Hello readers,

Hope everyone had a nice weekend. There is so much happening in the crypto space these days that it’s nearly impossible to keep up. Here are just a few recent highlights:

Strike (Bitcoin layer 2 scaling solution for payments) has officially partnered with Shopify. Stike enables dollars (or any fiat currency) to be transacted globally over the Bitcoin network at zero fees, peer-to-peer, at current exchange rates. Some people are calling it magic.

Tesla, Block, and Blockstream announced plans to mine BTC using solar in Texas.

In more sustainable mining news, Exxon Mobil is now mining bitcoin in North Dakota with flared gas to reduce emissions

Tesla closed a deal with MakerDAO to finance commercial real estate repair and collision centers using the largest decentralized lending/borrowing app in the ecosystem. A huge move for MakerDAO in their shift to lending on real-world assets.

We even got a well-done segment about Bitcoin on 60 Minutes last night

The price of bitcoin must be on the rise right? Wrong. Funny how that works. Price doesn’t always match fundamentals. This is particularly true in a nascent market like crypto. We get price dislocation to the downside. We get it to the upside as well. And I think we should expect it. And embrace it. Because if you’re paying close enough attention to these nascent markets, you are gaining significant information asymmetry. Something that only the elites on wall-street have access to in traditional markets.

On that note, this week we’re looking at on-chain data and a few other metrics. I wish I could cover everything in one post, but I hope this report provides a solid high-level glimpse into market activity today. These are a few of the areas that I look to get a marker for what’s going on out there - please don’t take it as investment advice and always do your own research. As a reminder, when we look at the on-chain data, we are focusing on Bitcoin. Bitcoin has the largest market cap, the most liquidity, and the most available data. Bitcoin is still king and tends to lead the rest of the crypto market. Until this changes, we’ll continue to use Bitcoin as our marker.

As a reminder, if you’re new to the program, you can subscribe below to have these free reports dropped into your inbox as they are published.

Let’s go.

