Hello readers,

In Part 1 we covered the current state of private markets and how they differ from public markets. The key takeaway was that private markets are massive, yet see just a fraction of the secondary trading volume of the public markets. The primary driver of this discrepancy is access to trusted data for market participants.

In Part 2 we will cover:

The new Tech Stack and Database for Private Assets

The Future State of Private Markets

How Private Markets will Interact with DeFi

If you’re new to The DeFi Report, drop your email below to receive free reports twice/month directly to your inbox. We provide easy-to-follow mental models, frameworks, and analyses of DeFi and web3 business models.

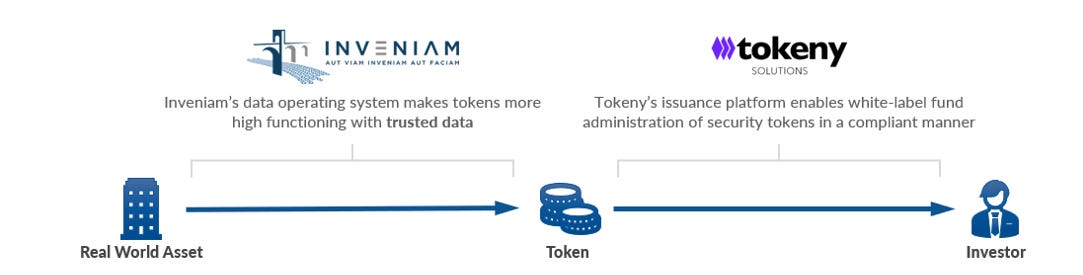

Tokeny is the leading white-label solution for compliant issuance and administration of private digital assets.

Let’s go.

The New Tech Stack

Private markets will never become more liquid without a trusted database. We believe this new database will be distributed and owner-controlled — as opposed to a centralized database, such as the EDGAR database in public markets. In this section, we’ll cover the basic elements of the nascent tech stack and the key players today.

Inveniam is a distributed, owner-controlled data room and the gateway to tokenized private assets.

The Base Layer

It all starts with better data. Inveniam is a distributed, owner-controlled database and operating system for private assets. Integrations are in place today that connect these client-controlled data rooms with tokenized assets and marketplaces for compliant digital trading.

But how do we trust the data?

We trust it because it has been reviewed and attested to by 3rd party firms such as Cushman & Wakefield, JLL, CBRE, Houlihan Lokey, ValuStrat, Mercer, etc.

Blockchain Interaction

All valuation documents are anchored to a blockchain via a cryptographic hash. The documents themselves stay off-chain. This creates an immutable audit trail for the data used in the valuation. You can think of it as a time stamp or notary. Inveniam is blockchain agnostic, though we favor public blockchains. We anchor to Ethereum, Polygon, Avalanche, Solana, and Tezos. Private chains are also available upon request.

Finally, Accumulate is a universal layer 2 public blockchain designed for interoperability, identity, and data anchoring cross-chain. The team will be launching its mainnet later this month and will be the preferred chain for Inveniam clients due to its throughput, multi-chain security, and low transaction costs.

The idea here is that large asset owners and managers can hook into Inveniam, receive efficient (leveraging AI) and independent 3rd party valuations on a monthly or quarterly basis, and anchor that data to a blockchain. Owners can then permission access to their data rooms as needed for various market participants and marketplaces.

Inveniam is a technology. But from a practical perspective, it is essentially an interface to owner-controlled data. This functions as a distributed, owner-controlled data room that leverages AI to help you value your assets and prepare for compliant tokenization. If you're interested, check out this interview with Tara Stacom, Executive Vice Chairman at Cushman & Wakefield, and Inveniam CEO Pat O’Meara riffing on Commercial Real Estate, data, and Valuation as a Service.

We now have the essential base layer for price discovery of private assets: trusted valuation data for market participants to observe.

The Tokenization Layer

There are many benefits for an asset owner/manager to consider when simply receiving monthly or quarterly 3rd party valuation marks while anchoring the data to a blockchain. One such benefit is that the assets are always “sale ready,” creating optionality during evolving market conditions.

Should an asset owner or fund manager seek to tokenize, or fractionalize the capital stack of their assets, they could move a layer up in the tech stack.

Tokeny Solutions is the leading white-label solution in the market today for compliant, institutional-grade digital asset services. Tokeny’s solution allows asset owners and managers to compliantly issue, transfer, and manage digital assets or “tokens”. All processes — from client onboarding, including KYC/AML checks, to the administration required to manage investor subscriptions (capital calls, distributions, etc) — are streamlined on the Tokeny platform. Tokeny developed the ERC3643 token standard for complaint, permissioned digital assets — a standard that has been adopted by the Ethereum Foundation.

