Digital Assets vs Traditional Assets

Why the entire financial system will move onto blockchains

Hello readers,

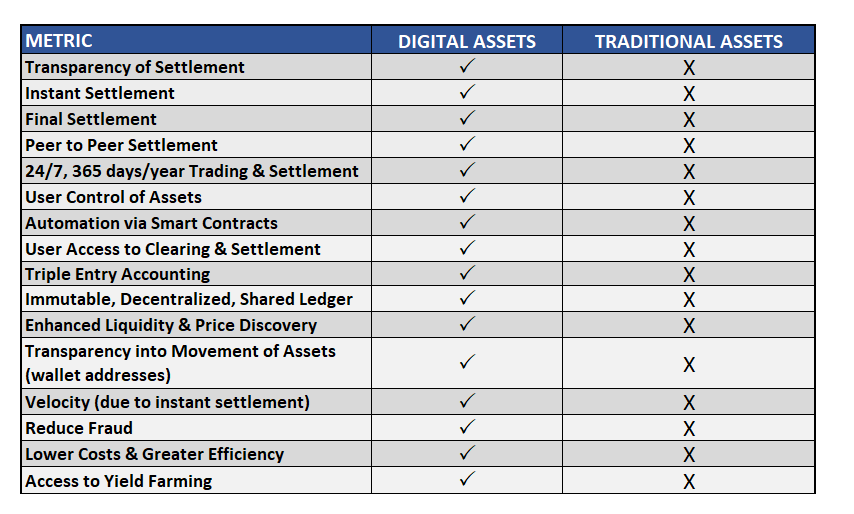

This week we are analyzing the differences between digital assets and traditional assets. When we look at these differences, it becomes pretty clear that ALL assets will trade on blockchain technology in the not-too-distant future.

As a reminder, if you haven’t subscribed yet and would like to receive these reports directly to your inbox as they are published, drop your email below:

Topics covered:

Let’s go.

Settlement

Transactions on blockchains are peer to peer, settle nearly instantly, and with absolute finality (cannot be reversed). Furthermore, users can watch their transactions settle in real-time with full transparency.

Here is an example of the transparency I’m referring to:

The above is taken from Etherscan, Ethereum’s blockchain explorer. This is a recent transaction that I made. It’s a few weeks old now, but when I made this transaction I literally watched it settle on the blockchain.

How this differs from a Traditional Asset Transaction:

If this were a transaction from my brokerage account, I would not be able to see these details. Furthermore, I would not be able to control the asset transferred. All of that is handled by the broker in conjunction with market makers. Eventually, the transaction would settle after a few days time and be recorded at the Depository Trust & Clearing Corporation (DTCC).

The fact that I don’t have control of the asset is a really big deal. Because I cannot control the asset, I cannot use it as collateral. But my broker can. My broker can use my asset to lever up their portfolio (rehypothecation) for their benefit and not mine. But in crypto, users have control. This means crypto users can stake their assets into DeFi protocols (as collateral) and earn a yield themselves. By cutting out the middleman, we return control and power back to the individual. This is what blockchains are enabling. Digital property rights.

Rehypothecation

You’ve probably heard the phrase “the big banks are too big to fail.” But does anyone ever talk about why this is the case? We saw this come to the forefront during the Financial Crisis in 2008.

What this really means is that when sh*t hits the fan, we have no way of knowing who owns what. For example, multiple banks and financial institutions are constantly pledging the same collateral when they lever up their portfolios. This allows them to increase their returns. All is well until everyone runs to find the collateral in a recession. And in many cases, as we found out in 2008, the same collateral is being used by 10-20 different counterparties. Crazy, right? How can multiple parties claim the same dollar as collateral when there is only one actual dollar in the system? This comes back to a lack of oversight, regulation, poor tech, and irresponsible actions by these large institutions.

Blockchains solve this. Why? Because it is literally impossible for two people to pledge the same crypto asset as collateral on-chain - users have full control of the asset. It can only be in one place at a time. And this is all transparent on the blockchain. Therefore, rehypothecation is impossible with digital assets on-chain. This holds everyone accountable and we don’t even need regulators to make the rules. The blockchain does it for us.

24/7, 365 Days/Year Trading

Blockchains don’t sleep. They run themselves. This means we get global trading 24/7, 365 days per year. When we look back at this we will laugh at how silly it was that we could only trade and transfer our money from 9-4:30 Monday through Friday.

