Hello readers,

Despite the recent price volatility in Bitcoin (noise), we are seeing some very interesting game theory developments from from large corporations, asset managers, and nation-states (signal).

This week we cover these developments and provide some context into what they could mean for the future of Bitcoin.

Topics covered:

Geopolitical game theory

KPMG buying Bitcoin as a treasury asset

Blackrock offers Bitcoin products to their customers

Bitcoin Mining collaborations with the energy industry

If you’re new to the program and haven’t yet subscribed, drop your email below to receive these free reports directly in your inbox as they are published:

Let’s go.

Bitcoin & Geopolitical Game Theory

This week, Russia announced that the country’s central bank and government have reached an agreement to draft legislation or amend existing laws recognizing crypto as a form of currency.

Let’s try to remove any bias we have against Russia and Putin and try to observe what’s going on here with clear eyes.

It feels to me that, with everything going on around the world (increasing instability), Bitcoin could be on the verge of entering a period of game theory amongst nation-states.

To understand why this could be the case, we need to first step back and observe the current hegemony that is the US dollar.

In 1944, under the Bretton Woods agreement, gold was set as the basis through which the dollar would peg itself, and all other currencies would peg themselves to the dollar (a gold standard). The system was designed to minimize international currency exchange rate volatility, which would help international trade relations. Nation’s whose currencies slipped above or below their peg to the dollar by more than 1% would manage the peg by buying/selling dollars with their local currency. This would level the playing field for international commerce - the countries that could produce the best products at the cheapest cost would benefit the most.

It’s important to note that the US was holding the majority of the world’s gold supply at the time, and was providing custody of many foreign countries’ gold. So, if the United States started printing dollars in excess of the gold reserves, they would be devaluing the currency (dollars would convert to less gold - the thing with the real value) and hence devaluing the rest of the world.

Then Vietnam happened. And this is exactly what played out. The US started printing money to pay for the War. Foreign countries started to question whether the US actually had the gold reserves equal to all of the dollars in circulation.

The President of France at the time, Charles de Gaulle, was first to catch onto this and sent a warship to NY in 1971 to collect their gold. Other countries soon followed. This was a global run on the bank. If every country came to collect their gold, there would simply not be enough gold in reserve to convert everyone’s dollars back to gold. The US had already broken the peg.

Richard Nixon was President at the time. He was in a quandary. The tide was coming in, and it was about to be revealed that the United States was swimming naked. So what did he do? He “temporarily” removed the gold peg to the dollar. It is now 2022, and the peg to gold was never restored.

But the US still had another problem to solve. We had to figure out a way to maintain the network effect of the dollar. To maintain the hegemony. So, Nixon sent his National Security Advisor and Secretary of State, Henry Kissinger, to Saudi Arabia to cut a deal to price oil in dollars. In return, the United States would provide military protection to the Saudi’s. And the Saudi’s would convert excess dollars received for oil into US Treasury bonds, essentially financing the US debt. The petrodollar system was born.

The plan worked. By 1975 every OPEC nation was pricing their oil in dollars. So, for any country globally that wanted to do business with OPEC, they had to first convert their local currency to dollars. This created false demand for dollars globally. The result is the dollar trades at a premium to other countries.

This move had *profound* impacts on world trade and the United States middle class. The point of the gold standard was to level the playing field for international trade. No country would be able to manipulate their currency so that their goods were cheaper than other country’s goods.

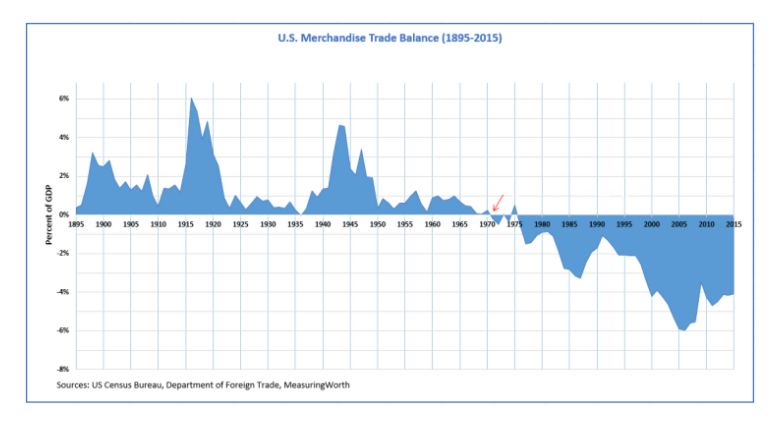

When we made this move, the United States had to switch from net producers (exporters) to net consumers (importers). Because we created false demand for dollars (due to the deal with Saudi Arabia), the dollar trades at a premium to other currencies, which makes US goods expensive for other countries. The outcome of this is we essentially exported our production and middle class to China (who can manipulate their currency to ensure their goods are cheap compared to US-produced goods). This never would have happened had we not left the gold standard. It is my opinion that the populism, social/economic inequality, and political tension we see today are directly related to multiple decades of this being baked into our middle class. These are the folks that used to make things in our country - their jobs are now largely in China and other countries.

