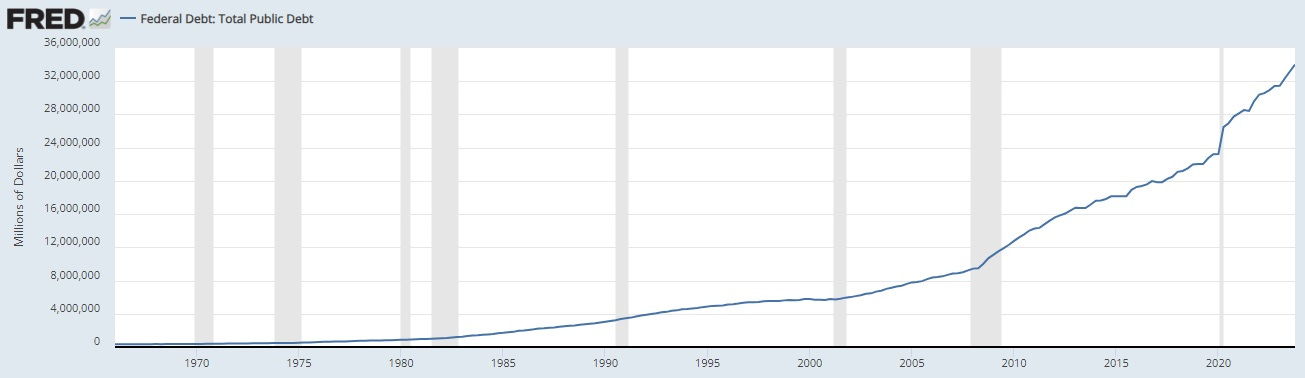

Core Tenet #5: Government Debt = Private Sector Savings

Data: FRED Database

Federal debt is now over 34 trillion dollars. The prevailing view is that we are “mortgaging our children’s future.” That we are “kicking the can down the road.” That “all of this debt hast to be paid back.” That is all “unsustainable.”

These views seem to assume that government finance is no different from that of a household or a business.

MMT seeks to reframe this.

Kelton would look at this chart and say: “that’s just our savings.”

[by “our,” she means the private sector]

Her view is that the government can rack up as much debt as it wants — as long as the interest expense doesn’t get so large that they have to print money to pay ever-growing interest expense — creating a reflexive spiral that can lead to elevated levels of inflation or even hyperinflation (which has happened over and over throughout history).

My View

“The debt is our savings” is an interesting reframing from Kelton. She’s pointing out that public debt is the difference between what the government puts into the economy via fiscal spending vs what it takes out (destroyed money via tax receipts). When this is in deficit, it means the private sector has the money (our savings). When it is in surplus, it means the government took out more money than it put in — which is bad for the economy. The total debt is just the sum of all the deficits we’ve run over the years.

With that said, the build-up of debt is not sustainable in my opinion. Why? Because interest expense continues to rise. This means more money must be printed to pay the interest — which we see today and is acknowledged by MMT as a problem.

MMT & The Current Economy

Is this QE? A bailout? Stealth liquidity?

It doesn’t matter what we call it. The Fed is currently providing more stimulus to the banking sector than it did during the financial crisis and Covid.

Data: FRED Database

And it’s happening while we are running the largest budget deficits in history.

Despite the fact that interest rates remain elevated, these two factors are driving the economy in my opinion.

The crypto markets started sniffing this out in Q4 of last year.

And now we are seeing a resurgence of “stonk trading” a la ‘21. Just look at how Truth Social (Trump’s social media company) is trading on Nasdaq (similar to a memecoin). Or the fact that “Roaring Kitty” — the trader behind the GameStop saga — recently re-emerged, driving GameStop shares up 74% on Monday and another 76% at the time of writing on Tuesday of this week.

Not to mention, we are in an election year.

As such, my conviction is growing that we will see the formation of a bubble in the second half of this year, and potentially a blow-off top into ‘25 if Trump wins the election.

Concluding Thoughts

The only thing that makes sense to me when it comes to government finance is that none of it really makes any sense.

Maybe it’s because I was trained as an accountant.

But nothing really makes sense. And the only explanation for this is that a select group of people are making it up as they go.

I believe this is why Bitcoin is so attractive as an alternative.

Bitcoin is simple. It doesn’t change. It’s transparent. And it requires proof of work.

With Bitcoin everyone is on a level playing field. Everyone has the same information.

This makes it easier to plan for the future. Which could allow the market to price goods and services based on known information. Which could lead to less randomness in society. Introduce more merit. And create more equal opportunity.

With that said, I’m not convinced Bitcoin/hard money is the answer to fiat/MMT. I see Bitcoin more as a counterweight to the current regime as “digital gold.” It has a place in our society for this reason.

Maybe Bitcoin ultimately becomes much more than a store of value.

But a currency needs a “release valve” during periods of crisis in my opinion. For example, what would have happened during Covid if the government hadn’t sent checks to everyone?

In any event, there’s nothing wrong with looking under the hood when it comes to the money system. If the establishment is calling you a “quack” for doing so, it probably means you’re onto something.

As an added bonus, the more I study this stuff, the better investor I become.

I recommend checking out the documentary for this reason.

Thanks for reading.

Take a Report.

And Stay Curious.

Disclaimer: Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment advisor and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice. The content contained in the report is derived from both publicly available information as well as proprietary data sources. All information presented and sources are believed to be reliable as of the date first published. Any opinions expressed in the report are based on the information cited herein as of the date of the publication. Although The DeFi Report and the author believe the information presented is substantially accurate in all material respects and does not omit to state material facts necessary to make the statements herein not misleading, all information and materials in the report are provided on an “as is” and “as available” basis, without warranty or condition of any kind either expressed or implied.