Cycle Reflections & Learnings: Smart Contract Platforms

A framework for analyzing Ethereum's competition

Hello readers,

Bear markets are painful, but they also bring immense clarity. In this cycle, we saw a number of “Ethereum Killers” enter the fray. They all seek to solve perceived deficiencies with Ethereum’s ability to scale. During the bull run, many of these chains saw immense speculation. It seemed like all you had to do was launch at the right time and you got a $30b valuation. With so much excess liquidity in the market, it was very difficult to tell what was real.

But now the tide has receded. And we get to see who was swimming naked all along. In this report, we’ll review each platform based on its fundamentals - revenues, developers, active addresses, # of validating nodes, transactions, value locked, etc.

As a quick reminder, if you are new to The DeFi Report and would like to receive future free reports directly to your inbox, drop your email below:

Let’s go.

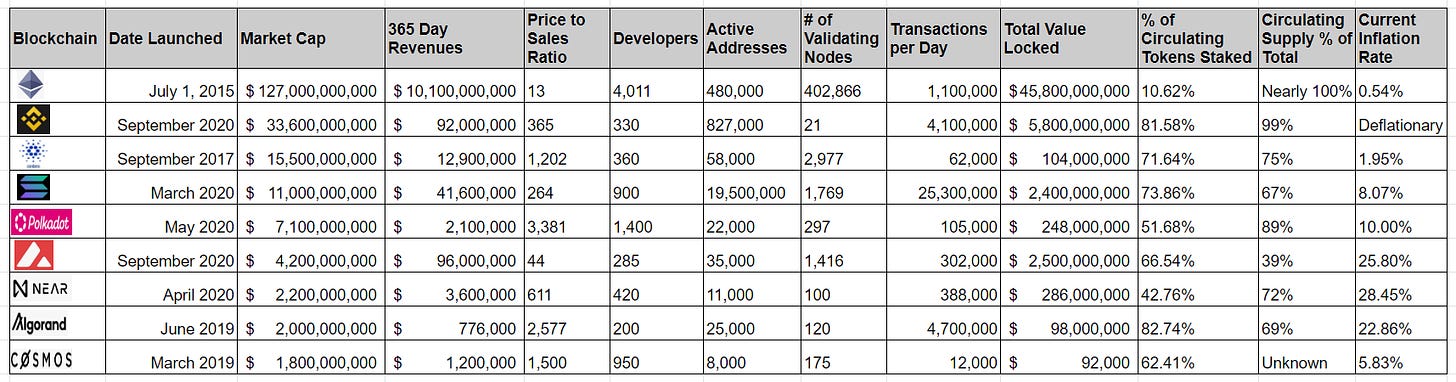

Top Smart Contract Platforms

You’re looking at the top smart contract platforms in the ecosystem today. Some of these will likely be the base layer protocols upon which the next iteration of the internet (web3) will be built. Please note that all figures were taken as of 6.18.22.

Let’s take a look at them one by one.

Ethereum

Ethereum was first to market. They are also dominating the playing field to date. One thing to note here is the power of network effects. What I have observed in crypto is that network effects tend to hold very well. This is because of how difficult it is to scale a blockchain. You need to build something that works. And then you need to entice really smart entrepreneurs/developers to build on your chain. If you can accomplish this, and they build real products/services that solve real problems, users will come. Transactions will ramp up. Data providers will report on your chain. The market starts to see the value being provided. And a positive feedback loop begins to take hold. More builders. More users. More positive data. Network effects beget network effects. I like to think of Ethereum as I think of the iPhone. The thing that makes my iPhone cool is not the phone, but the apps on it. Ethereum is cool today because it has more apps with more users than any other chain. DeFi has clearly found product/market fit on Ethereum. Meanwhile, games, NFTs, and the Metaverse were all kick-started over the last few years.

Ethereum’s network effect helps them dominate the most important KPI of all: revenue. Users paid over $10.1 billion dollars to access the blockchain over the last 365 days. With a Price to Sales ratio of 13 today, this appears to be pretty cheap for a high-growth network with a total addressable market in the trillions.

