Hello readers,

Uniswap just raised a $165m Series B round. In this week’s report, we examine the long-term viability of the Automated Market Maker model and how DeFi protocols such as Uniswap could fit into the future of finance.

Topics covered:

A high-level overview of AMMs and Uniswap

Should Uniswap start its own blockchain?

MEV & Payment for Order Flow

Future of Centralized Exchanges

Regulation

If you’re new to The DeFi Report, drop your email below to receive free reports twice/month directly to your inbox. We provide easy-to-follow mental models, frameworks, and analyses of DeFi and web3 business models.

Let’s go.

We are still super early in the overall adoption of these new technologies. Projecting how things play out is super challenging. But when we think of the build-out, we think it could look something like this:

Hardware (ASIC miners, GPUs, computers/servers)

Software: base layer blockchains (Bitcoin, Ethereum, Solana, etc),

Layer 2 scaling solutions (Lightning, Arbitrum, Optimism, etc)

Bridges or connections between Layer 1/Layer 2 blockchains and TradFi systems

Data/Computation layer across the entire tech stack

Consumer-facing applications

Right now we’re in between steps 2-4. These reports are meant to give you a sound understanding of the infrastructure in play today and an idea of where we are heading. Having an idea of where we are heading today could be pretty valuable in the years to come as adoption ticks up. We see a lot of quality projects building out there right now. It wouldn’t be surprising to see the space grow 10x larger in the next cycle. This research helps us think through where value could accrue and how we might be able to position ourselves. With that said, please do your own research. And let’s get some activity going in the comments section — so that we can all get a little bit smarter together.

High-Level Overview of AMMs & Uniswap

Automated Market Makers (also referred to as decentralized exchanges) function by organically forming two-sided marketplaces using blockchain technology and smart contracts.

How it works: You, and anyone with an internet connection can be a liquidity provider. Liquidity providers, or “LPs,” deposit crypto assets into liquidity pools. They receive a derivative token or “liquidity token” for doing so — for lending the protocol liquidity. The “liquidity token” represents a given liquidity provider’s contribution to the pool as a % of the total liquidity in the pool. Stay with me. Traders come in and make trades within liquidity pools. They pay fees (30 basis points for most pools) directly to the liquidity providers. This is all accounted for using the liquidity token (which is just data). Liquidity providers = supply. Traders = demand. Traders pay liquidity providers directly. Smart contracts (if/then statements written in computer code) function as the intermediary.

Quick Example: You deposit 1 ETH (and 1 ETH worth of USDC) into the ETH/USDC trading pool on Uniswap. For simplicity, let’s say you own 10% of the pool. A trader comes in and swaps ETH for USDC. They pay 30 basis points to the pool. For simplicity, let’s say the 30 basis points equate to $1. You would receive 10 cents for providing a service to the protocol in the form of liquidity. You could do this as long as you want, earning passive income. When you want to remove your liquidity, you would send your liquidity tokens back to the smart contract. The smart contract then returns your original ETH & USDC contribution + your % of the fees directly to your wallet.

Comparing to TradFi: In TradFi, traders don’t pay fees. Well, that’s not actually true. We pay a fee, we just don’t know how to quantify it. Let’s say you submit a trade into Robinhood, TD Ameritrade, or your favorite brokerage account. Robinhood sends your order to a market maker such as Citadel. Citadel executes the trade for you (provides liquidity). They also front-run your trade or use the information in some way to make a quick arbitrage. Citadel cuts Robinhood into the deal and shares a small slice of the pie with them.

So, when we compare Uniswap and the AMM model, you have individuals all over the world playing the role of Citadel. The role of the market maker. Except in this case the market maker is not front-running you (stay tuned on this idea). Uniswap is essentially breaking up a monopoly on market-making by redistributing the business model to anyone that wants to participate. Today, 100% of the fees generated by the protocol are distributed directly to the liquidity providers or market makers.

