Decentralized Real Estate Lending

An analysis of the lending market today and a new DeFi protocol

Hello readers,

Buckle up because we are diving into the world of decentralized lending in this edition of The DeFi Report. Can you imagine depositing your $ into a bank and being able to see exactly where your money went on the other side? That’s what the future of lending looks like. Except this won’t happen via a bank. And the future is already, kinda, here. At least it is for readers of The DeFi Report.

This week were are analyzing the lending market today and breaking down the Bacon Protocol built on Ethereum. Yes, I said Bacon. I’m excited to publish this report because I think it gives us a great view into the role that banks/loan originators will play in the future as we progress into Web 3.0 and the distributed data economy.

If you haven’t subscribed yet and would like to receive these reports directly to your inbox as they are published, drop your email below:

Let’s go.

Lending Today

If you have a bank account, you probably have some cash in there. Your cash is an asset on your books, and a liability of the banks. But when we give banks our money, we don’t have any insight into what the banks are doing with it. If we all had transparency into this, do you think we would have allowed the housing crisis of 2008 to transpire? Would we have been ok with our money being lent out to subprime borrowers who couldn’t afford their homes? Do you think we would be ok with those loans then being packaged into mortgage-backed securities and sold to Wall Street? Would we have put a stop to all of this before the Federal Reserve ultimately started buying those loans and socializing the losses?

These are questions that we couldn’t even ponder prior to the invention of blockchain technology. So now we have to ask if any of this makes any real sense.

The way the system is set up today, none of us have any insight into our counterparty risk when we give the bank our $. But we don’t consider this to be risky because if anything were to happen, we believe the FDIC would step in and ensure our funds were returned to us. But does anyone even know if this is true? It seems like it’s more about trust than anything to me. My guess is that if we ever need that FDIC insurance, it’s not going to really be the insurance we thought we had. It’s not like the FDIC is not sitting in the background somewhere backing every dollar that is in every bank account. This does not exist. The government would print the money if it ever came down to this. Whether that makes everyone whole or not is anyone’s guess.

The FDIC is ultimately about psychology and confidence. If everyone believes their money is safe, then it must be safe. Right?

Bringing Big Banking Business down to the Individual

The idea with decentralized lending is that we are bringing the $13.8 trillion-dollar mortgage market (residential + multi-family) down to the individual level. Down to you and I. Today, banks, companies, and governments occupy the mortgage market. In fact, the Federal Reserve currently holds $2.7 trillion worth of mortgage-backed securities.

Source: Federal Reserve

Please note the monthly stair steps in the chart above since March of 2020. The Fed has been purchasing $40 billion in mortgages per month since Covid began. This is something I see very few people talk about when analyzing housing prices.

Furthermore, the Government-run Fannie Mae and Freddie Mac own an additional $6.8 trillion in mortgages in the United States.

The below chart shows Fannie Mae’s number. What’s most surprising is the amount of time it has taken (12 years) for the purchase of this many mortgages, as seen in the chart.

Source: Federal Reserve

And here we have Freddie Mac’s figures. Please note these figures are in millions of dollars (add six zeros to the number you see).

Source: http://www.freddiemac.com/investors/financials/pdf/1021mvs.pdf

These are simply astounding numbers for anyone that believes in free-market solutions. Altogether, the Federal Reserve and the United States Government control 68% of the residential mortgage market.

The numbers do not lie. Anyone pointing at this as evidence that the United States is on a trend toward socialism has a valid argument. I’m not one for hyperbolic statements like that, but again, these numbers do not lie.

The US Treasury guarantees the obligations of Fannie & Freddie. This allows them to completely dominate the mortgage-backed securities market. Essentially 100% of the profits of Fannie and Freddie are paid to the Treasury as a dividend, making these companies financial arms of the US Government.

It seems as if the US Government is making land and power grabs in the mortgage market in an attempt to pay down the Federal deficit (and in an effort to stabilize the economy). What is the output of all of this incestuous financialization? Have the taxpayers received any benefit?

Is the debt being paid down? You tell me.

Source: Federal Reserve

Has this achieved any other positive outcomes?

It is very difficult to find any. The homeownership rate in America sits at around 65% today - the same figure we had back in 1975.

The most profound impact of these Government programs has been the following: inflating housing prices and inducing higher debt and leverage in the financial system. This is creating more problems, and it is setting us up for a catastrophic outcome - one in which the Gov’t will come rushing in to “save us.” The fact of the matter is that it appears they are creating the problem. Here’s the impact on housing prices since the Gov’t began buying the $40b mortgages/month at the start of Covid.

Source: Federal Reserve

This is a problem in search of a solution. And we might just have found one in DeFi.

