Hello readers,

In this report, we’re covering Bitcoin’s value proposition from first principles.

If you haven’t subscribed yet and would like to receive these reports directly to your inbox as they are published, click the button below.

Let’s go.

What is Bitcoin and what problems does it seek to solve?

Bitcoin is *two* things. It is a *scarce digital asset*, and a *global payment network*.

We’ll cover the scarce digital asset first.

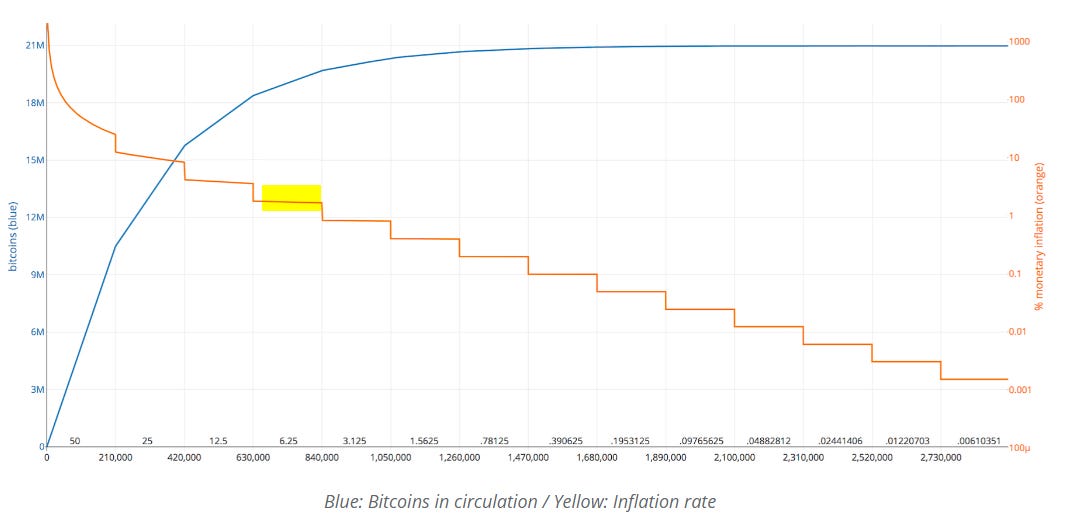

Bitcoin’s scarcity is derived directly from its pre-programmed monetary policy. Currently, every 10 minutes, 6.25 bitcoin are mined and come into existence. This happens like clockwork. Today we have 900 bitcoins added to the supply per day.

[please note that I’m using a lowercase “b” to describe the asset and an uppercase “B” to describe the Network/blockchain]

This pre-programmed monetary policy is on a disinflationary schedule (less and less over time). So, come spring of 2024, the new supply entering the market will be “halved” to 450 bitcoin per day. Supply added will remain at 450/day for about 4 years or precisely after 210,000 blocks are mined. In 2028, we will drop to 225/day. The new supply added to the market will halve every 4 years until all 21 million bitcoin have been mined. We expect this to occur sometime in the year 2140.

There will only ever be 21 million bitcoin. Today, 89.6% of the supply is already on the market. Bitcoin is open-source software so any market participant can verify these facts.

We can visualize Bitcoin’s monetary policy below. The orange line depicts the new bitcoin coming onto the market. The blue line is showing the total supply in circulation over time. The highlighted area is the epoch we are currently in today (6.25 bitcoin/block or 900/day). Again, this is pre-programmed. Which means it is perfectly predictable and reliable. It has been for 12 years now, and it continues to get stronger and more secure with more and more adoption.

When market participants can plan around a clear and predictable future, it completely changes their behavior. We see this with holders (hodlers) of bitcoin. When you know that you can buy an asset that has a monetary policy that is pre-programmed to increase in value over time, you don’t over-consume anymore. You live within your means. You invest. You plan for the future.

