Bitcoin Thesis

And a market/data update

Hello readers,

In this report, we’ll cover my long-term thesis on Bitcoin. Topics covered:

How I think about Bitcoin

Macroeconomic and geopolitical set-up

Comparing today’s conditions to the 1940s

Bitcoin’s features that inform the thesis

Bitcoin’s % allocation of my crypto portfolio

Current market/price data

Short and Long-Term Risks

If you’re new to The DeFi Report and would like to receive these free reports directly into your inbox going forward, drop your email below:

Let’s go.

Where it all Started

My journey with Bitcoin started in 2008, however, I didn’t know it at the time. Back then I was a naive college student that was trying to understand what was happening in the economy. Lehman Brothers and Bear Stears had just collapsed. AIG, Fannie Mae, and Freddie Mac had all been taken over by the Federal Government. GM and Crysler were about to go bankrupt. Ford was next. The global financial system was on the verge of a collapse. Of course, the government bailed out the banks as well as GM and Crysler. Confidence was eventually restored. But I never really stopped thinking about why that happened, and whether we solved the root problem that created the crisis in the first place.

The big revelation for me was how fragile the world is and how our economy is largely based on trust. I learned that in a fiat-based system, debt and money are the same things. Every dollar ever created is a dollar of debt. Debt must be paid back with interest. Except, when we create money (debt), we don’t create extra units for the interest payments. Interest must come from the pool of money already in existence. Therefore, there is never enough money in the system to pay back the debt. For this reason, the Long-Term Debt Cycle is very, very real. More and more currency units must be created over time as the debt burden grows. This is ok when debts are manageable. Bankruptcies happen. Some businesses win, and some lose. However, when debts reach extremely elevated levels as we see today, the system can become quite fragile - risk gets consolidated to the system itself. Everybody owes everybody money. This came to a head in 2008/2009. Since then, we haven’t really done anything to address the root issues [regulators treated symptoms such as poor lending standards in real estate markets post crisis]. In fact, we have doubled the debt to GDP burden and increased the Fed’s balance sheet 5x over the last decade:

Credit to Andrew Axelrod for sharing this chart on LinkedIn

If you’re curious about exponential growth and how it is likely to catch us all off guard, check out this video.

In 2008, I learned about gold and began investing in gold mining companies.

Later, I discovered Bitcoin. Once I wrapped my head around proof-of-work and how mining works, it became pretty intuitive to grasp why it could have a lot of value.

Bitcoin is essentially digital gold - anyone who has studied the mining process and proof-of-work can see this. With that said, there are two critical elements to Bitcoin that could make it far more valuable than gold:

Bitcoin has a completely inelastic supply response to demand. There is no other commodity in existence with this feature - with anything else, as demand increases, more quantity is produced. This is true even for gold. But with Bitcoin, there is no such supply “release valve.” The release valve is price.

Bitcoin is highly divisible and can be transported all over the world in a peer-to-peer manner.