Velocity

Because transactions settle instantly on blockchains with finality, the velocity of transactions is astronomical when compared to traditional assets (which take 2 days to settle). For example, we have observed stablecoin velocity at 1,000x the velocity of traditional bank money. Again, this comes back to instant settlement and control of the assets. Caitlin Long from Avanti Bank does a great job articulating this. You can listen to this interview she did on RealVision if you’re curious to learn more.

Traders in crypto can move in/out of trades at lightning speed. And they can do this without holding any collateral against an unsettled trade. This means we don’t need leverage to satisfy market demand for collateral. And we end up with a much more stable financial system as a result. Leverage tends to build up in the traditional financial system because there is no way to settle transactions in real-time. They simply don’t have the tech to do it. As a result, collateral is pledged and re-pledged due to the lag time of settlement. Time is money. All of this rehypothecation doesn’t get reconciled until sh*t hits the fan. And then we put our hands up and say “the banks are too big to fail - let’s bail them out and socialize the losses.” Insane, right?

Triple Entry Accounting

Blockchains introduce triple entry accounting. This is due to the fact that the ledger of transactions is held on a decentralized set of computers all over the world. Each computer updates its ledger in real-time and reconciles itself. This serves as an automatic audit function. Furthermore, all market participants have full transparency into the ledger. Not only is the ledger shared, decentralized, and permissionless, but it is immutable. Because of the power of cryptography, each block of transactions is hashed and anchored to the previous block of transactions. This makes the ledger immutable. To hack a blockchain, a bad actor would have to take control of over 51% of the network, undo the last block of transactions (which would be immediately obvious to the network), and then undo every block of transactions previously. You’ll notice in the Etherscan transaction above, that in two weeks’ time, there have been 89,422 blocks of transactions since my transaction. For this reason, blockchains have 100% uptime and have never been hacked. [I’ll note that smart contract protocols have been hacked, but this is a separate issue from the ledger itself being hacked]

Liquidity & Price Discovery

I’m specifically referring to private market assets here. Public exchange markets (besides OTC markets) do not have issues with liquidity & price discovery. However, private assets like Commerical Real Estate are illiquid. Blockchains are solving this. It all comes back to data and user control of the asset. With blockchain technology, we can create a digital twin of a physical building, and underpin the token with all relevant data to price the asset including a 3rd party appraisal mark. This allows for price discovery which facilitates liquidity. Because users/owners can control the digital asset which represents ownership in the physical property, they can then fractionalize the asset, seek investment, and eventually be able to trade the asset (or fractions) on liquid secondary markets. We are probably a few years away from this reality.

Earn Yield on Assets

Again, this comes back to user control of the asset. Because you have digital property rights in crypto, you can control your asset. You can stake it into a DeFi protocol or add liquidity to a DEX and earn a yield on your assets. This is not possible today with a stock, bond, etc. But your broker and your bank are doing this with your assets to juice their returns.

Furthermore, users in crypto can swap one asset for another. Imagine if you could trade a share of Tesla for a share of Apple? These transactions are normal in crypto.

Conclusion

When we get into the nuance and details regarding the difference between these assets, it becomes abundantly clear that traditional markets are going to merge onto blockchains. Stocks, bonds, currencies, real estate, etc will all be traded on blockchain rails. I think this is something that a lot of people are missing today. Lots of folks think that crypto is an asset class. But it’s not an asset class - it is going to swallow all assets and become the base layer of the financial system for trading and settlement. This reminds me of the early days of the internet. Most businesses saw the internet as another “channel.” They had their newspaper channel, their magazine channel, and maybe a paid TV channel. They looked at the Internet as another “channel” that they needed to create a strategy for. But this was incredibly flawed because the internet essentially swallowed all other channels. Everything moved to the internet.

The same thing is going to happen in crypto.

___

Thanks for reading and for your continued support. If you have a question, comment, or thought, leave it here:

And if you’re getting value from these reports, please share them with your friends, family, and social networks so that more people can learn about crypto and this exciting new innovation.

Finally, if you would like to send me a tip, you can do so through the addresses below. If you do send a tip, please be sure to let me know so that I can send you a thank you note.

Bitcoin: bc1qghetd4g3lk7qnsn962amd9j92mkl4388zxz0jz

Ethereum: 0x084fcd3D9318bAa383B9a9D244bC0c32129EE20E

_____

Take a report.

And stay curious my friends.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.

Awesome breakdown and explanations, especially around rehypothecation and what blockchain and tokenization are doing to bring this power back to individual asset owners. Great edition, as usual