Bitcoin: Poised for a late-cycle fall rally?

A view into what the on-chain data is telling us.

Hello DeFi Enthusiasts,

I hope everyone had a nice weekend. And if you’re in the US you’re enjoying a pleasant holiday. In last week’s report, we discussed how nascent crypto markets still are, and just how big these markets could become this decade. It was a high-level, big picture view. Today I want to talk about crypto cycles. While we are super early in the big picture, we also need to understand where we stand in the current cycle. We’ll start with a quick review of the halving cycle before we jump into some on-chain data to get a sense of where we are currently in this cycle.

Let’s go.

Crypto markets tend to have a bull run every 4 years. We can visualize this in the logarithmic price chart/stock to flow model below. As a quick aside, I highly recommend learning more about the stock-to-flow model. Stock to flow modeling is typically used for scarce, natural resources like Gold and Silver. The model below is forecasting the price of Bitcoin based on supply-side scarcity and has been remarkably accurate to date. Because less and less Bitcoin comes onto the market over time (per Bitcoins set monetary policy), the stock to flow (# of years to create the current supply) grows over time. After the next halving in 2024, Bitcoin will become the most scarce asset on the planet. Its stock to flow will be over 100 at that point. And it will only become more and more scarce as the years go by - today 89% of the total supply (21 million) is available on the market. More on that below.

So what the heck is “the halving”? The red lines above denote the dates of each halving. This is when new Bitcoin supply coming onto the market is “halved” every 210,000 blocks (4 years), hence the terminology. The first halving occurred in November 2012. The amount of new Bitcoin rewarded to miners for validating transactions was cut in half from 50 to 25 at that time. The second halving occurred in July 2016. This time it went from 25 bitcoin per block of transactions down to 12.5. The 3rd halving occurred in May 2020 when we dropped from 12.5/block to 6.25. This is the subsidy miners receive for validating each block of transactions, which occurs every 10 minutes on the network. Today, 900 Bitcoin come onto market every day. This will happen like clockwork until the spring of 2024 when that number will drop to 450/day. This is the most important feature of Bitcoin. Bitcoin’s supply is completely inelastic to price or demand. It is the only financial asset/commodity in existence with this feature. In the above chart, we can see what happens to the price each time we cut new supply in half. We go on a bull run! It’s just math. Supply/demand. What tends to happen is we get a building supply shock that eventually is expressed with a big move up in price. This volatility drives media attention which then translates into FOMO from the general public, which further pushes the price up.

To be clear, this “halving schedule” constitutes Bitcoin’s monetary policy. This is built into the protocol and it cannot change. Anyone can verify this since it’s just open-source software.

With all of this said, we should anticipate the halving’s impact on the price to dissipate over time. This is because the shock to supply is less and less every 4 years. We continue to get more and more scarce but on a sliding scale. And to be clear, the stock-to-flow model is focused on the supply only. Demand for Bitcoin is global, comes from a variety of sources, and should be analyzed separately.

*If you have questions about Bitcoin mining, please ask away in the comments (you need to be a subscriber to comment). I am a Bitcoin miner and happy to answer them.*

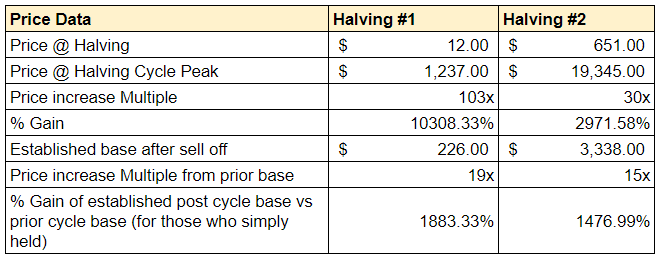

So hopefully you can see that we are in the middle of a bull run. The prior 2 bull runs ended in December of the year following the halving. Here is the price impact from start to finish for the first 2 cycles:

The first cycle was about 13 months from the halving date to the cycle peak in price. The second cycle was about 18 months. We are currently 15 months into this cycle. Most of the crypto market is anticipating a blow-off top sometime this fall or winter for this reason. The end of the cycle can be quite explosive. In 2013, the price did a 5x in the final month of the rally. In 2017 we saw a 5.4x over the final 3 months of the rally. We haven’t seen anything like this so far in this cycle.