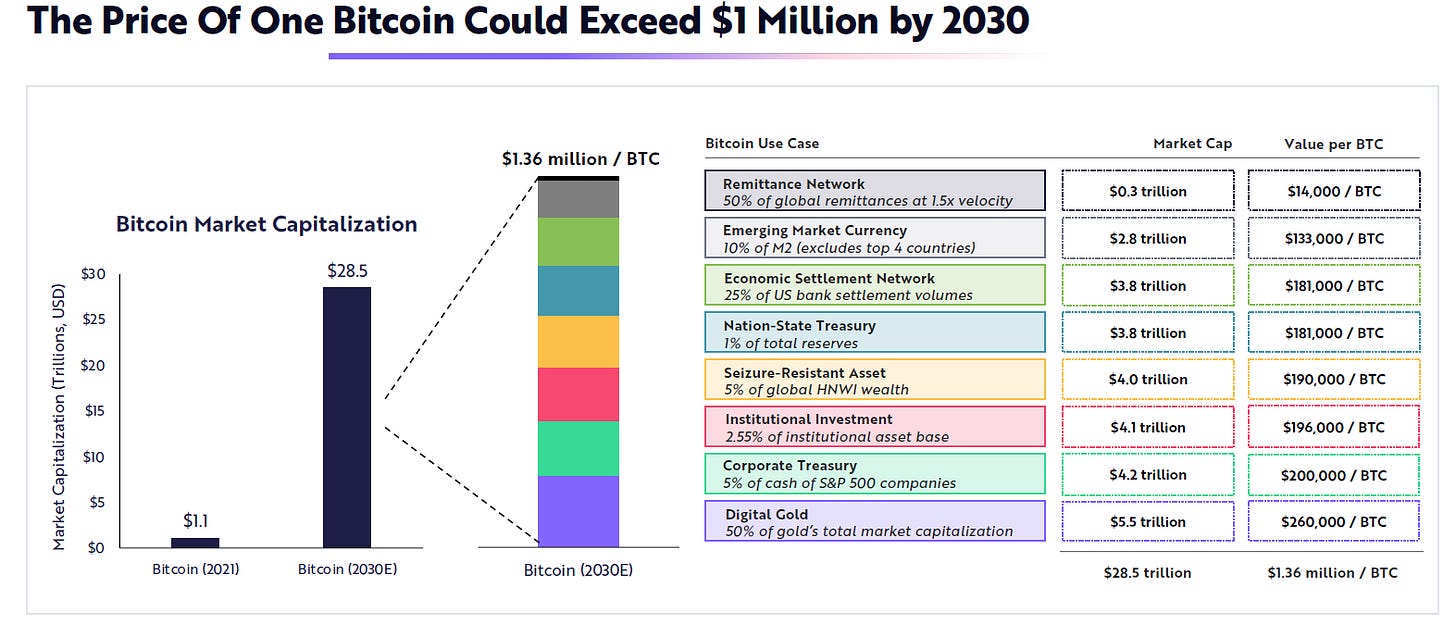

So, Bitcoin looks like digital gold, except it is far more scarce, and it comes with a global, permissionless, peer-to-peer payment network. My base case when I first started studying Bitcoin was that these features, in a digital world, could make Bitcoin worth at least the value of gold someday ($533k/coin). When I hear people say that Bitcoin could one day be worth $1m/coin, it seems reasonable to me. The average person scoffs at this. But if you asked them if they understand the monetary system, monetary history, proof of work, network effects, macroeconomics, geopolitics, game theory, technology, etc they might give you the deer in the headlights look. Here is how Ark gets to that figure. Keep in mind that these estimates are based on conditions today and do not factor in monetary debasement over the next 8 years. If BTC were to get to these prices, we should anticipate highly inflationary conditions. For example, the cost to buy a home (and everything of value) would likely rise sharply as well.

The Macroeconomic Set-Up

The Long-Term Debt Cycle:

Credit: Ray Dalio

History doesn’t repeat, but it tends to rhyme due to the long-term debt cycle. I find this guide as well as the research and books that Ray Dalio has authored to be the best tool for what we should expect to see this decade. Principles for Dealing with the Changing World Order is a must-read for anyone interested in this subject. Ray Dalio built one of the largest hedge funds in the world, is a truth seeker, and has access to the best research data out there.

I believe we are at the stage of the cycle we see on the right side - Printing Money and Credit/Revolutions and Wars. This seems pretty obvious as I look around the world. The pandemic (and economic response) is an accelerator in this regard.

Looking at history, the current predicament looks a lot like the 1940s. Back then we had a similar Debt to GDP ratio (125% today), high inflation, populism, and global geopolitical turmoil (WWII). There was also a debt crisis about a decade earlier (the stock market crash of 1929) - the Great Recession and the near collapse of the global economy in 2008/2009 looks pretty similar to that period. Both periods were followed by a decade of slow growth - a depression in the 1930s and a period of quantitative easing, disinflation, and slow growth in the 2010s.