Liquid Supply

h/t: William Clemente

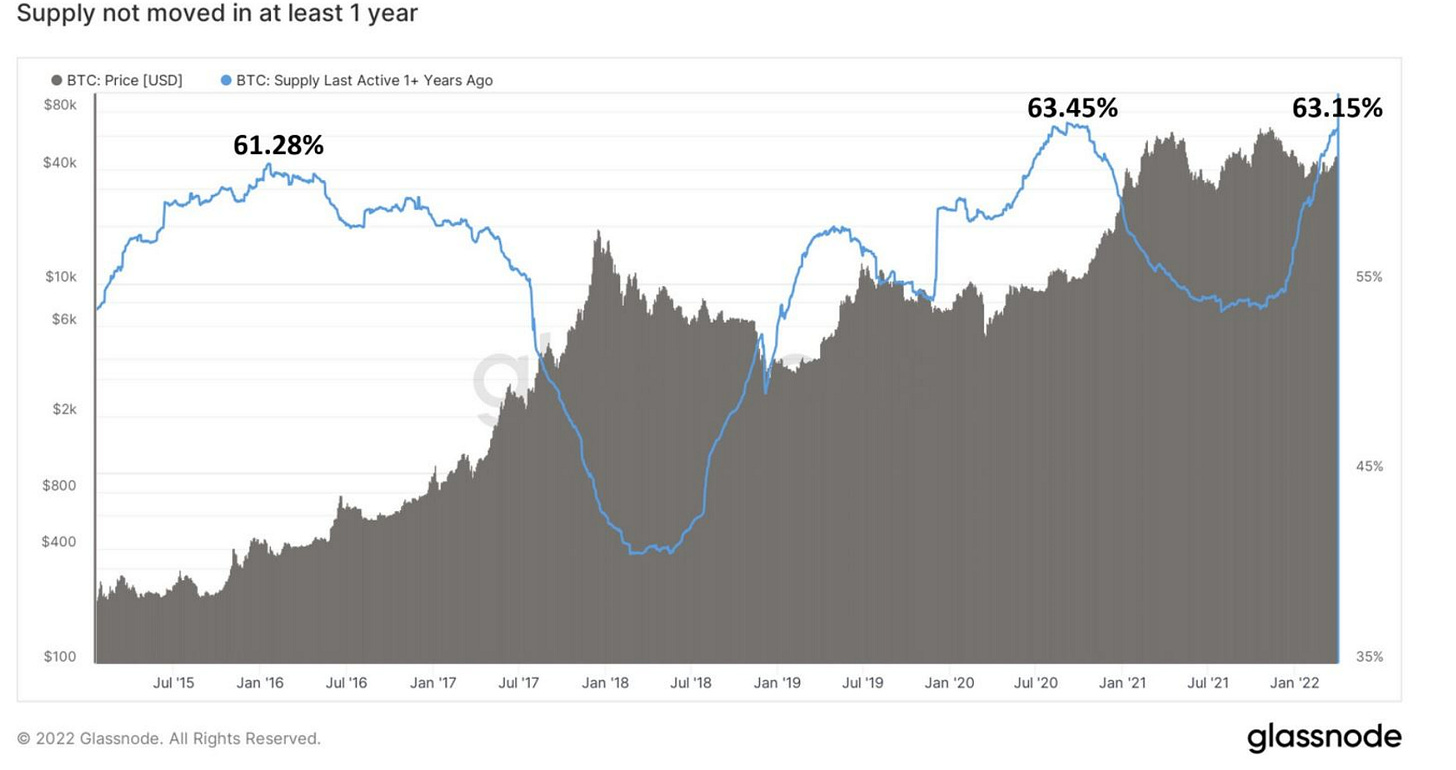

The amount of supply that has not moved within 1 year on the Bitcoin network is nearly at an all-time high right now. This is a sign that long-term holders (smart money in bitcoin) have been the primary buyers since the last 50% correction in January. We can visualize market activity here. As the price bottomed, long-term holders stepped back into the market. Each time this happens, this cohort of market participants sets a new bottom for bitcoin. When new market participants FOMO into bitcoin during bull runs, we see the long-term holders sell portions of their holdings, and the illiquid supply on the network drops. And then the cycle repeats. This data is telling us that we are in the re-accumulation phase today, which is typically a good spot to be dollar-cost-averaging into.

Here is another view:

Source: Ark Invest - h/t David Puell

This view is further analyzing the behavior of long-term holders. When we are in the green, we can observe that the long-term holder cohort is accumulating BTC at a rate faster than the amount of new supply released by miners into the market. What we can see here is that the accumulation of bitcoin by long-term holders, relative to new supply entering the market, is at its most deflationary in the history of bitcoin. So, not only are long-term holders buying up all of the newly issued bitcoin each day (900/day today per Bitcoin’s fixed monetary policy), they are buying up large portions of the rest of the liquid supply as well.

Again, this points to Bitcoin being in a reaccumulation phase today. It would appear that a strong, new floor is being set here. We’ve seen this over and over with Bitcoin. As time goes on, more and more investors learn about Bitcoin and enter the market. They usually enter during a bull run. Many start learning deeply about Bitcoin after their initial investment. They start following more closely. Their convictions strengthen. And they become part of the long-term holder cohort during the next bull run. I expect this to continue for some time. This is essentially how adoption is playing out. We are still very, very early in the grand scheme of things when it comes to Bitcoin and crypto at large.

Deviation from 11 Year Trend

Source: Pantera Capital

Here we are looking at bitcoin’s price action, relative to its 11-year trend. We are currently 56% below trend. This is about as low as we’ve seen in Bitcoin’s history. Again, this points to Bitcoin being in a reaccumulation phase. Using this data, we could say that it is pretty rare for bitcoin to be this cheap relative to its historical trend.

We’ve seen two 80+ % pullbacks in bitcoin’s short life (once after the 2013 bull run, and again after the 2017 run). With the size and robustness of the market today, it is very possible we’ll never see this again. In the past, bitcoin was traded by retail only, and we did not have fully formed futures, trusts, or ETF markets. The size and numerous access points for investors (including large institutions) point to relatively less volatility going forward. On the flip side of this, we will most likely not see the parabolic price increases during bull runs we saw in the past. The chart below illustrates this.

Source: Pantera Capital

Market Value to Realized Value

The MVRV Z-Score is measuring bitcoin’s market value relative to its realized value. The realized value is measured by analyzing the purchase price of coins last moved on the network. In short, it is calculating the average cost paid for each bitcoin on the market. Today, realized value sits at about $25k. As we can see in the data, the best time to buy bitcoin is when the market value to realized value is collapsing. We are in one of those ranges today.

As a quick aside, the realized price would be where we would look for an absolute bottom for bitcoin in a liquidity event. Another great metric for absolute bottoms is the 200 Week Moving Average. The price of bitcoin has never dropped below its 200 Week Moving Average. Today this sits at $21k. If the price of bitcoin were to converge into these areas it would represent fantastic conditions for dollar-cost averaging for investors with high, long-term conviction.