How Decentralized Real Estate Lending Works

The first thing that has to happen to make this work is the two critical elements to a mortgage must be broken apart:

The right to claim part of the value of a house, which we call a lien

A loan secured by that lien and an agreement to repay the loan

Separating these two makes it possible to keep the connection to real-world legal contracts. Everything beyond this small, but very real connection to the real world are moved to the blockchain and executed via smart contracts that are transparent, predictable, automated, decentralized, and composable.

This allows for a decentralized group of loan originators to be incentivized by the protocol to handle the small real-world relationships (we’ll get into this in detail later). The amount of trust required by any off-chain party is minimized with this structure.

These lending markets are formed by users - the lenders are everyday people (you or I become the bank) and the borrowers are everyday people (homeowners seeking liquidity using their home equity). Therefore, we will break this down from each person’s perspective.

Decentralized Real Estate Lending from the Borrowers Perspective

This analysis is of the Bacon Protocol (built on Ethereum), which is the first of its kind that I’m aware of. And to be clear, it does not support loans originated for new home purchases as far as I can tell. These are loans that users can access by leveraging the equity in their homes. We can think of this as more like a home equity line of credit, in a decentralized format. The loan is secured by the real estate used to access the loan.

Borrowers must first be approved by an Originator. Today, LoanSnap (Fintech backed by Richard Branson) is handling this, but the protocol expects to have many more Originators in the future.

So, if you have equity in your home that you would like to turn into liquidity, you start on LoanSnap. LoanSnap (the Originator) handles 4 tasks:

Makes sure the owner has enough equity in the house to cover the amount of the loan requested

Confirms the person requesting the loan is the rightful owner of the house

Executes a Deed of Trust agreement with the owner to create a lien

Records the lien in the public records with the county the house is in

Loanswap leverages AI for a lot of this work. Therefore, loans can be issued in as little as 1-2 days. These steps ensure that this process is still perfectly tethered to the real world and real contracts. Everything else is handled by smart contracts on the blockchain.

Once you are approved for the loan, LoanSnap creates an NFT for you. The NFT represents a lien on your property. The NFT is backed by the Deed of Trust that was filed in the public records.

You can now take your NFT, and deposit it into a smart contract within the Bacon Protocol, and receive a loan in USDC (crypto stablecoin backed by the dollar). Upon receipt of the loan, you are now obligated to make monthly payments to the protocol. As a borrower, you have the option to make interest-only payments, pay the full amount off early, refinance (automated in your favor), etc.

The benefits for you as a borrower are that you can turn illiquid equity in your home into cash pretty easily. You can do this without walking into a bank. And you can save on a myriad of fees. Finally, you don’t have to wait a few weeks for the paperwork to clear.

We should anticipate that this process will become even more streamlined over time. Furthermore, the loans are automatically refinanced (in your favor). If for some reason lots of liquidity enters the smart contract you borrowed from, your interest rate could drop. However, this would likely cause more borrowers to enter that smart contract for loans, which would drive the interest rate back up. The beauty of free markets.

Decentralized Real Estate Lending from the Lenders Perspective

Let’s say you want to earn a yield on some extra cash you have lying around. You can convert your fiat to a stablecoin, and deposit that stablecoin into smart contracts on the Bacon Protocol. You just became a bank for someone else. That’s how this works. The market is formed by users of the protocol. The person that borrowed your cash on the other side is going to make interest payments to you (and others that deposited liquidity). Smart contracts on the blockchain handle the interest payments and disperse these payments to the lenders in an automated fashion. Furthermore, when you deposit liquidity, you have the option to pick which pool of assets you want to lend to. For example, the protocol plans to offer smart contracts for loans only in the city of Boston. Or only on Jumbo loans. Or only in rural neighborhoods with low crime rates. So you’ll know where your money went and what types of assets are backing your loan.

This is pretty intersting.

But how is the Interest Rate Determined?

The protocol uses an Automated Market Maker (quite similar to a decentralized exchange like Uniswap). This is pretty simple - the more liquidity that lenders deposit into a particular smart contract (that is backed by a particular type of home or in a particular geographic region), the lower the interest rate. The less liquidity in the smart contract, the higher the interest rate. Supply and demand. Free markets. Do these exist anymore in traditional finance? It’s hard to tell sometimes.

In theory, the smart contracts that have pools of safe assets in them will have lower interest rates. Why? There will likely be more liquidity available for safe assets. The smart contracts for assets in a less desirable location or for a cheaper home could have less liquidity in them since they may appear riskier to lenders. This means the interest rate is higher.

Borrower Defaults

Defaults are going to happen. So how does this work in a decentralized format? Because the loans are backed by the home (via a Deed of Trust registered in the public records), the lender is covered by the home itself.

If there were a case where the protocol had to liquidate the value of the NFT to maintain stability, the Bacon Protocol will keep the NFT and recoup the lost value when either the borrower sells the home or LoanSnap (or any other originator) sells the home through foreclosure. The money received from the sale would be used to repay the lenders who deposited into that particular smart contract.