This was the only chart I could find that went back to 1971 to show this. To be clear, the trade deficit has grown much larger in the years since 2015.

[If you’re interested in learning more about the profound impacts of coming off the gold standard using data, this is a great resource]

Up until this day, the United States has used the “exorbitant privilege” of the dollar as the reserve currency to enforce economic sanctions on any country that steps out of line with its worldviews. It also allows us to go into extreme levels of indebtedness. We don’t export goods anymore. We export dollars by buying goods from foreign currencies and racking up debt.

This is the state of play today. And it’s why we keep seeing Joe Biden make statements that the US will impose economic sanctions on Russia if they invade Ukraine. The United States could shut Russia or any country off from the SWIFT payment network and hurt their local economies.

As an American, I try to step out of whether I think this is right or wrong, and simply understand it from the perspective of foreign countries. If another country had this privilege, would Americans be ok with it? My sense is no, we would not be ok with it.

When we understand the incentives of others, we can begin to forecast out what the various outcomes could be.

Russia and China

Due to the constraints the dollar imposes on other countries, they are incentivized to move away from the dollar system. This is exactly what we have been seeing in recent years. China is no longer buying US treasuries. Instead, they are taking their existing dollar holdings and investing in assets and infrastructure in emerging countries. This is a similar strategy to what we see Microstrategy and Michael Saylor doing. They are simply taking their cheap debt in dollars, and converting them into Bitcoin or other hard assets. It’s essentially an attack on the dollar.

Meanwhile, Russia has been stockpiling its gold reserves in recent years and selling its energy resources in Euros.

And now Russia appears to be moving on Bitcoin.

Game theory suggests that other countries could be incentivized to make similar moves. If the dollar ends up destabilizing, there will be a massive first-mover advantage for those that made the decision to opt into the Bitcoin network early. Nobody wants to be left holding the bag at the end of the day.

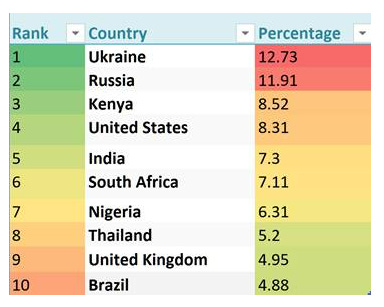

This is incredibly fascinating and something many in the Bitcoin community have forecasted would play out for years. Because Bitcoin is decentralized and non-sovereign, it cannot be controlled by any foreign government. Anyone opting into the Bitcoin network is opting into a system where everyone has the same rights, where no economic sanctions can be imposed. If you’re curious, below are the countries with the highest % of their population holding Bitcoin:

And here are the countries with the largest number of holders of Bitcoin.

Source: c-sharpcorner.com

El Salvador and Bitcoin Bonds

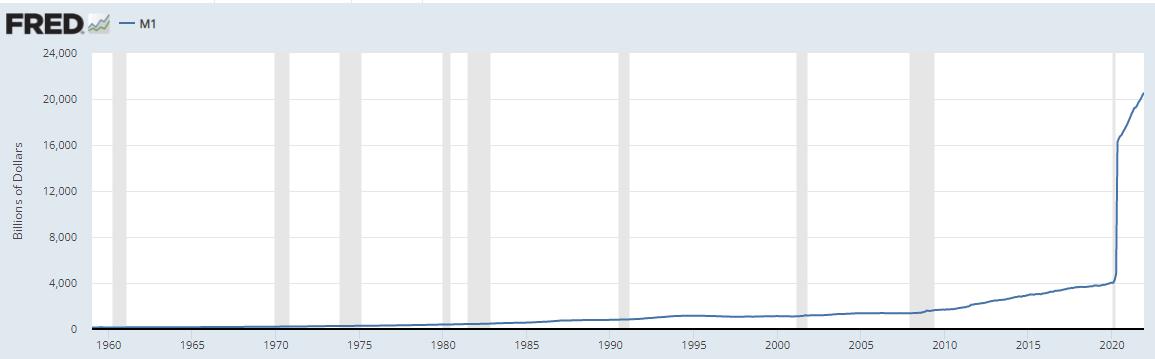

Along these same lines, we saw El Salvador make Bitcoin legal tender in 2021. El Salvador is on a dollar standard as they do not have their own sovereign currency. While they use the dollar, they do not benefit from US monetary policy or fiscal policy. In fact, they are abused by these systems. When Covid hit in America, Congress issued stimulus checks and free loans to US citizens and businesses. This devalues the dollar, while El Salvador gets none of these benefits.

So, the President of El Salvador had to sit and watch this happen, while having zero power to control it.

