Hello readers,

Our last report laid out a mental model covering 5 high-level themes that point to broad adoption of DeFi products and services in the years to come. This week we are niching down with a focus on the lend/borrow sector of DeFi.

Topics covered:

What Happens to the Banks?

ETH Stake Rate & Yield Curve for DeFi

Interest Rate Swaps and Fixed-Rate Lending

Undercollateralized Loans and Tokenized Real-World Assets

The Impact of a CBDC on the Banking System

I hope this analysis helps you develop a framework for how we can think about DeFi protocols and the role they could play within financial services in the years to come. Please drop a comment at the end of the report if you agree, disagree, or have any additional thoughts or takes.

If you’re new to The DeFi Report, you can subscribe below to have these free issues dropped into your inbox twice/month as they are published. We provide easy-to-follow mental models, frameworks, and analyses of DeFi and web3 business models.

Let’s go.

What Happens to Banks?

Let’s hit the elephant in the room first. If we believe that DeFi lend/borrow & money market applications will be broadly adopted by 2030, what happens to the banks? In short, the banks are not going anywhere. The idea that we could move into a “bankless” future seems pretty far-fetched. When you look around the crypto/DeFi ecosystem, you will see plenty of decentralized (some more than others) applications — but there is also a fiat on/off ramp pointing to a bank in almost all cases. To be clear, the only way that DeFi can scale is through traditional regulated entities — not only from a logistics/user experience perspective but from a capital markets perspective as well. We do not have the idea that DeFi applications will replace banks any time soon. Does DeFi provide access to services for the unbanked on the margins? Absolutely. But this will not be the main driver of growth for the industry.

We also do not think Bitcoin will replace the dollar or other global fiat currencies anytime soon. That said, we do believe that both will play a significant role in the future of finance.

One of the core themes of our high-level thesis for DeFi involves the power of open-source technology. The open-source operating system, Linux (which started as a fringe movement in the 90s), is a great example of this. Microsoft was extremely defensive and combative toward Linux in the 90s, going so far as to call it a “cancer.” It turned out that Microsoft became one of the largest contributors in the world to Linux. But Linux didn’t disrupt Microsoft. Instead, Linux allows Microsoft to integrate more features, flexibility, security, and hardware support into the products/services its customers demand.

We could think of DeFi lend/borrow apps through a similar framework. These are open-source protocols that allow others to freely use them, build on them, integrate with them, etc. For this reason, we think that banks will ultimately integrate with DeFi lend/borrow applications. Why? Their customers will demand new features, services, flexibility, control, yields, etc. In this case, users will be interacting with DeFi applications through banking interfaces without even realizing they are using DeFi under the hood. Sort of like how Microsoft users have no idea they are interacting with Linux under the hood.

State of the Banking Industry

The number of banks in the US has been in decline since 1921 when we peaked at 30,456 banks. Below we can see the rate of change in just the last 21 years, where the number of banks has been cut in half to 4,236. And if we go all the way back to 1984, the number of banks in the US has decreased by 70%. The more recent acceleration in the decline of new banks points to a lack of profitability since the Great Recession, driven largely by low-interest rates which have collapsed net interest margins. New regulations post-crisis have also driven up administrative setup costs, creating additional barriers to entry.

Source: FDIC, Statista

With the number of banks in decline, we have also seen a consolidation within the industry. Below is a comparison of the number of small and large banks from 1994 to today. In 1994, small banks represented 84% of the market share. Today the figure stands at 52%.

Source: NCRC

In the US, when we think of banking, we typically think of JP Morgan. Bank of America. Credit Suisse. Or Wells Fargo. The major players. But many banks are smaller, community banks. These banks do not have the resources to implement expensive new technologies, leading to their demise and/or mergers with the larger banks. This is where DeFi becomes incredibly powerful. Your local credit union does not have the resources to implement and integrate expensive new technologies to compete with the larger banks. And now they don’t need them. They can simply “plug in” to open-source DeFi protocols through software developer kits. By doing so, they leverage a network of open-source developers that essentially work for them for free. We touched on the idea of “plugging into” open source financial tech when analyzing El Salvador’s decision to opt into the Bitcoin Network in 2021.