We’ll note that digital securities are not bearer instruments (as opposed to blockchain native crypto assets such as BTC, ETH, etc). As such, digital securities can be recovered if lost, stolen, etc. Legal contracts can be adhered to. Furthermore, regulatory requirements can be coded into smart contracts, wallets, and IDs. For example, an investor in one jurisdiction could be restricted from transacting with an investor in another jurisdiction based on IDs tied to wallets. This is all possible and deliverable today with a solution such as Tokeny.

Tokeny’s lead investor is Euronext, Europe's largest stock exchange group. Through their partnership, Inveniam and Tokeny offer the only solution in the market today that connects trusted private asset valuation data to compliantly issued digital assets.

Why would an asset owner want to tokenize? Again, this comes down to optionality and the ability to raise capital without selling off 100% of high-performing assets. A General Partner may want to offer liquidity for their Limited Partners. As more and more funds are tokenized, LPs could begin demanding liquidity. This could lead to pressure on GPs to move in this direction to maintain their investor base. Finally, GPs can utilize the efficiencies of smart contracts to handle investor administration including capital calls, distributions, expense calculations, etc. Real estate funds are early adopters so far.

Apex Group, a fund administrator with $3 trillion of assets under management, has recently partnered with Inveniam and Tokeny. If you’re interested, here is Georges Archibald, Chief Innovation Officer at Apex, discussing their partnership with Inveniam and “Valuation as a Service” powered by Inveniam.

The Custody Layer

The interesting thing about digital assets is that these are instruments that individuals and organizations can control and self custody — which is not possible with traditional assets such as stocks and bonds. We think there will likely be a need for both custodial and non-custodial solutions. Forthcoming regulations may play a role here as well as securities laws require custodians today.

Fireblocks is the leader in the non-custodial category today for institutions and is the tech behind BNY Mellon’s recent announcement regarding crypto custody at the bank.

Fireblocks also provides a platform or interface for managing digital assets, reporting, and a gateway to services across the DeFi ecosystem. They have a direct partnership with Tokeny for white-labeled tokenization services. Fireblocks is one of the “bridges to DeFi.”

Anchorage Digital is a leader in the custodial category today, and also has non-custodial solutions for crypto assets. Anchorage provides custody services for Oasis Pro Markets, which we’ll get to shortly.

Picture this: an LP of an Apex-administered real estate fund utilizing the Inveniam/Tokeny platform could have an interface into DeFi lend/borrow applications through Anchorage or Fireblocks. This would allow an LP holding tokenized real estate assets to leverage those assets as collateral for loans in DeFi. MakerDAO and Aave, the two largest lend/borrow DeFi platforms are explicitly looking to lend more against real-world assets. VCs are funding this space heavily. It’s anyone's guess what kind of services and products spawn out of the merger between off-chain assets and DeFi. This leads us to…