Source: Federal Reserve

So what did he do? He opted into Bitcoin. A non-sovereign, global, finite supply, peer-to-peer monetary system. Of course, the Bitcoin network is already built (and growing) and has been running flawlessly for 13 years. Do you think El Salvador has the resources to build a new, peer-to-peer, global, non-sovereign monetary system? Of course not. So, instead, they just opted into the Bitcoin network. Now they have developers and miners all over the world working for them for free - securing and enhancing a system that can protect the wealth of the country.

El Salvador Bitcoin Bonds

El Salvador would typically have to work with the IMF to receive the necessary loans to finance the countries operations. Of course, this forces them to comply with whatever rules the IMF wants to impose on them.

With Bitcoin, they can opt-out of this system. And that is exactly what they are doing.

El Salvador is issuing its first Bitcoin Bond next month. They will be raising $1 billion in the free market and expect the offering to be oversubscribed by $500 million. The note will mature in 2032 and will carry a 6.5% interest rate. Half of the funds raised will be used to buy Bitcoin (essentially the same play as Michael Saylor and Microstrategy), and the other half will be used to invest in Bitcoin Mining facilities leveraging geothermal energy. The idea here is that if Bitcoin does its thing (average compound annual growth rate over the last 10 years is 148%), they will be able to easily pay back the loan while also financing significant infrastructure to bootstrap itself into a Bitcoin mining hub which would add jobs and services to their economy while allowing them to increase their Bitcoin treasury holdings.

If this works, what do you think Panama, Peru, Ecuador, Venezuela, Colombia, Costa Rica, etc. will do? You better believe they are watching. The first mover sticks his neck out while everyone else watches. As soon as the strategy starts to appear less risky, others will follow suit. Bitcoin game theory at play.

KPMG, Blackrock, and Apple

KPMG

This week we learned that KPMG has purchased Bitcoin and Ethereum to hold as a treasury asset. KPMG works with some of the largest and most powerful fortune 500 companies in the world - advising them on accounting and treasury management. This means that any corporation looking to add Bitcoin (or other cryptoassets) to their balance sheet will likely look to KPMG for guidance. This is an example of Bitcoin’s game theory playing out at the corporate level. Do you think that E&Y, PwC, and Deloitte are watching this wondering if they are going to be left out?

Blackrock

We also learned this week that Blackrock (over $10 trillion under management) is planning to offer its clients access to Bitcoin products and crypto trading on their Aladdin network. Larry Fink, the CEO of Blackrock, has been asked several times about Bitcoin - he tends to give a non-answer but says that it doesn’t matter what he thinks, his clients are demanding access. And now that Blackrock, one of the largest asset managers in the world, is entering the space, what do you think others will do? This greenlights any asset manager in the industry to follow suit. There is no longer career risk in doing so - if Blackrock is moving in this direction it essentially gives everyone else permission to do so as well.

Bitcoin Miners Collaborating with the Energy Industry

A quick note here as this could easily be its own separate report. We continue to see aligned incentives between Bitcoin miners and renewable energy producers. Bitcoin mining is an incredibly unique load source because it is location agnostic and interruptible. With Bitcoin mining, we can bring demand to the supply. This has never existed before. Typically, energy is produced (supply) near population centers (demand) due to the cost of building the infrastructure to move the energy. One of the main issues with wind and solar producers today is curtailed (wasted) energy and the distance between where it is produced and consumed. Because these energy sources are intermittent, if the energy produced is not used while it is producing (midday for the sun and at night for wind), it is lost. But Bitcoin miners can simply turn on/off their machines when there is excess energy to mop up. This is a win/win. It allows miners to access cheap, renewable energy. And it allows producers to monetize energy that was previously curtailed.

Could Bitcoin mining be helping push us toward the adoption, integration, and monetization of more renewable energy projects? It seems this is happening in real-time. We can observe this today in West Texas, where there is abundant wind energy, but not enough infrastructure to move the energy where it is needed. Therefore, renewable energy produced gets wasted. But with Bitcoin miners coming in to mop up the cheap energy, they are monetizing the energy that was previously a sunk cost. This is allowing producers and grid operators to finance and expand out the infrastructure to move the energy to where communities need it most.

This is something to keep an eye on and another element of Bitcoin’s game theory we could see play out in the coming years.

Follow the incentives of the players in the game if you want to map what the outcomes could be.

___

The DeFi Report would love to help anyone currently looking to explore a career in the blockchain space. As such, we’ve partnered with The Crypto Recruiters. If you’re looking for a job in crypto, please see the list of openings here.

___

Thanks for reading and for your continued support. If you have a question, comment, or thought, leave it here:

I hope you got some value from this week’s report. If you did, please share it with your friends, family, and social networks so that more people can learn about crypto and this exciting new innovation.

Finally, if you would like to send me a tip, you can do so through the addresses below. If you do send a tip, please be sure to let me know so that I can send you a thank you note.

Bitcoin: bc1qghetd4g3lk7qnsn962amd9j92mkl4388zxz0jz

Ethereum: 0x084fcd3D9318bAa383B9a9D244bC0c32129EE20E

___

Take a report.

And stay curious my friends.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.