AMMs are not Order Books. Users swap tokens on Uniswap and other AMMs. For example, ETH for UNI. Or UNI for ETH. Fees on Uniswap are lower than centralized order books, such as Coinbase (30 basis points vs 100 or 1% on Coinbase). Additional demand on Uniswap comes from traders — who are measuring their ability to profit based on the amount of ETH or UNI in each pool (and other pools) relative to the prices of these assets on other exchanges. Arbitragers will swap various assets within liquidity pools when opportunities arise, bringing pool balances between pairs in line with listed prices on other centralized and decentralized exchanges.

When we think about the underbelly of Uniswap we should imagine this massive, open financial infrastructure that is automatically run by smart contracts, liquidity providers, traders, and arbitrageurs 24/7, 365 days per year. Globally.

Impermanent Loss. We’d be remiss not to mention the concept of impermanent loss. This refers to the idea that in some cases, liquidity providers would be better off holding their assets rather than depositing/lending them into liquidity pools for fees. Without getting into the weeds, you can think of this as the opportunity cost incurred if the price of your deposited assets changes in a significant manner. Said another way, passively providing liquidity in an AMM is not entirely risk-free.

Uniswaps 365 day Revenues = $1.1 billion.

Source: Token Terminal

Uniswap’s Market Share

Source: Dune Analytics

Despite the fact that Uniswap’s code is open-source and can be forked and copied at will, they dominate the trading volume among Automated Market Makers. It’s noteworthy that their slice of the pie is getting even larger in the bear market.

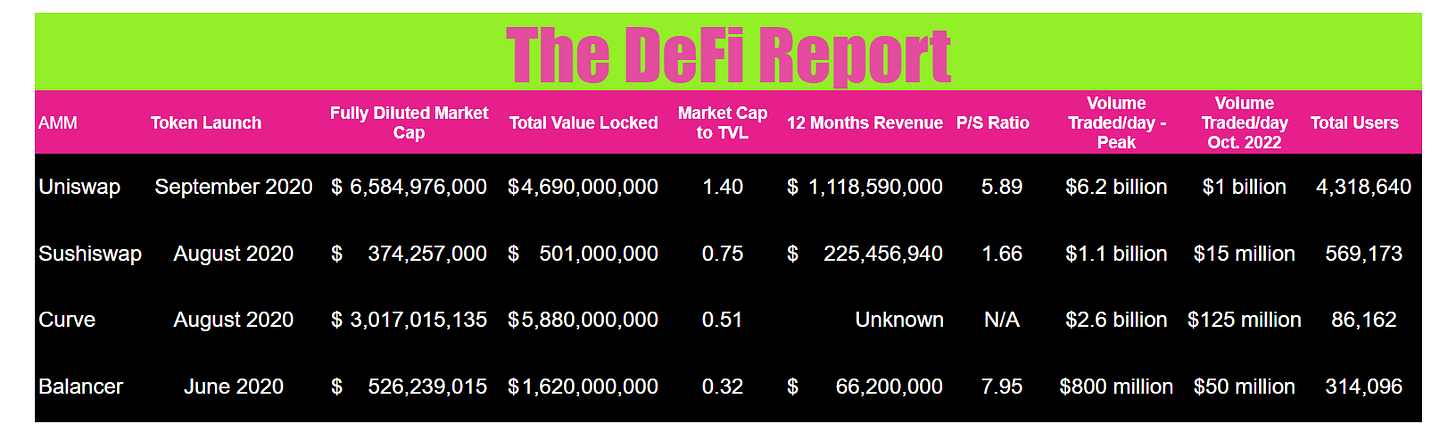

Uniswap averages about $1b in trading volume/day right now in the crypto winter. Their volumes have spiked as high as $6.5 billion in one day and they surpassed $1 trillion in aggregate volume in May of this year. Here is a quick comparison to a few other Ethereum AMMs. Note that there are growing AMMs on the alternative L1 chains as well.

Data: Coinmarketcap, Dappradar, Token Terminal, Dune Analytics

*Users = total over time. Market Cap to TVL uses a Fully Diluted Market Cap.

At this point, it looks like Uniswap is going to win the Automated Market Maker battle. We’re seeing signs of power law emerging in DeFi across the board. The projects that are truly being used are starting to really stand out.