Please also note that I am using Bitcoin as the marker for the entire crypto market (which is over 11,000 cryptoassets today). This is because Bitcoin is the OG and it is still by far the largest cryptoasset. Bitcoin tends to lead, with the rest of the market responding to its price action. I also want to be clear that Bitcoin is the only cryptoasset with a set, completely predictable, and disinflationary monetary policy. It’s the only viable cryptoasset that seeks to be a global monetary asset (digital gold). You might notice that I do not call these assets “cryptocurrencies.” I believe it is a complete misnomer and confuses the discussion. To be a legitimate currency, an asset must be a store of value, unit of account, and medium of exchange. Today, Bitcoin is only a store of value. Could it be a unit of account and medium of exchange someday? Certainly. But it is not that today. The rest of the 99.9% of cryptoassets have no ambition to be monetary assets. These assets have different use cases and economic incentive structures. They do not compete with Bitcoin directly. We’ll go deep on this in future reports.

————

Time to get under the hood on what’s happening on-chain within the Bitcoin network right now. Data in crypto is really strong. This is because blockchains are transparent, open-source networks. We can analyze the movement of tokens to paint a picture of what’s happening in the market. With blockchains, it’s as if we can see into the activity of everyone’s bank accounts (wallets in crypto). We can see how many and when coins moved. We can see where they were moved. We can ask questions like: Are long-term holders accumulating or selling? Are flows moving onto or off of exchanges? Is leverage building in the network? What’s happening with on-chain transaction velocity? Are miners selling the new supply into the market? Are unique addresses (wallets) increasing or decreasing?

As we run through these questions we can get a nice visualization of the market and a high-level idea of if it’s bullish or bearish.

Let’s get into it.

NVT Ratio

The NVT Ratio measures network value to transactions ratio. We can think of it as we think of a PE ratio used in equity markets. When Bitcoin’s NVT is high, it indicates that its network value is outstripping the value being transmitted on its payment network. This occurs when the network is in high growth and investors are valuing it as a high return investment. We could also view it as a sign that the price is in an unsustainable bubble and due for a correction. NVT ratio is calculated by dividing the market cap by the daily transaction volume.

Let’s take a look at what we see today:

The NVT has historically been a pretty good indicator for timing on entering or exiting the market. We can see that when the price fell to $30k in May, the NVT ratio flipped to a “buy” indicator. Now that we have bounced back up to $50k, the data is telling us that the transaction activity did not pick up at the same rate as the price. Therefore, the indicator flipped to a “sell.”

There is some nuance here: as Bitcoin has grown in adoption, its narrative around its use as a store of value or digital gold has solidified. Investors increasingly buy and hold the asset, which lowers transaction volume. In addition, the Lightning Network (a layer 2 scaling solution on top of Bitcoin) is seeing more and more transaction volume. Side chains like Liquid Network (for scaling & small transactions) are also growing. This is where a lot of the transaction activity is picking up, and this is not reflected in the chart above.

An investor could interpret this data as a signal to be cautious about entering right now. With that said, I’d like to note that we can also see in the chart that Bitcoin just recently moved past its 200-day moving average. We can see in the prior cycles (as well as this one) that this tends to be a bullish indicator. Let’s move on.

Relative Strength Index

RSI is an indicator used in technical analysis (not coming from on-chain) that measures the magnitude of recent price changes to evaluate overbought or oversold conditions in the price of a stock or other asset. It can have an indicator of anywhere from 0 to 100.

As we can see at the bottom of the chart, we are currently reading a 60. The last time we recovered from a below 60 period was October 2020, when the price of Bitcoin was $10k. Back then, the RSI moved up into the 70-90 range and we saw the price do a 5x. To confirm an uptrend, we’ll need to see the RSI once again move into the 70-90 range and stay there for a few months. Next.

Reserve Risk

Reserve Risk allows us to visualize the sentiment amongst long-term bitcoin holders relative to the price of bitcoin at any given moment. We can tell that certain wallets are long-term holders based on the timing of coins moved to exchanges from their unique addresses. Again, the transparency of data in the blockchain is phenomenal.