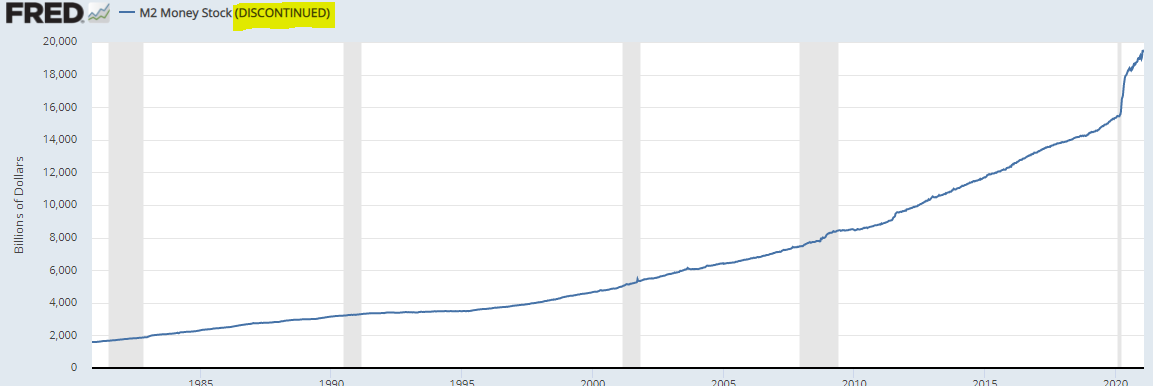

This is the opposite of how the dollar works.

We can contrast this clean, pre-programmed monetary schedule with that of the Federal Reserve and the M2 money supply below.

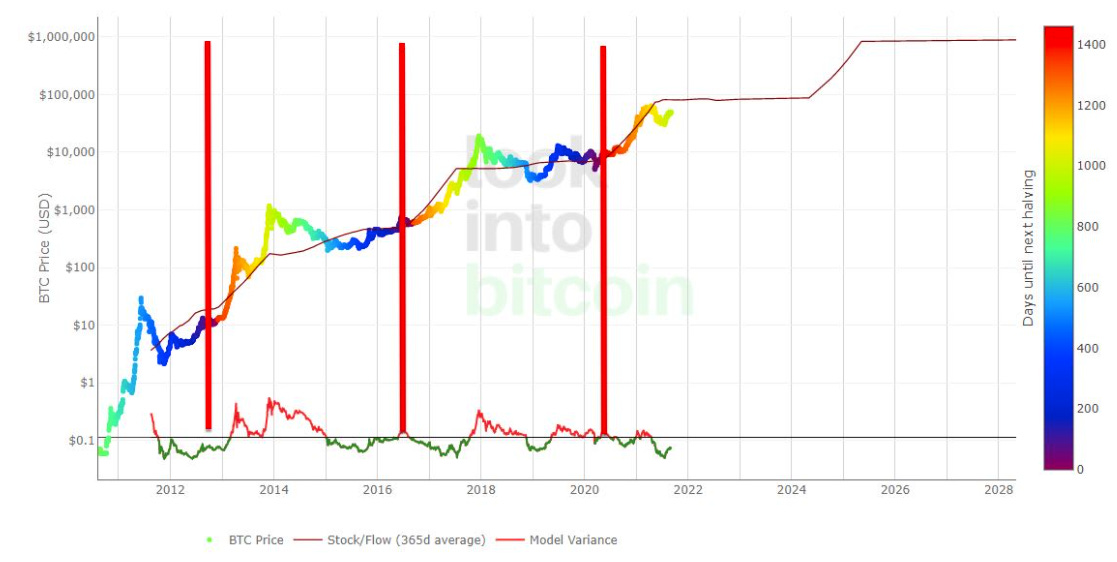

Hopefully you can see that Bitcoin is a scarce asset. Scarcity just flat-out matters. These shocks to supply every 4 years have kicked off a bull run each time as seen below. The red lines denote the date of the halving when new supply coming to market was cut in half.

When we understand that bitcoin has a fixed supply schedule and that the Fed is creating bank reserves at a pace we’ve never seen before, it makes perfect sense why Bitcoin would capture monetary energy from this excessive money printing. Hard assets win in this environment. There is no cap to how much money the Fed can print. But there is a hard cap on the amount of bitcoin in existence. Bitcoin’s fixed scarcity makes it the hardest asset on the planet. Furthermore, it is the only commodity in the world that has a completely inelastic supply response to demand. With any other commodity, as demand increases, more supply is produced. This can never be the case with Bitcoin.