The Liquidity Layer

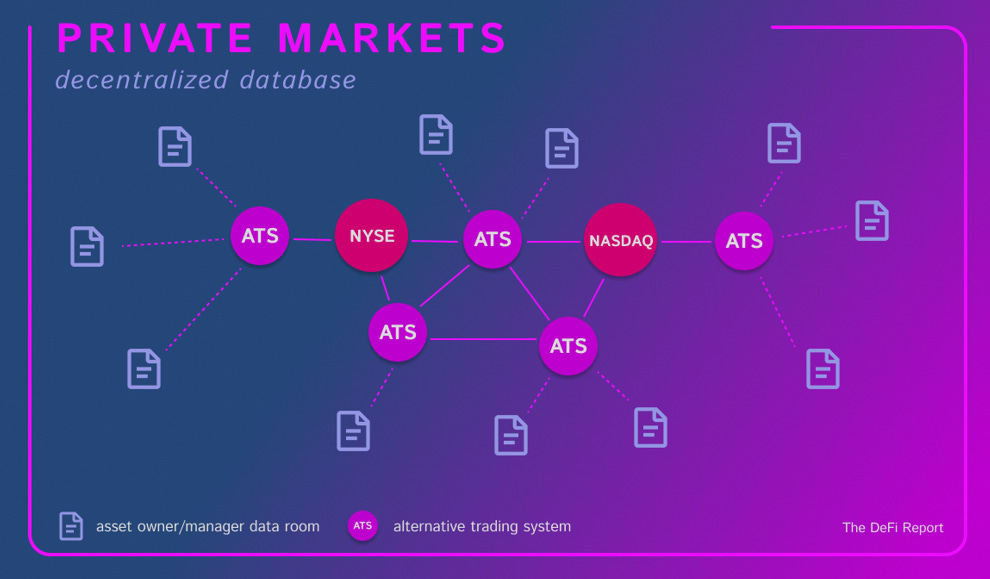

While liquidity is nascent today, we are seeing the formation of a network of digital Alternative Trading Systems. These are SEC/FINRA registered broker-dealers that are leveraging blockchain technology to build order books for the trading of private market assets.

Oasis Pro Markets, or “OPM,” is one such firm and another partner of Inveniam. OPM raised $27m recently and has strategic backing across both DeFi and TradFi channels. Pat LaVecchia, a wall-street veteran and current CEO of Oasis Pro is a former strategic advisor to DeFi OG, MakerDAO. Ties to OPM as well as Maker’s recent deals with Tesla and the purchase of $500m in treasury/corporate bonds point to further bridging between TradFi and DeFi.

Others ATSs include Rialto Markets, ADDX, SDX, INX, Securitize, Archax, Texture, tZero, and more.

Via API, investors on the OPM platform [and other marketplaces] will have a direct view of the trusted valuation data through Inveniams distributed data room interface. Asset owners and managers will be able to control permissioned access to the data on a deal-by-deal basis.

It should be noted that large exchange operators have investments in the space. The Intercontinental Exchange (which operates the NYSE) is the lead investor in tZero and Euronext is the lead investor in Tokeny.

The architecture of a distributed database for private markets, with connections to SEC-registered Alternative Trading Systems (ATSs) and large exchanges such as NYSE, looks something like the below:

Graphic Design: Laerta Premto

Regulation

Just a quick note on regulation. Everything we have covered so far is dealing in securities. While there is great uncertainty pertaining to cryptoasset regulations, there is much less ambiguity when it comes to digital securities. In this case, we are simply taking existing securities and putting them on blockchain rails — to enable access to information, custody, and secondary trading. Additional benefits include enhanced security, transparency, and efficiency (smart contracts).

The existing rules apply here. That said, regulations should change in the coming years. Blockchains fundamentally obviate the need for transfer agents [smart contracts handle this] and custody providers [self-custody is possible and could be preferable for some firms]. The SEC requires these two parties today, which adds unnecessary friction and costs. The laws could change as the tech becomes more understood and trusted.

Connection to DeFi

The primary connection to DeFi for these markets will likely be through lend/borrow applications and asset servicing. Platforms such as MakerDAO, Centrifuge, and Aave offer services for lending on real-world assets — a nascent concept today that we expect to grow further in the years to come. Many, many start-ups have been funded in this space.

We do not expect to see these assets traded on decentralized exchanges such as Uniswap, primarily due to regulatory constraints.

The Future State

The infrastructure is being laid out today that is creating the foundation for the liquid trading of private market assets — an evolution that we believe will ultimately look similar to the digitization of the public markets in the 90s. We like to analogize this to the build-out of a railroad or highway system. As the base layer takes form, we should expect to see an explosion of entrepreneurial activity around data, asset servicing, fundraising, trading, financial products, etc.

We are in the very early innings today. To see the vision we are all building, we will have to come together to reduce friction and create a superior user experience for asset owners/managers, investors, administrators, and the general public. As they say, “it takes a village to raise a child.”

It will take an entire ecosystem to transform and digitize the private markets.

Ultimately, bridging private markets to liquid trading and DeFi lending/borrowing will open up the velocity of money within private markets while unlocking the hidden value that has been tied up in these illiquid assets for generations.

It’s incredibly exciting and humbling to get to have a front-row seat to all of the action. I’m glad to have the opportunity to share my boots-on-the-ground perspective with you.

*Please note that Inveniam has direct financial relationships and operating contracts with many of the firms referred to in this report.*

___

Thanks for reading and for your continued support. If you got some value from this week’s report, please like this post, and share it with your friends, family, and social networks so that more people can learn about DeFi and web3.

This small gesture means a lot and helps us grow the community.

If you have a question, comment, or thought, please leave it here:

If you are interested in working with Inveniam or any kind of partnership, sponsorship, or bespoke consulting services feel free to reach out at mike@thedefireport.io or reply to the email if you are reading this from your inbox.

___

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such should not be construed as investment advice.