DeFi protocols will give these smaller banks the ability to offer new cutting-edge services at low costs. This could help to level the playing field between the large and small banks and offset the aggressive consolidation we’ve seen throughout the industry.

To see this begin to play out, we will first need to see regulatory clarity, on-chain identity, and audit standards for smart contracts.

Ethereum’s Post-Merge Staking Yield

With Ethereum’s merge to proof-of-stake now complete, the yield for staking ETH is currently about 5.2% — a real yield (as opposed to a nominal yield represented by protocol inflation). Ethereum is the only network in crypto that is producing a meaningful real yield. With that said, on-chain activity has been slowing of late as there have been a few days where the transaction fees burned did not offset the new issuance of ETH. But keep in mind that with the slightest uptick in on-chain activity, ETH becomes deflationary. As this happens, holders of ETH are no longer being diluted by new issuance. The blockchain is now profitable and does not need to subsidize security providers/validators with new ETH issuance as user transaction fees take over. Ethereum is growing up right before our eyes.

Impact on DeFi Lend/Borrow Apps

With a 5% real yield for staking ETH, many analysts are projecting that Ethereum could be setting a benchmark “risk-free” rate for DeFi. In this case, not only are stakers/validators earning a real yield, they are earning it in an asset that includes a “call option” on the future of web3. Of course, there are risks to consider as the price of ETH could also drop in the future or the network could simply not realize its potential.

If the ETH stake rate is seen as crypto’s “risk-free” rate, we could start to see the formation of a yield curve for DeFi. In a rational market, anyone using DeFi apps (riskier) for yield should demand a higher rate than the ETH stake rate. Staking rates on alternative L1s could also fall onto this yield curve.