As an American, it is easy to take for granted the scarce nature of a digital monetary asset like bitcoin. We live in a stable country with a relatively high-functioning government, clear property rights and laws, and a historically reliable currency. This is not the case for the majority of the world. Therefore, it is no surprise that bitcoin adoption in countries like Vietnam, India, Pakistan, Ukraine, Kenya, and Nigeria is happening at a faster pace than in America. Unlike in America, Bitcoin is intuitive for citizens of these countries.

To wrap up the asset side of the equation, I want to be really clear that *bitcoin the scarce asset* is the vehicle through which the market is valuing *Bitcoin the Network.*

-----

So what is Bitcoin the Network? And why is it valuable?

Bitcoin the Network is a global payment network. Here’s an example of what it does and how disruptive it could be to the banking sector:

If I want to send a wire to my friend in Italy, it will likely take 3-14 business days for the funds to arrive. You might ask why that’s the case.

It takes this long because global payment rails between banks are not open and interoperable. Banks have not upgraded these archaic systems.

So banks have been coasting and the general public has put up with it (because to date, we’ve had to). Because of this inefficient payment system, international wires travel through multiple intermediary banks before landing at their final destination. This slows down the transaction, and each bank extracts fees from the customer for this “service.”

Furthermore, 2 billion people worldwide do not have bank accounts today. This is because it is not profitable for banks to service developing nations. Therefore these folks are often left out of the global financial system.

How does Bitcoin the Network fix this?

Bitcoin the Network is a wide-open global payment network. It’s interoperable with all existing payment rails - this means it connects to everything and everyone. It’s simply superior technology.

This means we can send value all over the world peer to peer on the Bitcoin Network. 24/7, 365 days/year. We can do this with instant and final settlement. At nearly zero fees. And you don’t even have to use bitcoin (the asset) to do this. We can send dollars abroad over the Bitcoin Network and have them land instantly in Italy as euros, at current exchange rates.

I want to repeat that:

We can transfer bitcoin or dollars/euros etc all over the world 24/7, 365 days/year peer-to-peer

The transfer will settle immediately

There will be almost zero cost to doing this

Anyone can access this network, including the 2 billion unbanked individuals worldwide

Let’s step back and ponder this for a minute because I think it’s difficult to really grasp how powerful this could be.

What we’ve done here is disrupted the international SWIFT payment network. We have completely removed the “chains” that banks have on the flow of international commerce. This has the potential to have a dramatic impact in terms of globalization/ international commerce, and the velocity of money in an increasingly digital global economy.

This potential shift from banks to the Bitcoin Network/blockchain reminds me of the shift from handwritten letters to email. Think about how much friction was involved with writing a letter: Putting a postal stamp on it. Bringing it to the post office. Putting it on a plane. Delivering it to its final destination.

When we created email we cut out all of that friction.

The big difference here is the friction we are cutting out sits firmly in the banking sector. Which makes Bitcoin highly controversial. But is Bitcoin actually controversial? Or is it just a neutral technology doing what technology does? Remove friction. Increase efficiency. Increase productivity. Collapse and compress costs.

Wrapping up Bitcoin’s value prop

Not only does Bitcoin disrupt the international SWIFT network but we should expect to see similar disruption to domestic payments as well as remittance payment networks like Western Union. This same technology could be used by businesses instead of credit card payments. For example, restaurants operate on super slim margins. It’s super competitive. On top of this, they are forced to pay 2.5% of their revenues to Visa/Mastercard as a “cost of doing business.” Restaurants (and any online e-commerce business) could just use the Bitcoin Network to receive secure payments for free.

The use of the Bitcoin Network would also reduce credit card fraud. Today, this is such a big problem for merchants, credit card processors, and banks that fraud detection systems are designed to stop transactions that are even slightly suspicious-looking, even when not fraudulent. As a result, merchants can be forced to turn away incoming orders. We eliminate the possibility of this fraud with cryptographically secure payments on the Bitcoin Network.

I’ve covered just a small sample of Bitcoin the Network here. Today we also have decentralized finance apps (smart contract programmed lending/borrowing) being built on Bitcoin. We’re seeing programmable money applications. Decentralized communication networks. The party is really just getting started. Where it goes from here is anyone's guess.

-----

Thanks for reading and for your support.

As always, for more frequent daily updates, you can follow me on LinkedIn.

And if you’re getting valuable insights from these reports, please share them with your network so that more people can learn about blockchain and crypto.

Take a report.

And stay curious my friends.

-----

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.