This looks pretty healthy. We can see in the past that when Reserve Risk (red line) moves into the shaded red area it tends to correlate to a cycle price peak. We can also see that we got close to that level back in May, but we haven’t moved all the way into the green zone. In fact, it looks like we are seeing the early signs of a bounce back up, which is similar to the action we saw in the double top back in 2013.

Next, we’re looking at exchange flows. When we see Bitcoin flowing into exchanges (orange line moving up), it’s an indicator that market participants are sending their Bitcoin in to sell and cash out to fiat. When flows are moving off of exchanges (orange line moving down) it is an indicator that buyers are scooping up coins and moving them to their cold storage wallets off of the exchange. We can see that this data point shows a pretty clear relationship to price. When BTC are moving off exchanges, price goes up. When coins move into exchanges, price moves down. Today we can see that exchange balances are once again moving down - a bullish indicator.

And here’s another metric analyzing the activity of long-term holders (hodlers in bitcoin speak). This is an interesting metric as it is showing the activity of wallets on the bitcoin blockchain that have not moved bitcoin in over 1 year.

In the 2013 bull run, the price peaked when the 1 Year Hodl ratio hit 38%. In 2017 it peaked at 42%. Today we are at 52%. We can see the relationship to price in the chart. As the yellow line moves lower, it is showing that long-term holders are selling into the market. This is corresponding with the run-up in price as less experienced market participants are entering and buying their coins during the late stages of the rally. If the prior rallies are any indication, this metric is telling us we still have some room to run.

Finally, let’s take a look at leverage and derivatives in the system today. Below we are looking at Funding Rates (leverage) and Open Interest (options & futures contracts). These metrics help us to determine sentiment from traders as well as the amount of leverage/derivatives in the system. Leverage & derivatives can work for and against the price of Bitcoin (and any asset). When the sentiment amongst traders and market participants is high, leverage flows into the system and helps to push up the price, along with spot buying (buying the actual commodity with no leverage). When leverage builds up, it makes the market extremely sensitive to periods of high volatility. We can think of this as a game of Jenga. As leverage builds up, the stability of the price becomes less and less stable. The reason for this is that traders are buying BTC on margin and/or buying futures contracts which are pushing the price up. If the price reverses, these traders can be caught off guard. Their margin position is then automatically liquidated (sold), driving the price down. This can create a cascade of additional liquidations. Blood in the streets. This is why you should never play with leverage in crypto.

Volatility can also happen in the opposite direction when trader sentiment is negative. If traders are shorting Bitcoin, and spot buying drives the price up, their short positions will be liquidated, pushing the price up. We like this kind of volatility. And this is when we see trader sentiment kick positive. Which means leverage flows in. Which pushes the price up. The media starts talking, etc. This is the sequence of events we tend to see with Bitcoin price movement. We get it in both directions.

Below we can see that today, leverage and open interest are very healthy in comparison to the run-up in price in the spring. This tells us that the recent run-up in price from $29k to $51k is coming primarily from spot buying. This is what we want to see. In the chart, we can see that leverage (purple) and open interest (red) picked up significantly late last year and into Q1. This was helping to drive the price up. It also helped to push us back down to $29k. Now that we are rebounding, and doing so with mostly spot buying, this looks healthy and could be viewed as a bullish indicator.

Conclusion

I hope this is helpful in getting a sense of how we can use blockchain data to analyze current market activity. As we compare to prior cycles, we can start to get a sense of where we stand in this one. I’m compiling the data here for you so that you can learn the dynamics of the market and begin to draw conclusions about what you’re seeing. From my view, these metrics look pretty healthy overall. It’s worth noting that as crypto markets continue to grow, they become more tied in with the macroeconomy. This is another factor to consider in our analysis. At present, we continue to see a dovish monetary policy from the Fed which tends to be positive for crypto and other high growth assets. As I continue to monitor these data points as well as others, I will be sure to provide brief updates when needed. Subscribe to this newsletter to get those free updates directly to your inbox.

You can also connect with me on LinkedIn for daily insights.

Take a report.

And stay curious my friends.

____

Individuals have unique circumstances, goals, and risk tolerances, so you should consult a certified investment professional and/or do your own diligence before making investment decisions. Certified professionals can provide individualized investment advice tailored to your unique situation. This research report is for general investment information only, is not individualized, and as such does not constitute investment advice.