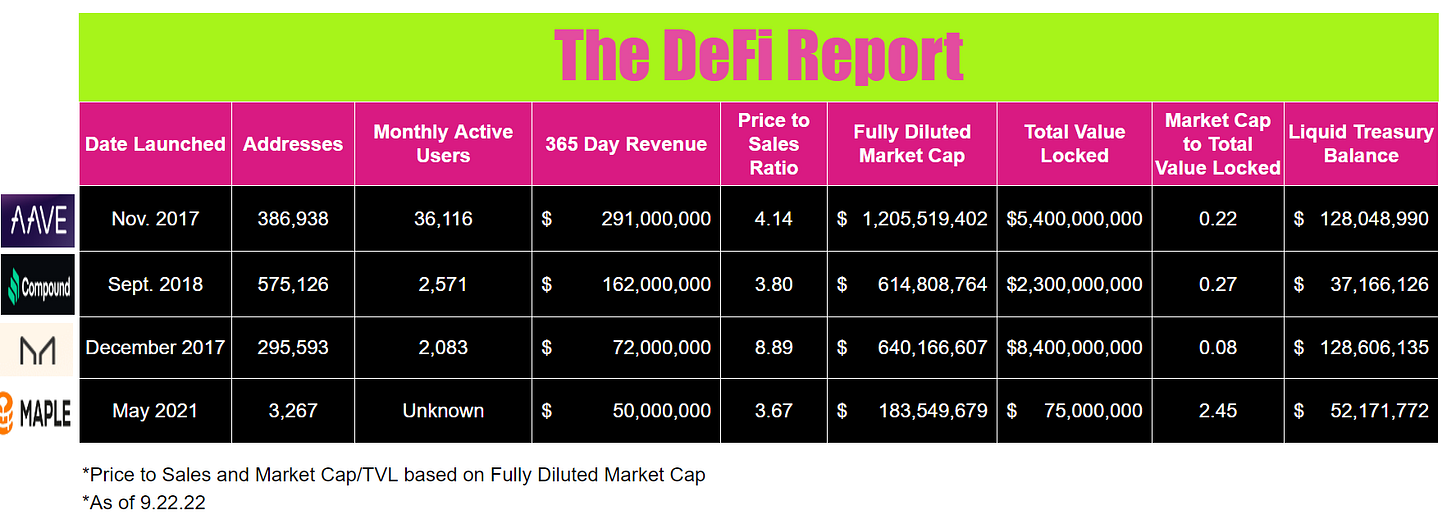

The bottom line is that this new, real yield available to ETH stakers should have an impact on capital flows in DeFi. If you can earn 5% with relatively low risk for staking ETH, lend/borrow rates on applications like Aave and Compound should exceed the ETH stake rate in the not-too-distant future. This is something we’ll be keeping an eye on.

Finally, if we circle back to our thesis that banks will “plug into” DeFi lend/borrow apps, we should also expect banks to offer access to the ETH stake rate. Should pension funds be able to diversify out of treasury bonds? Would they want access to something with a higher yield that includes significant upside? And would the banks be incentivized to offer access to these services to boost their margins? Will enterprise customers prefer custody solutions with trusted entities as opposed to holding their own private keys? We believe the answers to these questions will be a resounding yes.

Interest Rate Swaps: Fixed Rate Lending for DeFi

If we look up and down the tech stack, yield is structurally variable from the bottom up and determined by supply and demand. For example, at the bottom, we have the ETH stake rate which is determined by the number of stakers and the amount of on-chain activity happening across DeFi apps, gaming apps, NFTs, transactions, trading, etc.

If we move up the tech stack we have DeFi apps, where again, the yields are determined by the supply and demand of borrowers and lenders.

To be clear, this same problem exists in traditional finance. At the base layer in TradFi, we have treasury yields, which are set by Central Banks and change from time to time (as we’ve seen of late). Variable rates introduce uncertainty and make it difficult for borrowers. For example, most people do not want to hold a 30-year mortgage with an interest rate that can increase at any time. Enter the market for interest rate swaps — a quadrillion-dollar derivative market that allows for fixed-rate lending.

About 88% of corporate borrowing is done at fixed rates today in traditional finance. As the DeFi ecosystem evolves and matures, we should expect to see new products coming into the market to further support new business models. For example, today DAO structures use their native token to raise capital and bootstrap. Upon establishing product-market fit, many of these new structures will likely seek traditional debt financing, backed by their revenues. Like any business, they will seek fixed-rate lending. Voltz protocol is one such solution that seeks to unlock fixed-rate lending through its interest rate swap AMM. [We have no affiliation or investment with Voltz]

Undercollateralized Lending & Real World Assets

Borrowing in DeFi today requires the over-collateralization of liquid deposits in the form of cryptoassets (ETH, BTC, etc). For example, if you want to take a $100 loan, you need to deposit $150. This is the case today for all of the blue-chip lend/borrow apps such as Maker, Aave, and Compound. The overcollateralized structure is necessary to allow smart contracts to automatically liquidate positions and ensure lenders get their money back during periods of market volatility. There is no counterparty risk in DeFi for this reason. That said, not all risk has been removed as DeFi has considerable smart contract risk today.

We view this over-collateralized lending structure as essentially a proof of concept for DeFi tech today. In the long run, this is not a capital-efficient way to borrow. Businesses are not set up to over-collateralize for loans. Instead, they would prefer to loan against productive assets while using those assets to deliver products and services. As such, undercollateralized, or capital-efficient lending is preferable. For example, if you are buying a home for $200k, you don’t want to put up $125k and receive a loan of $75k. You want to put up much less, and use your home (productive asset) as the collateral.

The solution to this challenge is bringing real-world assets on-chain. The first instantiation of this has been dollar-backed stablecoins. But there are many, many use cases. For example, tokenizing the legal entity that holds real estate assets would then enable those assets to be used as collateral for efficient on-chain lending. In reality, anything of value can be tokenized. That said, there needs to be a robust infrastructure for lenders and other market participants to understand the nature of the underlying assets tokenized (legal status, financial statements, disclosures, etc). As this infrastructure is built out, we should expect to see more and more assets tokenized. This will open up more liquid trading of all kinds of assets as well as more capital-efficient lending in DeFi. My employer, Inveniam, sits at the epicenter of this infrastructure for private market assets. We recently partnered with Apex Group ($3 trillion AUM) and released our white paper on Valuation as a Service which you can find here if you’re interested.