So, what happens on the global stage when there is too much debt in the system? History says we get rising inequality, monetary repression (inflation runs much hotter than nominal interest rates), populism/political tension, geopolitical instability, and sometimes revolutions and wars (gulp).

What do you see when you look around?

I see political division and populism on both sides. High inequality. Geopolitical tensions and war in Eastern Europe. The U.K.’s Prime Minister just resigned. So did Italy’s. Food and energy costs are rising globally. The dollar is surging, causing instability in emerging markets that earn revenue in debasing local currency but have dollar-denominated debts. I see monetary repression at play. Lack of trust in important institutions. I see a big demographic shift underway as baby boomers enter their retirement years.

*I also see lots of beauty - art, nature, acts of kindness, etc.*

But I can’t help but acknowledge the reality of the math we are dealing with on a global stage. History rhymes because math is real. The long-term debt cycle is real. And when the numbers don’t reconcile, history says that humans do some odd things.

Looking Forward

There seem to be two schools of thought out there. The first believes the Fed can increase interest rates as far as they want to crush inflation (as in the 70s). The second camp thinks this is impossible, and that they will have to reverse course and drop interest rates again in the near term. Count me in camp #2. My background is in accounting, and I’ve done my homework. It appears to be impossible for the Fed to raise rates past 4% or so on a sustained basis. This is due to the aforementioned debt in the system, which was not present in the 70s. All of this debt relies on low-interest rates, as do tax receipts. Positive real interest rates would bankrupt the country, force the gov’t to default on the debt, and push the economy into a depression. This is a very low probability.

What I expect to see is lots of volatility in the years to come. It is probable that inflation is persistent, with plenty of volatility mixed in. This is due to supply chain issues as well as the aforementioned debt. The factors influencing inflation are 1) the war in Ukraine and energy costs, 2) the war in Ukraine and food costs (Russia/Ukraine are the “bread basket” of the world), 3) deglobalization, 4) the new post-covid economy that we have yet to fully embrace/adjust the system to (causing supply chain issues), 5) the fact that monetary policy is ineffective when debt gets this high - this forces inflationary fiscal policy to step in as we saw during Covid, 6) changing world order and geopolitical tensions, 7) the current debt/GDP situation — which requires more money printing to avoid a deflationary bust.

The deflationary offsets that are difficult to measure are 1) the demographic shift, and 2) technology.

We had a similar setup in the 1940s. The outcome was that we ran inflation hot (as high as 19%), pinned interest rates, and inflated the debt away. This is my base case right now for the next 5-10 years. However, I think this will be very confusing and volatile. We just saw a massive amount of liquidity injected into the economy during Covid and the Fed lose control of inflation. Now they are jacking interest rates and whiplashing the economy around. I expect more of this. And lots of volatility for an asset like Bitcoin.

Here’s the question: if the only reasonable outcome to resolve the math problem is to inflate the debt away, which assets will do well in that environment? Remember, this is global and not just the United States. Hard assets should do well, and I think it’s possible Bitcoin will outperform everything (as it has done throughout its short life so far).

For this reason, Bitcoin represents 75% of my crypto portfolio. Ethereum is 15%. DeFi blue chips, NFT/Gaming infrastructure, and Metaverse infrastructure represent the remaining 10% (largely Ethereum based). This could change in the future as Ethereum looks like it’s here to stay, and could have a lot of upside as well.

I view Bitcoin as separate and distinct from all other cryptoassets - I believe it is a monetary asset and a play on the macro set-up for the next 10+ years.

Ethereum and all other crypto assets are more like venture-funded tech investments.

DeFi, NFTs, Metaverse, etc are basically leveraged derivatives of Ethereum.

I also like real estate, gold, commodities, value stocks, and some tech plays.