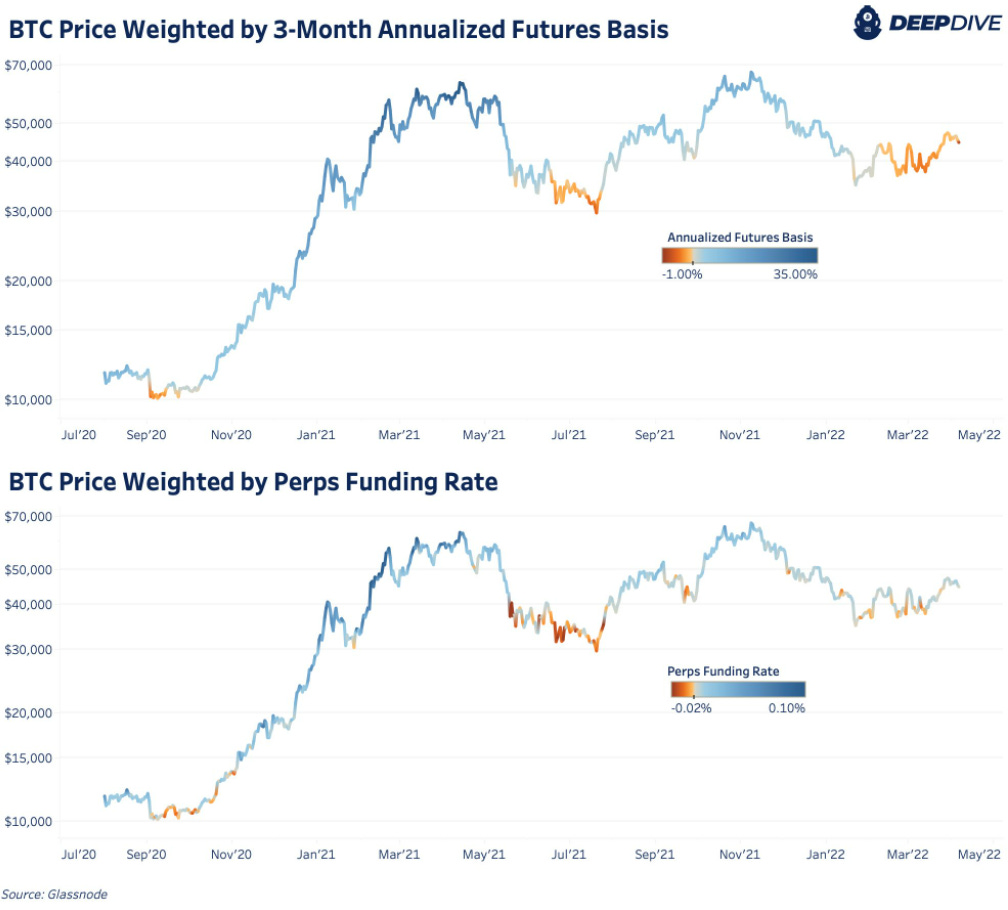

Futures & Funding Rates

h/t: Dylan LeClair

The futures market is bearish right now. We see the same sentiment in funding rates. During bull runs, we will see the futures price soaring well past the spot price. This opens up the “cash & carry” trade where sophisticated investors will sell futures contracts and buy spot bitcoin, pocketing the spread. This trade is off the table right now. Additionally, when market sentiment is bullish, funding rates turn strongly positive (dark blue). We are not seeing this today. While these signs are not bullish short-term, if you are someone looking to dollar cost average at healthy prices, this is what we want to see.

Macro Environment

With interest rates on the rise, returns on government bonds are on track for their worst year since 1949.

The Bitcoin community has long awaited the day that bond investors would wake up and move out of government bonds and into a hard, liquid asset like bitcoin. We may be nearing that moment, or at least nearing that tipping point. Why would anyone own a bond yielding 2.5% when inflation is running at 8% +? It boggles the mind. We should expect massive amounts of capital tied up in bonds to start moving. Where it will go is anyone’s guess. If it floods into crypto, all bets are off as far as upside.

That’s all for this report.

___

Thanks for reading and for your continued support. If you got some value from this week’s report, please share it with your friends, family, and social networks.

If you have a question, comment, or thought, please leave it here:

Looking for a job in crypto? Check out the list of openings with The Crypto Recruiters here.

Finally, if you would like to send me a tip, you can do so through the addresses below. If you do send a tip, please be sure to let me know so that I can send you a thank you note.

Bitcoin: bc1qghetd4g3lk7qnsn962amd9j92mkl4388zxz0jz

Ethereum: 0x084fcd3D9318bAa383B9a9D244bC0c32129EE20E

___

Take a report.

And stay curious my friends.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.