Aave and MakerDAO, the two largest lend/borrow apps in DeFi have been expanding into this area over the last year or so. This can ultimately bridge the regulated TradFi worlds with the efficiencies enabled by public blockchain infrastructure.

Central Bank Digital Currency

It is important to note that the Federal Reserve is currently exploring a “hypothetical” CBDC (digital dollar) along with over 100 Central Banks around the world. If this were to be implemented, it’s possible that it could fundamentally restructure the existing monetary system with significant ramifications to the banking sector. Today, the Fed does not have direct access to individuals and businesses in the economy. Instead, they interact with large Commercial Banks, who in turn deal directly with individuals and businesses. A CBDC would give the Fed direct access to individuals and businesses and broad tactical control in managing the economy and consumer behavior.

It’s not yet clear how a CBDC would impact the banking system, privacy, payments, the economy, and consumer behavior. It all depends on how it is implemented. It’s possible that a CBDC would remove the need for large commercial banks. It could also remove physical cash from society and allow for negative interest rates. Furthermore, we don’t know if a CBDC would ultimately come directly from government entities or from the private sector. For what it’s worth, the Fed is working with MIT’s Digital Currency Initiative (as is the Bank of England and Bank of Canada) on initial prototypes.

Many view a CBDC to be antithetical to DeFi and what is being built with Ethereum, Bitcoin, and other public blockchains. These are open, fully transparent platforms that users can opt into. A CBDC would likely move the monetary system into further centralization. We believe that a system designed to transfer greater control over the economy and consumer behavior to governments would be better suited for some eastern cultures and socioeconomic structures. While we shouldn’t jump to any conclusions as to how a CBDC would be designed and implemented, we do know that governments prefer more control over less when given the option. And while it may not be obvious to the general public, controlling money is one of the most powerful vectors of control for any government.

As we have outlined, we think that western cultures will move toward more decentralized systems in the coming years (similar to the embrace of the internet, but with more regulation). With that said, we still need to assign some probability that the future becomes more centralized. The implementation of a CBDC is something we’ll be keeping an eye on.

Conclusion

We believe that the growth of DeFi lend/borrow applications will ultimately be driven through regulated entities. Most of the friction within DeFi today has to do with the on/off ramps between crypto/DeFi and fiat currency. For this reason, going truly “bankless” will not be feasible anytime soon. The open-source nature of DeFi protocols will allow smaller banks to offer new products and services without the need to build the new functionalities themselves. By “tapping” into DeFi, these banks instantly bring millions of new users into DeFi globally.

In the more near term, we expect to see a yield curve develop within DeFi, with the ETH stake rate serving as the DeFi equivalent to the Fed Funds Rate. We also expect to see new products adopted that will enable fixed-rate lending in DeFi, as well as the continued build-out of infrastructure to support tokenized real-world assets — which can be used as collateral in DeFi for more capital-efficient lending.

Finally, the introduction of a CBDC could throw somewhat of a monkey wrench into the forecast for DeFi. It all depends on the implementation. There are many scenarios where a CBDC could force further centralization and a complete reset of the monetary system. There are others where CBDCs worldwide would reinforce the need for DeFi services and decentralized monetary networks such as Bitcoin.

___

Thanks for reading and for your continued support. If you got some value from this week’s report, please like this post, and share it with your friends, family, and social networks so that more people can learn about DeFi and web3.

It costs nothing for you and will help us grow our community.

If you have a question, comment, or thought, please leave it here:

If you are interested in any kind of partnership, sponsorship, or bespoke consulting services feel free to reach out at mike@thedefireport.io or reply to the email if you are reading this from your inbox.

___

Take a report.

And stay curious my friends.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such does not constitute investment advice.