Back to Bitcoin - the bottom line is the Fed is painted into a corner right now. They have to continue increasing the money supply to hold the house of cards up, and the only way they can reset Debt to GDP is by running inflation hot. If they do that for 10 years, debt to GDP will drop significantly. They can then normalize monetary policy — this is what we saw coming out of the 1940s. There is one caveat here that is difficult to measure: information spreads like wildfires on the internet. The general population likely did not understand what was happening in the 1940s. It’s possible that monetary repression will be very obvious this time - and could spark social unrest.

The ultimate outcome seems inevitable - The Fed and Treasury will need to print a massive amount of money over the next 5-10 years. Bitcoin should do well in that environment, but I would expect lots of volatility.

For the record, pretty much all investable assets follow M2 growth. Real estate, stocks, etc. Bitcoin just happens to be much smaller and a new, misunderstood technology. It also has a global addressable market. For this reason, I believe there is a favorable probability that it will outperform.

Additional Thoughts

In this section, I’ll rattle off additional important items and features of Bitcoin that help to inform my long-term thesis.

Bitcoin is the most secure computing network in the world. This is due to the economic resources required to hack the network.

Metcalf’s Law/Network effects lead to digital scarcity. Digital scarcity would otherwise seem like an oxymoron since Bitcoin can be easily copied (and has been many times).

Bitcoin is the only commodity in existence that has an inelastic supply response to demand.

Bitcoin is the only investable asset that has a pre-programmed, disinflationary supply issuance schedule. This is the subsidy paid to its service providers (miners) who secure the network.

Bitcoin is two things: 1) scarce, liquid, monetary bearer asset, 2) global, permissionless, peer-to-peer payment network

Bitcoin is the only proof-of-work blockchain we need

Bitcoin is a permissionless/open data infrastructure and fully auditable accounting ledger

Bitcoin is the most decentralized crypto network in existence - this is due to the low cost and easy setup to run a Bitcoin node and participate in consensus

Bitcoin mining represents a location-agnostic, intermittent electric load source that is being used to stabilize the grid in Texas today.

Bitcoin mining has very clear synergies with energy producers — I expect to see them become the largest miners in the coming decade.

Bitcoin has the most ardent, grass-rooted, global network of believers, evangelists, and defenders.

Bitcoin is a truly free market. When we combine this with information asymmetry due to its infancy, the fear and greed of humans, and a Federal Reserve continually slamming on the gas and brakes, we get a highly volatile asset. For this reason, Bitcoin often dislocates to the upside *and* downside.

While Bitcoin is highly volatile, its market value tends to collapse to its production value (where it roughly sits today) during extreme volatility to the downside. This is consistent with the behavior of traditional commodities.

Bitcoin is scalable on Layer 2.

At its absolute core, Bitcoin is rooted in merit-based economics and incentives through its proof-of-work mining structure.

Bitcoin is the only cryptoasset that has a clear asset class designation from regulators (commodity).

The best use case for Bitcoin is not as a medium of exchange. This is due to Bitcoin’s demonstrated long-term compound annual growth rate in a world of inflationary fiat currencies. It’s better as a store of value which could ultimately make it pristine, transparent collateral in the future.

Bitcoin is becoming integrated with financial systems and markets as treasury bonds show defensive weakness for the first time in 40+ years. It should be clear that we are in a very, very different macro and investing environment since Covid hit. What happens when it becomes easy for every financial institution in the world to buy and custody Bitcoin?