But what are Uniswap’s unforeseen challenges?

MEV: Maximum Extractable Value

Some analysts have suggested that Uniswap should start its own blockchain or an “app chain”. This would be possible on Cosmos or Polkadot.

But why would Uniswap do that?

To understand this we need to get into the mechanics of how a trade works on Uniswap. Traders actually make 3 or 4 payments when a trade is processed today:

Note that the DeFi Aggregator fee only applies to trades conducted through MetaMask, Zapper, Matcha, etc (approx. 80% of all Uniswap trades)

The Ethereum Gas Fee is paid to transaction validators

MEV “hidden fee” is paid to block builders and validators

MEV or Maximum Extractable Value = value extracted by block builders and validators when they order transactions in the mempool (where transactions go before being added to blocks) — in a way that benefits certain arbitragers. It is important to note that MEV is an emergent phenomenon in any market — high volumes of transactions across asset types and marketplaces simply produce lots of value for those who can understand the nature of the transactions and profit from the information. This is not unique to Ethereum or crypto.

A few examples of how MEV works:

Sandwich Attack: this is a form of front running where a bot will detect a trade in the mempool. They will then front-run the trade, driving up the price for the trade behind them, and selling at the elevated price. This is essentially what Citadel is doing in traditional finance and it is perfectly legal.

Arbitrage on different AMMs: tokens can have slightly different prices on different AMMs. When price discrepancies emerge, MEV bots will buy assets on one AMM and sell them on another. Of course, being able to order transactions within blocks to extract the most value becomes highly profitable. It should be noted that arbitrageurs do provide a service in that they help to balance prices across exchanges when dislocations occur.

Impact to Uniswap

As we can see, the Uniswap protocol is creating a lot of value due to its deep liquidity. But only the 30 basis point fee is captured by Uniswap users today — the distributed set of liquidity providers. The rest of the value is going to aggregators and Ethereum validators at the base layer (including MEV or those bribing validators). For this reason, there seems to be an argument that Uniswap should launch its own blockchain. This would allow them to control the entire value chain.

But what are the trade-offs to doing so?

There are many.

DeFi protocols live and die with liquidity. Uniswap has access to a wide array of liquidity because they are built on Ethereum. If Uniswap had less liquidity, they would generate fewer fees, and there would be more slippage on trades. This would be a threat to their entire business model.

Uniswap would have to build out the data and smart contract infrastructure they currently receive from Ethereum. This means they need their own validators and would have to bootstrap this from scratch. This is no easy task.

Security. Uniswap leverages Ethereum for base-layer security today. This cannot be understated. Moving to their own chain, and bootstrapping security from zero is a monumental task.

For these reasons, we do not think it makes sense for Uniswap to launch its own blockchain.

This brings us back to MEV and the emergence of Payment for Order Flow within DeFi…

Payment for Order Flow

I’m hearing whispers that large traditional finance players are already building solutions to bring PFOF to DeFi within new trading models.

In this section, we’ll cover what this could look like and how it could impact an AMM such as Uniswap. In particular, could PFOF disrupt the current distributed liquidity provider model?

As we mentioned above, MEV is essentially a cost that traders are incurring today due to sloppy trade execution & bribing at the block-building layer of the tech stack. Traders are paying for this. They also pay Uniswap “LPs.” What would happen to MEV if a Payment for Order Flow model entered the fray?

With Payment for Order Flow, you would likely have an auction of bids to fill trades (order blocks) before they are received. The exchange would sell the order flow — similar to how Robinhood and other brokers sell their flow to large market makers today. This would mean traders would pay zero fees through a DeFi protocol selling the order flow. The model would revert to what we see in traditional finance. Payment for Order Flow firms would then order transactions to their benefit (they become MEV), and make a small payment to the aggregators or the order book protocol (or wallet - think MetaMask) directly for providing the flow. Here’s how the fee structure changes:

The difference here is that PFOF firms take the fees and split them with the aggregators/wallet that served them the flow. They cut out the distributed liquidity providers. If markets are to seek the most efficient, cost-effective route, it’s possible the market moves in this direction. This assumes there isn’t some other sort of restructuring of Uniswaps’s model. As adoption and volume pick up, it’s possible LP fees could come down as well.