Ethereum dominates in terms of developers. This is the leading indicator for strong network effects. Ethereum also has a formidable lead in terms of Value Locked. We can think of Value Locked as we think of bank deposits. It’s the amount of money on-chain seeking to earn a yield.

Finally, Ethereum has the most favorable tokenomic structure of the bunch. With EIP1559 and the upcoming move to Proof of Stake, the Ethereum Foundation is projecting that the supply of ETH may peak before the merge. The monetary policy could turn deflationary thereafter with more ETH being burned than net new issuance to validators. The incentives/token structure looks good here - as the chain is used more, more ETH gets burned. This is akin to a company buying back more of its stock as it makes more money.

My final note on Ethereum is that it has benefited immensely from the fact that it started as a Proof of Work network. Proof of Work requires an investment of capital that covers the mining servers. In addition, miners incur operating costs (energy) to run them. As such, miners typically sell a large portion of the coins they mine to cover operating costs. This cycles the new coin issuance back into the market. Into new hands. This decentralizes the holder base. Proof of Stake networks (all of Ethereum’s competitors) are much more centralized in terms of the holder base. This is because validators do not have any operating costs. They lock their coins up to validate transactions and earn the block subsidies. Their coins are less likely to cycle back into the market.

Binance Smart Chain

BSC essentially copied/pasted the Ethereum chain and went live in Sept. 2020. It had perfect timing as the price of Bitcoin started rocketing up at this time. The chain saw immense speculation and a significant market cap at the peak of the bull - reaching a valuation of over $100 billion within 1 year. Yikes.

If you’re not aware, Binance is basically a Las Vegas casino on steroids. They primarily serve the Asian market. The company started as a centralized exchange (currently the largest in terms of volume). They grew incredibly fast by essentially green-lighting any ICO project that wanted to trade on their platform. The vast majority of these are pump & dump schemes. Binance took their fees and looked the other way. They are the sketchiest exchange of the bunch and have avoided cooperating with regulators to date. So sketchy that if you have a US address, you cannot access Binance’s primary marketplace. The Binance exchange makes Coinbase look like a choir boy.

The same approach was taken with Binance Smart Chain. This is a public blockchain, but it is not really public. There are a total of 21 validators running the network. All of these are insiders at Binance. I’ll note that all blockchains must start centralized. It has to be this way, but they have had time to decentralize and clearly, that is not part of their agenda. Binance has a good amount of activity on-chain. The problem is that it is unclear if any of these projects are real and sustainable. My sense is most of it is garbage. The one thing I like is their tokenomics - a deflationary model. This is the same transaction fee burn mechanism that Ethereum now employs.

My take here is that despite the chaos that Binance relishes, they are probably not going away. Their founder, CZ, is now one of the richest people in the world. They have significant influence and are wielding it - we see this with a deal they did with the French government to expand into Europe and with their recent $200 million investment in Forbes Magazine. They also committed $500 million alongside Elon Musk to buy a portion of Twitter. Binance represents big crypto whether we like it or not. Will the market punish Binance for its centralization? This is unclear as they mainly serve the Asian market which seems less concerned about decentralization at the moment.

Cardano

There-is-no-there-there. I don’t know what else to say about Cardano. These guys started building in 2015 and launched in 2017. They are led by Charles Hoskinson, the charismatic former Ethereum co-founder. Cardano seems to have an army of loyal followers. These folks are drinking the Kool-Aid but they aren’t looking at the fundamentals. Cardano did one-tenth of one percent of Ethereum’s revenue last year. That’s 10 basis points for the folks keeping score. Enough said.

Solana

Solana is backed by Sam Bankman-Fried. The FTX founder dumped $314 million into Solana Labs last March through his trading firm, Alameda Research. Sam got his start on Wall Street and Solana tends to attract a lot of folks from traditional finance. The knocks on Solana revolve around its high degree of centralization - remember, all blockchains start pretty centralized and become more decentralized with time. Solana has been live for about 2 years. I remember when the Bitcoin community would lob the same accusations regarding decentralization at Ethereum (and still do). Interestingly, the Ethereum community is now lobbing these same claims at Solana.