Market Data Update

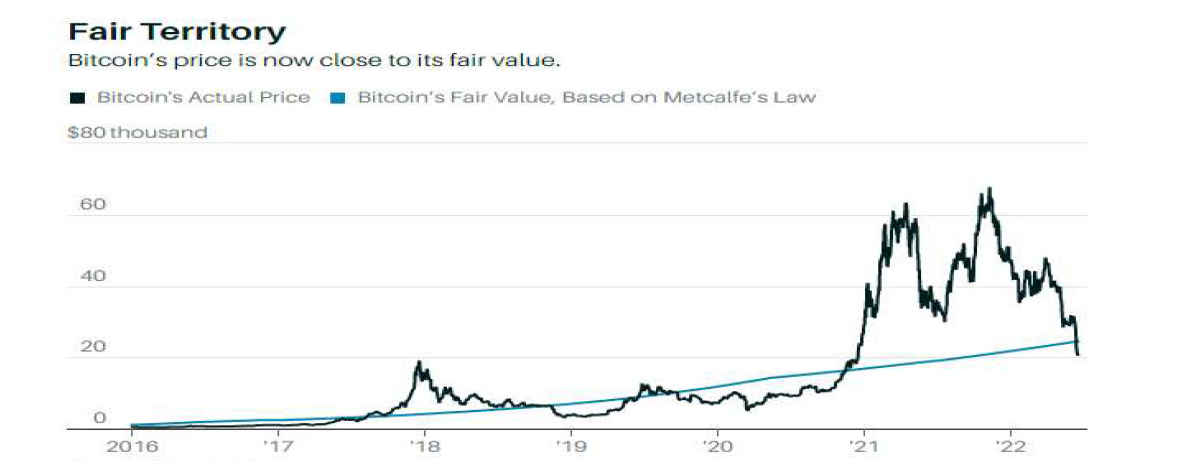

Bitcoin is currently trading below its fair value per Metcalf’s law.

Source: https://www.barrons.com/articles/bitcoin-price-valuation-51655844486

Market Value to Realized Value:

Market Value to Realized Value is currently at its 4th lowest point in Bitcoins’ short 13-year history.