We think the PFOF model could make sense in a multi-chain future. For example, we think games could build their own app chains, and PFOF firms could direct liquidity across various disconnected apps/ecosystems as liquidity needs arise.

At the end of the day, we think the market will pick the service that creates the most user-friendly execution at the best cost. Fees, slippage, front-running, etc will all play into this.

FlashBots to the Rescue

Flashbots is here to save the day. We think. Flashbots is a research & development organization working on mitigating the negative externalities of MEV on Ethereum. Without getting too technical, Flashbots is creating a more transparent, open marketplace solution that seeks to align incentives and distributes the benefits of MEV to the distributed set of validators and stakers, rather than to bot operators/block builders/proprietary trading firms. Because of Flashbots, stakers or validators now get to share approximately 50% of the MEV with the block builders/arbitrageurs. Basically, validators are getting 50% of the value that would be extracted by a firm such as Citadel within traditional finance. If you want to go deep on this topic, listen to the founder of Flashbots discuss how it works on Bankless. This is an extremely important topic concerning Ethereum, centralization, and censorship of transactions.

*Note that blockchains such as Bitcoin do not have MEV. Bitcoin is just a payment network and store of value. So, there aren’t any arbitrage opportunities across various marketplaces for traders to exploit.*

Uniswap + Genie

Uniswap recently purchased NFT aggregator Genie. This signals a few things:

They want to expand into NFT swapping

They are thinking of new ways to monetize. Owning the aggregator allows Uniswap to control flow.

This makes us believe that Uniswap may look to acquire a large aggregator firm such as Zapper. This would allow them to control the market to some degree, protect their liquidity providers, and maintain the ability to drive value back to their native token, UNI. For example, Uniswap could maintain its LP fee model and direct any additional fees earned through the aggregator back to the treasury or out to token holders.

If Uniswap cannot maintain its decentralized liquidity provider model, its token could become worthless. Why? The ability to take a slice of the fee paid to LPs (or from an aggregator) is what is giving value to the token today. Token holders get to vote on how fees are directed in the future. In fact, the Uniswap DAO recently voted to experiment with protocol fees by returning 10% of the LPs back to the protocol treasury for a few select pools. If we imagine a world where Uniswap directs 10% of its LP fees back to the protocol or token holders, this would equate to over $100 million/year today or $.13/token in circulation — which is based on revenues in the current bear market. At the time of writing, Uniswap trades at $6.30/token, so this would equate to about a 2.1% yield. Pretty pedestrian stuff. If you think Uniswap will 10x its liquidity, volume, and revenues in the next cycle, this gets us to about $1.30/token or a yield of 21% based on the current token price. Please note this is purely speculative. We present these figures simply to provide a viewpoint on how an investor might measure potential risk/reward when analyzing Uniswap.

We think that acquiring an aggregator such as Zapper would also allow Uniswap to push back on the emerging PFOF model, protect its LPs, and control another layer of the value stack. The recent acquisition of Genie signals this could already be a strategy the team is considering

Is anyone wondering what happens to Coinbase and centralized exchanges?

Cause we are…

Centralized Exchanges

It would appear that large centralized exchanges such as Coinbase, Binance, Kraken, and Gemini could be in trouble. Uniswap is undercutting them on fees. Below we can see volume comparisons for the ETH/USD pair and ETH/BTC pair for a data sampling period from June 2021 to March 2022.

Source: Paradigm Capital

Keep in mind that centralized exchanges are building out several business lines. Coinbase is moving heavily into staking and has a strong institutional custody business line. They have also been pushing their wallet of late and built an NFT marketplace. As a publicly traded company, Coinbase has become the trusted source for institutions in terms of custody and trading. Deals with Blackrock and Google are representative of this. We expect to see Coinbase’s share of revenues from trading activities drop in the coming years, while their ancillary business lines could grow substantially.