Solana has also had issues with the chain staying live. There have been 12 disruptions this year alone. You’ll see all kinds of FUD (Fear, Uncertainty, Doubt) on Twitter and LinkedIn when this happens. However, Ethereum ran into similar issues in its early years - does anyone remember The DAO hack and hard fork?

The features that brought Solana into the mainstream are its transaction speed and low costs, early development activity, usage, and marketing/brand. Solana has a fairly active ecosystem with 900 devs today and $2.4 billion of value locked. They did about $41 million in fees last year. The number of transactions and active addresses is astronomical compared to its competition. However, there is a reason for this. Bad actors are able to spam the network because transactions are so cheap. This is what is causing the shutdowns. So, when you see the super high addresses and transaction volume figures, just realize that it is not actually real. We see this same issue with email. There is zero cost to spamming someone’s inbox. We don’t see this on Ethereum because you actually have to pay for block space over there. There is no free lunch. This is a known problem and something Solana will have to fix, likely by increasing fees. That’s interesting because didn’t we all want cheap fees? Careful what you ask for.

Solana is trading at $34 dollars currently. Down 87% from its peak last year. For reference, Ethereum dropped 95% after its first bull run in 2017. It went on to do a 60x trough to peak in the last cycle. I think Solana is interesting at these prices. Keep in mind that if it drops 95% like Ethereum did the last cycle, that would equate to another 62% drop from here. The network has issues, but it also has a strong team behind it, backers with deep pockets, and strong developer activity. Solana’s developer growth is actually faster than Ethereum’s was at this stage of the lifecycle.

Finally, Solana has a high inflation rate today of 8%. Remember this when you see that users can earn 10%+ staking Solana. The real rate of return is not 10%. That said, the monetary policy is deflationary and is projected to level out at 1.5% inflation after year 10 of the project. It is worth noting that Ethereum also had a higher inflation rate in its early years.

Polkadot

Polkadot seems to be following a similar trajectory as Cardano in its early years. That said, they went live 3 years after Cardano so we have less track record to form a thesis on. The network was founded by Gavin Wood, another charismatic former Ethereum co-founder. Polkadot is a layer zero chain as opposed to a layer 1. Its ecosystem represents a “chain of chains." It seeks to achieve interoperability by hosting a web of interconnected, modular, and independent blockchains called parachains. The benefit to Polkadot’s design is that it should be able to host a wide variety of applications and use cases. The ability to secure unique and independent blockchains makes Polkadot a united network of sovereign systems, with interoperability amongst all the various subchains.

Gavin has created an extremely strong community and developer base - the 2nd largest developer base in the ecosystem. However, there isn’t much happening on-chain just yet. Polkadot has an outrageous Price to Sales Ratio, and this is after its valuation has dropped 87%. Wow. There is very little revenue. Very few active addresses. And almost no value locked on-chain. To be fair, Polkadot is building a very complex blockchain, and they are only 2 years into the project.

I actually think there is something here despite the lack of activity on-chain to date. The reason I say this is that Polkadot has over 1,400 devs and a very strong community. They have an experienced and charismatic leader. It is probably prudent to place a bet on a layer zero chain. Polkadot could be interesting at these prices for investors with long-term conviction.

Avalanche

Avalanche is an EVM (Ethereum Virtual Machine) that launched 4 months after Polkadot, yet has 45x the revenue, and 10x the value locked. Meanwhile, Avalanche has a valuation 40% lower than Polkadot.

That said, Avalanche’s quick growth can be attributed to the fact that it is EVM compatible. What I am observing is that just about every blue-chip DeFi app is launching on Avalanche in addition to Ethereum. This is a very positive sign. Avalanche’s design includes subnets, which act as a Layer 2. This makes L2’s on Avalanche unnecessary. The design is similar to Polkadot and Cosmos’ “layer zero” design - a chain of chains with interoperability across the entire ecosystem.