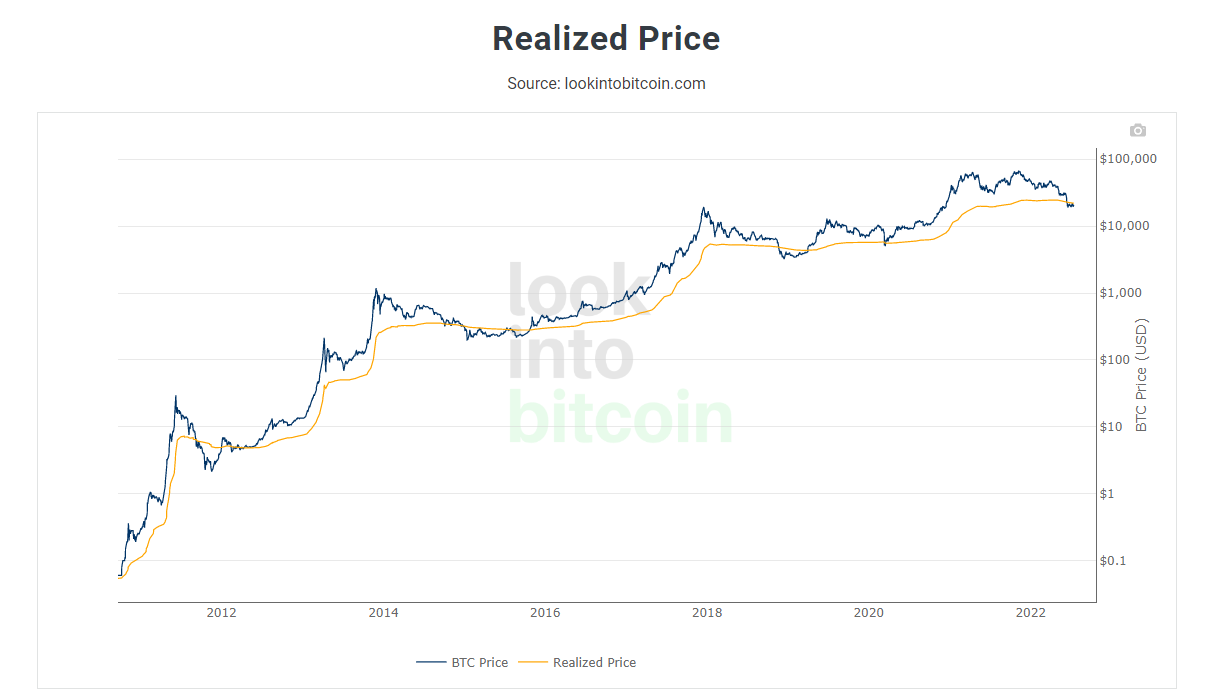

Realized Price:

Realized Price, a proxy for the average price that each Bitcoin in circulation was purchased at is currently above the market price. Historically this has represented a good buying opportunity.

Short Term Risks

Miners took on A LOT of leverage during the bull cycle. Many are now capitulating and selling BTC to cover debt and operating costs as liquidity has dried up and the price is down 70%.

As such, some miners are unplugging their machines. Older ASIC mining machines (S9s, which represent about 20% of the network) are no longer profitable.

The hash rate is now rolling over (down 15% from the top). Hash rate dropped 35% from the top after the 2017 bull run and it took 12 months for it to bottom out after the price peaked. The price hit the bottom around when the hash rate bottomed in late 2018. Because this has not happened yet in this cycle (could take another 3-4 months), it is definitely possible that the price of BTC goes lower from here. This is a tough call because $20k (previous all-time high) is showing strong support right now. Bitcoin dropped 82% last cycle. If it did that again, it would take us into the $13-$14k range.

This potential move could potentially correspond with the release of $3b worth of BTC to creditors from the Mt. Gox hack in late August. These coins have been locked up for 7+ years so it is very possible that creditors receiving the coins will sell them into the market.

Longer-Term Risks

The longer-term risks that would debunk the thesis would be the following:

An issue with the code renders the network insecure. I view this as a low probability since hackers have been attacking Bitcoin since day 1.

ESG narrative. I believe this is misguided, but in a world where energy costs are soaring, it is a real concern.

Rather than an inflationary decade, we see austerity and deflation (like the great depression). I do not think Bitcoin would do well in this environment.

Transaction Fees. In the long run, Bitcoin is dependent on transaction fees to support the security of the network. The network cannot sustain itself with block subsidies forever because they eventually drop to zero as Bitcoin’s new issuance is halved every four years. Therefore, an existential threat to Bitcoin would be that the blockchain does not develop enough on-chain activity for fees to support its miners — rendering the blockchain insecure and vulnerable to hackers.

Conclusion

The future looks very different from the past. Therefore, it seems prudent to have an allocation to Bitcoin. This is different for everyone - it could be 1%, it could be 5%, or it could be 10% +. Whatever your situation is, I hope this helps frame up a high-level view of Bitcoin’s value proposition within the context of the world we currently inhabit. Please do not take it as financial advice, and do your own research.

___

Thanks for reading and for your continued support.

If you got some value from this week’s report, please do me a favor and share it with your friends, family, and social networks.

If you have a question, comment, or thought, please leave it here:

___

Take a report.

And stay curious.

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. The author is not an investment professional and may hold positions in the assets covered. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general educational purposes only, is not individualized, and as such does not constitute investment advice.

I'm with you on number 2. However, as an Austian School student and follower, I cannot help but see the FED as The Problem. Central banking is inherently flawed and only benefits the large, multi-national banking/business interests! The FED spin-meisters, aka Powell, et al would have us think they know far more about 'managing' the economy- and proffering solutions- than they truly do.

I agree with much of what you have stated and predicted. My concern is that bitcoin does not address the looming crisis of the monetary-economic system from consuming our ecological base of the economy. I have a solution for that and it involves NCUs - natural capital units - to create a limited, quasi nonfiat currency. Money systems are more critical to the manifestation of economic systems that we realize.