This is very similar to the process a bank must go through today when a borrower stops paying on a loan.

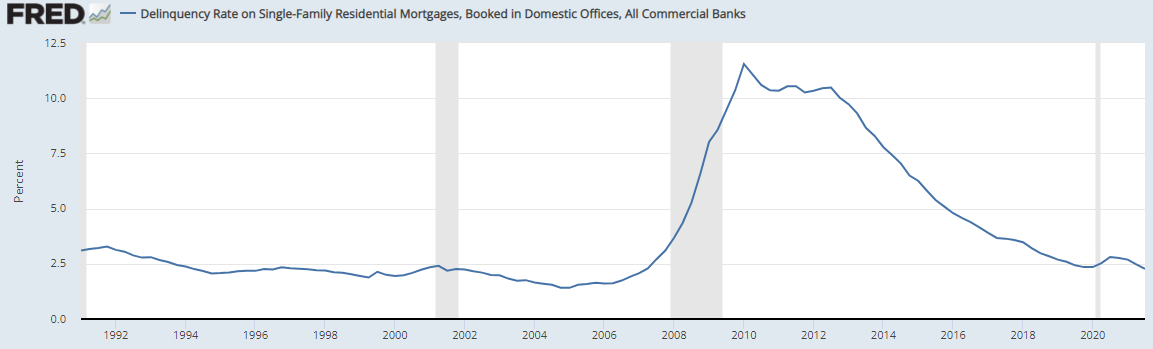

For reference, over the last 30 years, the average delinquency rate on mortgages is about 2.5% during normal economic conditions.

Source: Federal Reserve

Loan Originators - How do we keep them honest?

The loan originators are absolutely key to making this work. This is where the real world interacts with the blockchain.

So what is keeping these folks honest? How do we know that they aren’t approving borrowers for loans that could put lenders like you and me at risk?

Originators are economically incentivized to do the right thing.

They receive fees for minting the NFT that represents a lien on the property. The originator receives .5% of the value of each NFT created (as does the protocol).

They also receive fees equal to .5% of the total interest payment as the loans are paid down.

For example, let’s say an originator creates a loan for $100k on a $1m home. The homeowner then uses the NFT (lien) to get a loan on the $100k @ 3%. When the loan is created, the originator (and the protocol) each get $500 ($100k * .5%). They each also receive $41.66 each time a payment is made (3% loan and .5% goes to the originator and the protocol).

So, if they want to actually get paid, they better only approve borrowers who will actually pay because they directly have skin in the game. Incentives drive everything - this structure incentivizes the Originators to do the right thing.

These incentives are designed to keep the originators acting in everyone using the protocols’ best interest.

Conclusion

Like everything in the DeFi space, this is a super new and unproven idea. Is this going to be perfect from the jump? For sure not. I’m not recommending that anyone go out and try this right away. But I think this is a super interesting concept. A concept that will likely be honed and improved upon in the coming years.

We can also learn a lot about the role that banks could play as DeFi works its way into our everyday lives. In this scenario, the bank (loan originator) did not issue the loan. They simply provided administrative support for the process by ensuring that the homeowner is who they said they were and that the lien created by the loan (represented by the NFT) was recorded in the public records. This was value-added work. Most of what the banks do today is paper-pushing as a result of the archaic processes and lack of alternatives for customers. We put up with this (and the associated fees) because we have to. But this looks like it is going to change pretty soon.

At the end of the day, I think everyone would agree that the real estate industry could benefit from innovation. Most of the processes related to buying and selling a home or accessing a loan are quite outdated and inefficient. Below are the typical fees associated with accessing a loan:

Application Fee

Appraisal Fee

Credit Check Fee

Origination and/or underwriting fee (this is the only fee that survives in a decentralized format)

Title Insurance

Title Search Fee

Transfer Tax

Legal Fees

And there is no doubt that allowing homeowners to access the equity in their homes would be great for individuals and the economy as a whole. It’s staggering to think about all the equity value that is locked in illiquid homes across the country and world.

Imagine what would happen if we unlocked all of that?

We may just get to find out.

_____

Thanks for reading and for your continued support. If you have a question, comment, or thought, leave it here:

And if you’re getting value from these reports, please share them with your friends, family, and social networks so that more people can learn about crypto and this exciting new innovation.

Finally, if you would like to send me a tip, you can do so through the addresses below. If you do send a tip, please be sure to let me know so that I can send you a thank you note.

Bitcoin: bc1qghetd4g3lk7qnsn962amd9j92mkl4388zxz0jz

Ethereum: 0x084fcd3D9318bAa383B9a9D244bC0c32129EE20E

_____

Take a report.

And stay curious my friends.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.

As a borrower, can you deduct the interest expense against your taxes in this format?