Firms such as Coinbase control the on/off ramps today. But this is not guaranteed in the future. MetaMask recently partnered with Sardine, a fintech, to enable bank transfers directly to MetaMask users’ wallet/DeFi brokerage. This cuts out Coinbase and creates a direct bridge from Banks to DeFi without going through a centralized exchange first. It also allows MetaMask to capture a more direct flow.

Keep in mind that this space is incredibly early. Coinbase and the other centralized firms may lose a % of trading fees to AMMs such as Uniswap, but a rising tide could lift all boats for the foreseeable future.

Regulation

A quick note on regulation. Uniswap and other AMMs are unregulated today. For the record, so is Coinbase. The caveat is that Coinbase sits at the on/off ramps to the traditional banks. To set up a Coinbase account, you have to go through KYC (Know Your Customer). This means law enforcement can track anyone that enters/exits crypto through their exchange. The same cannot be said for Uniswap. This means two things: 1) it is more difficult to track illicit activity on Uniswap, and 2) it is more difficult to track activity for tax collections. Keep in mind that today, the vast majority of users that have made it to Uniswap had to start at Coinbase or some other centralized exchange — to buy crypto which can be used within DeFi. Uniswap has no direct on/off ramp with a KYC provider.

Based on bills being put forth in Congress, it looks like the CFTC is going to regulate most of crypto. The centralized exchanges would fall under their oversight. With DeFi protocols it is trickier to project what could happen. It is certainly possible that Uniswap will be forced to install KYC through its website interface for any direct access to the protocol. The same could be said for any aggregator sitting on top of Uniswap. It’s also possible that law enforcement will come up with new ways to track illicit behavior and tax cheats. We could also see some pools on Uniswap become “permissioned” while others remain permissionless.

Of course, we also cannot rule out that Uniswap gets a broker/dealer license, registers with the SEC, and becomes the trading infrastructure for a new financial system in which all assets are tokenized.

It’s all anyone's guess. But don’t forget that Uniswap just raised $165 million from some very powerful VC firms, including the most powerful VC in the world. For more on this topic, we found this thread by Jake Chervinsky, Head of Policy at the Blockchain Association helpful.

Conclusion

We think DeFi protocols are infrastructure. Uniswap is infrastructure. Similar to our thesis for lend/borrow protocols, we see AMMs as base-layer protocols. We think that aggregators, brokerages, gaming apps, etc will tap into AMMs for liquidity. Even traditional order books such as Robinhood could one day tap into Uniswap for liquidity.

Based on what we’ve laid out in this report, it could be in Uniswaps best interest to acquire a middleware aggregator. This would allow them to control a critical layer of the trading stack. Most importantly, it will allow them to maintain a fully decentralized liquidity provider/market maker structure they utilize today. In this case, the aggregator would take a small fee (which could go to the Treasury or token holders) for providing a slick interface to Uniswap (and other AMMs), and the LPs would still receive their fees for providing services at the base layer.

Meanwhile, Flashbots is looking to solve the sloppy execution at the block-building layer of the trading tech stack and keep the network as decentralized as possible.

Due to impermanent loss, it has become harder and harder to make profits as an unsophisticated, passive liquidity provider on Uniswap. We expect to see larger players move in and capture a larger and larger portion of the pie as time goes on. Liquidity providing could become institutionalized.

It’s also possible that we could see an order book model built on top of Uniswap.

As time goes on, the path will become more obvious for the Uniswap team.

But one thing is undoubtedly true: the most important metric for any DeFi protocol is liquidity.

And Uniswap is the king today.

I hope you got some value from this meandering report on Uniswap and the AMM model. There are many questions today. Not as many answers, but maybe a few ideas.

___

Let’s get some discussion going in the comments section. What do you think about Uniswap? Where do you see the ecosystem going?

Thanks for reading and supporting The DeFi Report. If you got some value from this week’s report, please like this post, and share it with your friends, family, and social networks so that more people can learn about DeFi and web3.

This small gesture means a lot and helps us grow the community.

If you are interested in working with The DeFi Report or any kind of partnership, sponsorship or bespoke consulting services feel free to reach out at mike@thedefireport.io or reply to the email if you are reading this from your inbox.

___

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.

Fantastic Report.

Thanks