There is a lot to like about Avalanche. That said, I don’t like the outrageous inflation rate of 25% today. We can think of the inflation rate as the “cost to grow” right now. Avalanche is still in its early years - its cost to grow could be viewed as similar to any other start-up that needs to spend aggressively on sales & marketing in the early years. 66% of the circulating Avalanche tokens are locked up in staking contracts. This means the network is paying their early holders handsomely for locking up their coins. This is intended to suppress price volatility, which is why they are incentivizing users to do so. However, they are severely concentrating wealth by doing this. Furthermore, only 39% of Avalanche’s token float is in the market today. Token holders have quite a bit of dilution coming in the years ahead.

Near, Algorand, and Cosmos

Cosmos has a similar design to Polkadot. It’s a layer zero “chain of chains.” The platform is designed to be easily transferable, allowing developers to build new blockchains with their SDK kit while offering easy access to connect to other chains in the ecosystem via the Cosmos Hub. Cosmos has been around since 2019. They have strong developer activity but that is about it. The chain offers fantastic features. We just have not seen a ton of user activity on-chain just yet.

I don’t have a strong take on Cosmos at this time. I like its features and ecosystem but will need to see some real activity on-chain before developing any real conviction about its future prospects.

I feel the same way about Near and Algorand. Of the two, Near clearly has more activity on-chain and solid developer growth. However, I do not like to see an inflation rate of 28%. Near is still in its infancy, so we can rationalize the high inflation as a mechanism to bootstrap the network. We should see this number come down in the coming years if they can successfully build out a sustainable ecosystem. An interesting note about Near is that they have a scaling solution called Aurora. Aurora is EVM compatible, allowing Ethereum app developers to easily deploy. Building an attractive platform for developers and engineers has clearly been a focus for Near. This is a great sign and something we’ll have to watch for in the coming years.

Conclusion

Ethereum clearly made it through the cycle as the king of the smart contract platforms. This is obvious when we look at the fundamentals. I find the tribal nature of blockchain communities to be quite interesting. I see folks touting their favorite blockchains (the ones they have invested in) all the time but I don’t see them pointing at fundamentals. The fact of the matter is that the data for these networks are readily available. That’s the beauty of public blockchains. Anyone can investigate what is actually happening in these ecosystems if you take the time. With that said, the tribal nature of these communities makes it such that fundamentals don’t even matter sometimes. For heaven’s sake, Dogecoin reached a market cap of nearly $90 billion last cycle 🤯.

I believe this is a sign of how early we are in the adoption cycle of these new technologies. Just wait until Wall Street learns that Ethereum is ESG-friendly, yield-generating, and has a deflationary monetary policy.

___

Thanks for reading and for your continued support. This is the start of a short series we will be doing: “Cycle Reflections & Learnings.” DeFi is up next. If you got some value from this week’s report, please do me a favor and share it with your friends, family, and social networks.

If you have a question, comment, or thought, please leave it here:

Finally, if you would like to send me a tip, you can do so through the addresses below. If you do send a tip, please be sure to let me know so that I can send you a thank you note.

___

Take a report.

And stay curious my friends.

References:

https://tokenterminal.xyz/

https://explorer.near.org/

https://www.mintscan.io/cosmos/validators

https://medium.com/electric-capital/electric-capital-developer-report-2021-f37874efea6d

Coinmarketcap

http://theblockresearch.com/

Messari.io

Glassnode

https://bscscan.com/

http://etherscan.io/

http://explorer.solana.com/

https://beaconcha.in/charts/validators

https://polkadot.js.org/apps/#/staking

https://algorand.foundation/faq#running-nodes-

https://www.stakingrewards.com/cryptoassets/

https://wiki.polkadot.network/docs/learn-staking#:~:text=Inflation%20is%20designed%20to%20be,the%20remainder%20going%20to%20treasury.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such does not constitute investment advice.